Tax Evasion Crackdown: When you hear “Tax Evasion Crackdown: Income Tax Raids After Overpriced Medicine Purchases,” it might sound like a Netflix crime drama. But this isn’t Hollywood—this is real life, and it’s rocking the healthcare and financial systems in India. The Income Tax Department has been cracking down on inflated medical bills, fake deductions, and overpriced medicine purchases. The message is loud and clear: cheat the system, and you’ll be caught. This crackdown is making headlines because it touches on two things we all care about—healthcare and money. Whether you’re a doctor, a business owner, a patient, or just a taxpayer, you’ll want to know how these raids work, why they matter, and what lessons they hold for the rest of the world.

Tax Evasion Crackdown

The Tax Evasion Crackdown: Income Tax Raids After Overpriced Medicine Purchases isn’t just a story about fraud—it’s about fairness. Healthcare fraud undermines trust, drives up costs, and drains billions from taxpayers. By combining technology, stricter laws, and ethical practices, governments worldwide are tightening the net around fraudsters. For patients, it’s a reminder to stay vigilant. For professionals, it’s proof that honesty isn’t just the best policy—it’s the safest long-term investment.

| Aspect | Details |

|---|---|

| Event | Income Tax raids targeting bogus deductions, including inflated medical expenses and overpriced medicine bills |

| Scale | 200+ locations raided across India (July 2025) |

| Sectors Impacted | Pharma companies, hospitals, diagnostic labs, and individuals filing false deductions |

| Findings | Fake donation receipts, inflated tuition and medical expense claims, suppressed income |

| Official Reference | Income Tax Department of India |

| Professional Insight | Stresses the importance of compliance, recordkeeping, and ethical billing practices |

Why This Tax Evasion Crackdown Happened?

In July 2025, the Indian Income Tax Department raided more than 200 locations across the country. Investigators were targeting individuals and businesses filing bogus tax deductions. The most shocking part? Medical expenses were at the center of the scandal.

By inflating medical bills or showing fake medicine purchases, people were reducing their taxable income and cheating the system. This type of fraud drains billions from the public treasury. That’s money that could have funded schools, hospitals, and roads.

How Tax Evasion Works in the Medical Sector?

Bogus Medical Bills

Hospitals or patients create inflated bills to show higher medical expenses. A $500 X-ray is listed as $1,500, allowing for higher tax deductions.

Overpriced Medicine Purchases

Pharma distributors and hospitals sometimes inflate medicine costs on paper. A drug worth $10 is recorded at $50, creating fake expenses that reduce taxable profits.

Pharma Company Shenanigans

Even large corporations are under the microscope. In January 2025, Akums Drugs & Pharmaceuticals Ltd, one of India’s biggest pharmaceutical firms, was raided at its offices and plants. Around the same time, a pharmaceutical unit in Baddi, Himachal Pradesh faced tax investigations.

Global Perspective: Not Just India’s Problem

This isn’t a uniquely Indian issue. Across the globe, healthcare systems have been exploited through tax evasion and fraud.

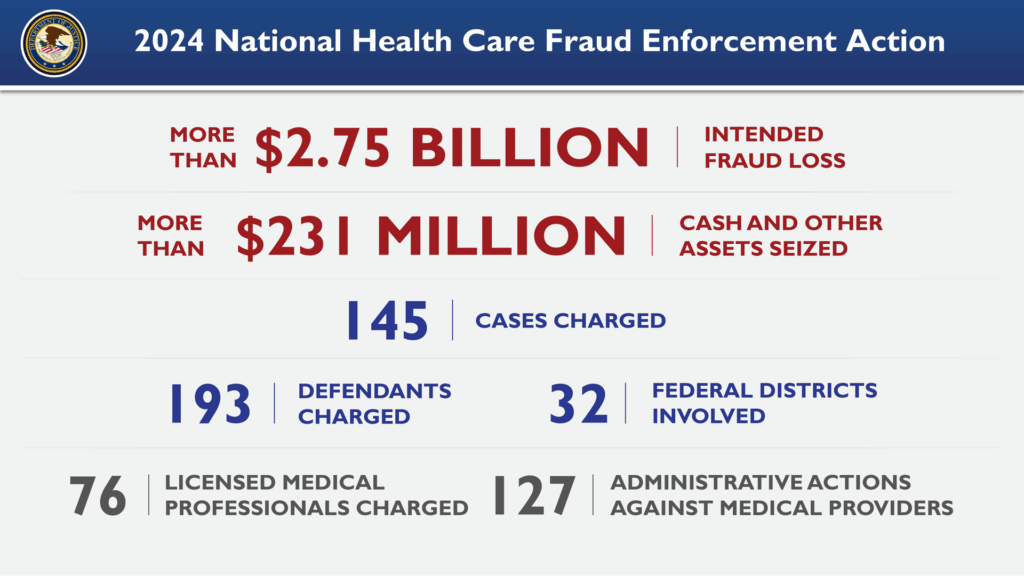

- United States: Healthcare fraud is a massive concern. In 2022, the U.S. government recovered over $1.7 billion from healthcare fraud cases, according to the HHS OIG report. Many cases involved Medicare and Medicaid billing scams.

- United Kingdom: The NHS estimates annual fraud losses of £1.2 billion, including fake invoices and inflated service claims.

- Worldwide: The World Health Organization (WHO) estimates that up to 10% of global healthcare spending is lost to fraud and abuse. That’s billions of dollars wasted every year.

The Indian crackdown is part of a global fight against medical fraud and tax evasion.

Step-by-Step: How Tax Raids Work

Step 1: Data Collection

Authorities use digital tools to analyze tax filings, invoices, and supplier records. In India, the NUDGE program (Non-intrusive Usage of Data to Guide and Enable) spots irregularities in filings.

Step 2: Cross-Verification

If a clinic claims $2 million in medicine purchases, but suppliers report only $1 million in sales, that’s a red flag.

Step 3: Surprise Raids

Teams arrive unannounced to seize documents, hard drives, and sometimes cash. This ensures evidence isn’t destroyed.

Step 4: Penalties and Legal Action

Individuals caught face heavy penalties. In India, up to 60% of undeclared cash can be taxed on the spot, plus interest and fines. In the U.S., offenders risk jail time under federal healthcare fraud laws.

The Human Impact: Why Patients and Taxpayers Should Care

Higher Medical Costs

When medicine is overpriced or tests are unnecessary, patients bear the burden.

Taxpayer Losses

Fraud reduces government revenue, often leading to higher taxes or cuts in public services.

Erosion of Trust

When fraud is exposed, patients lose trust in doctors, hospitals, and pharma companies.

For example, in 2017, tax raids in Bengaluru revealed doctors earning 35% commissions for MRI referrals and 20% for CT scans. That’s not just financial fraud—it’s medical exploitation.

Policy and Reform Efforts

India

- E-invoicing systems to prevent fake bills.

- Digital health IDs to improve billing transparency.

- More use of AI and big data to detect fraud.

United States

- The Medicare Fraud Strike Force investigates fraudulent claims.

- Whistleblower rewards under the False Claims Act encourage insiders to report fraud.

Europe

- The European Anti-Fraud Office (OLAF) monitors cross-border fraud in the healthcare sector.

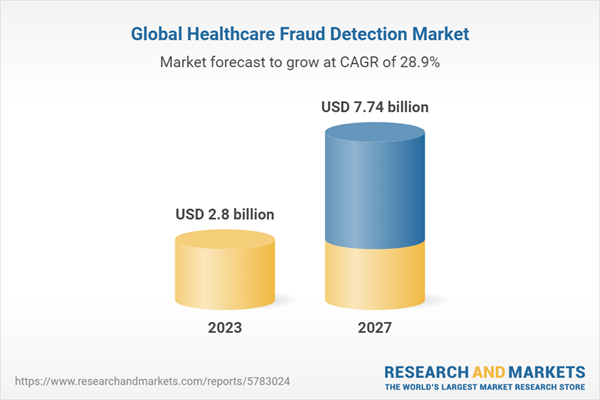

Technology: The Future Weapon Against Fraud

- Artificial Intelligence: AI algorithms detect suspicious billing patterns faster than humans.

- Blockchain: Immutable digital ledgers can track medicine from manufacturer to patient.

- Electronic Health Records: Digital records reduce opportunities for fake or duplicate bills.

September 2025 Tax Calendar: Key Income Tax Deadlines You Can’t Miss

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Income Tax Dept Offers Relief to Black Money Holders — No Penalty or Prosecution in Select Cases

Practical Advice

For Professionals

- Keep thorough and transparent records.

- Avoid inflated or fake billing.

- Invest in compliance audits to avoid penalties.

For Patients

- Always request itemized bills.

- Compare medicine prices online through resources like GoodRx.

- Report suspicious activity to fraud hotlines.

For Businesses

- Train staff on ethical billing.

- Use digital compliance tools.

- Stay updated on local tax regulations.

Ethical and Social Responsibility

Healthcare isn’t just another business—it’s a public good. When medical bills are inflated or medicine is overpriced, it’s not only illegal but unethical. Patients trust healthcare providers with their lives. That trust should never be broken for financial gain.

Future Outlook

Governments are moving toward stricter oversight. Expect:

- More digital integration between tax systems and healthcare billing.

- Increased international cooperation to fight cross-border fraud.

- Rising use of AI-driven monitoring for real-time fraud detection.

Honest businesses and professionals will benefit because stricter systems will weed out bad actors.

Case Studies Worth Noting

- Assam, India (2021): Doctors were caught hiding over ₹100 crore ($12 million) in income. Authorities seized more than ₹7.5 crore in cash.

- Jodhpur, India (2024): A hospital property deal exposed ₹3.5 crore in undeclared cash. Doctors involved faced penalties of up to ₹7 crore ($840,000).

- U.S. (2019): A Michigan oncologist was sentenced to prison for giving unnecessary chemotherapy to patients and billing Medicare. The case cost taxpayers over $17 million.