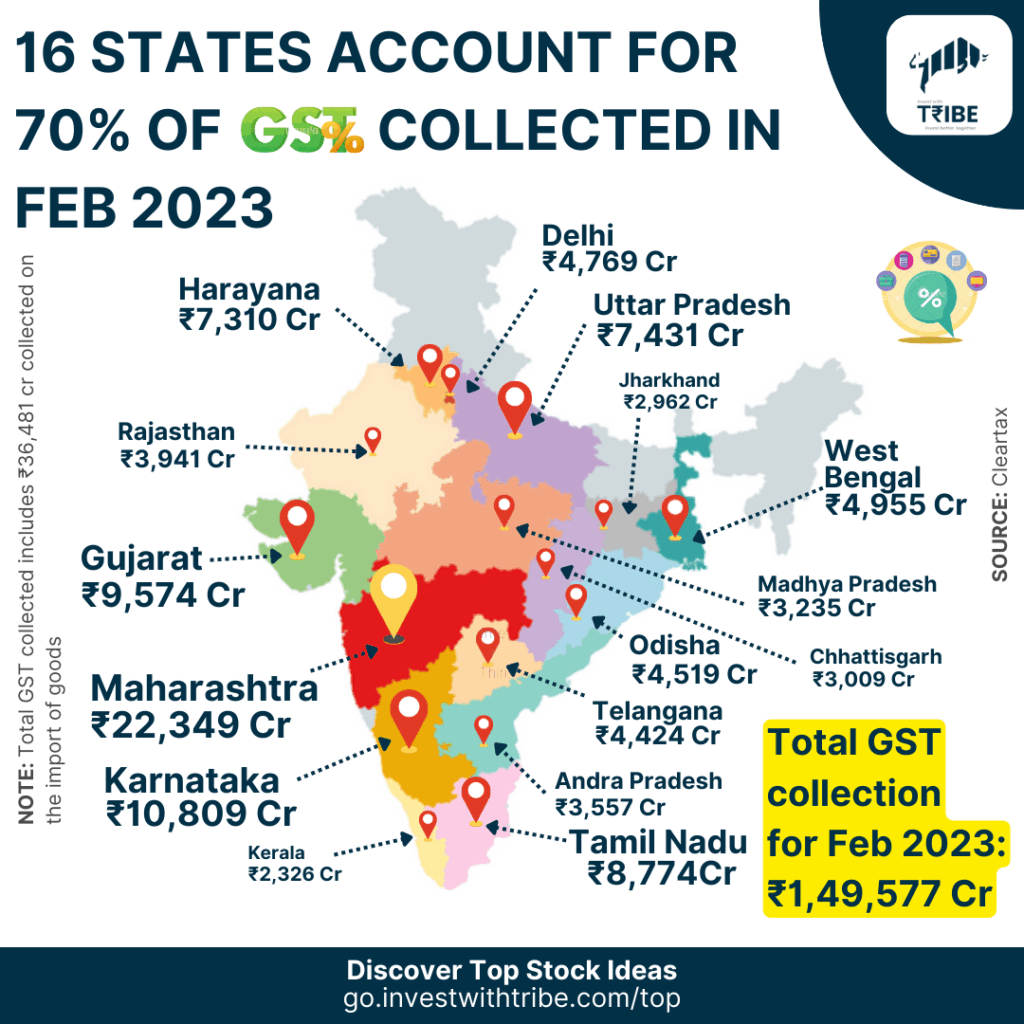

Tamil Nadu May Lose ₹7,000 Crore Annually: When the news broke that Tamil Nadu may lose ₹7,000 crore annually after GST rate rationalisation, it raised eyebrows across India’s political and economic circles. For many, it sounded like another technical debate between New Delhi and the states. But the truth is, this shift could affect everything from the roads we drive on to the schools our kids attend. For professionals, it’s a big fiscal warning sign. For ordinary citizens, it’s about whether the government will have enough funds to keep life running smoothly. Let’s dive deep into what this means, with facts, examples, and practical insights.

Tamil Nadu May Lose ₹7,000 Crore Annually

The headline “Tamil Nadu may lose ₹7,000 crore annually after GST rate rationalisation” isn’t just economic jargon. It’s about whether children get schools, patients get hospitals, and industries get roads. GST rationalisation may be great for simplicity, but without compensation, states like Tamil Nadu risk financial crisis. India now faces a defining choice: protect its states or risk weakening its federal foundation. For Tamil Nadu, the stakes are crystal clear—₹7,000 crore is not just money, it’s the future of its people.

| Key Point | Details |

|---|---|

| State Affected | Tamil Nadu (also Telangana, Kerala, and others) |

| Projected Annual Loss | ₹7,000 crore for Tamil Nadu |

| Combined State Losses | ₹1.5–2 lakh crore annually (all states together) |

| Tamil Nadu’s Stand | CM M.K. Stalin demands revenue protection |

| Why It Matters | Loss could affect welfare schemes, schools, hospitals, infrastructure |

| Industries Hit | Automobiles, textiles, FMCG, hospitality |

| Official Source | GST Council Website |

What Exactly Is GST and Why Is It Changing?

The Goods and Services Tax (GST) was introduced in July 2017 to simplify India’s complex tax system. Before GST, every state had its own rules for sales tax, VAT, and excise. Businesses had to navigate a maze of levies. GST rolled all of that into one uniform tax system, governed jointly by the GST Council.

But GST wasn’t perfect. It had five slabs (0%, 5%, 12%, 18%, 28%), and businesses complained about compliance headaches. Economists argued that India needed a simpler structure. That’s why the Centre is now pushing for GST rationalisation—basically, reducing the number of slabs, likely to three.

Sounds neat, but here’s the catch: states like Tamil Nadu rely heavily on revenue from higher slabs (18% and 28%). Simplifying slabs could mean lower collections, and that’s where the ₹7,000 crore annual loss figure comes in.

Why Tamil Nadu May Lose ₹7,000 Crore Annually?

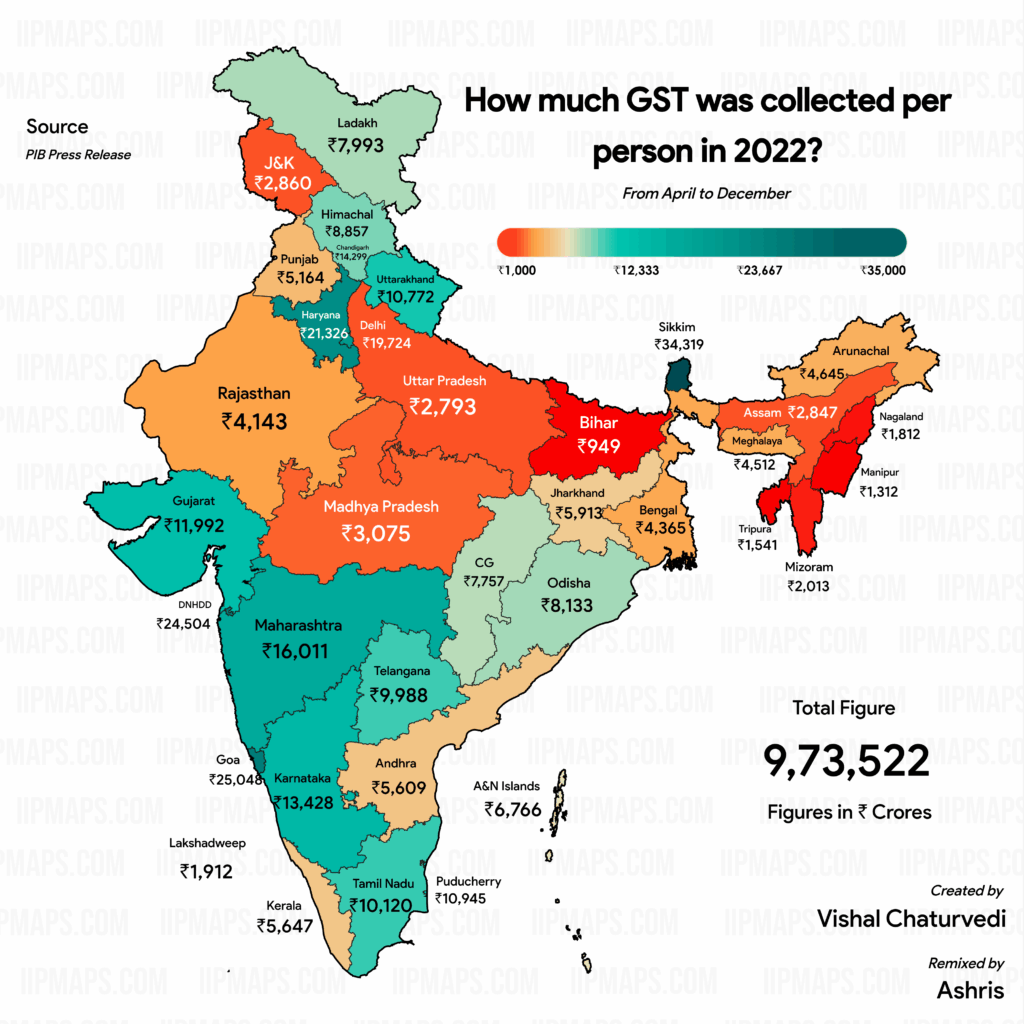

Tamil Nadu isn’t just any state. It’s one of India’s industrial and manufacturing powerhouses. From the auto factories of Chennai (Hyundai, Ford, Renault-Nissan) to the global textile hub of Tiruppur, the state thrives on industries that contribute big-time to GST.

If GST slabs are merged downward, Tamil Nadu stands to lose nearly 15% of its GST revenue. To understand this, imagine running a lemonade stand where each cup sells for $1. Suddenly, the city tells you to sell it at 80 cents. Even if you sell more cups, your daily earnings fall. That’s how Tamil Nadu views the proposed reforms.

A ₹7,000 Crore Loss in Real Terms

Numbers in crores and billions can feel abstract, so let’s break it down.

- ₹7,000 crore = roughly $840 million USD.

- With that money, Tamil Nadu could:

- Fund 7 lakh student scholarships worth ₹1 lakh each.

- Build 140 government hospitals (₹50 crore each).

- Construct 700 high schools (₹10 crore each).

This isn’t just about balance sheets. It’s about children’s futures, healthcare access, and infrastructure projects that create jobs.

Historical Context: GST’s Rocky Road

When GST was launched, states were skeptical. To win them over, the Centre promised five years of compensation (2017–2022) if GST collections fell short. That deal ended in June 2022, leaving states to fend for themselves.

Tamil Nadu, Kerala, and Punjab have repeatedly argued that GST erodes state autonomy. They claim producing states like Tamil Nadu lose more, while consuming states gain. The logic is simple: goods made in Tamil Nadu but sold in other states generate less revenue locally.

In the U.S., this would be like California losing its state sales tax on cars made in Los Angeles but sold in Texas. You can bet governors would be up in arms.

Telangana’s Case: A Mirror Image

Tamil Nadu is not alone. Telangana’s Deputy Chief Minister Bhatti Vikramarka warned his state could also lose ₹7,000 crore annually—15% of its GST revenue. He claimed Telangana already lost ₹27,000 crore in 2024–25 and over ₹80,000 crore cumulatively since GST began.

That’s like two neighbors both being told to lower lemonade prices while costs stay the same. Both will struggle to survive.

Industry Concerns

Businesses are watching closely.

- Automobiles: Chennai’s auto corridor fears reduced state support for infrastructure if revenue shrinks.

- Textiles: Tiruppur exporters worry that rationalisation could mess up input credit, making exports less competitive.

- Hospitality: Hoteliers welcome simplification but warn states might hike property or excise taxes to cover losses.

- FMCG: Consumer goods makers expect short-term price relief but anticipate state-level surcharges later.

In short: Businesses like simpler tax codes, but not if states retaliate with higher local levies.

How It Affects Citizens?

This isn’t just a boardroom debate. Everyday people will feel the pinch.

- Groceries and Clothing: Some essentials may get cheaper if slabs fall.

- Cars and Electronics: Prices could drop if 28% slab items move to 18%.

- Public Services: States may cut funding for healthcare, schools, or housing schemes.

- Local Taxes: Expect hikes in electricity bills, fuel surcharges, or property taxes if revenue gaps aren’t filled.

So yes, you might save ₹500 on a TV but pay ₹1,000 more in electricity bills annually.

Federal Structure at Stake

This fight goes beyond numbers. It’s about India’s federal balance of power.

States argue:

- They bear responsibility for welfare but lack control over key taxes.

- The Centre shouldn’t centralize revenue while leaving states with the spending burden.

- Compensation is essential to keep the spirit of cooperative federalism alive.

Think of it like U.S. states losing Medicaid or highway grants overnight. The local impact would be immediate and severe.

Expert Opinions

- M.K. Stalin, Tamil Nadu CM: “GST reforms must protect state revenues, or they will fail the people.”

- Economic analysts: Rationalisation is good for simplicity, but dangerous without a safety net.

- Reuters analysis: Opposition-ruled states could lose ₹1.5–2 lakh crore annually if reforms pass without compensation.

Global Comparisons

Other countries have tried similar tax simplifications:

- Canada’s GST/HST: Provinces like Alberta resisted centralisation, demanding revenue-sharing deals.

- Australia’s GST: Canberra compensates states through horizontal transfers to ensure fairness.

India’s situation echoes these experiences. Without safeguards, producing states lose out.

What States Can Do?

Tamil Nadu and others are not powerless. Their roadmap includes:

- Demand a 5-Year Compensation Plan – Similar to the original GST Compensation Act.

- Leverage State Taxes – Increase collections from alcohol excise, property registration, and road taxes.

- Push Exports – Boost textiles, electronics, and IT to expand indirect revenue.

- Public-Private Partnerships – Fund metros, airports, and housing projects with private investors.

Future Scenarios

- With Compensation: States maintain welfare and infrastructure spending. GST simplification benefits businesses and consumers without major disruptions.

- Without Compensation: States cut services, hike local taxes, and delay infrastructure. Federal tensions rise sharply.

- Middle Ground: Centre offers partial compensation but asks states to raise more revenue on their own.

All eyes are now on the GST Council meeting in September, where states are expected to demand guarantees.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Caught Profiteering! Subway Franchise Penalized ₹5.45 Lakh for Withholding GST Rate Cut Benefits

GST Reforms Update — Will Insurance Finally Get Tax Exemption?