Sudden GST Cuts Could Disrupt Entire Supply Chain: The medical device industry in India is sending a clear warning: sudden changes in Goods and Services Tax (GST) could shake up the entire healthcare supply chain. Imagine walking into your local Walmart or Target, and overnight every single price tag changes without notice. Cashiers can’t process items, suppliers are confused, and shelves stay empty. That’s the kind of disruption medical device makers say could happen if the government slashes GST from 12% to 5% without proper planning. This issue isn’t just about percentages or policy paperwork. It’s about whether hospitals can get enough syringes, whether doctors will have access to affordable implants, and whether Indian manufacturers can survive in a market already flooded with imports.

Sudden GST Cuts Could Disrupt Entire Supply Chain

The medical device industry’s concerns aren’t just about money—they’re about ensuring hospitals stay stocked and patients don’t suffer. Sudden GST cuts may sound like a win for affordability, but without planning, they risk creating shortages, financial stress, and heavier import dependence. A smarter path is clear: phase in cuts, protect domestic manufacturers, and focus on affordability with stability. By balancing patient needs with industry realities, India can achieve both affordable healthcare and a thriving local manufacturing ecosystem.

| Aspect | Details & Data |

|---|---|

| GST Proposal | Cut from 12% to 5% on medical devices. |

| Industry Concern | Sudden cuts could disrupt labeling, packaging, and stock. |

| AiMeD Recommendation | 3–6 month transition, keep 12% for consumables, reduce only for high-value devices. |

| Impact on Domestic Players | Risk of inverted duty structure → imports gain advantage. |

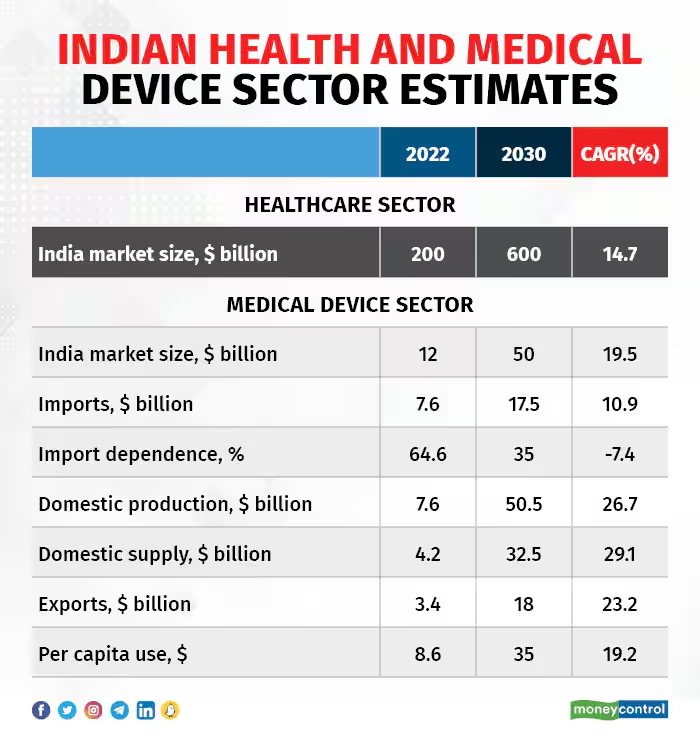

| Market Size | $11 billion in 2023, projected to reach $50 billion by 2030. |

| Import Dependence | 70–80% of India’s medical devices are imported. |

| Proposed Solution | Health Cess of 10% on imports, smoother GST refunds. |

| Official Reference | Goods and Services Tax Council |

A Brief History: GST and Healthcare in India

GST was launched in 2017 as a unified tax system to replace dozens of state and central levies. For the healthcare industry, GST simplified compliance but introduced new challenges. Medical devices were slotted under a 12% tax bracket—a middle ground aimed at keeping products affordable while maintaining government revenue.

In the years since, there have been pushes to lower GST on certain categories of devices and life-saving drugs. For example, when GST was cut on cancer drugs in 2024, it brought relief to patients but caused temporary chaos as pharmacies scrambled to relabel and distributors dealt with mismatched invoices.

Lesson learned? Even well-intentioned changes can cause real-world headaches if rolled out without warning.

Why Sudden GST Cuts Could Disrupt Entire Supply Chain?

1. Supply Chain Shake-Up

Medical devices—whether a $1 syringe or a $10,000 CT scan machine—are labeled and packaged months before they hit hospital shelves. If GST suddenly changes:

- Old stock becomes outdated overnight.

- Distributors must redo billing, relabel boxes, and handle compliance risks.

- Hospitals face delays in getting even the most basic supplies.

Case in point: A distributor in Mumbai explained that if GST drops instantly, thousands of IV sets sitting in warehouses would carry the wrong labels. Either they’d need expensive relabeling or they’d be stuck with unsellable stock. For hospitals, that means shortages in the short term.

2. The Inverted Duty Structure

Here’s the big economic headache. Raw materials like plastics, metals, and electronic components often attract higher GST than the finished product. If GST on finished devices drops to 5% but inputs stay taxed at 12–18%, manufacturers bleed cash waiting for refunds.

This structure is a dream for importers, who avoid such delays entirely, but a nightmare for domestic producers struggling with liquidity.

3. Imports vs. Local Players

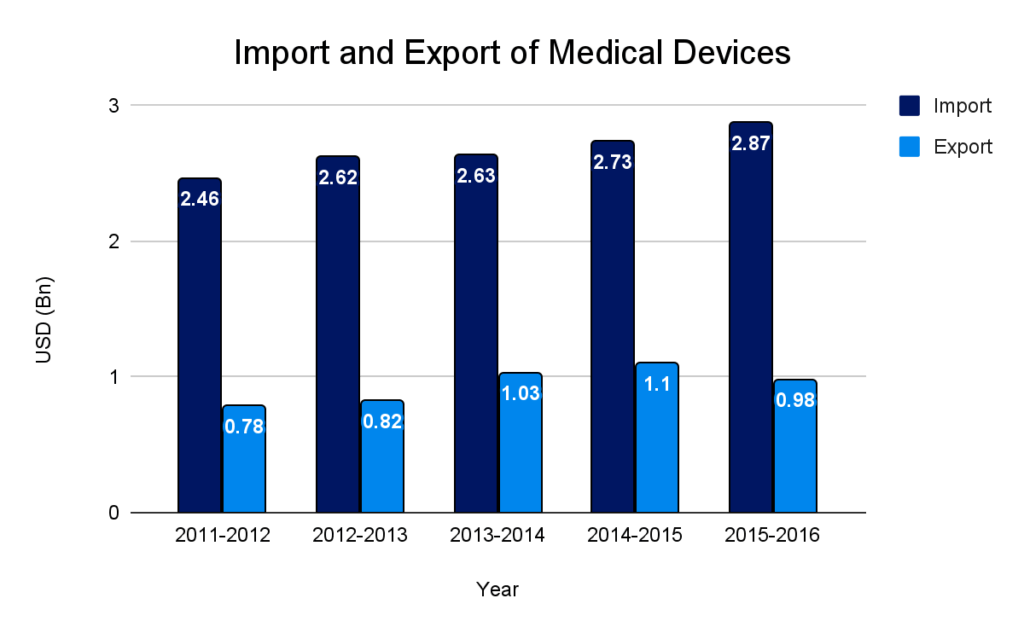

India’s medical device market depends 70–80% on imports, especially for advanced tools like MRIs, pacemakers, and robotic surgery systems. Imports mainly come from the U.S., Germany, Japan, and China.

If GST suddenly drops, imported products become cheaper overnight. Local companies making stents, syringes, and diagnostic tools can’t compete, risking closures. That runs directly against India’s Atmanirbhar Bharat vision of self-reliance.

How Other Countries Manage Medical Device Taxes?

Looking at global practices shows why India needs caution:

- United States: The U.S. once imposed a 2.3% excise tax on medical devices under the Affordable Care Act. It was repealed in 2019 because it discouraged innovation and raised costs without helping patients. Instead, the U.S. now uses a mix of reimbursement models under Medicare and private insurance to manage affordability.

- European Union: Many EU countries apply reduced VAT rates (5–7%) on essential devices. But they don’t implement cuts suddenly—phased rollouts and advance industry consultation are standard.

- China: Taxes medical devices but strongly subsidizes domestic manufacturing through grants, tax holidays, and state-backed financing.

Unlike China, India doesn’t heavily subsidize its manufacturers. Sudden GST cuts without safeguards risk tilting the market further toward imports.

The Economics: Why This Matters

According to IBEF, India’s medical device market stood at $11 billion in 2023 and is projected to reach $50 billion by 2030. That’s a 15% annual growth rate—one of the fastest in the world.

However:

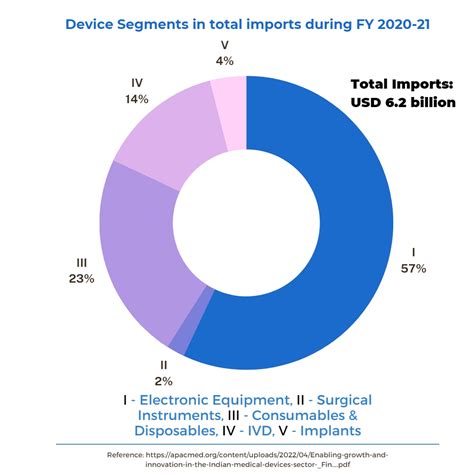

- Imports dominate the high-value segment (diagnostic imaging, implants).

- Domestic players dominate low-value consumables (syringes, catheters).

- Without protective policies, domestic growth could stall, leaving India permanently dependent on imports.

This dependence became painfully obvious during COVID-19, when India scrambled for ventilators and PPE. The pandemic highlighted the importance of domestic manufacturing capacity for national security.

Practical Advice for Stakeholders

For Policymakers

- Introduce phased GST cuts instead of overnight changes.

- Allow a 3–6 month transition period for labeling and compliance.

- Impose a 10% Health Cess on imports to balance competitiveness.

- Simplify and speed up GST refund processes to ease liquidity issues.

For Domestic Manufacturers

- Invest in automation for compliance and labeling.

- Build coalitions through industry bodies like AiMeD to lobby for fair policies.

- Diversify into higher-value products like diagnostic tools, where margins are stronger.

- Explore partnerships with global firms to strengthen R&D.

For Healthcare Providers

- Communicate proactively with suppliers about potential disruptions.

- Stock up on essentials before GST transitions.

- Negotiate long-term contracts with suppliers to lock in stable prices.

Future Scenarios: What Could Happen

If GST Cuts Are Sudden

- Chaos in distribution, outdated inventory.

- Imports surge, local manufacturers shrink.

- Shortages of basic consumables in hospitals.

- Costs rise indirectly due to supply disruptions.

If GST Cuts Are Phased

- Smooth adaptation across supply chains.

- Domestic manufacturers remain competitive.

- Patients actually benefit from lower prices in the long run.

- India strengthens its “Make in India” strategy for healthcare.

Case Example: A Hypothetical Hospital

Let’s say a mid-size hospital in Lucknow orders 10,000 syringes monthly. If GST drops instantly:

- Distributor stock with 12% labels can’t be sold.

- Hospital waits weeks for new stock with updated 5% labels.

- In the meantime, patients face shortages, and prices could temporarily spike.

Now imagine the same change phased over six months:

- Distributors sell existing stock with old labels.

- New stock gradually comes in at 5%.

- No shortages, no waste, and patients benefit as intended.

This simple difference—planning versus rushing—decides whether patients win or lose.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

GST Cuts Could Boost Consumption by ₹2 Lakh Cr – Can Economic Growth Offset Losses?

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?