These 5 ELSS Funds Delivered 28 Percent Returns in 3 Years: When it comes to tax-saving investments in India, Equity Linked Savings Schemes (ELSS) are having their moment in the spotlight. These mutual funds not only let you save up to ₹1.5 lakh in taxes under Section 80C of the Income Tax Act, but they also give you an opportunity to grow your wealth by investing in the stock market. In fact, some ELSS funds have delivered a jaw-dropping 28% annualized return over the past three years. For perspective, that’s nearly four times higher than the interest you’d earn from a traditional fixed deposit. For an investor, that kind of number is hard to ignore. Before we jump into the top funds, let’s quickly break it down. ELSS is essentially a two-in-one deal: tax-saving benefits combined with the potential of market-linked returns. The catch? A mandatory three-year lock-in period. The upside? This lock-in is shorter than every other tax-saving option under Section 80C.

These 5 ELSS Funds Delivered 28 Percent Returns in 3 Years

ELSS has proved once again why it is considered one of the most powerful wealth-building tax-saving tools. With returns touching 28% or more in the last three years, funds like ITI ELSS Tax Saver, Quant ELSS, and SBI Long Term Equity Fund have shown how equity-based investments can turbocharge wealth while cutting tax liabilities. However, investors must remember that equities come with risk. ELSS is best suited for those who can handle volatility and are ready to stay invested beyond the three-year lock-in. In short, it’s not just about saving taxes—it’s about creating long-term wealth.

| Feature | Details |

|---|---|

| Top ELSS Performer (3 Years) | ITI ELSS Tax Saver Fund – ~28.6% annualized return |

| Other Strong Funds | SBI Long Term Equity Fund, Motilal Oswal ELSS Tax Saver, HDFC TaxSaver, Quant ELSS |

| Tax Benefit | Up to ₹1.5 lakh deduction under Section 80C |

| Lock-in Period | 3 years (shortest among tax-saving instruments) |

| Capital Gains Tax | 10% on LTCG above ₹1 lakh annually |

| Official ELSS Resource | SEBI Mutual Funds Overview |

Why ELSS Funds Are Rocking the Charts?

Equity has always been a wealth-creator, and ELSS benefits from this directly. Over the past three years, India’s benchmark indices have delivered strong double-digit returns. For example, the Nifty 50 Index posted gains of more than 55% from 2021 to 2024. That growth has naturally boosted ELSS funds that invest in large-cap, mid-cap, and small-cap stocks.

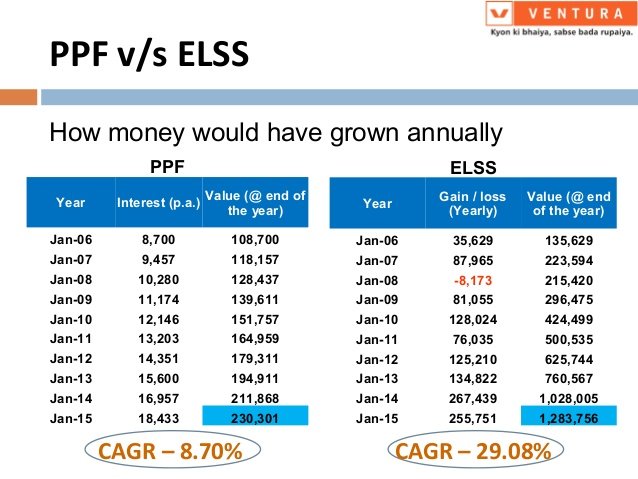

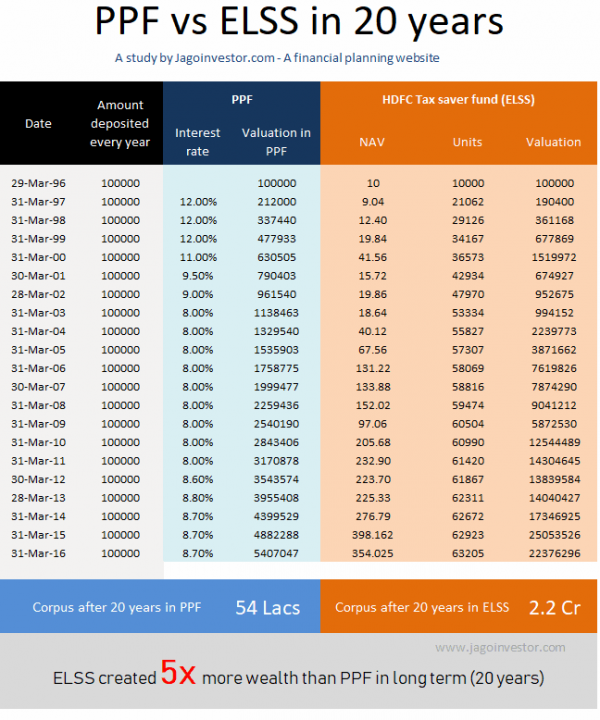

When you compare ELSS with other 80C options, the contrast is striking. The Public Provident Fund (PPF) gives around 7.1% annually, while National Savings Certificates (NSC) and tax-saving fixed deposits provide about 6–7%. Against that backdrop, ELSS funds with returns in the 25–30% range look exceptional.

These 5 ELSS Funds Delivered 28 Percent Returns in 3 Years

1. ITI ELSS Tax Saver Fund

- 3-Year Annualized Return: ~28.6%

- Why It’s Hot: The fund has consistently beaten its benchmark by focusing on growth-oriented sectors and quality companies.

- Investor Fit: Ideal for investors with a high-risk appetite who want aggressive growth.

- Official Page: ITI Mutual Fund

2. SBI Long Term Equity Fund (SBI Tax Saver)

- 3-Year Annualized Return: ~25–27%

- Why It’s Hot: Backed by SBI’s fund management strength, it has a broad portfolio that balances stability with growth.

- Investor Fit: Suitable for moderate investors seeking steady long-term wealth creation.

- Official Page: SBI Mutual Fund

3. Motilal Oswal ELSS Tax Saver Fund

- 3-Year Annualized Return: ~25%

- Why It’s Hot: Known for high-conviction stock picking and concentrated bets on fundamentally strong companies.

- Investor Fit: Works well for investors who believe in long-term compounding.

- Official Page: Motilal Oswal AMC

4. HDFC TaxSaver Fund

- 3-Year Annualized Return: ~23–25%

- Why It’s Hot: One of the oldest ELSS funds in India, backed by a legacy of strong fund management discipline.

- Investor Fit: Perfect for conservative investors who want reliability with moderate returns.

- Official Page: HDFC Mutual Fund

5. Quant ELSS Tax Saver Fund

- 3-Year Annualized Return: ~30%+ (top performer in some quarters)

- Why It’s Hot: Aggressive investment strategies with exposure to high-growth sectors like technology and mid-caps.

- Investor Fit: Best for high-risk takers looking for maximum returns.

- Official Page: Quant Mutual Fund

Historical Performance Snapshot

| Fund | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|

| ITI ELSS Tax Saver | ~35% | ~28.6% | ~20% |

| SBI Long Term Equity | ~30% | ~25% | ~18% |

| Motilal Oswal ELSS | ~29% | ~25% | ~17% |

| HDFC TaxSaver | ~27% | ~24% | ~15% |

| Quant ELSS | ~40% | ~30%+ | ~22% |

How ELSS Works: Explained Simply

Imagine putting your money into a special savings jar. Unlike a piggy bank, this jar doesn’t just hold cash. Instead, it buys small pieces of big companies—think Infosys, Reliance, and HDFC. Over time, as these companies grow, the value of your jar increases. That’s how ELSS builds wealth.

The catch? You can’t open the jar for at least three years. But compared to the 15-year lock-in for PPF or 5 years for NSC, this is the shortest waiting period among all tax-saving instruments.

Benefits of Investing in ELSS

High Returns Potential

Because ELSS invests in equities, it has the potential to outperform all other tax-saving options over time.

Shortest Lock-in Period

Only three years, which gives more flexibility compared to other 80C investments.

Tax Savings

Up to ₹1.5 lakh invested in ELSS is deductible under Section 80C, reducing taxable income.

Diversification

Funds invest across industries and sectors, spreading risk while capturing growth opportunities.

Long-Term Wealth Creation

A smart ELSS investment can help with retirement, children’s education, or buying a home.

Risk vs Reward: Understanding Volatility

It’s important to remember that equity markets are volatile. A fund that delivers 28% one year could deliver far less the next if markets correct. That doesn’t mean ELSS isn’t effective—it simply means you need to stay invested for longer periods.

Funds like Quant ELSS are more aggressive, which means bigger swings in performance. Funds like HDFC TaxSaver are relatively conservative, providing more stability but slightly lower returns.

Metrics like the Sharpe Ratio are useful for analyzing risk-adjusted returns. Top-performing ELSS funds like ITI and Quant often score higher, which means they give better returns for the level of risk taken.

Taxation Rules for ELSS

ELSS gains after three years qualify as long-term capital gains (LTCG). The taxation works as follows:

- Gains up to ₹1 lakh in a financial year are tax-free.

- Gains above ₹1 lakh are taxed at 10%.

Example: If you invested ₹1.5 lakh and made a gain of ₹1.8 lakh, ₹80,000 is tax-free, and ₹30,000 is taxed at 10%, meaning a tax of ₹3,000.

ELSS vs Other Tax-Saving Options

| Investment | Lock-in | Average Return | Risk |

|---|---|---|---|

| ELSS | 3 years | 12–28% | High |

| PPF | 15 years | ~7.1% | Low |

| FD (Tax Saver) | 5 years | ~6–7% | Low |

| NPS | Till 60 years | 8–10% | Moderate |

| NSC | 5 years | ~7.7% | Low |

The clear advantage of ELSS is its higher return potential combined with the shortest lock-in.

Common Mistakes Investors Make

- Chasing Past Performance – Just because a fund performed well recently doesn’t guarantee future success.

- Redeeming Immediately After 3 Years – ELSS is best held for 5–10 years for compounding.

- Ignoring Risk Appetite – Aggressive funds can cause panic in market downturns.

- Not Diversifying – Putting all tax-saving money in one fund increases risk unnecessarily.

Pro Tips for ELSS Investors

- Begin with SIPs (Systematic Investment Plans) to average out volatility.

- Stay invested for at least 5–7 years for meaningful wealth creation.

- Reinvest proceeds instead of cashing out after the lock-in.

- Compare expense ratios and fund manager track records before choosing.

Step-by-Step Guide to Investing in ELSS

- Open an account with an AMC or use platforms like Groww, Zerodha, or Paytm Money.

- Choose your ELSS fund based on financial goals and risk tolerance.

- Decide on lump sum or SIP mode of investment.

- Stay invested for at least three years (mandatory lock-in).

- Review performance annually but avoid reacting to short-term volatility.

NRI Students With Foreign Investments or Bank Accounts — The Income Tax Rules You Can’t Ignore

Income Tax Bill 2025 Brings No Rate Hike – But Here’s The Catch

SEBI Scraps ₹10,000 Minimum for Mutual Fund Distributor Transaction Charges