Tax Scammers Just Got Smarter: Every spring, millions of Americans scramble to get their taxes done—chasing down W-2s, 1099s, and receipts. For most of us, it’s about checking the boxes, filing on time, and maybe getting that sweet refund. But in 2025, there’s a new challenge: tax scammers just got smarter, and they’re pulling off tricks that would fool even the sharpest professionals. We’re no longer talking about clumsy robocalls or emails full of spelling errors. These days, scammers are armed with artificial intelligence, deepfake voices, and sophisticated phishing campaigns. They can mimic IRS agents, copy your accountant’s voice, or create entire fake websites that look identical to IRS.gov. If you’re not careful, they’ll walk away with your refund—and maybe even your identity.

Tax Scammers Just Got Smarter

Tax scams in 2025 are smarter, sharper, and scarier than ever. But here’s the truth: you don’t have to be a victim. By filing early, sticking to official channels, verifying preparers, and staying skeptical of unsolicited calls or emails, you can beat scammers at their own game. Stay informed, share what you know with family and friends, and remember: if something feels off, it probably is. Protecting yourself is no longer optional—it’s essential.

| Topic | Details |

|---|---|

| AI-Powered Scams | Phishing emails, fake IRS portals, and deepfake calls that look and sound legitimate. |

| Ghost Preparers | Fraudulent preparers who file returns but don’t sign them, stealing refunds or personal data. |

| IRS “Dirty Dozen” 2025 | IRS warns about phishing, fake charities, and bogus credits. |

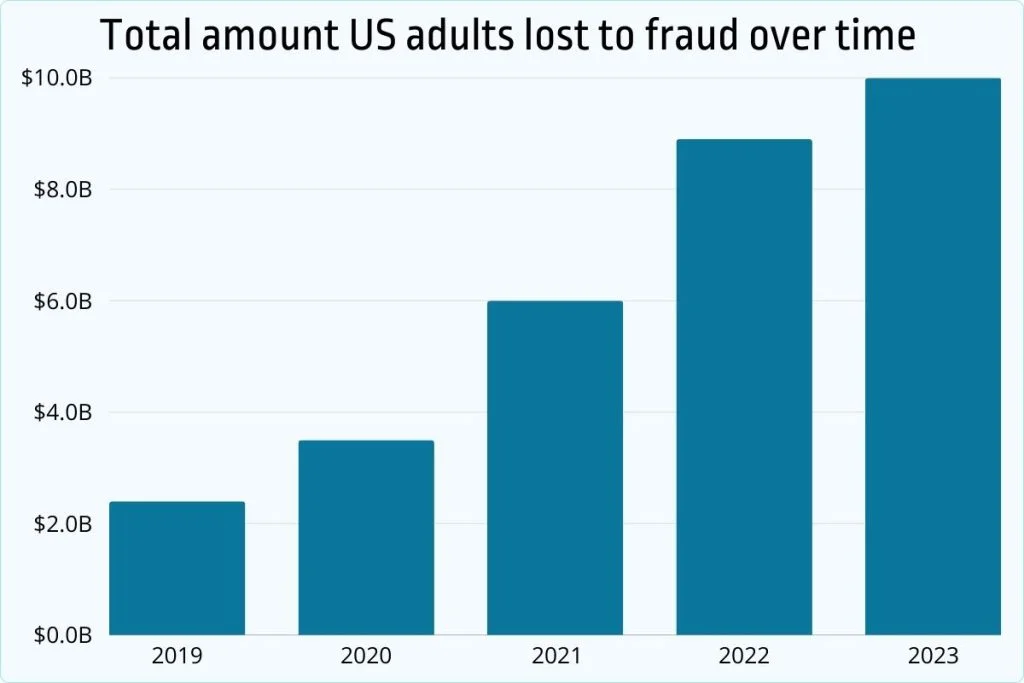

| Financial Impact | U.S. tax fraud losses topped $9.1 billion in 2024. |

| Complaints | FTC logged 2.6 million fraud reports in 2023, with identity theft one of the top categories (FTC.gov). |

| Who’s At Risk? | Regular taxpayers, gig workers, immigrants, small businesses, and even CPAs. |

| Practical Tips | File early, set up IRS IP PIN, check preparers’ PTIN, ignore suspicious emails or calls. |

The Evolution of Tax Scams: From Robocalls to AI Deepfakes

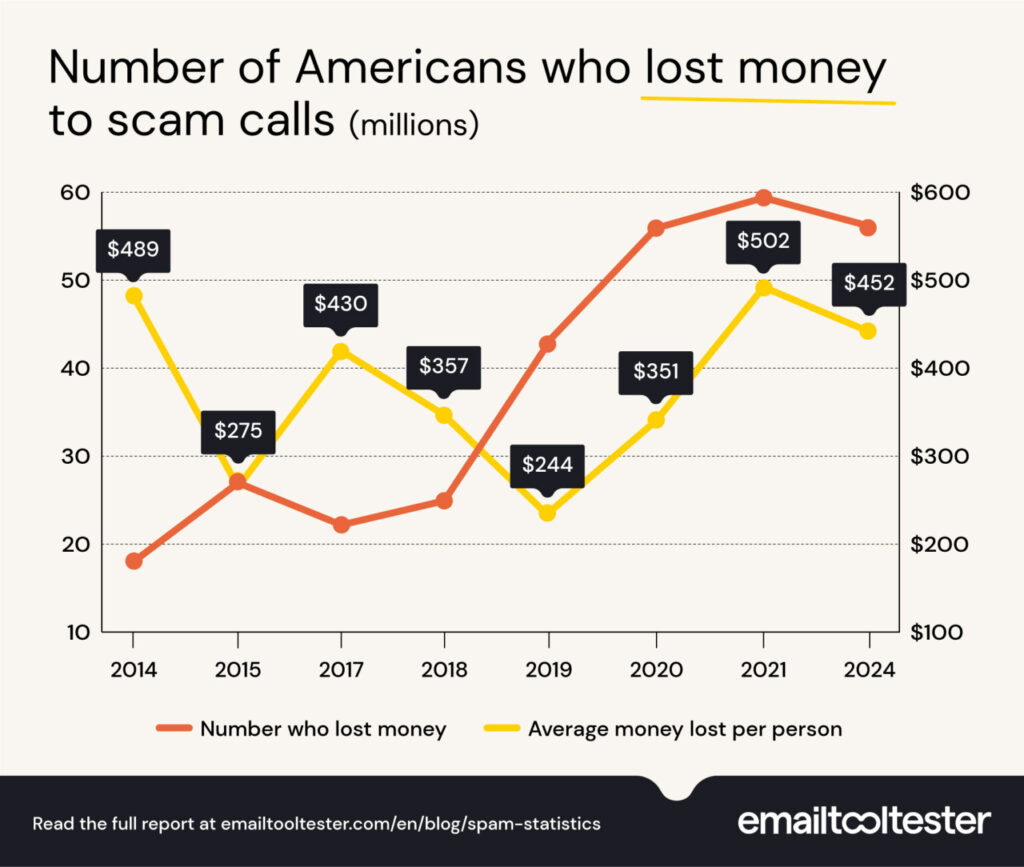

If you’ve been around long enough, you probably remember the old-school scams. In the early 2000s, they were mostly robocalls with robotic voices threatening jail if you didn’t pay. By the 2010s, phishing emails flooded inboxes, often riddled with grammar mistakes. Most people could spot them a mile away.

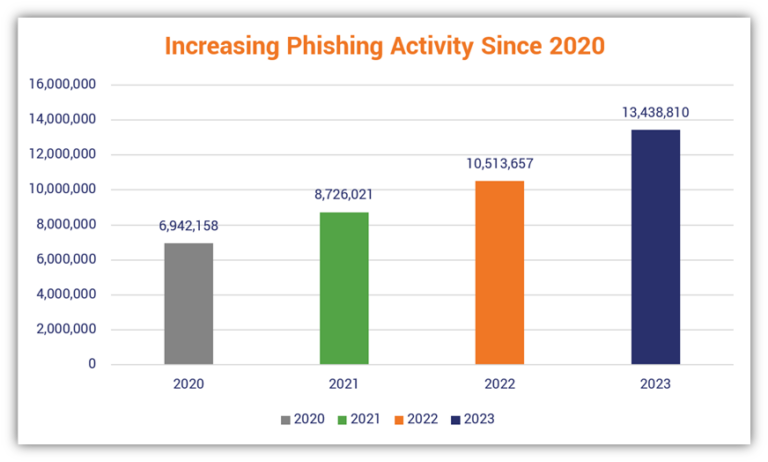

But times have changed. By 2020, scammers were already using caller ID spoofing. Fast forward to 2025, and the game has completely shifted. Scammers now use AI to craft professional-looking messages, often personalized with real details stolen from data breaches. Add in deepfake voices and fake tax prep companies popping up online, and suddenly the scams are nearly indistinguishable from the real deal.

Tax Scammers Just Got Smarter: The Smartest Tax Scams of 2025

AI-Generated Phishing That Looks Legit

Scammers use AI to craft IRS lookalike emails with logos, signatures, and professional formatting. Unlike old scams, these emails are free of typos and often include your actual name. The links lead to fake IRS websites where victims unknowingly hand over Social Security numbers and banking info.

Deepfake Voice Calls (Vishing)

Phone scams just leveled up. In 2025, scammers use AI-generated voices that mimic real people—sometimes even your tax preparer. Caller IDs are spoofed to show “IRS” or a familiar number. Victims are pressured into paying “immediate fees” or “avoiding arrest.”

Social Media “Tax Hacks”

Scroll through TikTok or Instagram, and you’ll find so-called tax gurus promising refunds through loopholes. Many of these “hacks” involve filing false credits like the Earned Income Tax Credit or expired pandemic-era benefits. The IRS is now auditing thousands of cases tied to social media misinformation.

Ghost Preparers

Ghost preparers remain one of the IRS’s top concerns. These scammers pose as professionals, file your return without signing, and then vanish—often redirecting refunds into their own accounts. Victims are left responsible when the IRS comes knocking.

Fake Charities & Credit Mills

Natural disasters, like hurricanes or wildfires, create openings for scammers. Fake charities collect donations that never reach victims. Other scammers promote “credit mills”—convincing people to file for credits they don’t qualify for.

Spear Phishing Targeting CPAs

Tax professionals themselves are being targeted. Scammers pose as new clients, sending malware-laden attachments labeled “tax documents.” Once opened, the malware gives hackers access to the CPA’s client files, exposing hundreds of taxpayers at once.

Why Tax Scams Work: The Psychology Behind Them

Scammers aren’t just using tech—they’re exploiting human emotions. Most tax scams rely on fear, urgency, and confusion.

- Fear: “You’ll be arrested if you don’t pay today.”

- Urgency: “Act now or miss your refund.”

- Confusion: “We’ll help you claim credits you didn’t know about.”

When people panic or get greedy, they stop double-checking—and that’s exactly when scammers strike.

Step-by-Step Guide: Outsmarting Tax Scammers

Step 1: File Early and Securely

The IRS processes returns on a first-come, first-served basis. If a scammer files in your name first, you’ll be locked out. Filing early cuts that risk.

Step 2: Verify Your Preparer

Use the IRS Preparer Directory to make sure your preparer has a valid PTIN. Walk away if they refuse to sign your return.

Step 3: Learn the Red Flags

- IRS doesn’t call, text, or email to demand payment.

- No legitimate tax agency accepts payment in gift cards or cryptocurrency.

- Watch for misspelled URLs or links that don’t start with irs.gov.

Step 4: Lock Down Your Identity

Apply for an Identity Protection PIN at IRS.gov. Add two-factor authentication to all financial logins. Freeze your credit if possible.

Step 5: Double-Check Charities

Before donating, confirm the group is listed on the IRS Tax-Exempt Organization Search Tool.

Step 6: Don’t Trust Social Media Advice

Fact-check every “hack” with a certified CPA or enrolled agent.

Expert Insights

Tax experts agree: knowledge is the best defense.

According to the National Taxpayer Advocate, identity theft remains one of the fastest-growing tax-related crimes, with thousands of taxpayers still dealing with unresolved cases from years prior.

Cybersecurity professionals also warn that AI scams are only getting more convincing. “The days of spotting scams by bad grammar are over,” says a security analyst at Microsoft. “If you receive a message about your taxes, assume it’s suspicious until proven otherwise.”

What If You’re a Victim?

Unfortunately, victims often don’t realize until it’s too late. If your refund has already been stolen, you must:

- File Form 14039 Identity Theft Affidavit.

- Contact the IRS Identity Protection Specialized Unit.

- Monitor your credit for suspicious activity.

- Refile your taxes by paper with proof of identity.

The process can take months. In 2024, the IRS resolved over 1.1 million identity theft cases—but thousands are still pending.

Penalties for Scammers (and Unwary Filers)

- Scammers can face up to 20 years in prison and heavy fines for wire fraud.

- Taxpayers who knowingly file fraudulent credits can be fined, audited, or barred from claiming credits for up to 10 years.

- Even unintentional mistakes tied to social media “hacks” can result in penalties.

Real-Life Stories

- A California gig worker lost $4,000 after clicking a fake IRS refund link.

- A Texas business owner wired $7,500 after a deepfake call mimicked her CPA.

- A college student tried a TikTok “refund hack,” only to trigger an audit and lose eligibility for future credits.

How Scams Trap You: The Fraud Funnel

- Hook – An email, text, or TikTok video grabs your attention.

- Trust – The scam looks official or mimics someone you know.

- Pressure – They warn of jail, fines, or “limited time refunds.”

- Action – You click, call, or pay.

- Damage – Your refund, identity, or savings vanish.

Recognizing this funnel makes it easier to stop scams at step one.

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

Quick Action Checklist

- File taxes early

- Verify preparer PTIN

- Set up IRS IP PIN

- Freeze your credit

- Avoid email or text links

- Confirm charities via IRS tool

- Ignore “tax hacks” on social media