Step-by-Step ‘Legal’ Tax Evasion Tricks: In recent weeks, a viral video from Mumbai has captured the attention of social media and finance enthusiasts across India. The video features a Mumbai-based couple who claim to demonstrate step-by-step “legal” methods to evade taxes. While the video presents itself as a guide for reducing tax liabilities, it raises critical questions about the ethics and legality of the strategies discussed. Taxpayers are naturally curious about ways to save money, but it is vital to understand the distinction between legal tax planning and illegal tax evasion.

This article explores the claims of the viral video, examines the legal framework governing taxation in India, provides actionable strategies for legally minimizing tax liabilities, and shares expert insights to help both individuals and professionals navigate taxation responsibly. By the end, readers will have a comprehensive understanding of what constitutes safe tax planning, the risks associated with illegal practices, and how to make informed financial decisions.

Step-by-Step ‘Legal’ Tax Evasion Tricks

The Mumbai couple’s viral video is a cautionary tale highlighting the dangers of following online advice without verification. While the desire to reduce tax liabilities is understandable, individuals must ensure that their strategies remain within the legal framework. Engaging in fraudulent or deceptive practices can result in severe financial and legal repercussions. Tax planning is a smart, responsible, and legal approach to reduce liabilities. By leveraging deductions, exemptions, tax-saving investments, and professional guidance, taxpayers can achieve their financial goals safely. Always prioritize compliance over shortcuts—avoiding viral “tricks” ensures peace of mind and long-term financial security.

| Aspect | Details |

|---|---|

| Video Content | A Mumbai couple demonstrates methods to reduce taxes, claiming legality. |

| Legal Concerns | The strategies may border on tax evasion, which is illegal and punishable under Indian law. |

| Legitimate Tax-Saving Tips | Utilize deductions, exemptions, and credits legally available under the Income Tax Act. |

| Recent Legal Cases | Thane couple arrested for evading GST worth ₹12.23 crore. Read more |

| Professional Advice | Experts recommend consulting chartered accountants or tax professionals before implementing any tax-saving strategies. |

Understanding the Viral Video

The Mumbai couple’s video claims to reveal a blueprint for legally reducing tax liabilities. It shows multiple methods the couple allegedly used to minimize their taxable income, presenting them in a step-by-step format that appears simple and accessible.

What the Video Shows

- Inflated Expenses – Claiming higher expenses than actually incurred to reduce taxable income.

- Fictitious Transactions – Recording transactions that did not take place to generate artificial deductions.

- Misuse of Tax Credits – Applying tax credits to which they may not be legally entitled.

While the video is presented as “legal,” such tactics are generally considered tax evasion, which is illegal in India and most other countries. Even minor misrepresentations can lead to fines, interest payments, and imprisonment. It is important to understand that there is no shortcut to legally avoiding taxes beyond what is explicitly allowed by law.

Legal Implications of Tax Evasion

Tax evasion is a serious offense under Indian law. According to the Income Tax Act, 1961, deliberately misreporting income, falsifying financial records, or claiming deductions illegally is punishable by severe penalties.

Possible Consequences

- Fines: Up to 300% of the evaded tax amount.

- Imprisonment: Up to seven years for serious offenses.

- Interest on Unpaid Taxes: Accrues over time, increasing liability.

- Legal Proceedings: Tax authorities can conduct audits, raids, and investigations.

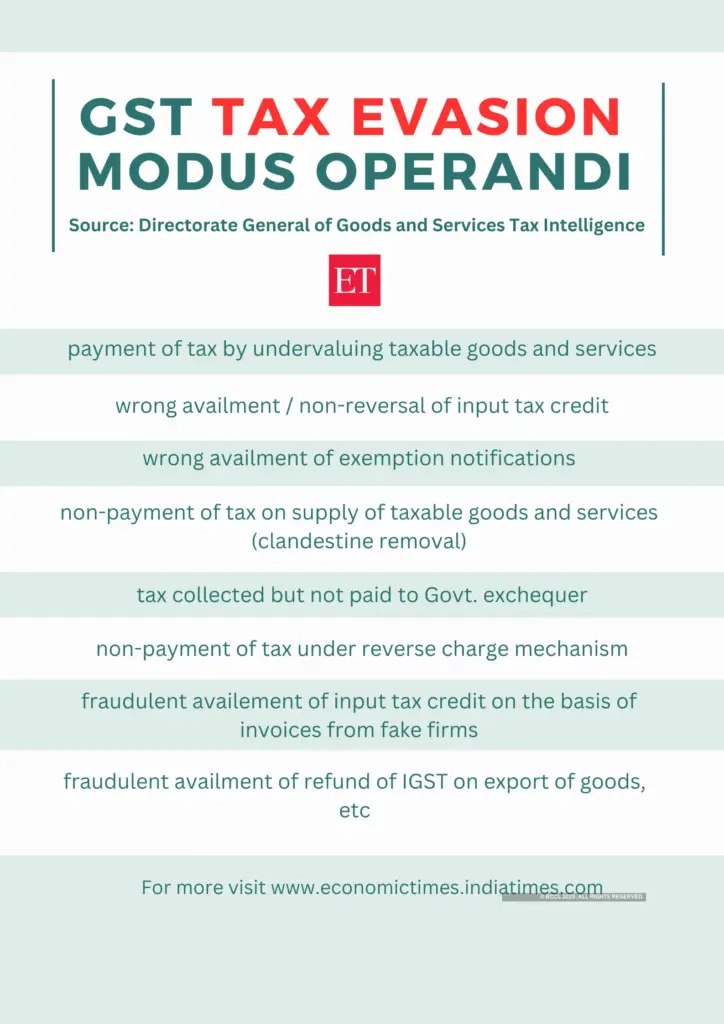

Case Study: Thane Couple Arrest

In 2022, a couple from Thane was arrested for evading GST worth ₹12.23 crore. The duo allegedly created fake invoices and shell companies to claim input tax credits fraudulently. The case demonstrates how sophisticated schemes, no matter how cleverly executed, can result in serious legal consequences.

Other Notable Cases

- Surat Couple (2021): Accused of orchestrating a ₹111 crore GST scam by passing fraudulent input tax credits through bogus firms.

- Mumbai Property Case: A wife received an income tax notice for her husband’s property purchase, highlighting complexities in joint ownership and tax liabilities.

These cases serve as cautionary examples of the risks associated with unlawful methods of reducing taxes.

Historical Context & Trends in Tax Evasion in India

India has witnessed significant changes in taxation enforcement over the past decade. Technological advancements and regulatory reforms have made it more difficult for individuals and businesses to evade taxes.

- 2015–2020: The Income Tax Department reported a 15% increase in the detection of tax evasion cases.

- GST Implementation (2017): Introduction of digital invoices and automatic tracking reduced opportunities for fraudulent claims.

- Recent Trends: The rise of viral videos and online forums promoting “loopholes” has increased the risk of individuals attempting illegal strategies.

Globally, India’s approach mirrors that of countries like the United States and United Kingdom, where authorities actively monitor suspicious activity, prosecute offenders, and encourage voluntary compliance through transparency initiatives.

Step-by-Step ‘Legal’ Tax Evasion Tricks

While avoiding illegal tactics, there are numerous legitimate ways to reduce tax burdens. Here’s a practical guide:

1. Utilize Section 80C Deductions

Investments in Public Provident Fund (PPF), National Savings Certificates (NSC), Equity-Linked Savings Scheme (ELSS), and life insurance premiums can help save up to ₹1.5 lakh annually.

2. House Rent Allowance (HRA) Exemption

If you live in a rented home, you can claim HRA exemption by maintaining genuine rent receipts.

3. Home Loan Interest Deduction

Interest paid on home loans for self-occupied properties is deductible under Section 24(b).

4. Health Insurance Premiums

Premiums paid for yourself, spouse, children, and parents are deductible under Section 80D.

5. Education Loan Interest Deduction

Interest on student loans qualifies for deduction under Section 80E.

6. Invest in Tax-Free Bonds

Government bonds offer interest income that is exempt from tax, providing a safe and reliable investment with tax benefits.

7. Contribute to Retirement Accounts

Investing in the National Pension Scheme (NPS) under Section 80CCD(1B) allows for an additional ₹50,000 deduction beyond Section 80C limits.

8. Keep Accurate Records

Maintain clear documentation for all investments and expenditures. Proper record-keeping can prevent disputes with tax authorities and ensure compliance.

By following these strategies, taxpayers can legally minimize liabilities without risking penalties or prosecution.

Expert Opinions

Chartered Accountant Rajiv Mehta says:

“Many viral videos oversimplify complex tax laws. Individuals must distinguish between deductions allowed by law and schemes that appear legal but are technically illegal. Always consult a professional before implementing any online advice.”

Tax Lawyer Anjali Desai adds:

“The allure of loopholes can lead to serious consequences. Even minor infractions can snowball into significant fines, interest, and potential criminal liability.”

Identifying Fraudulent Advice Online

The rise of social media has made it easier for misinformation to spread. To avoid falling victim to fraudulent tax advice:

- Stick to official sources such as Income Tax India and CBDT.

- Be wary of content that promises zero taxes or guaranteed savings.

- Verify any method with a licensed chartered accountant or tax lawyer.

- Avoid viral “quick-fix” schemes, which often rely on illegal practices.

Comparison: India vs. USA Tax Enforcement

| Country | Key Features |

|---|---|

| India | Income Tax Department, GST enforcement, digital invoices, PAN linking, e-filing audits. |

| USA | IRS audits, strict reporting for offshore accounts, whistleblower programs, severe penalties. |

| UK | HMRC digital tracking, penalties for inaccurate returns, automatic assessments. |

The global takeaway is clear: tax evasion is monitored rigorously worldwide, making “viral tricks” risky and often illegal in any jurisdiction.

Future Outlook: Digitalization and Compliance

The Indian government continues to invest in technology to strengthen compliance:

- AI and Data Analytics: Used by tax authorities to detect anomalies in returns.

- Mandatory E-Invoicing: Reduces fake transactions and shell company usage.

- Financial Literacy Campaigns: Help citizens differentiate between legitimate planning and fraudulent schemes.

- Blockchain Exploration: Could further enhance transparency in financial transactions and tax reporting.

As enforcement becomes more sophisticated, taxpayers are better protected, and fraudulent practices become harder to execute undetected.

Rs 200 Crore Tax Evasion Case – Coke Plant Owner From Meghalaya Arrested By DGGI

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

I-T Department Cracks Down On Tax Evasion And CSR Donation Misuse