Subway Franchise Penalized ₹5.45 Lakh: If you’ve been tracking GST profiteering in India, this one’s worth your coffee break. The GST Appellate Tribunal (GSTAT) has slapped a ₹5.45 lakh penalty (plus 18% interest) on Urban Essence, a Subway franchisee, for failing to pass on GST rate cut benefits to customers. In plain English? They pocketed savings meant for you and me — the sandwich lovers. The decision isn’t just about punishing one franchise. It’s about sending a clear message to businesses across India: Pricing transparency is non-negotiable. Whether you run a fast-food outlet in Mumbai or a boutique in Chicago, there’s a universal truth — when tax rates drop, your customers should feel it in their wallets.

Subway Franchise Penalized ₹5.45 Lakh

The Subway GST penalty isn’t just a local franchise story — it’s a global business lesson. Tax laws may vary from country to country, but fairness in pricing is a universal expectation. For customers, it’s proof that your voice matters. For businesses, it’s a reminder that short-term profits gained through hidden price hikes can lead to long-term reputational damage and legal trouble. Compliance isn’t a burden; it’s a trust-building tool. Use it well, and your brand will stand the test of time.

| Key Detail | Info |

|---|---|

| Offending Entity | Urban Essence – Subway Franchisee |

| Penalty Amount | ₹5.45 lakh (₹545,005) + 18% interest |

| Legal Provision | Section 171, CGST Act (Anti-profiteering) |

| GST Rate Change | 18% → 5% (effective Nov 15, 2017) |

| Alleged Period | Nov 15, 2017 – Oct 31, 2019 |

| Action Authority | GST Appellate Tribunal (GSTAT) |

| Funds Destination | Consumer Welfare Fund, Maharashtra |

| Official Source | GST Appellate Tribunal Order |

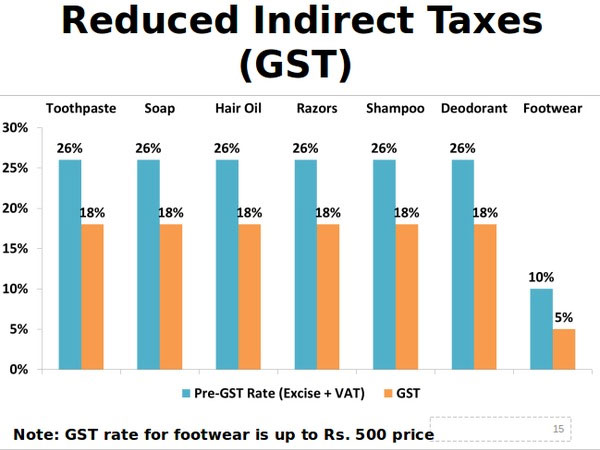

Understanding the 2017 GST Rate Cut

The Goods and Services Tax (GST) was introduced in India in July 2017 to replace a messy patchwork of state and central taxes. One of its most debated features is the dynamic tax rate structure, which allows the GST Council to adjust rates periodically.

In November 2017, the Council made a big move:

- Restaurants GST Rate: Slashed from 18% to 5%.

- Trade-off: Input Tax Credit (ITC) removed.

The idea was to simplify billing and reduce the tax burden on customers. But for restaurants, losing ITC meant higher operating costs since they could no longer offset taxes paid on raw materials, utilities, and other inputs.

The government expected restaurants to strike a balance — passing on at least part of the savings to consumers while accounting for the ITC loss.

What Went Wrong at Subway’s Urban Essence?

According to the Directorate General of Anti-Profiteering (DGAP), instead of reducing menu prices, Urban Essence raised base prices around the time of the GST cut. The result? Customers ended up paying about the same (or more) than before, despite the lower GST rate.

The investigation covered a 23-month period — from November 15, 2017 to October 31, 2019. Data analysis showed profiteering worth ₹5.45 lakh, which the GSTAT ruled must be returned (with interest) to the Consumer Welfare Fund.

Why Subway Franchise Penalized ₹5.45 Lakh Case Matters?

Think of it in U.S. terms. If California suddenly cut sales tax from 8% to 3%, but your local diner hiked menu prices overnight so your bill didn’t change — you’d feel cheated, right? That’s exactly what Indian authorities call profiteering.

This case matters for two big reasons:

- For customers: It’s proof that watchdog agencies will step in if businesses try to sidestep fairness.

- For businesses: It’s a warning — transparency in pricing isn’t just “good PR,” it’s a legal requirement.

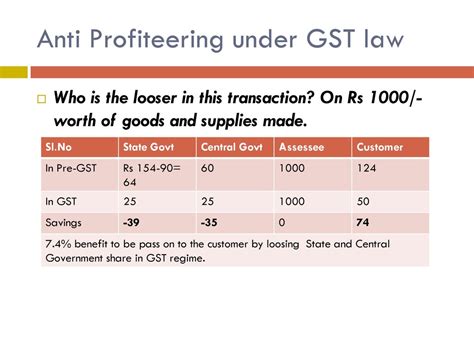

The Legal Foundation — Section 171, CGST Act

Section 171 is India’s anti-profiteering law. It says:

Any reduction in the rate of tax must be passed on to the consumer by way of a commensurate reduction in prices.

Failing to comply can lead to:

- Refund of profiteered amount with interest (18% in this case).

- Funds being deposited into the Consumer Welfare Fund.

- Possible reputational damage and loss of franchise credibility.

In this case, Urban Essence has three months to deposit the funds or face further legal consequences.

How Common Is GST Profiteering in India?

It’s more common than most people think. According to official NAA (National Anti-Profiteering Authority) records from 2017–2023:

- Over 500 cases investigated.

- Sectors most affected: Food & Beverage, Real Estate, Retail.

- Largest single penalty: Over ₹90 crore in a real estate case.

Food and beverage outlets like restaurants are top offenders due to frequent menu price adjustments and high transaction volumes.

Step-by-Step: How Anti-Profiteering Cases Unfold

- Complaint Filed – By a customer, competitor, or consumer group.

- Standing Committee Review – Screens for merit.

- DGAP Investigation – Collects sales data, compares pre- and post-tax change prices.

- Tribunal/NAA Ruling – Issues binding decision.

- Execution – Profiteered amount + interest deposited to Consumer Welfare Fund.

This process can take months or even years, depending on complexity.

Compliance Checklist for Business Owners

If you operate in a GST regime, here’s how to stay compliant:

- Track every GST rate change and immediately review your pricing.

- Keep detailed records of why prices went up or down.

- Train frontline staff to explain price changes honestly to customers.

- Consult a tax professional before adjusting menus or price tags.

- Conduct regular internal audits — prevention is cheaper than penalties.

Global Perspective: Similar Rules in the U.S. and U.K.

While the U.S. doesn’t have GST, state consumer protection laws guard against deceptive pricing. For instance:

- New York: Failure to reflect a tax cut in pricing could fall under “false advertising.”

- California: Misleading advertised prices can lead to fines under the Business & Professions Code.

In the U.K., when VAT was temporarily cut for hospitality businesses in 2020, the government expected savings to reach customers. Regulators and consumer groups actively monitored pricing behavior.

The Bigger Picture — Trust Is Priceless

In today’s transparent, social-media-driven market, brand trust is everything. For global brands like Subway, one local franchise’s misstep can ripple worldwide.

When customers feel cheated, they don’t just stop visiting — they talk. And in the digital age, that talk can reach thousands within hours. The cost? Far more than any tax saving you thought you’d keep.

Real-Life Example: Doing It Right

Let’s say you own a coffee shop in Bengaluru. GST drops from 18% to 5%, but you lose ITC, raising your cost per latte by ₹5. The tax cut should save customers ₹15. You choose to reduce the price by ₹10, absorbing ₹5 in costs.

Your customers see a tangible benefit, you maintain fairness, and you protect your brand from scrutiny. That’s how ethical pricing works.

Historical Cases Worth Noting

- 2018 Subway Gujarat Case: A different Subway franchise was cleared of profiteering when the NAA found that price increases were proportional to ITC loss.

- Major Real Estate Case (2019): A developer was fined ₹90 crore for not passing on GST rate cut benefits to homebuyers.

- ** FMCG Sector Investigations**: Multiple packaged goods companies have been probed for profiteering on essentials after GST changes.

These show that outcomes vary — but detailed, transparent records are the deciding factor.

Data-Driven Insight — Why Food & Beverage Leads

Why are restaurants so often in the spotlight?

- High frequency transactions make pricing changes immediately visible.

- Menu flexibility allows quick adjustments that can mask profiteering.

- Customer sensitivity — a ₹10 difference in a sandwich price is noticed faster than a hidden fee in a construction bill.

No GST Refund for Traders with Cancelled Registration—Delhi HC’s Ruling Shakes Business Community

New Laws That Could Change India Forever? GST Ordinance & Anti-Doping Amendments Hit Lok Sabha

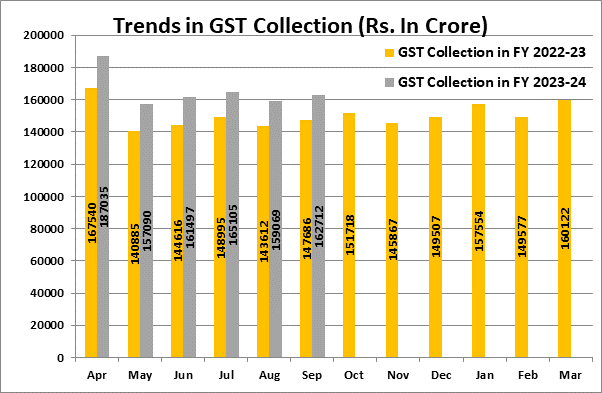

New DDP Indicators and GST Collections Reveal Economic and Cultural Shifts in Districts