Supreme Court Denies Plea Challenging GST ECL Blocking Relief: In a recent landmark ruling, the Supreme Court of India dismissed a Special Leave Petition (SLP) challenging a decision made by the Delhi High Court regarding the blocking of the Electronic Credit Ledger (ECL) under Goods and Services Tax (GST). The case concerns a business’s ability to use Input Tax Credit (ITC) when the ECL is blocked, and the Supreme Court’s verdict has important implications for businesses operating under GST in India. The case, involving Kings Security Guard Services Private Limited, has caught the attention of the business community, as it brings clarity to the often-complex issue of blocking credits in the ECL. If you’ve been following GST-related developments, this ruling will significantly impact how businesses interact with GST authorities moving forward. Let’s break down the key aspects of this ruling and explore its consequences for businesses.

Supreme Court Denies Plea Challenging GST ECL Blocking Relief

The Supreme Court’s ruling on the blocking of ITC in the ECL under GST Rule 86A brings important clarity to businesses and tax authorities alike. The decision strengthens legal protections for businesses, ensuring that the blocking process remains transparent and evidence-based. For businesses, staying informed about GST laws and maintaining proper documentation is critical. With this ruling, companies can confidently navigate the complexities of the GST system, knowing their rights are well-defined and protected.

| Key Point | Details |

|---|---|

| Supreme Court Ruling | Dismissed the petition challenging the blocking of ECL under GST Rule 86A. |

| High Court Ruling | The Delhi High Court previously quashed the blocking of credits, stating it was impermissible. |

| Impact on Businesses | Businesses will need to be cautious about the blocking of Input Tax Credit (ITC) beyond available credit. |

| Legal Basis | The High Court ruled that negative blocking of credits is not allowed under Rule 86A. |

| Significance | This ruling aligns with past decisions, reinforcing that ITC blocking should be based on actual evidence. |

| Reference Link | Supreme Court’s Official Judgment |

What Does the Supreme Court’s Ruling Mean for GST?

This ruling is critical for businesses that use the Electronic Credit Ledger (ECL) to manage their Input Tax Credit (ITC) under the GST regime. So, let’s break down what exactly happened, why it matters, and how businesses should move forward.

What is ECL and How Does It Work?

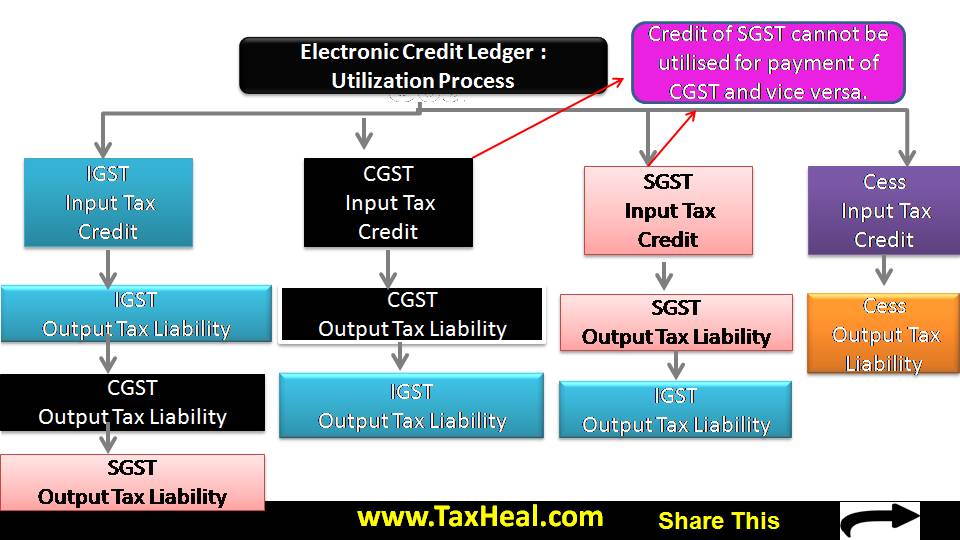

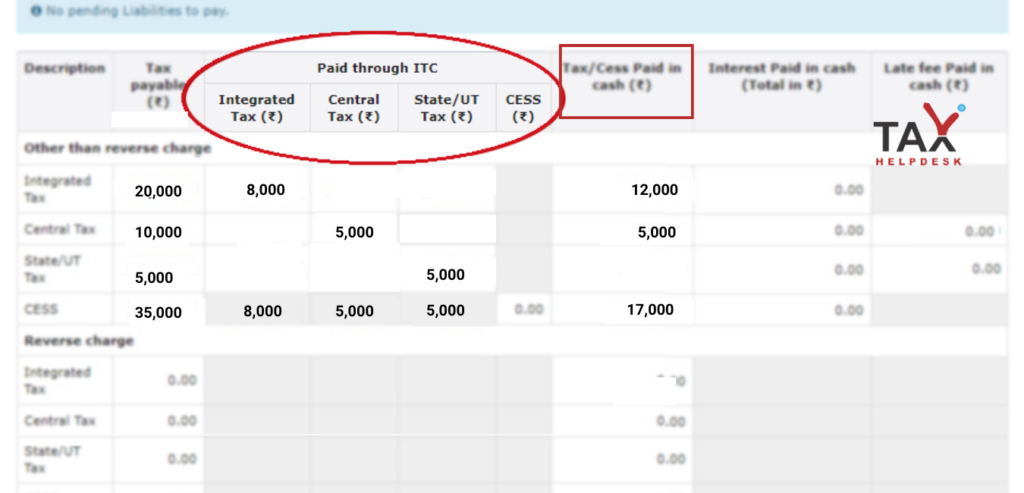

To understand the ruling, we need to first understand the concept of the Electronic Credit Ledger. In simple terms, the ECL is where a business’s Input Tax Credit (ITC) is stored. ITC refers to the tax paid on inputs—such as materials or services—purchased by a business. This tax credit can be offset against the tax the business collects on its sales. The ECL keeps track of how much ITC a business has accumulated and can use.

For example, if a business buys goods worth ₹100,000 and pays a GST of ₹18,000, it can use this ₹18,000 as ITC to reduce the GST it needs to pay on its sales. However, if the government believes there’s something wrong with the ITC claims (such as potential fraud), it can block a business’s access to its ITC in the ECL, as permitted under GST Rule 86A.

What Happened in This Case?

In this case, the Directorate General of GST Intelligence (DGGI) blocked the ECL of Kings Security Guard Services under Rule 86A, citing concerns over potential misuse of credits. The business challenged this action in the Delhi High Court, arguing that the government was blocking more ITC than what was actually available in the ledger.

The Delhi High Court sided with the business, ruling that the blocking of ITC beyond the available balance in the ECL was impermissible. The Court also pointed out that blocking credits arbitrarily could harm businesses and disrupt their operations.

Not satisfied with this ruling, the DGGI took the case to the Supreme Court. But the highest court upheld the High Court’s decision, reinforcing that the blocking of ITC in the ECL must be reasonable, evidence-based, and cannot go beyond what’s available in the ledger.

Why Is This Ruling Important?

1. Protection for Businesses

For businesses, especially small and medium-sized enterprises (SMEs), this ruling provides an important level of protection. The blocking of ITC was a process that, when used inappropriately, could cripple a business’s cash flow. In this case, the ruling ensures that businesses cannot be punished by blocking credits that they don’t even have access to.

It also reassures businesses that any block of credits must be backed by solid evidence, not just arbitrary or broad suspicions of fraud.

2. Clarification of GST Law

This ruling clarifies how GST authorities should approach Rule 86A, which has often been a point of contention. The rule allows the government to block ITC if there’s suspicion of fraud or misuse, but the Court made it clear that it cannot be used as a blanket tool to penalize businesses. The ruling prevents misuse of power by the government, ensuring that businesses are not unfairly targeted.

3. Guidance for Future Cases

This ruling sets a precedent for future cases regarding the blocking of ITC. Now, it’s clearer that the authorities cannot block credits arbitrarily and must provide concrete evidence when making such decisions.

4. Impact on GST Compliance

This decision also has an impact on how businesses approach GST compliance. Companies will now be more diligent in ensuring their ECLs are accurate and that they’re not exposed to unnecessary risks. Additionally, tax consultants will be needed more than ever to help businesses navigate the complexities of GST laws.

A Step-by-Step Guide to Navigate Supreme Court Denies Plea Challenging GST ECL Blocking Relief

So, what does this mean for businesses going forward? Here’s how you can ensure you’re prepared and protected under the current framework.

1. Understand GST Rule 86A and ECL Mechanisms

The first step for any business is understanding Rule 86A and how it affects the Electronic Credit Ledger (ECL). It’s important to know when the government can block your ITC and what the process entails. Stay updated with the latest official rules and amendments from the GST Council.

2. Keep Your Records in Order

Maintaining clear and accurate records is crucial. In case the GST authorities decide to block your ITC, having detailed invoices, payment receipts, and other documentation will allow you to defend your position.

3. Monitor Your ECL Regularly

Regularly track the status of your ECL. If you notice any unexpected blocks, take action immediately. With online GST portals, you can keep an eye on your ledger to make sure there are no surprises.

4. Consult with Experts

If you find that your ITC has been blocked or your ECL is under scrutiny, it’s highly advisable to consult a GST expert. They can help you understand your legal rights, represent you in court if necessary, and ensure that you’re not subjected to unjust actions.

5. File an Appeal If Necessary

If your ITC is blocked incorrectly, don’t hesitate to file an appeal. This can be done through the GST portal or with the help of a legal professional. If the blocking is not substantiated by evidence, you have the right to challenge it.

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”

India’s Tax Disputes Enter New Era as Govt Appoints Key Tribunal Members Nationwide