The Best-Rated Tax Software in the UK for 2025: When it comes to tax season, nobody’s exactly throwing a party. Taxes are confusing, stressful, and—let’s be honest—time-consuming. But in 2025, a new name is shaking up the UK tax world: Pie. That’s right. Millions of taxpayers are making the switch to Pie because it promises something almost magical: stress-free, simple, and smart online tax filing.

Still, Pie isn’t the only choice out there. Longstanding names like Sage, QuickBooks, Xero, TaxCalc, and GoSimpleTax are still some of the best-rated tax software in the UK for 2025. Each tool has strengths and weaknesses, and the right one for you depends on whether you’re freelancing, running a small business, or handling complex returns. This article breaks it all down with data, examples, and actionable tips, so you’ll walk away knowing exactly which tax software fits your situation.

The Best-Rated Tax Software in the UK for 2025

The best-rated tax software in the UK for 2025 depends on your needs. If you’re a freelancer or self-employed, Pie is the rising star, with millions already on board. For businesses, Sage, QuickBooks, and Xero remain the most trusted. For complex returns, TaxCalc delivers powerful tools. And if you just want simple, mobile filing, GoSimpleTax gets the job done. One thing’s clear: digital tax tools are here to stay. They save time, money, and stress—three things everyone could use more of when tax season hits.

| Feature / Data | Insights (2025) | Source |

|---|---|---|

| Pie Popularity | Millions of UK taxpayers are switching in 2025 for free HMRC filing and live tax projections. | Pie Official Website |

| Top Alternatives | Sage Business Cloud, QuickBooks, Xero, FreeAgent, TaxCalc, GoSimpleTax. | TechRadar |

| Pricing | TaxCalc from £38/year, GoSimpleTax from £64.99/year, Pie offers free filing. | TechRadar & Pie |

| Market Trend | Digital tax filing up 35% year-over-year in the UK due to Making Tax Digital (MTD). | HMRC |

| Best For… | Pie – freelancers; Sage – businesses; QuickBooks/Xero – SMEs; TaxCalc – complex cases. | Multiple sources |

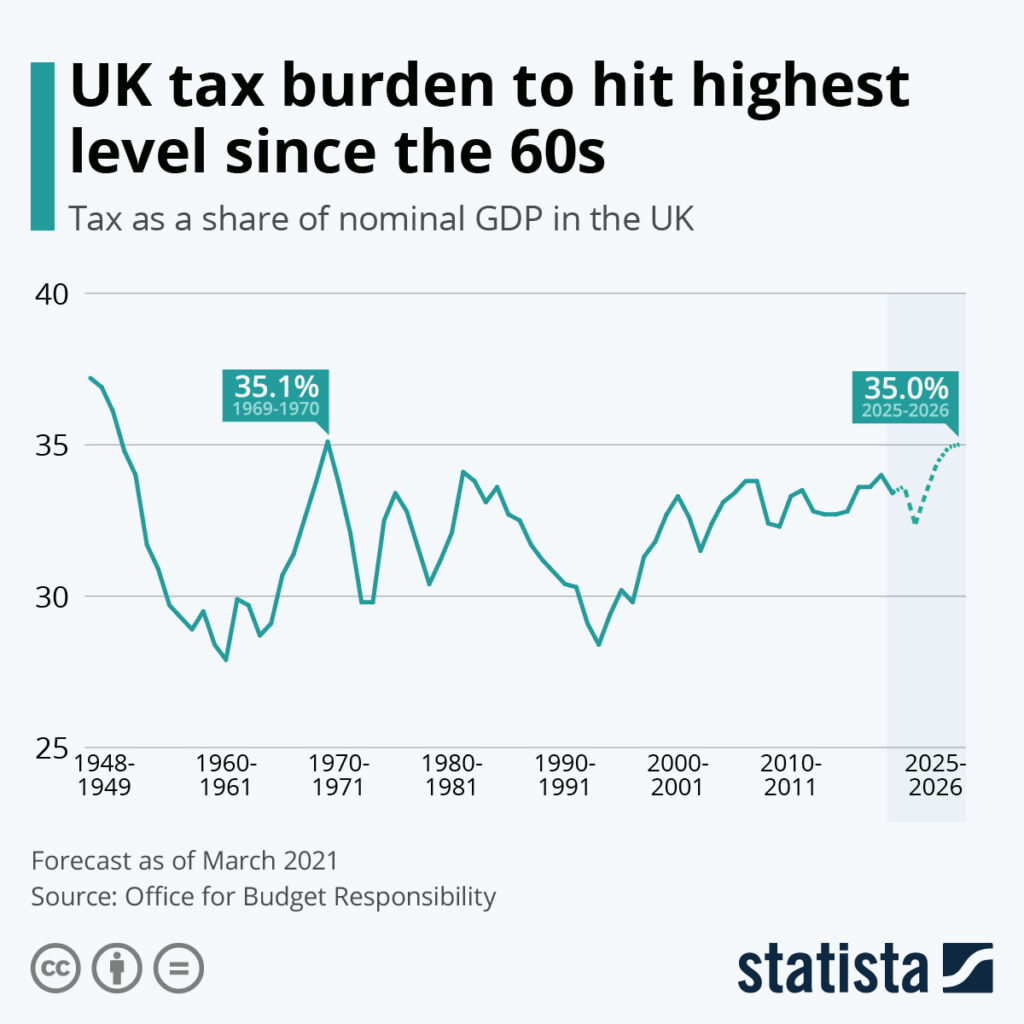

Why Tax Software Matters in 2025?

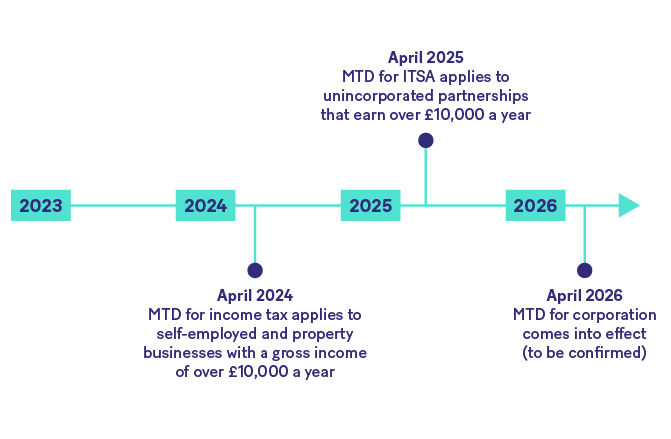

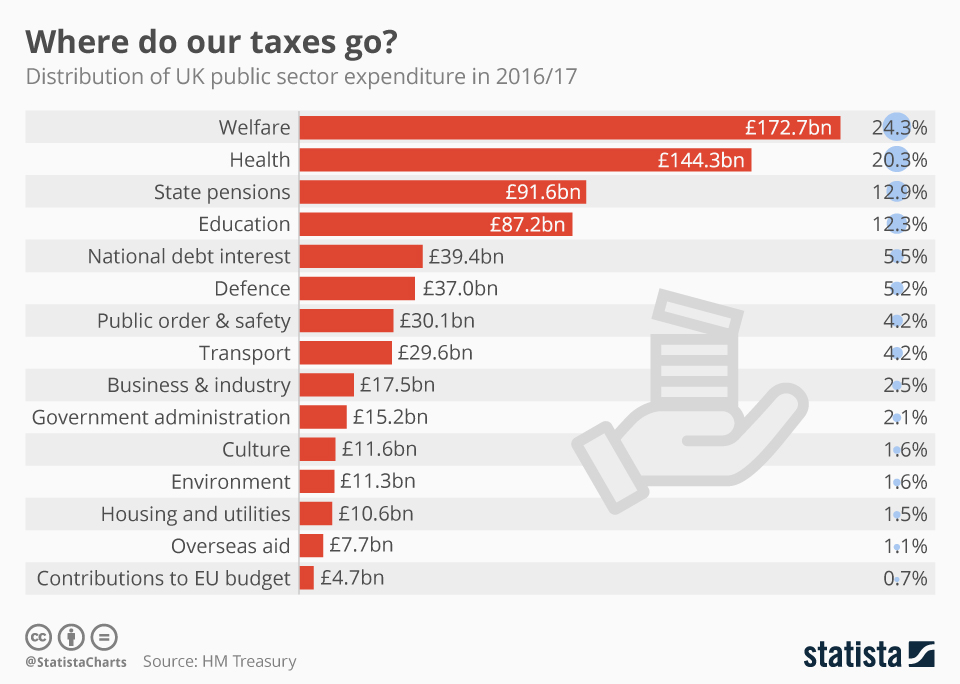

Let’s start with context. For decades, UK taxpayers either hired accountants or battled spreadsheets and calculators. But the government’s Making Tax Digital (MTD) program changed the game. Under MTD rules, individuals and businesses must keep digital records and file using HMRC-recognized software.

Add in inflation, a growing freelancer economy, and a surge of side hustlers, and suddenly affordable, user-friendly tax software is not just helpful—it’s essential.

HMRC reports that by 2026, all self-employed individuals and landlords earning over £10,000 will be required to use MTD-compliant tools. That deadline is pushing millions toward platforms like Pie, Sage, and QuickBooks.

Pie: The Newcomer That’s Stealing the Spotlight

Pie is designed with one mission: make tax filing feel less like rocket science.

Here’s what’s fueling its popularity:

- Free filing with HMRC – No surprise fees for basic submissions.

- Live tax projections – Know exactly what you’ll owe, month by month.

- Mobile-first design – Snap receipts, categorize expenses, and file from your phone.

- Optional expert help – For those times you just want a professional to double-check.

Reports suggest that millions of UK taxpayers switched to Pie in 2025 because it’s both intuitive and cost-effective. Freelancers and gig workers especially love it because it combines personal finance insights with tax filing in one app.

Market Trends in 2025

The shift to digital filing is accelerating:

- HMRC data shows a 35% increase in digital tax filings year-over-year since 2024.

- There are over 4.3 million self-employed workers in the UK, most of whom now rely on software.

- By April 2026, MTD rules will cover nearly every self-employed worker and landlord.

- Small businesses are increasingly choosing hybrid setups—software for bookkeeping, occasional accountants for advice.

This trend explains why new entrants like Pie are thriving while established players continue to adapt with more automation and cloud-based tools.

Comparison Table of The Best-Rated Tax Software in the UK for 2025

| Software | Best For | Price (2025) | Key Features |

|---|---|---|---|

| Pie | Freelancers & self-employed | Free filing, extras optional | Live projections, mobile-first, receipt scanning |

| Sage Business Cloud | Small & medium businesses | From £12/month | Full accounting suite, payroll, VAT, MTD compliant |

| QuickBooks | Growing businesses | From £14/month | Bank integration, invoicing, detailed reports |

| Xero | Cloud accounting & accountants | From £15/month | Scalable, strong support, VAT filing |

| TaxCalc | Complex tax cases | From £38/year | Handles non-resident, capital gains, error checks |

| GoSimpleTax | Simple returns | From £64.99/year | Mobile app, real-time calculations, HMRC submission |

Step-by-Step Guide: How to File Taxes with Software in 2025

Filing digitally can seem intimidating, but it’s easier than ever. Here’s how:

- Choose HMRC-recognized software – Verify on the official HMRC list.

- Set up your Government Gateway account – This is your login for HMRC services.

- Connect your accounts – Most platforms link directly to your bank for transaction imports.

- Input income and expenses – Freelancers add invoices, businesses upload records.

- Run tax calculations – Software shows what you owe, often with real-time updates.

- Check for errors – Tools like TaxCalc run error detection to flag mistakes.

- Submit online – One click sends your return straight to HMRC.

- Store records securely – Most apps keep your documents safe for six years, matching HMRC requirements.

The Future of Tax Software in the UK

Looking ahead, the UK tax landscape is only going to get more digital. HMRC’s Making Tax Digital (MTD) deadlines mean that by April 2026, nearly every freelancer, landlord, and small business owner will be required to file digitally. This creates huge opportunities for platforms like Pie, as well as established players such as Sage and QuickBooks, to continue innovating. Expect to see features like AI-driven bookkeeping, automated expense categorization, and even real-time tax advice built into apps. For professionals, this means less manual work and fewer mistakes. For everyday taxpayers, it means more control and transparency. The shift mirrors trends in the U.S., where apps like TurboTax dominate. The takeaway? Digital tax software isn’t a fad—it’s the future. Getting comfortable with it now will save time, money, and stress as tax rules tighten in the years ahead.

Pros and Cons of Leading Tax Software

Pie

- Pros: Free filing, mobile-friendly, live projections.

- Cons: Not built for large businesses.

Sage Business Cloud

- Pros: Comprehensive accounting, VAT-ready, trusted brand.

- Cons: Too complex for sole traders.

QuickBooks

- Pros: Deep integrations, excellent for scaling businesses.

- Cons: Pricing climbs with extras.

Xero

- Pros: Cloud-native, accountant-friendly, excellent support.

- Cons: Learning curve for beginners.

TaxCalc

- Pros: Affordable, detailed error-checking, handles complex cases.

- Cons: Desktop focus may feel outdated.

GoSimpleTax

- Pros: Simple, mobile-based, real-time calculations.

- Cons: Limited features compared to bigger platforms.

Case Study: A Freelancer’s Experience with Pie

Take Jess, a graphic designer in Manchester. In 2024, she paid nearly £600 to an accountant. In 2025, she switched to Pie.

- She filed her return in under 30 minutes.

- Saved more than £500 in fees.

- Used Pie’s projections to budget for taxes monthly, avoiding surprises.

Her verdict? “Pie saved me money and gave me control. It’s like TurboTax for the UK.”

Practical Advice: Choosing the Right Software

Picking tax software is like picking shoes—different fits for different people.

- Freelancers or side hustlers → Pie or GoSimpleTax.

- Small to medium businesses → Sage, QuickBooks, or Xero.

- People with capital gains, foreign income, or rental properties → TaxCalc.

- Those who want accountant support on demand → Crunch or TaxScouts.

Don’t just look at cost. Think about time saved, features included, and whether you’ll need human help down the line.

Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable

New £40,000 Pension Rule Could Hit Every UK Household; Here’s What You Need to Know

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling