States Need 5 Years of Compensation After GST Rejig: When Karnataka Chief Minister Siddaramaiah declared that states need five years of compensation after the GST rejig, he wasn’t just making political noise. He was flagging a survival issue for state governments across India. This debate, often buried under complex tax jargon, is really about whether your state can keep funding schools, hospitals, and infrastructure without collapsing financially. If you’ve ever had your paycheck suddenly cut while bills stayed the same, you know the scramble that follows. That’s what states like Karnataka, Tamil Nadu, and Kerala fear with GST 2.0. They’re saying: “Don’t make us balance our budgets on a knife’s edge without giving us a safety net.”

States Need 5 Years of Compensation After GST Rejig

Karnataka CM Siddaramaiah’s call for five years of GST compensation is more than politics—it’s about protecting states from financial freefall. The stakes are high: states warn they could lose up to ₹2 lakh crore annually, jeopardizing welfare and development. As the GST Council meeting on September 3–4, 2025 approaches, the choice before India is clear: either provide states with a cushion or risk fracturing the very foundation of fiscal federalism.

| Point | Details |

|---|---|

| Main Issue | Karnataka CM Siddaramaiah demands 5 years of GST compensation for states after GST 2.0 rejig. |

| Why It Matters | States estimate losing ₹1.5–2 lakh crore annually, about 15–20% of their GST revenues. |

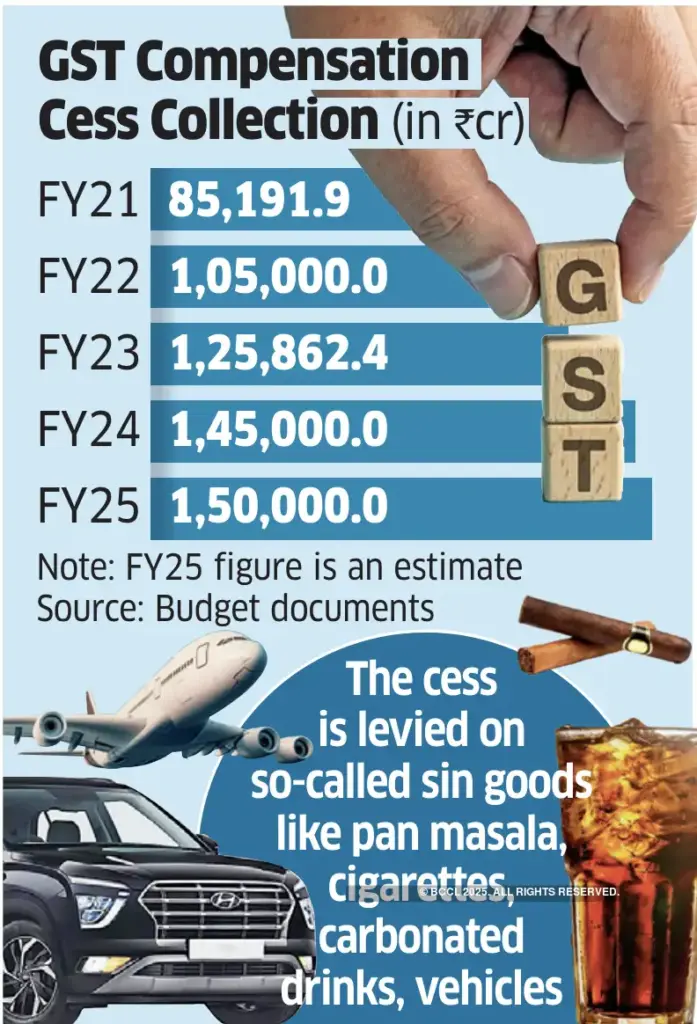

| Proposed Fix | Five-year compensation, levy on sin & luxury goods, anti-profiteering safeguards. |

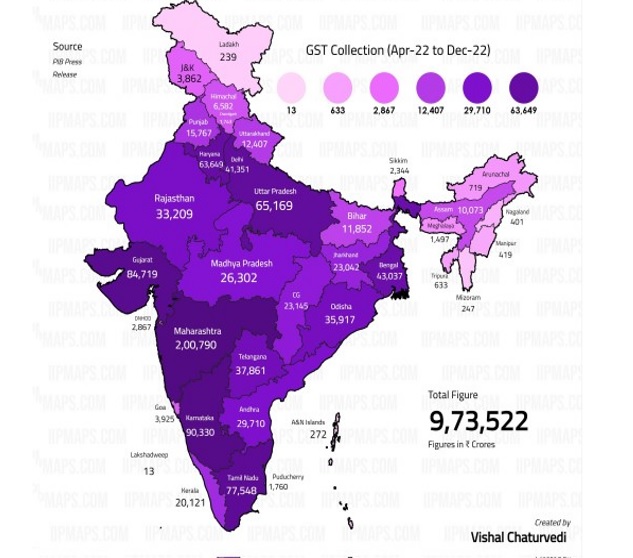

| Affected States | Karnataka, Tamil Nadu, Kerala, West Bengal, and other opposition-led states. |

| Historical Context | GST launched in 2017 with a 5-year compensation promise (till June 2022). |

| Next Step | Proposal to be debated at the GST Council meeting on Sept 3–4, 2025. |

| Official Source | GST Council – Official Website |

GST: A Quick Refresher

India introduced the Goods and Services Tax (GST) in 2017, merging a patchwork of state and central taxes into a single, unified system. The slogan was catchy—“One Nation, One Tax”—but the compromise wasn’t easy.

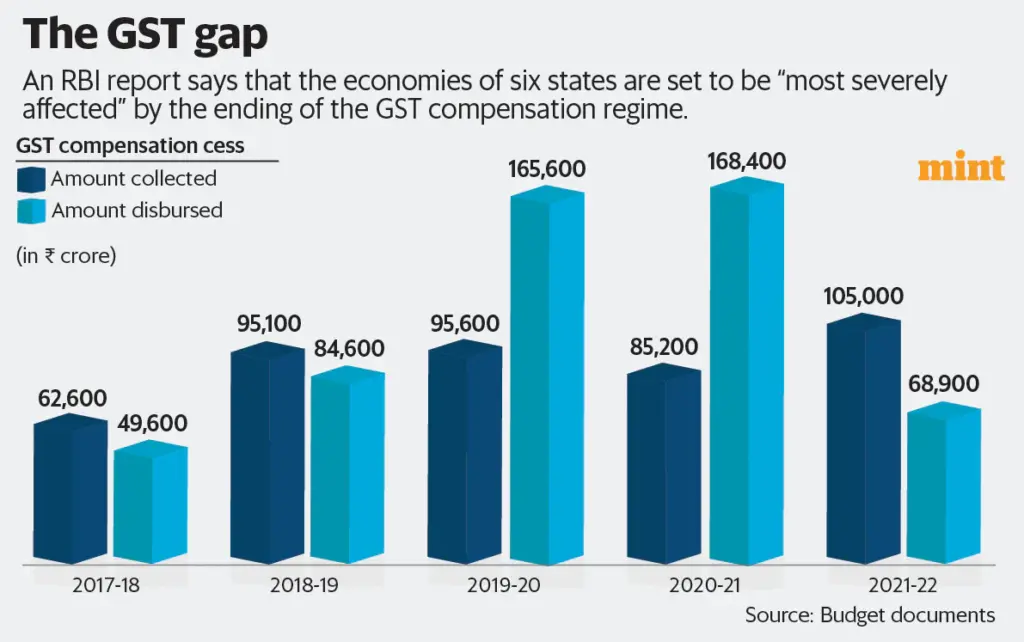

States gave up the right to levy many of their own taxes, in return for a promise: if their revenues fell short, the Centre would compensate them for five years. That deal expired in June 2022. Many states argue their revenues still haven’t stabilized.

Now, with the government proposing GST 2.0, the fear of fresh revenue losses has reignited old wounds.

What Changes Under GST 2.0?

The Centre wants to simplify GST by moving from four slabs (5%, 12%, 18%, and 28%) plus a cess to just three key slabs:

- 5% for essentials

- 18% for most goods and services

- 40% for luxury and sin goods (like alcohol, tobacco, and luxury cars)

On paper, that sounds neat and tidy. But state finance ministers are sounding alarms: according to estimates, the rejig could wipe out ₹1.5–2 lakh crore annually from state revenues. That’s around 15–20% of the money states count on to run everything from welfare programs to highways.

Why Siddaramaiah Says States Need 5 Years of Compensation After GST Rejig?

- Revenue Crunch: States spend big on health, education, and rural development. Losing 20% of their revenue is like pulling the rug from under them.

- Past Experience: States still remember the Centre’s delays in paying compensation during COVID-19, when many were forced to borrow.

- Autonomy Concerns: By demanding a five-year cushion, states want to ensure they can still plan development projects without begging for central handouts.

Siddaramaiah summed it up best: “We are not opposing reforms, but states cannot be left high and dry. We need assured protection.”

How States Want Compensation to Work?

The proposal many states are uniting around includes:

- Five years of guaranteed compensation, or until revenues stabilize.

- A special levy on luxury and sin goods, with proceeds passed directly to states.

- 2024–25 as the base year for revenue calculation, so states aren’t penalized for short-term dips.

- Anti-profiteering rules to ensure tax cuts actually reach consumers and not just pad corporate profits.

Historical Context: Lessons From GST 2017

When GST first rolled out, the Centre agreed to compensate states for five years, assuming revenue growth would stabilize by then. But reality bit harder:

- COVID-19 slump (2020–21): GST collections crashed, and the Centre struggled to pay compensation on time. States were asked to borrow against future revenues.

- Delayed Payments: Several states publicly complained that they didn’t receive their dues for months, forcing budget cuts.

- End of Compensation (2022): When the promised period ended, states saw revenues stagnating at around 5–6% growth, far below the projected 14%.

This history explains why states are so skeptical about the Centre’s assurances now.

What It Means for Consumers?

Here’s a simple breakdown for the average citizen:

- Short-term win: Groceries, clothes, and services may get cheaper with lower GST rates.

- Long-term risk: If states lose revenue and don’t get compensated, welfare schemes (like free school lunches, subsidized healthcare, or rural job guarantees) could shrink.

- Hidden costs: States may raise taxes on petrol, alcohol, or property to plug the gap. That could mean you end up paying more indirectly.

So while you may save ₹500 on monthly shopping, you might lose out on better schools, roads, or healthcare in the long run.

The Political Angle

This issue isn’t just about economics—it’s about power. The Centre, led by the BJP, wants to streamline taxes. Opposition-ruled states argue that doing so without compensation undermines fiscal federalism—the balance of power between Centre and states.

Eight opposition-ruled states, including Karnataka, Tamil Nadu, Kerala, and West Bengal, have already formed a united front to demand safeguards. The September GST Council meeting is set to be a high-stakes showdown.

Expert Opinions

- Economists at the National Institute of Public Finance and Policy (NIPFP) suggest states will need at least 3–5 years of transitional support.

- Industry bodies like CII and FICCI back GST simplification but admit states must be cushioned from short-term shocks.

- Analysts at Business Standard argue that without protection, states may resort to aggressive local taxation—hurting investment and consumer spending.

Global Comparisons

This tug-of-war isn’t unique to India. Other federal systems face similar issues:

- United States: Federal government matches state spending in programs like Medicaid. If funds are cut, states either raise taxes or cut services.

- Canada: Runs an “equalization program” where wealthier provinces’ taxes help poorer ones balance their budgets.

- Australia: Distributes GST revenue to states through a formula ensuring smaller states aren’t left behind.

In short, India’s states aren’t asking for anything extraordinary. They just want a formula that protects their fiscal health while reforms take effect.

Future Scenarios

- If Compensation Is Granted: States will have breathing space, Centre–State relations improve, and reforms roll out smoothly.

- If Compensation Is Denied: Expect budget cuts, state-level tax hikes, and political battles over federal autonomy.

- Middle Ground: A shorter compensation period (say, three years) plus partial levies might be offered as a compromise.

Practical Advice for Businesses and Professionals

If you run a business or handle finances, here’s how to prepare:

- Stay Updated: Track GST Council announcements closely.

- Adjust Pricing: Rework product pricing and contracts once new slabs take effect.

- Upgrade Systems: Ensure your accounting and billing software reflects updated slabs.

- Budget for Disruptions: Refund delays or compliance changes may cause short-term hiccups.

- Keep a Tax Advisor Close: Regulations may evolve quickly; professional advice can save you from penalties.

12% & 28% GST Slabs Axe Approved – Will Consumers and Businesses Finally Benefit?

GST 2.0 to Replace All Slabs With One Tax Rate – Here’s What It Means for You

GST Restructuring Debate – Why Experts Say It Could Hurt Federalism

A U.S. Analogy: Why This Feels Familiar

If you’re an American reader, think of it like the federal government suddenly cutting Medicaid reimbursements. States would have to decide whether to cut healthcare programs or raise local taxes. That’s exactly the type of tradeoff Indian states are facing with GST 2.0.