Tamil Nadu Pushes Back on GST Reforms: and it’s not just political theater. India’s southern powerhouse is taking a firm stance against the central government’s proposed overhaul of the Goods and Services Tax (GST). The Centre is marketing the reforms as a “simplified two-tier system” to help consumers. But Tamil Nadu and several other states argue it could leave them with massive revenue losses, weakened fiscal independence, and less freedom to design state-specific economic policies. Think of it like your boss “simplifying” payroll and suddenly your paycheck drops by 20%. That’s how states like Tamil Nadu view these changes.

Tamil Nadu Pushes Back on GST Reforms

Tamil Nadu’s resistance to GST reforms underscores a larger challenge: balancing central simplification with state survival. While New Delhi highlights consumer benefits, states fear being stripped of crucial revenues. For Tamil Nadu, already losing ₹7,000 crore annually due to GST, the reforms could mean even deeper cuts in welfare, education, and infrastructure spending. The bottom line? GST reforms might simplify taxes but complicate federal harmony. If India wants a strong economy, it must ensure states share fairly in the pie.

| Category | Details |

|---|---|

| Reform Proposal | Two-tier GST structure: 5% (essentials) & 18% (most goods) |

| Central Govt Impact | ~₹85,000 crore annual revenue loss |

| State Govt Impact | ~₹7,000–9,000 crore loss annually per state |

| GDP Impact | States: -0.36% |

| Tamil Nadu Position | Studying impact; cites long-term annual loss of ~₹7,000 crore since GST rollout |

| Official GST Council | gstcouncil.gov.in |

GST Reforms in Plain English

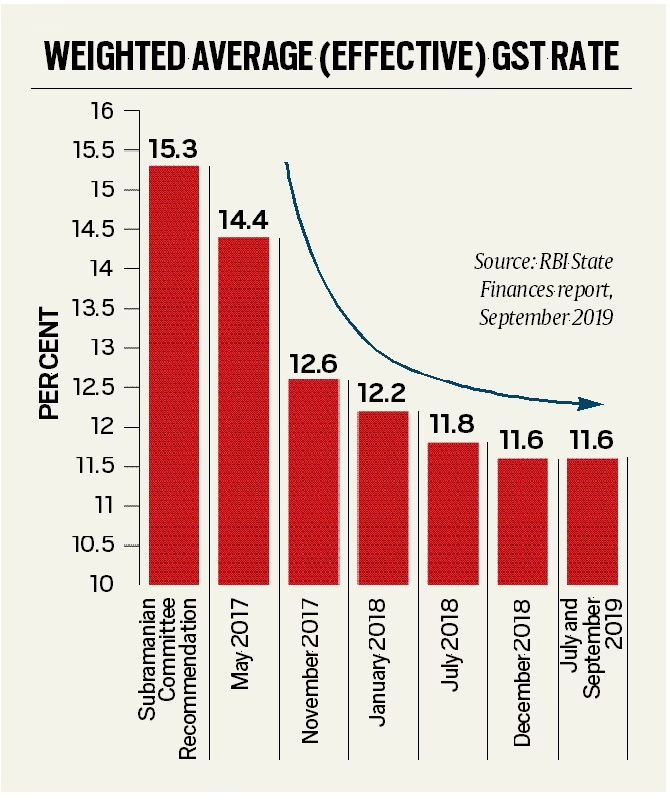

GST (Goods and Services Tax) was introduced in July 2017, replacing India’s messy network of central and state taxes. Before GST, a product might face excise duty, VAT, service tax, and octroi—all at different rates. GST bundled these into one.

While it simplified things for businesses and promoted interstate trade, it also centralized power. States could no longer freely set their own taxes on goods and services.

Now, the Centre wants to move to a two-rate GST structure:

- 5% on essentials (food, medicine, basic needs)

- 18% on everything else

This looks like consumer relief, but for states, it means fewer revenue streams and reduced flexibility.

Tamil Nadu’s Pushback

Finance Minister Thangam Thennarasu has said the state is “carefully examining” the reforms. But the concerns are serious:

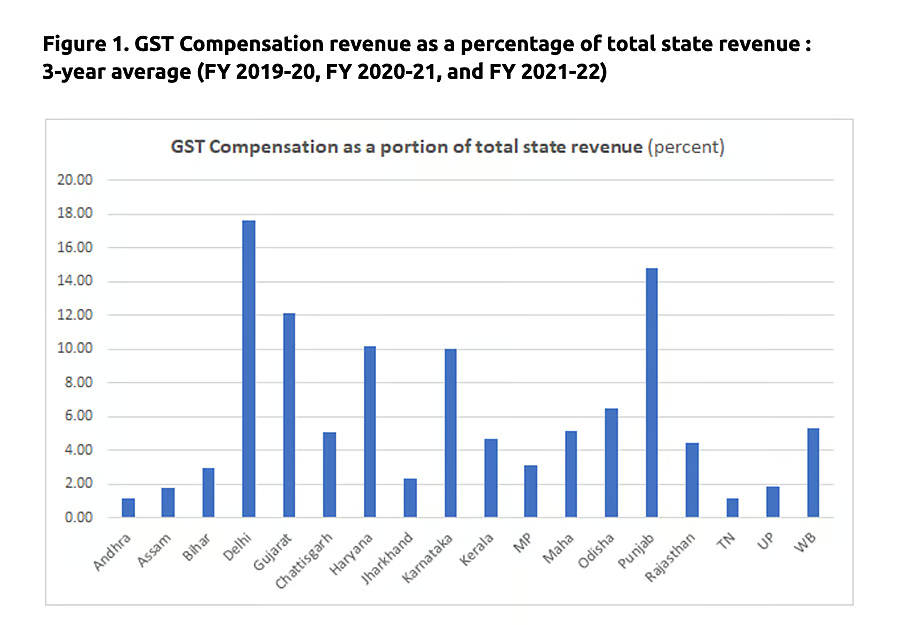

- Revenue Hit: States could lose ₹7,000–₹9,000 crore annually. Tamil Nadu already loses around ₹7,000 crore each year since GST began.

- Shrinking Fiscal Space: The state’s GDP loss (-0.36%) is over twice as severe as the Centre’s (-0.15%).

- Structural Bias: Tamil Nadu, a manufacturing hub, feels GST favors consuming states over producing ones.

In short, Tamil Nadu fears being left broke while still carrying the responsibility to fund healthcare, education, and infrastructure.

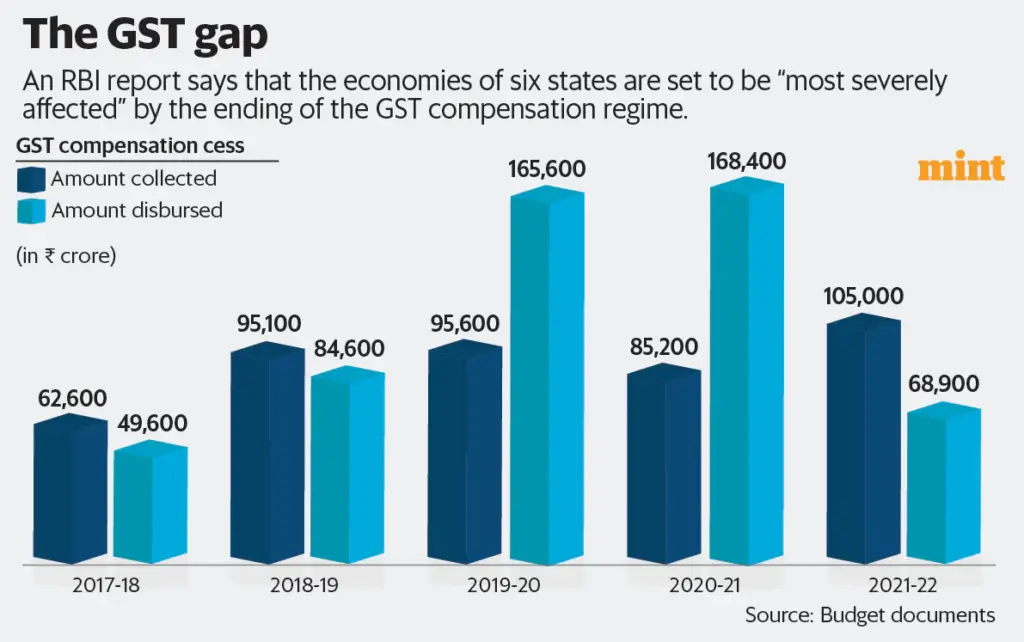

Historical Context: The Compensation Debate

When GST was rolled out in 2017, the Centre promised five years of compensation to states for any revenue shortfall. That agreement ended in June 2022. Since then, states have repeatedly asked for an extension, but the Centre has resisted.

This is why trust is so low. For Tamil Nadu, the lack of a compensation cushion means any new GST reform could blow a hole in its budget. The fear isn’t just about money—it’s about autonomy. States want the freedom to manage their own fiscal house.

Global Comparisons: How Others Do It

India’s federal tax model is unique—but comparisons help:

- United States: The federal government doesn’t impose sales tax. Each state sets its own rate. California’s is 7.25%, while Oregon has none. States keep control.

- Canada: Uses a “dual” system—federal GST plus provincial sales tax. Provinces like Alberta charge no provincial tax, while others harmonize with federal GST.

- Australia: GST is federally collected but redistributed to states based on population and fiscal needs, ensuring no state feels shortchanged.

Compared to these, India’s model is more centralized. That’s why states like Tamil Nadu feel cornered.

The Numbers Game

Here’s how the math breaks down:

- Centre’s Loss: ₹85,000 crore annually. Big, but manageable through income tax and borrowing.

- States’ Loss: ₹7,000–₹9,000 crore per state, annually. Huge, because states have fewer revenue tools.

- Tamil Nadu’s Specific Burden: Already loses ₹7,000 crore yearly due to GST, risks an even bigger gap.

In U.S. terms, it’s like Washington D.C. cutting federal aid but asking Texas or California to keep spending the same on schools and hospitals.

Case Studies: Tamil Nadu Industries at Risk

- Automobiles: Tamil Nadu is India’s “Detroit,” producing cars for Hyundai, Ford, and BMW. Earlier, the state taxed auto manufacturing to generate revenue. With GST reforms, that revenue flow shrinks further.

- Textiles: Coimbatore and Tiruppur drive India’s textile exports. Lower GST slabs may help consumers but hurt state coffers—fewer rupees to reinvest in export infrastructure.

- Electronics: Chennai’s “Electronics Corridor” has grown with state incentives. If fiscal resources dry up, Tamil Nadu may struggle to compete with Vietnam or Bangladesh in attracting global supply chains.

What Options Do States Have?

Tamil Nadu and others aren’t powerless. Options include:

- Reviving Compensation: States can demand that the Centre revive the 2017-style compensation scheme.

- Forming Alliances: In the GST Council, Tamil Nadu can join hands with Kerala, Punjab, and West Bengal to block or reshape reforms.

- Exploring Local Taxes: Liquor, property, and road taxes are state-controlled. Though unpopular, they can patch gaps.

- Industrial Expansion: Investing in exports and new industries to broaden the tax base.

Practical Takeaways

- For Businesses: GST rationalization may lower compliance costs, but watch out for sector-specific shifts.

- For Citizens: Essentials could get cheaper, but expect slower delivery of public services.

- For Policymakers: Avoid fiscal stress by balancing reforms with fairness to states.

Expert Opinions on Tamil Nadu Pushes Back on GST Reforms

- R. Kavita Rao, NIPFP economist: “GST rationalization is inevitable, but states must be fairly compensated to avoid fiscal stress.”

- Industry Body FICCI: Warns that sudden rate changes could unsettle industries already struggling with global supply chain disruptions.

- Tamil Nadu’s Finance Ministry: Repeatedly highlights that GST has eroded its manufacturing-led tax base, leaving the state at a disadvantage.

Policy Roadmap: Three Possible Futures

- Status Quo: States resist, reforms stall, and GST remains fragmented.

- Middle Path: Centre revises slabs but introduces partial compensation to pacify states.

- Full Reform: GST rationalization moves forward; states scramble with higher local taxes and budget cuts.

Long term, India will need a system more like Australia’s—central collection but fair redistribution to states.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling