Telangana Deputy CM Backs GST Reforms: When you hear “GST reforms,” it might sound like boring policy talk reserved for economists. But here’s the truth: the Goods and Services Tax (GST) touches every single person’s life. From the price of your pizza to the tax on your dream car, GST decides how much you pay. Think of it as India’s version of a nationwide sales tax, except way bigger and more complex. Recently, Telangana’s Deputy Chief Minister Mallu Bhatti Vikramarka publicly backed GST reforms. But he didn’t stop there. He made it clear that while simplifying GST is good, states like Telangana need fair compensation to keep schools running, roads built, and welfare programs alive.

Telangana Deputy CM Backs GST Reforms

Telangana Deputy CM Mallu Bhatti Vikramarka supports GST reforms but insists on fair compensation for states. His stance isn’t just about numbers—it’s about protecting welfare programs, infrastructure projects, and fairness among states. Just like in the U.S., where states argue with Washington over their fair share, India faces the same challenge. The GST story is about more than taxes—it’s about balancing efficiency with fairness, national unity with state empowerment.

| Topic | Details |

|---|---|

| Deputy CM’s Stand | Supports GST reforms but demands fair compensation for states |

| Revenue Growth Promise | Originally states were promised 14% growth, but actual is just 8–9% |

| Compensation Options | Continue GST compensation cess or raise taxes on luxury/sin goods |

| Impacted States | Telangana, Karnataka, Tamil Nadu, and other southern states |

| Global Parallels | Similar federal vs. state funding disputes exist in the U.S. |

| Why It Matters | States need funds for welfare, healthcare, and infrastructure |

| Official Resource | GST Council Official Website |

What Exactly Is GST?

The Goods and Services Tax (GST) is India’s biggest tax reform since independence. Launched on July 1, 2017, it replaced a confusing jungle of state taxes—sales tax, entry tax, excise duty, VAT, entertainment tax—with one single national tax system.

The goal was simple: make it easier for businesses to operate and ensure fairness in taxation. Imagine if each U.S. state had its own version of sales tax, service tax, and entertainment tax on top of federal taxes. Buying a burger in New York might cost way more than in Texas, just because of different tax layers. That’s what India faced before GST.

By unifying the system, GST created a common national market, cutting red tape and boosting trade. But like any big reform, it came with growing pains.

Why GST Struggled in Its Early Years?

GST was supposed to be a “one-stop” tax, but in reality, businesses had to deal with multiple tax slabs—5%, 12%, 18%, and 28%. Instead of simplification, it sometimes created confusion. Small businesses struggled with filing monthly returns. Technical glitches on the GST portal made compliance harder.

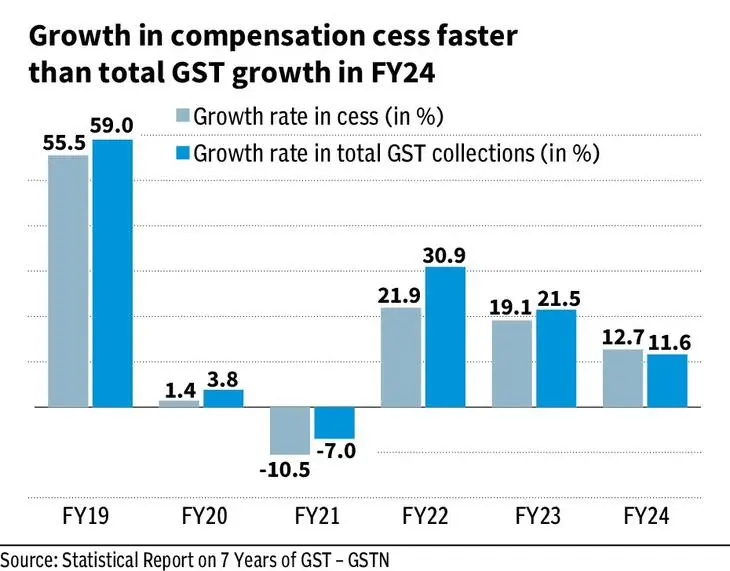

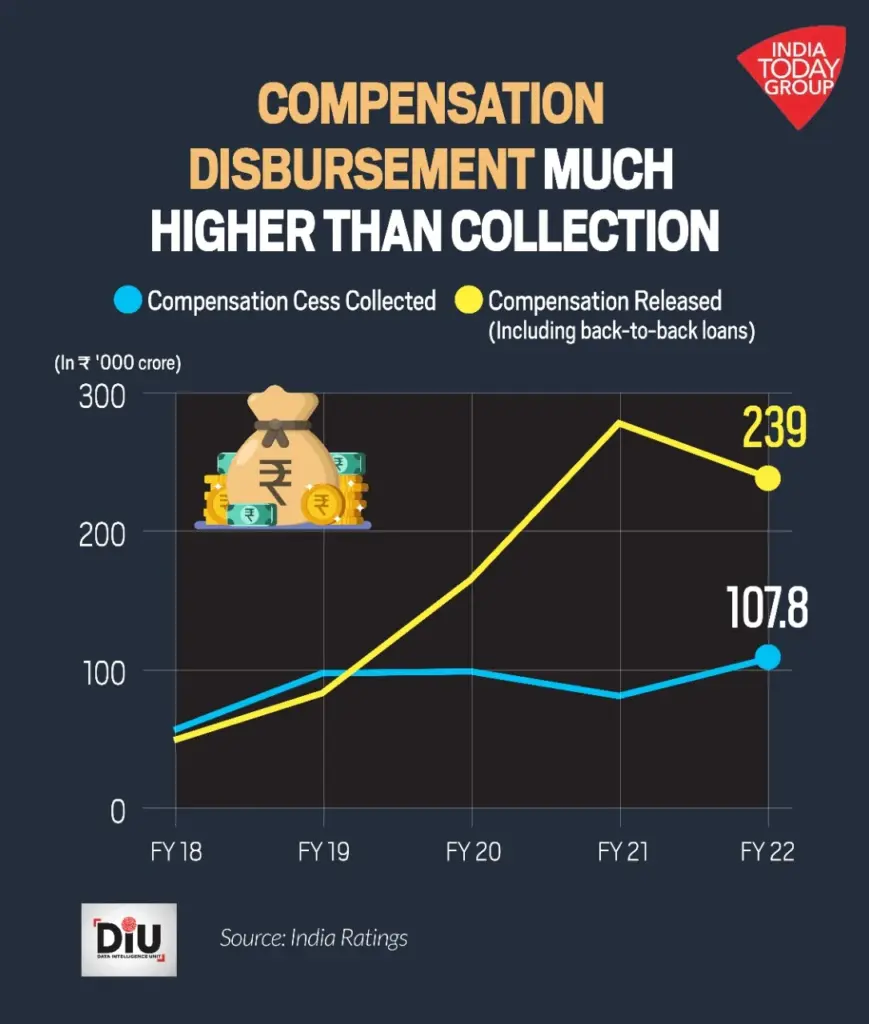

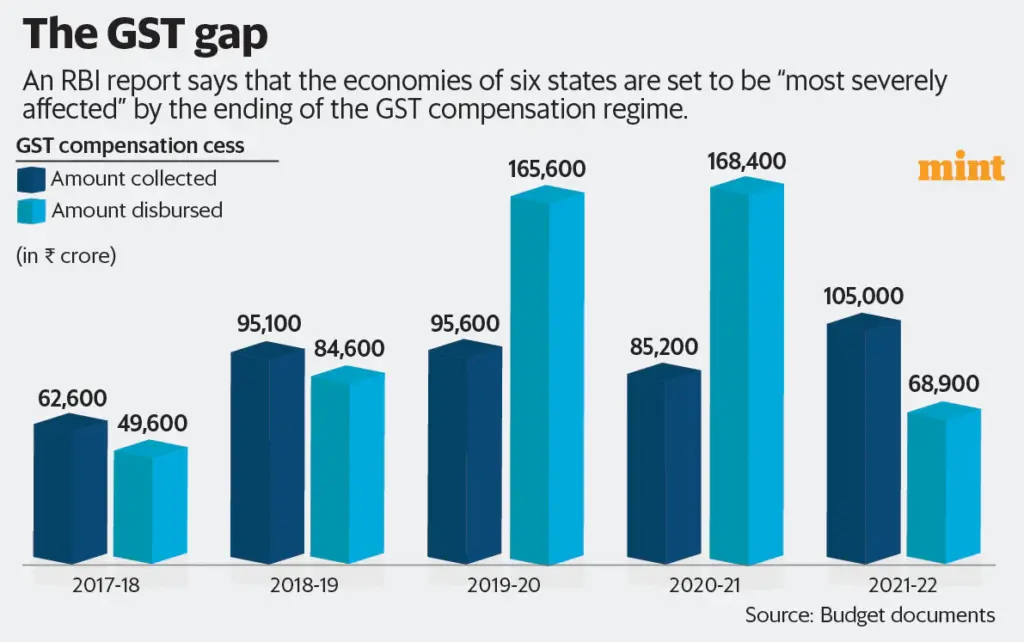

On top of that, states were promised a 14% revenue growth every year for five years, funded by a compensation cess. But the promise quickly ran into trouble. Actual growth hovered around 8–9%, leaving states with budget gaps.

This is where Deputy CM Vikramarka’s concern comes in—without steady compensation, states like Telangana could be forced to cut back on public spending.

Telangana’s Stand: Why Telangana Deputy CM Backs GST Reforms

Deputy CM Vikramarka’s demand isn’t just about numbers. It’s about real-life services and projects that affect millions of people.

1. Welfare Programs

Telangana spends heavily on welfare schemes such as free healthcare, scholarships, and subsidies for farmers. Without adequate revenue, these programs risk shrinking.

2. Infrastructure Projects

From Hyderabad’s metro expansion to rural water supply systems, infrastructure depends on consistent funding. If compensation stops, delays are inevitable.

3. Regional Fairness

Southern states like Telangana, Karnataka, and Tamil Nadu argue that they contribute more to India’s overall economy but receive less federal support in return. GST reforms, if not balanced, could deepen this sense of inequity.

The Deputy CM’s Proposals

To balance reforms with fairness, Vikramarka laid out two main options:

- Continue the GST Compensation Cess

- Luxury and sin goods (like tobacco, alcohol, luxury cars) already have an extra cess.

- 100% of that revenue should continue to flow back to states.

- Raise Taxes on Luxury and Sin Goods

- If the cess is phased out, increase GST on high-end goods.

- Redirect the extra income back to the states.

This isn’t new—many U.S. states also use “sin taxes” on cigarettes and alcohol to fund schools and healthcare. It’s a proven strategy.

Case Study: A Small Business in Hyderabad

Take the example of a mid-sized textile shop in Hyderabad. Before GST, the owner had to pay multiple state taxes and file paperwork separately for each. GST reduced the hassle, letting him focus on running the store.

But here’s the flip side: if Telangana loses revenue, the local infrastructure that supports his business—roads, electricity, internet upgrades—could weaken. So while simplified GST helps in one way, reduced state revenue hurts in another.

The Political Angle

GST has always been political. When it was launched, it had strong bipartisan support. But today, ruling and opposition parties clash on whether the central government has lived up to its promises.

Southern states—many led by regional parties—have been vocal about “fiscal injustice.” They argue that central policies often favor northern states, leaving southern economies underfunded. Vikramarka’s demand is part of this larger political push for fairness.

The U.S. Parallel: Federal vs. State Funding

For readers in America, this debate should sound familiar. States like California, New York, and Massachusetts often complain that they contribute more in federal taxes than they get back in spending. On the other hand, smaller states sometimes get more federal support relative to their size.

India’s GST debate is almost identical. Southern states like Telangana are essentially saying: “Don’t make us pay more and receive less.”

Expert Views and Global Context

According to the World Bank, India’s GST is one of the most ambitious tax reforms globally, but “its sustainability depends on balancing central and state needs.”

The International Monetary Fund (IMF) has also warned that without fair compensation, states could cut back on public services, widening inequality between rich and poor regions.

Indian economists echo the same point: reforms are good, but equity matters more than efficiency alone.

What Happens If States Don’t Get Compensated?

If states lose their revenue guarantees, three big risks emerge:

- Cuts in Welfare Spending – programs for the poor, elderly, and students might shrink.

- Delayed Infrastructure – metros, highways, and hospitals could take longer to finish.

- More Federal-State Tensions – states might resist central reforms, creating policy deadlocks.

This could slow down India’s growth story, just when the country is trying to attract global investment.

Practical Advice for Businesses and Citizens

- For Businesses: Simplified GST slabs mean fewer compliance headaches, but watch for tax hikes in luxury and sin sectors.

- For Professionals: If you’re in sectors like alcohol, tobacco, or luxury goods, prepare for possible price adjustments.

- For Citizens: Essential goods may stay stable, but luxury purchases could cost more. The trade-off? More funding for schools, hospitals, and public services.

Future Outlook

The GST Council is expected to finalize reforms soon. Here are two scenarios:

- If Reforms Come with Fair Compensation: States keep welfare intact, businesses get simpler taxes, and India’s economy grows stronger.

- If Compensation Fades Away: Expect more political fights, budget shortfalls, and possible service cuts at the state level.

India’s future depends on striking the right balance.

GST Rate Rejig to Benefit Farmers and Middle Class – FM Sitharaman Outlines Reform Gains

₹500 Crore GST Scam Busted in Guwahati, Four Held

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly