Tax Evasion Raids Conducted on Leading Salons in Chandigarh: When you hear about tax evasion, you might picture Wall Street sharks or offshore bank accounts tucked away in some tropical paradise. But in Chandigarh, India, the story is playing out in a surprisingly glamorous setting—luxury beauty salons. On August 9, 2025, the Union Territory Excise & Taxation Department and Central GST authorities joined forces for surprise raids on more than a dozen high-end salons in popular business hubs like Sectors 8, 9, 26, and 35. These weren’t just polite check-ins; they were full-scale enforcement actions aimed at uncovering alleged Goods and Services Tax (GST) evasion. Reports indicate that some salons may have been dodging the mandatory 18% GST on services, a practice that can cost governments millions in lost revenue each year.

Tax Evasion Raids Conducted on Leading Salons in Chandigarh

The Chandigarh salon raids send a clear message: tax compliance isn’t optional. Whether you’re a luxury spa in India or a corner barbershop in the U.S., the rules are the same—collect taxes, report them honestly, and keep your records clean. For businesses, this means building trust through transparency. For consumers, it’s about insisting on a bill and knowing your rights. At the end of the day, paying your fair share keeps the economy running—and keeps you on the right side of the law.

| Key Detail | Information |

|---|---|

| Date of Raids | August 9, 2025 |

| Agencies Involved | UT Excise & Taxation Department + Central GST |

| Locations Targeted | 12+ high-end salons in Sectors 8, 9, 26, 35 |

| Allegations | Not charging 18% GST, cash-only payments, no invoices |

| Period Under Scrutiny | Past 3 years of GST returns |

| Potential Penalties | Heavy fines + interest |

| Public Advisory | Always ask for a bill (Official GST Portal) |

| Source | The Tribune |

What Triggered the Raids?

Authorities don’t storm into businesses without reason. According to local sources, these raids came after months of monitoring, undercover visits, and consumer complaints.

Customers alleged they were offered “cash discounts” if they skipped taking a bill. Some reported that when they insisted on a bill, they were told the price would be higher because GST would have to be added. This practice suggested two sets of prices—one official, one off-the-books—which is a major red flag for tax agencies.

The Alleged Tactics

Investigators believe certain salons used a playbook that’s all too familiar in cash-heavy industries:

- Cash-Only Deals: Encouraging customers to pay in cash in exchange for a “discount” that actually just removed the GST amount.

- Product-Only Billing: Recording transactions as shampoo or beauty product sales while hiding high-value services like bridal makeup or hair treatments.

- No Receipts: Skipping invoices altogether so the transaction left no paper trail.

- Fake Discounts: Offering a supposed discount but charging the same net rate without GST paperwork.

By doing this, businesses avoid remitting GST to the government—effectively pocketing the tax amount.

Why GST Matters?

The Goods and Services Tax (GST) is a unified indirect tax in India, replacing multiple state and federal taxes. Beauty services typically attract 18% GST, which is collected by businesses from customers and paid to the government.

This money doesn’t just vanish into bureaucracy—it funds infrastructure, public schools, healthcare, and other essential services. When GST is evaded, the shortfall impacts public spending and forces compliant businesses to compete with artificially low prices.

A Step-by-Step Look at the Tax Evasion Raids Conducted on Leading Salons in Chandigarh

- Information Gathering – Complaints, anonymous tips, and transaction patterns are reviewed.

- Preliminary Surveillance – Officials conduct test purchases to check billing compliance.

- Planning – Raids are coordinated between multiple departments to ensure coverage.

- Surprise Entry – Teams arrive unannounced during peak business hours.

- Document Seizure – Account books, sales records, digital payment data, and computer hard drives are collected.

- Interviews – Staff and management are questioned about billing practices.

- Post-Raid Audit – Financial records are compared against GST returns over the past three years.

Legal Consequences of GST Evasion

Under the CGST Act, confirmed cases of GST evasion can lead to:

- 100% penalty equal to the tax evaded.

- Interest charges (often 18% annually) on unpaid tax.

- Suspension or cancellation of business licenses.

- Prosecution in severe cases, which can mean jail time.

The penalties can be financially crippling, especially for small or mid-sized businesses.

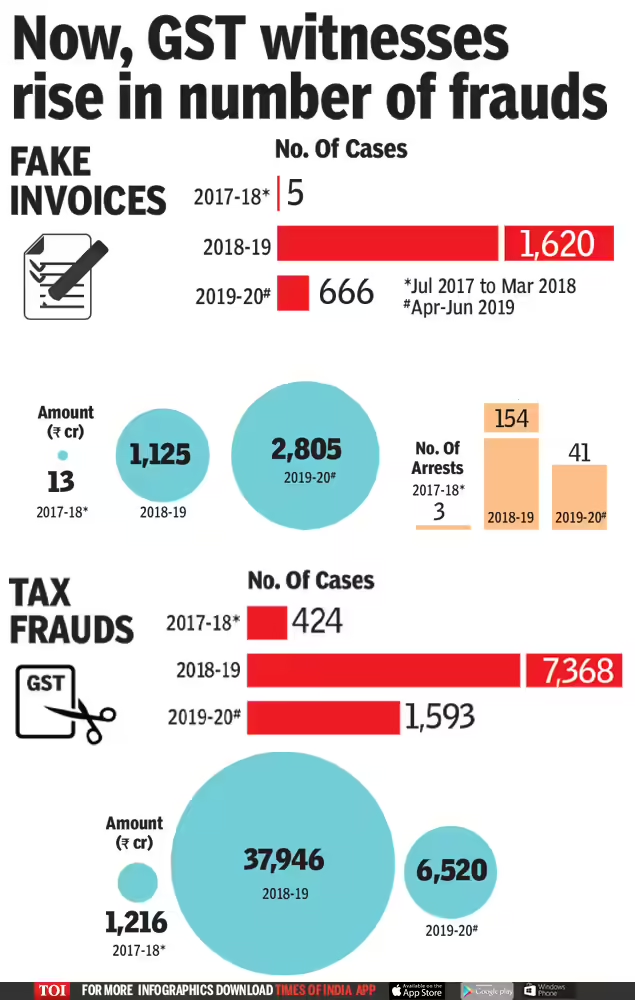

Historical and Global Context

This isn’t the first time beauty salons have come under the scanner. In 2019, raids in Delhi uncovered ₹25 crore in unpaid GST from salons and spas. Globally, tax agencies also keep a close watch on such industries:

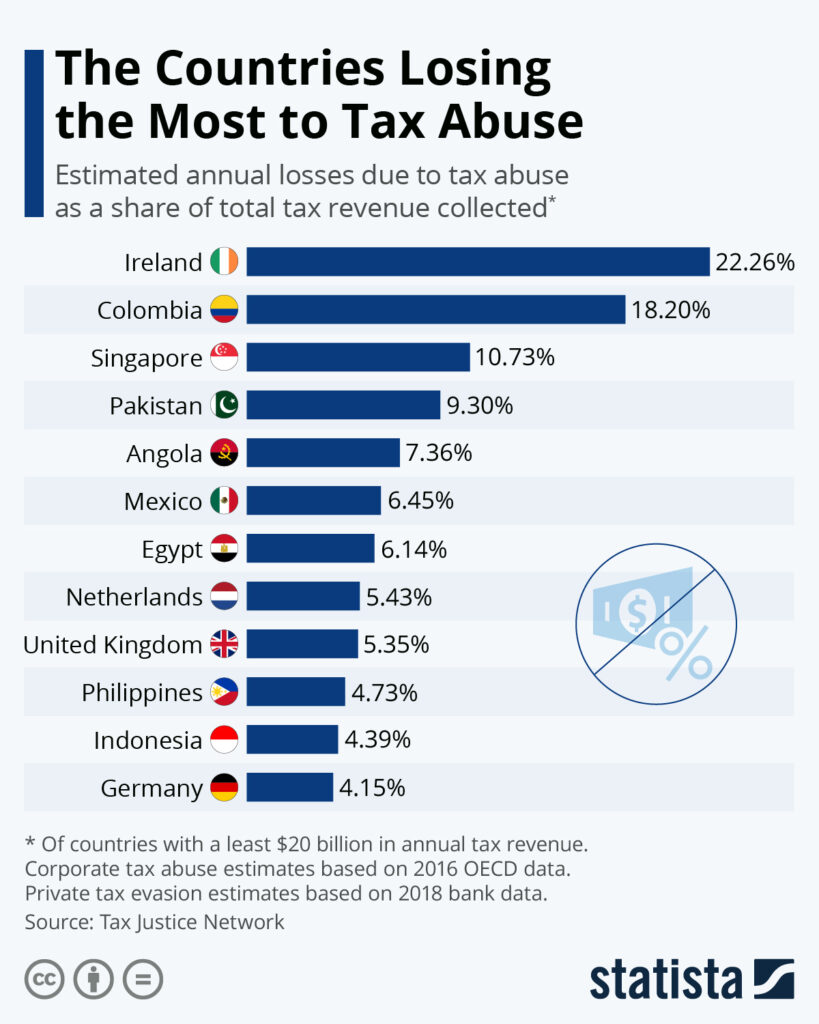

- USA: The IRS targets cash-based businesses like salons, restaurants, and auto repair shops for audits.

- UK: HMRC conducts surprise “compliance visits” to hairdressers to verify VAT payments.

- Australia: The ATO uses data-matching programs to detect underreported sales in the personal care sector.

The pattern is clear—cash-heavy industries are at higher risk for tax scrutiny worldwide.

Economic Impact

GST evasion has ripple effects beyond just government coffers:

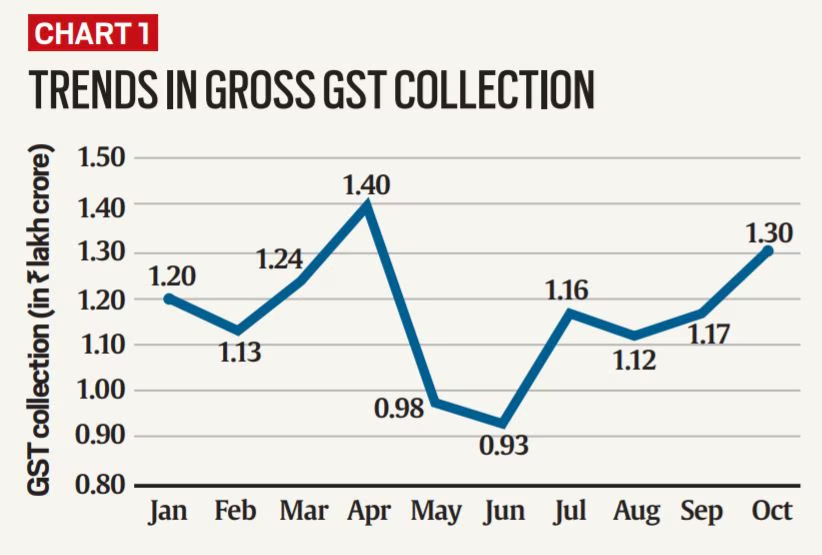

- Revenue Loss: According to government estimates, even a 1% drop in GST compliance could mean billions lost annually.

- Unfair Competition: Honest businesses that follow the rules find it hard to match the prices of those who skip taxes.

- Erosion of Public Trust: Customers lose faith in businesses when transparency is lacking.

In July 2025, India’s GST collection was ₹1.63 lakh crore, but authorities believe the figure could be higher if evasion were eliminated.

Expert Opinions

Former CBIC officer Anita Sharma commented:

“Cash-heavy industries are a red flag for tax enforcement globally. The audit trail may look clean at first glance, but discrepancies in service versus sales data are easy to spot once investigators dig in.”

U.S.-based CPA Mark Reynolds offered a parallel:

“In the U.S., the IRS doesn’t just focus on big corporations. Small salons and barbershops have been shut down for cash skimming. The principle is the same everywhere—report honestly or face serious consequences.”

Compliance Checklist for Salon Owners

If you’re in the beauty business, staying compliant is not just about avoiding penalties—it’s about running a sustainable operation. Here’s a quick checklist:

- Register for GST and display your GSTIN clearly.

- Issue an invoice for every transaction.

- Record both cash and digital payments accurately.

- Keep detailed daily sales logs.

- Train all staff in proper billing procedures.

- Hire a GST-knowledgeable accountant.

- Conduct internal audits at least twice a year.

Consumer Rights and Responsibilities

As a customer, you have the right to:

- Receive an invoice for every service.

- Verify a business’s GST registration on the official GST portal.

- Pay through secure, traceable methods when possible.

- Report suspected evasion through official complaint channels.

Refusing a bill may seem like a small thing, but collectively it enables businesses to dodge taxes, impacting public services.

How Investigations Continue After Raids?

Raids are just the first step. Afterward, authorities:

- Forensically analyze seized records.

- Match declared revenue with bank deposits.

- Compare supplier invoices to claimed sales.

- Identify patterns of underreporting.

- Issue show-cause notices to business owners.

- Decide on penalties or legal proceedings based on findings.

In many cases, investigations can take months, and additional raids may follow if a network of non-compliance is uncovered.

International Comparison Table

| Country | Typical Service Tax Rate | Enforcement Agency | Notable Actions |

|---|---|---|---|

| India | 18% GST | CBIC & State GST | Chandigarh salon raids 2025 |

| USA | Varies by state (4–10%) | IRS & State Tax Boards | Multiple “cash skimming” closures |

| UK | 20% VAT | HMRC | Hairdresser VAT compliance visits |

| Australia | 10% GST | ATO | Nail salon underreporting audits |

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

Assam Scores Big in Tax Evasion Fight—₹7.5 Crore Recovered from Haryana Firm

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know