Tampa OnlyFans Star Who Made $5.4 Million: When news dropped that a Tampa OnlyFans star who made $5.4 million is now charged with tax evasion, the internet lit up. For some, it was shocking. For others, it was a reminder that Uncle Sam always gets his cut. Whether you’re running an online store, freelancing, or building a digital empire, one thing is certain: you can’t ghost the IRS. This case blends internet fame, big money, and federal charges. It’s a cautionary tale for creators and professionals alike, showing how ignoring taxes can flip overnight success into a courtroom drama.

Tampa OnlyFans Star Who Made $5.4 Million

The story of a Tampa OnlyFans star charged with tax evasion after making $5.4 million is more than gossip. It’s a warning shot to the entire digital creator community. Kylie Leia Perez, known as Natalie Monroe, faces up to seven years in prison and over $1.6 million in unpaid taxes. For freelancers, gig workers, and entrepreneurs, the lesson is clear: treat your side hustle like a business. Track your income, pay your taxes, and don’t risk your freedom for short-term gains. Because at the end of the day, the IRS doesn’t care how you made your money—they just want their cut.

| Detail | Information |

|---|---|

| Name | Kylie Leia Perez (“Natalie Monroe”) |

| Earnings | Over $5.4 million on OnlyFans (2019–2023) |

| Charges | False tax return (2019); failure to pay federal income taxes (2020–2023) |

| Estimated Taxes Owed | At least $1.69 million |

| Indictment Date | July 22, 2025 |

| Arrest Date | August 14, 2025 |

| Maximum Sentence | Up to 7 years in federal prison |

| Source | U.S. Department of Justice |

Who Is Kylie Leia Perez, a.k.a. “Natalie Monroe”?

Kylie Leia Perez, widely known by her stage name Natalie Monroe, became a household name in the world of online content creation. Based in Tampa, Florida, she built her wealth primarily through OnlyFans, a platform where creators earn money directly from subscribers who pay for exclusive content.

Between 2019 and 2023, Perez reportedly made more than $5.4 million. But prosecutors allege she failed to report or pay $1.69 million in federal taxes during those years. What was once a success story in the digital economy has turned into a criminal case in federal court.

The Charges and the Breakdown of Tampa OnlyFans Star Who Made $5.4 Million

The indictment charges Perez with:

- One count of filing a false tax return in 2019.

- Four counts of failing to pay federal income tax between 2020 and 2023.

Earnings and missed taxes:

- 2020: $1.6 million earned, $498,549 in unpaid taxes.

- 2021: $2.13 million earned, no payment made.

- 2022: $1.08 million earned.

- 2023: $602,503 earned.

If convicted, Perez faces up to seven years in federal prison. Beyond prison time, she could also face steep fines, restitution, and long-term damage to her personal brand.

The Bigger Picture: Tax Evasion Isn’t New

Perez’s story isn’t unique in American history. Celebrities and everyday folks alike have faced consequences for tax evasion.

- Wesley Snipes: The Hollywood actor was sentenced to 3 years in prison for failing to file tax returns.

- Mike “The Situation” Sorrentino: The Jersey Shore star served 8 months for failing to pay taxes on nearly $9 million in TV earnings.

- Lauryn Hill: The Grammy-winning artist served prison time for unpaid taxes on over $1.8 million in income.

The lesson is simple: fame and fortune don’t protect anyone from the law.

Why Creators Often Struggle With Taxes?

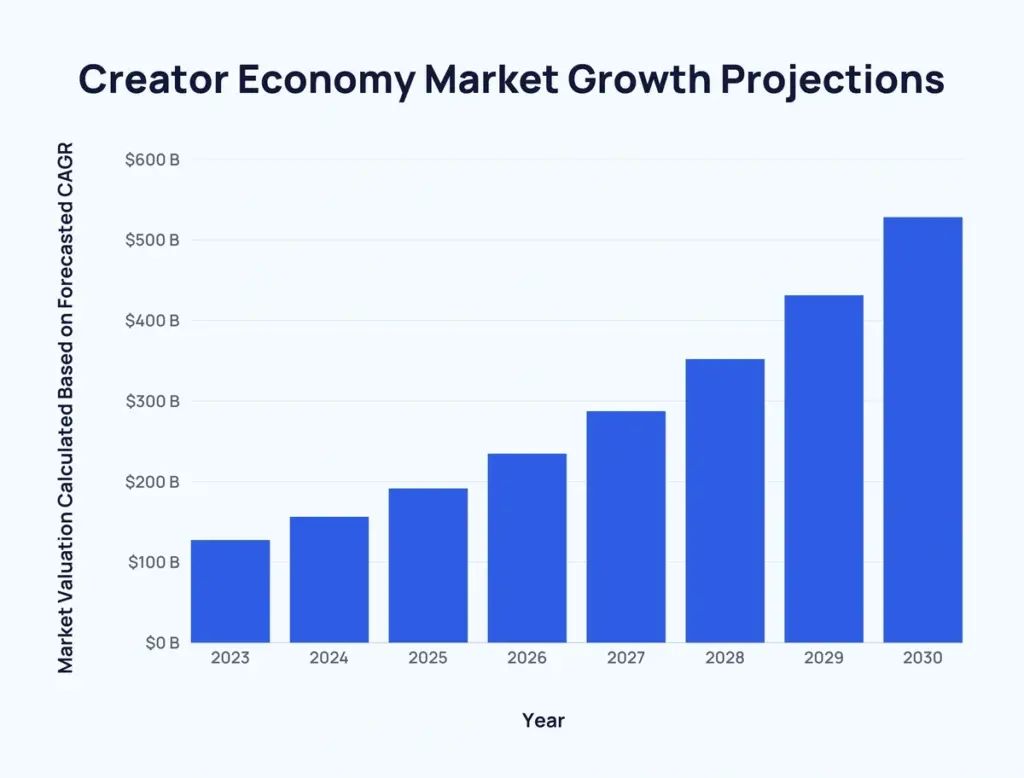

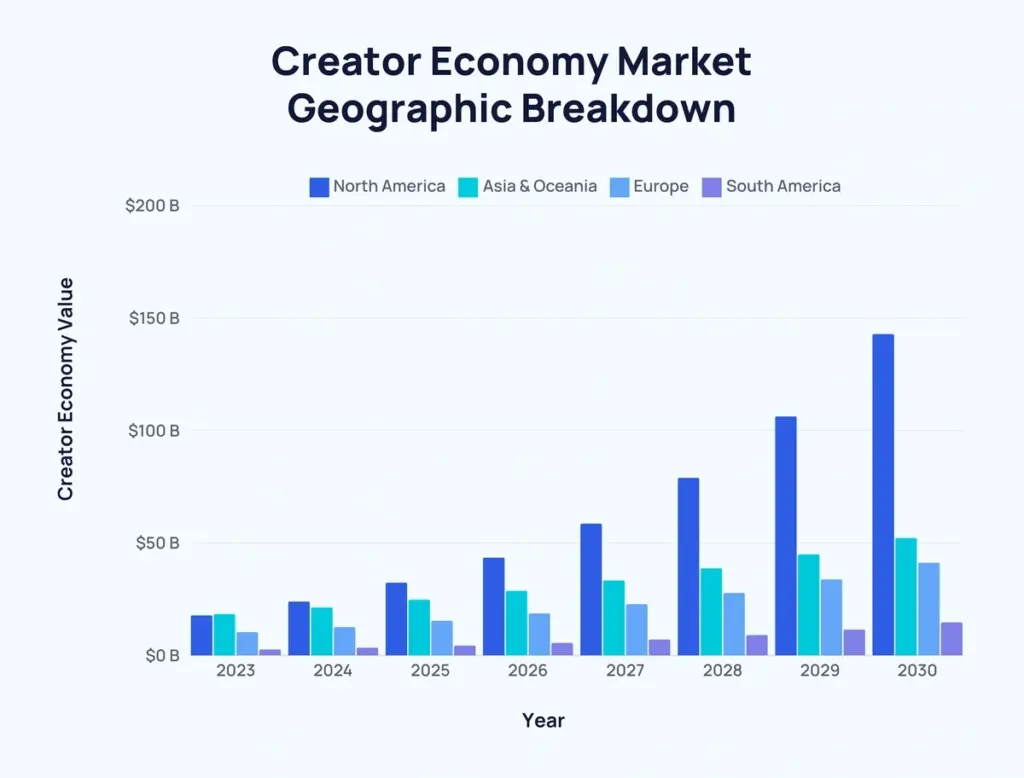

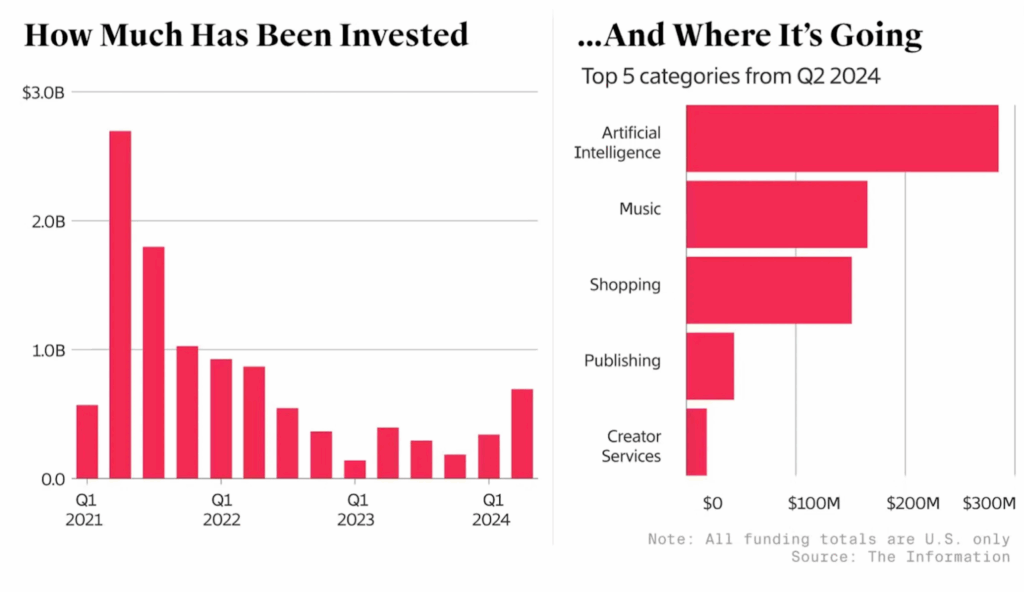

The digital creator economy is massive. In 2023 alone, the global influencer market was valued at over $21 billion, and platforms like OnlyFans, YouTube, and TikTok created thousands of millionaires. But with fast money comes confusion.

- Lack of knowledge: Many creators are young and have never run a business before.

- No withholdings: Unlike W-2 jobs, platforms don’t withhold taxes.

- Cash app myth: Some think income sent through apps like Venmo or Cash App flies under the radar. Not true—those companies report income above $600 to the IRS.

- Lifestyle creep: Instead of saving for taxes, many spend their income on luxury lifestyles.

The IRS, however, keeps track. And when millions are at stake, they act.

Civil vs. Criminal Tax Problems

Not all tax problems lead to prison. There’s a difference between civil and criminal issues:

- Civil penalties: If you make an honest mistake—like forgetting a deduction or missing a filing—you’ll likely face fines and interest.

- Criminal charges: If the IRS believes you intentionally lied, concealed, or refused to pay, you can face prosecution, as in Perez’s case.

Understanding the difference is key. Intent matters.

Expert Insight: Why the IRS Targets High-Profile Cases

Tax attorneys often note that the IRS strategically prosecutes public figures. By making examples of influencers, celebrities, or business moguls, they send a message to everyone else.

As one CPA put it: “The IRS doesn’t have to audit everyone. They just need a few big cases to remind people the rules apply to all.”

The OnlyFans Business Model and Taxes

OnlyFans exploded during the pandemic, giving creators direct income without traditional middlemen. But with that freedom comes responsibility.

- Revenue: Creators set subscription rates, sell pay-per-view content, and accept tips.

- Platform fees: OnlyFans takes a 20% cut, but creators keep 80%.

- Tax status: Earnings are classified as self-employment income. Creators receive a Form 1099-NEC each year if they earn $600 or more.

So while the business model empowers creators, it also places the burden of tax compliance squarely on their shoulders.

Step-By-Step Guide: How Creators Can Stay Safe

Step 1: Track Income and Expenses

Use accounting software or even a spreadsheet. Track income, tips, platform fees, and expenses like cameras, internet, and props.

Step 2: Understand Self-Employment Tax

Self-employed workers owe 15.3% for Social Security and Medicare, on top of federal and state income taxes.

Step 3: Pay Quarterly Taxes

Instead of waiting until April, send payments four times a year: April, June, September, and January.

Step 4: Work With a Professional

A tax pro can help you claim legitimate deductions while avoiding red flags.

Step 5: Always Report Honestly

The IRS receives copies of 1099 forms. Trying to “forget” income is tax fraud.

Example: $100,000 in OnlyFans Income

If you made $100,000 in one year, here’s a simple breakdown:

- Self-employment tax (15.3%): $15,300

- Federal income tax (approx. 22%): $22,000

- State income tax: Varies (Florida has none, but California does)

After taxes, that $100,000 can quickly shrink to $63,000–70,000 take-home pay.

Tax Audit Evasion Crackdown Coming—Automated File Selection to Catch More Offenders

Experts Warn Dismantling Justice Department Tax Division Could Cost Billions

Impact on the Creator Economy

Perez’s arrest highlights a new reality: digital creators are under scrutiny. The IRS and state tax agencies know billions flow through platforms like OnlyFans, YouTube, and TikTok.

- The gig economy has expanded rapidly, with over 36% of U.S. workers freelancing in some form.

- The IRS has already increased reporting requirements for third-party payment apps.

Experts predict more cases like Perez’s as the government cracks down on unreported income in the digital age.