Stocks That Could Skyrocket: When we talk about stocks that could skyrocket if a big GST rate rejig gets greenlight, we’re diving into one of the most anticipated financial shake-ups in India’s modern economy. Just like how Wall Street lights up when Washington rolls out new tax policies, Indian markets are buzzing with expectations of a historic Goods and Services Tax (GST) reform. The Indian government is working on a plan to streamline GST into a simpler, two-tier structure. If passed, this rejig could slash rates on automobiles, consumer durables, and everyday goods, triggering a wave of demand. Analysts say this reform could inject ₹2.4 lakh crore (~$29 billion USD) into the economy and add 0.7–0.8% to GDP growth in the coming year. For investors, this could be a golden opportunity to ride India’s growth wave.

Stocks That Could Skyrocket

The proposed GST rejig in India could be one of the most significant economic reforms of the decade. By cutting rates, simplifying slabs, and boosting consumption, it has the potential to add nearly $29 billion in demand and lift GDP growth by almost a percentage point. For investors, the opportunity spans across multiple sectors—autos, FMCG, durables, cement, finance, and more. Much like the U.S. tax cuts of 2017, this reform could trigger a multi-year bull run. Timing and strategy will be key, but one thing is clear: this is India’s breakout moment, and those who position early may see extraordinary returns.

| Topic | Details |

|---|---|

| Proposed GST Reform | Two-tier GST: 5% (essentials), 18% (most goods & services), removal of 12% & 28% slabs |

| Market Impact | Nifty 50 surged 1.36%; Maruti Suzuki stock jumped 8.2%, Hero MotoCorp 6.5% |

| Economic Boost | Estimated demand push: ₹2.4 lakh crore (~$29B USD); GDP growth up by 0.7–0.8% |

| Top Sectors Benefiting | Automobiles, Consumer Durables, FMCG, Cement/Real Estate, Banking & Finance |

| Reference | Official GST Council of India |

Why the GST Rejig Matters?

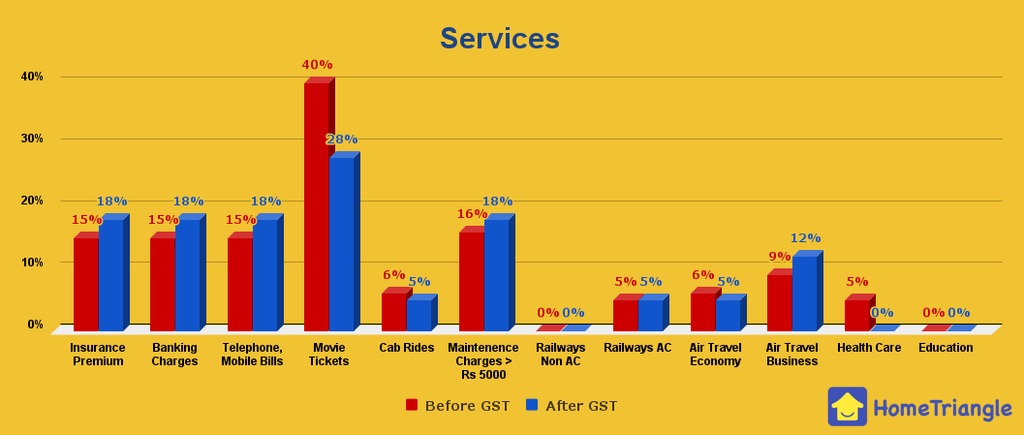

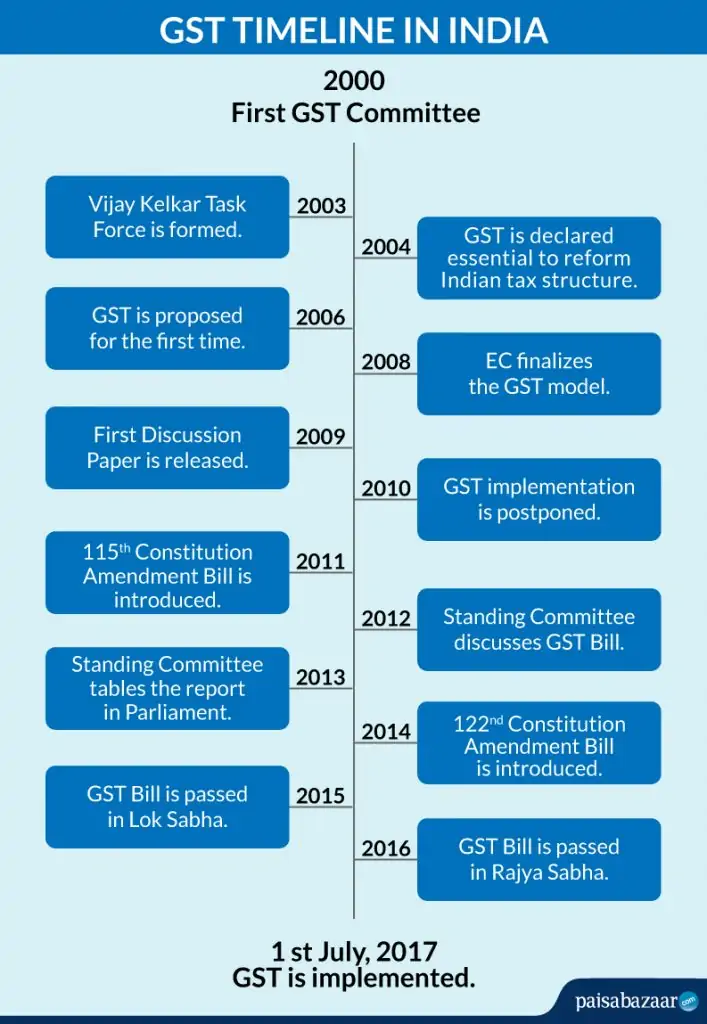

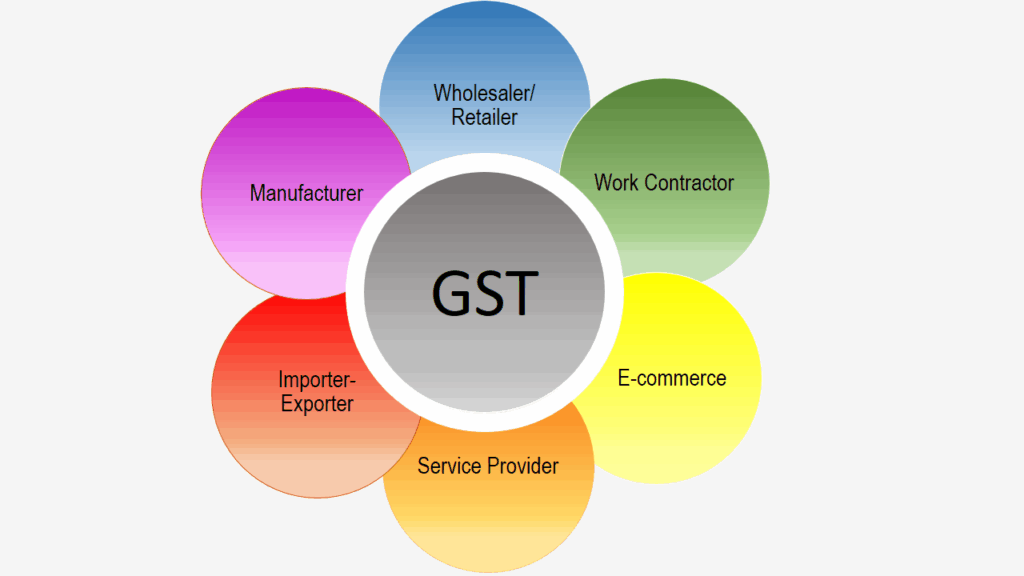

GST, or Goods and Services Tax, was launched in India back in 2017. It replaced a confusing patchwork of state and federal taxes with a unified system. But the structure still has four main slabs—5%, 12%, 18%, and 28%.

The problem? Too many slabs create pricing inefficiencies, increase compliance burdens for businesses, and discourage consumption of high-tax items like automobiles and electronics.

The proposed rejig aims to simplify GST into just two slabs—5% and 18%. Essentials like food will remain at the lower tier, while most goods and services will shift to the 18% slab. The big win comes from eliminating the 28% slab, which currently covers cars, air conditioners, and luxury items.

By slashing tax rates on these goods, the government hopes to revive consumption, especially at a time when global growth is slowing. For investors, that translates into fresh opportunities in India’s most dynamic sectors.

Automobiles – The Star Performer

The auto industry is expected to be the single biggest winner from GST reform. Right now, cars, SUVs, and two-wheelers fall under the 28% slab, making them expensive for India’s price-sensitive consumers.

- Maruti Suzuki: The country’s largest carmaker saw its stock jump 8.2% in a single day after reform talks gained momentum. With small cars likely to see lower prices, Maruti could see a surge in volumes.

- Hero MotoCorp, Bajaj Auto, TVS Motor: Two-wheelers dominate Indian roads, and lower prices could drive double-digit growth in rural and urban demand alike.

- Mahindra & Mahindra, Ashok Leyland: Utility vehicles and commercial trucks may see 10–11% upside, according to Nomura analysts.

Historical context supports this optimism. In 2008, when India slashed excise duties to fight the global financial crisis, auto sales spiked within months. A similar consumption revival could play out post-GST cuts.

Consumer Durables and Electronics

Electronics and home appliances—everything from televisions to refrigerators—are also heavily taxed under the 28% slab. Moving them down to 18% could spark a buying spree, much like Black Friday sales in the U.S.

- Blue Star and Voltas: Leading air-conditioner makers expect a sharp jump in sales. A Blue Star executive recently told Reuters they could see a 20% increase in demand post-reform.

- Whirlpool and Havells: Makers of refrigerators, washing machines, and small appliances could see strong growth.

- Amber Enterprises: A major supplier for AC brands, positioned for higher B2B orders.

Durable goods often face demand delays when consumers wait for tax cuts. Once the reform kicks in, pent-up demand could drive several quarters of growth.

FMCG and Staples

While autos and durables grab headlines, everyday goods also stand to benefit. Items like biscuits, packaged foods, and juices currently face 12% GST, which could drop to 5%.

- HUL, Britannia, Nestlé, Dabur, ITC: These consumer staples companies are household names. Even small price cuts here can push sales volumes higher, especially in rural India where affordability drives purchasing decisions.

- Analysts at Morgan Stanley expect a 5–7% boost in FMCG volumes in the first year after reforms.

For perspective, rural India makes up around 65% of the country’s population. Cheaper goods here could significantly expand consumption.

Cement, Real Estate, and Housing

Cement is another high-tax sector stuck at 28%. Cutting it down to 18% would reduce overall construction costs by about 7–8%.

- UltraTech Cement, JK Cement: With cheaper cement, housing and infrastructure projects become more viable.

- Real Estate Developers: Lower construction costs make homes more affordable, potentially sparking a housing boom.

Affordable housing has been a cornerstone of India’s policy goals, and GST reform could accelerate that push. Historically, real estate rallies follow major cost reductions, much like the housing market rebound in the U.S. after 2009 stimulus programs.

Banking and Financial Services

Whenever big-ticket purchases rise, lending activity follows. That’s why banks and NBFCs are also likely to gain.

- HDFC Bank, ICICI Bank, Bajaj Finance, IDFC First Bank: All positioned to benefit from higher demand for auto loans, home loans, and personal credit.

- India’s credit growth is already around 16% year-on-year, and GST cuts could push this even higher.

For financial institutions, higher loan growth means bigger balance sheets, improved profitability, and long-term shareholder gains.

Broader Consumption Play – Retail, Hospitality, and QSRs

GST reform doesn’t just impact autos or FMCG—it trickles down across the consumption chain.

- Retail stocks like Bata, Relaxo, and Trent may see higher discretionary spending.

- Quick Service Restaurants (QSRs) like Domino’s (Jubilant FoodWorks), Burger King (RBA), and KFC (Devyani) could thrive as eating out gets cheaper.

- Hospitality chains like Indian Hotels and Lemon Tree may benefit from increased leisure spending.

- Logistics providers like Delhivery and Swiggy would see higher delivery volumes as online consumption surges.

Global Parallels and Lessons on Stocks That Could Skyrocket

India isn’t the first country to use tax reforms as a growth tool.

- In the United States, the 2017 Tax Cuts and Jobs Act lowered corporate tax rates and sparked a rally, with the S&P 500 gaining nearly 19% that year.

- China’s 2019 VAT cuts gave manufacturers relief and boosted domestic demand.

These examples highlight how tax policy can fuel corporate profits and investor returns. India’s GST reform has the potential to create a similar impact in Asia’s third-largest economy.

Risks to Watch

No reform is risk-free. Some potential challenges include:

- Implementation delays: Political debates within the GST Council could stall the rollout.

- Short-term sales slowdown: Consumers may delay purchases in anticipation of tax cuts.

- Fiscal deficit pressures: Reduced tax revenues could widen government deficits.

- Inflationary risks: If demand spikes too quickly, supply shortages could push prices higher.

Investors need to be mindful of these risks and diversify portfolios accordingly.

How Investors Can Prepare for Stocks That Could Skyrocket– A Step-by-Step Guide

- Diversify your exposure: Don’t just load up on auto stocks. Spread across FMCG, durables, and banks.

- Use ETFs and mutual funds: For U.S. investors, funds like iShares MSCI India ETF offer broad exposure.

- Time your entry: Watch GST Council meetings and announcements around Diwali 2025.

- Monitor quarterly earnings: Focus on whether companies are converting tax cuts into real sales growth.

- Manage risk: Keep 10–15% cash in your portfolio to buffer against volatility.

Professional Tips for Portfolio Strategy

- Sector Rotation: Enter autos and durables in the short term, rotate into banks and FMCG for medium-term gains.

- Stick to leaders: Market leaders like Maruti, HUL, and HDFC Bank are safer bets than small caps.

- Balance global risks: Hedge with global ETFs to offset currency or macro shocks.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

India Proposes Tax Cuts on Small Cars – Modi Reforms Send Auto Stocks Soaring

Auto Companies Want New GST Rates Before Navratri – What This Means For Buyers