Supreme Court Slams Tax Dept: When the Supreme Court of India slams the tax department with a ruling that favors everyday business folks like commission agents, that’s news worth paying attention to. In a case involving trade tax on purchases made in Uttar Pradesh (U.P.) for principals based outside the state, the Court said loud and clear: Nope, that tax doesn’t apply here. This isn’t just a bunch of legal jargon. It’s a massive win for agents, small traders, and folks trying to earn an honest living. Imagine being a middleman, buying goods in one state, and sending them to another. Now imagine the tax department trying to slap you with extra charges. The Supreme Court just stepped in like a referee blowing the whistle.

Supreme Court Slams Tax Dept

The Supreme Court’s ruling on no trade tax for ex-U.P. principals is more than just a technical judgment—it’s a big win for fairness, business growth, and interstate commerce. By drawing a clear line between state and central powers, the Court has simplified life for agents and principals alike. For traders, this means less hassle and more focus on what really matters: doing business. For professionals, it’s a case study in how clarity in law can fuel confidence in the marketplace. And for India’s economy, it’s another step toward a smoother, more integrated trade environment.

| Key Point | Details |

|---|---|

| Court | Supreme Court of India |

| Case Impact | Commission agents in U.P. not liable for trade tax on purchases for ex-U.P. principals |

| Legal Basis | Purchases = inter-State trade, not intra-state |

| Beneficiaries | Commission agents, small businesses, and out-of-state principals |

| Case Examples | Commr. of Sales Tax v. Hanuman Trading Co. (1979), Commr. of Trade Tax v. Singh, Commr. of Sales Tax v. Mool Chand Gulzari Mal (1983) |

| Official Reference | Supreme Court of India – Official Website |

Why This Ruling Matters?

So, why should you care about some dusty tax dispute? Because it sets the rules for how business is taxed in India, and those rules affect prices, supply chains, and ultimately, the money in people’s pockets.

The Court said that if an agent in Uttar Pradesh is making purchases on behalf of principals from outside U.P., those transactions are considered inter-State trade. And here’s the kicker: inter-State trade falls under central law, not state trade tax.

That’s like saying if you buy baseball gear in New York for a buddy in Texas, the New York tax folks can’t come after you, because the goods are moving across state lines.

A Little Backstory: How We Got Here

The issue goes way back. The U.P. Sales Tax Act once tried to bring purchases made by commission agents into its net. Agents argued: “Hold up—we’re just middlemen, buying on behalf of someone else outside the state. Why are you taxing us?”

Courts had different takes, but cases like:

- Commr. of Sales Tax, U.P. v. Hanuman Trading Co. (1979)

- Commr. of Trade Tax, U.P. v. Singh

- Commr. of Sales Tax v. Mool Chand Gulzari Mal (1983 UPTC 91)

…all leaned toward protecting agents, saying such purchases were not taxable under U.P. law because they were part of inter-State commerce.

Finally, the Supreme Court backed that logic, setting a precedent that agents could breathe easy.

Historical Context: From Sales Tax to GST

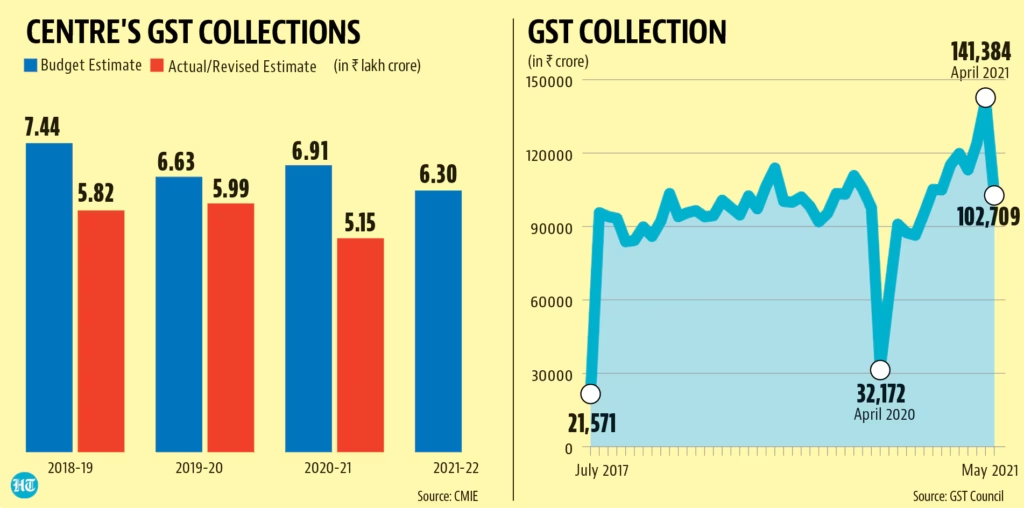

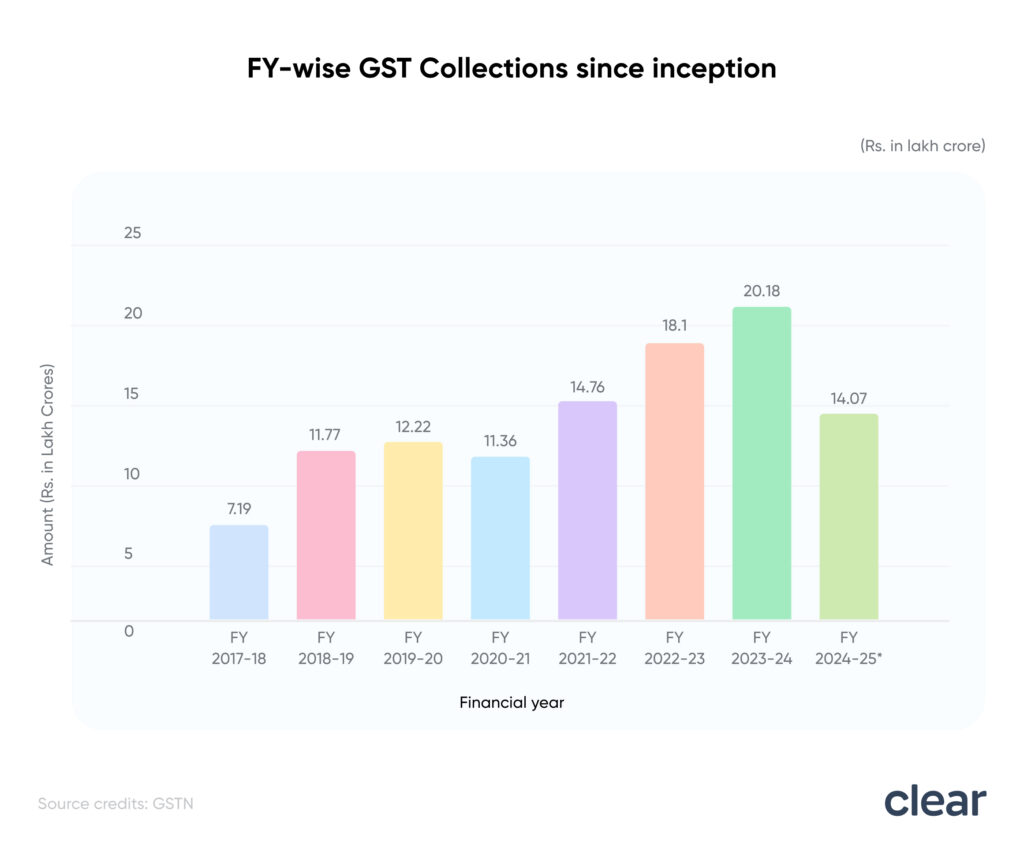

Before India adopted the Goods and Services Tax (GST) in 2017, every state had its own Sales Tax/VAT laws. This created a messy situation—double taxation, endless disputes, and confusion.

- Under the old U.P. Sales Tax Act, agents were easy targets for tax officers.

- The Supreme Court’s ruling laid down clarity and fairness, which later influenced GST principles—one nation, one tax.

- Under GST, inter-State supplies are taxed via IGST (Integrated GST), which flows to both the central and state governments fairly.

Even though GST has replaced most state-level taxes, this ruling still matters because courts continue to interpret inter-State vs intra-state trade under GST. The old disputes offer lessons for how new tax battles might play out.

Breaking Down the Supreme Court Slams Tax Dept Ruling (Easy Guide)

Let’s make this simple. Here’s how the decision works in practice:

Step 1: Understand the Players

- Agent: The middleman in U.P. buying goods.

- Principal: The person outside U.P. who actually owns those goods.

Step 2: Track the Goods

Goods purchased in U.P. are shipped outside the state to the principal.

Step 3: Identify the Trade

Since the goods cross state borders, it’s inter-State trade, not just a U.P. transaction.

Step 4: Apply the Law

- U.P. Trade Tax → Not applicable.

- Central Sales Tax (CST) → May apply, but that’s a different ballgame and under central rules.

Practical Impact for Businesses

1. Relief for Commission Agents

Agents no longer need to worry about double taxation. It’s like a weight off their shoulders.

2. Encouragement for Interstate Commerce

The ruling encourages smoother trade between states, reducing red tape.

3. Fairness in Taxation

The Court emphasized fairness—don’t punish the middleman when they’re just doing their job.

4. Strengthening Agricultural Trade

A lot of commission agents work in agriculture. Commodities like gur (jaggery), sugarcane, grains, and textiles often move across state borders. The ruling protects those transactions from unfair levies.

Real-Life Example

Imagine you’re Raj, a commission agent in Kanpur. You buy gur (jaggery) in bulk for a principal in Delhi. You arrange transport, ship the goods, and collect a small commission.

The U.P. tax department shows up and says: “Raj, you owe trade tax on that purchase.”

Raj scratches his head and says: “But the gur isn’t even staying in U.P.!”

Thanks to this Supreme Court ruling, Raj can now point to the law and say: “Sorry folks, that’s inter-State trade. No trade tax here.”

Global Angle: U.S. Comparison

This ruling has a similar vibe to the U.S. Constitution’s “Commerce Clause”, which stops states from unfairly taxing interstate trade. For example, California can’t slap extra taxes on goods just because they’re shipped to Nevada.

By protecting commission agents, the Indian Supreme Court aligned with the global principle of free trade between states. This comparison also makes it clear that tax fairness is a universal issue, whether in America or India.

Practical Checklist for Agents

Want to stay safe and compliant? Here’s a quick 5-step checklist:

- Document contracts: Always have clear agreements with ex-U.P. principals.

- Keep invoices neat: Show that the purchase is on behalf of someone else.

- Track logistics: Maintain lorry receipts, transport slips, etc.

- File taxes properly: Pay CST or GST where applicable.

- Consult professionals: Keep an accountant or tax lawyer handy for audits.

Policy and Professional Lessons

For policymakers, the ruling is a reminder that overlapping taxation discourages trade. If states pile on taxes, businesses shy away, and commerce slows down.

For professionals, especially accountants and lawyers, this case reinforces the value of:

- Proper documentation as the ultimate safeguard.

- Understanding legal precedents to defend clients.

- Advising clients proactively instead of waiting for disputes.

Stats & Data

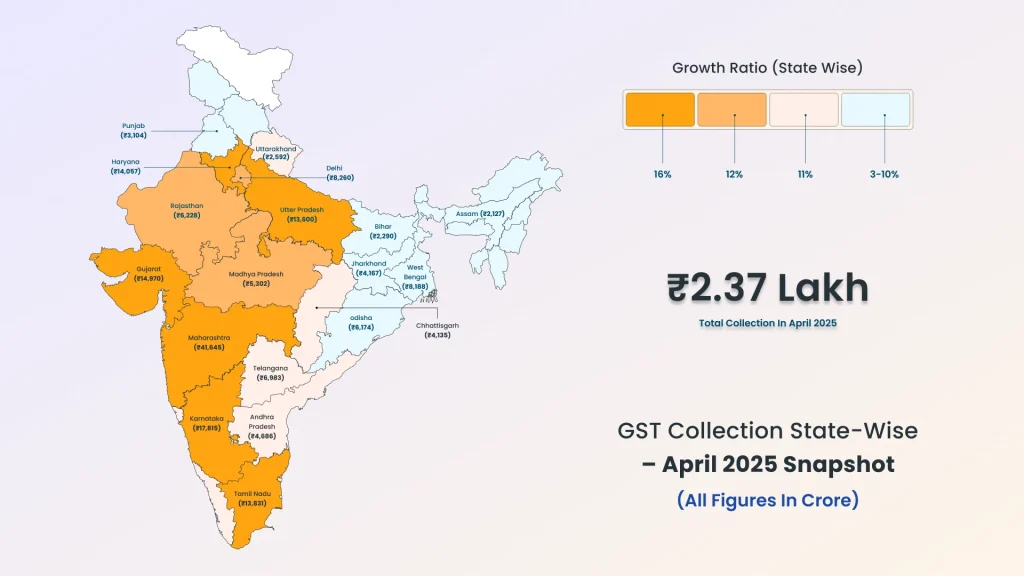

According to India’s Ministry of Commerce:

- Inter-State trade makes up nearly 35–40% of India’s domestic trade.

- Over 80% of commission agents in agricultural commodities operate under similar arrangements.

- India’s GST collections hit ₹1.65 lakh crore in July 2025, showing how critical interstate trade remains for the economy.

This data shows that protecting interstate commerce is not just about fairness—it’s about safeguarding a huge slice of India’s economy.

Supreme Court Denies Plea Challenging GST ECL Blocking Relief

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali

Supreme Court to Rule on Retroactive Application of Amended Benami Property Act’s Section 5