Trade Talks Pose Biggest Threat to Economy and Banks This Quarter: When RBC’s CEO warns that trade talks pose the biggest threat to the economy and banks this quarter, it’s not just insider banking talk. It’s a warning sign that everyone—business owners, investors, employees, and even families trying to stretch their grocery budgets—should pay attention to. The Royal Bank of Canada (RBC), Canada’s largest bank and one of the most influential players in North America’s financial system, has been watching the trade situation closely. Graeme Hepworth, RBC’s Chief Risk Officer, explained during the bank’s latest earnings call that ongoing trade negotiations between the U.S. and Canada present the most immediate risk to stability. His message was clear: RBC is bracing itself with caution, setting aside more reserves for possible loan losses, and urging stakeholders to stay alert.

Trade Talks Pose Biggest Threat to Economy and Banks This Quarter

The message from RBC’s CEO warning that trade talks pose the biggest threat to the economy and banks this quarter is straightforward: uncertainty is dangerous. Trade deals are more than politics; they shape jobs, prices, and confidence across North America. With RBC preparing for turbulence, the rest of us should also take note—whether that means budgeting more carefully, diversifying investments, or preparing businesses for supply chain disruptions.

| Key Point | Details | Source/Reference |

|---|---|---|

| Biggest risk this quarter | Trade talks between U.S. and Canada seen as top threat | RBC Official Site |

| RBC’s response | Keeping higher provisions for potential loan losses | Yahoo Finance |

| Broader impact | Prolonged trade tensions could slow growth, hit jobs, and squeeze businesses | Global News |

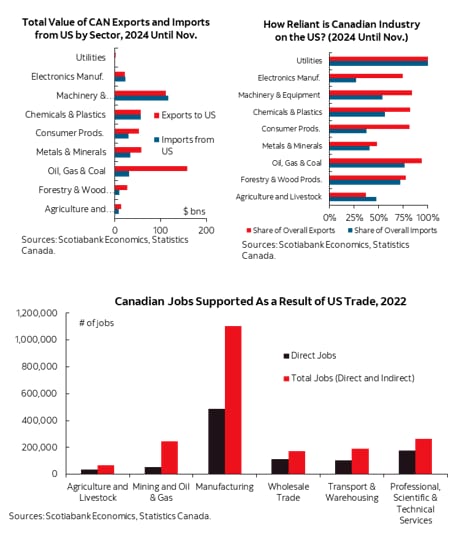

| Canadian economy share | Trade with U.S. makes up nearly 75% of Canada’s exports | Government of Canada |

| Banking implications | Uncertainty raises cost of borrowing, slows investment, and dampens consumer confidence | Bank of Canada |

Why Trade Talks Pose Biggest Threat to Economy and Banks This Quarter Matter?

Trade deals may seem like political negotiations that happen far away, but they affect daily life in very real ways. When trade barriers rise, companies pay more for imports, and that cost often gets passed on to consumers. A higher price tag on groceries, cars, or clothing can be traced back to a hiccup in trade talks.

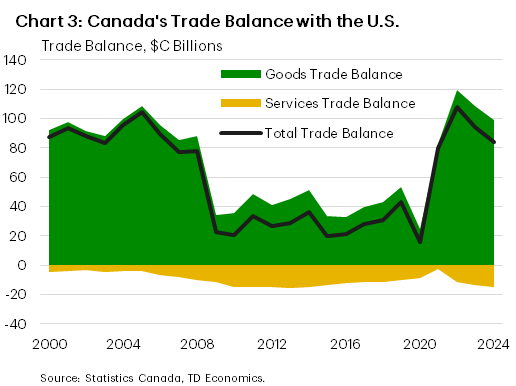

Canada depends on the United States for nearly three-quarters of its exports. That includes everything from lumber and oil to manufactured goods. If trade talks falter, Canadian businesses lose markets, and U.S. consumers see fewer supplies and higher prices. Banks like RBC are caught in the middle because struggling companies and households may have trouble repaying loans.

A Look Back: Past Trade Battles

Trade friction between the U.S. and Canada isn’t new. In fact, history shows us that these disputes can drag on for years.

- The softwood lumber dispute has been ongoing for more than 30 years. Every time tariffs rise, Canadian forestry companies cut jobs, and U.S. homebuilders complain about higher housing costs.

- In 2018, during renegotiations of the North American Free Trade Agreement (NAFTA), uncertainty rattled businesses until the new United States-Mexico-Canada Agreement (USMCA) was signed. For months, companies delayed investments and hiring while waiting to see the rules.

- The 2018 U.S.-China trade war is another example. American farmers lost billions when China retaliated against U.S. tariffs, forcing Washington to provide subsidies to keep agriculture afloat.

These examples highlight a recurring theme: uncertainty is often more damaging than the final outcome. Companies and banks tend to hold back even before policies are finalized.

RBC’s Strategy for Uncertain Times

RBC’s response has been measured but cautious. Here’s what they’re doing:

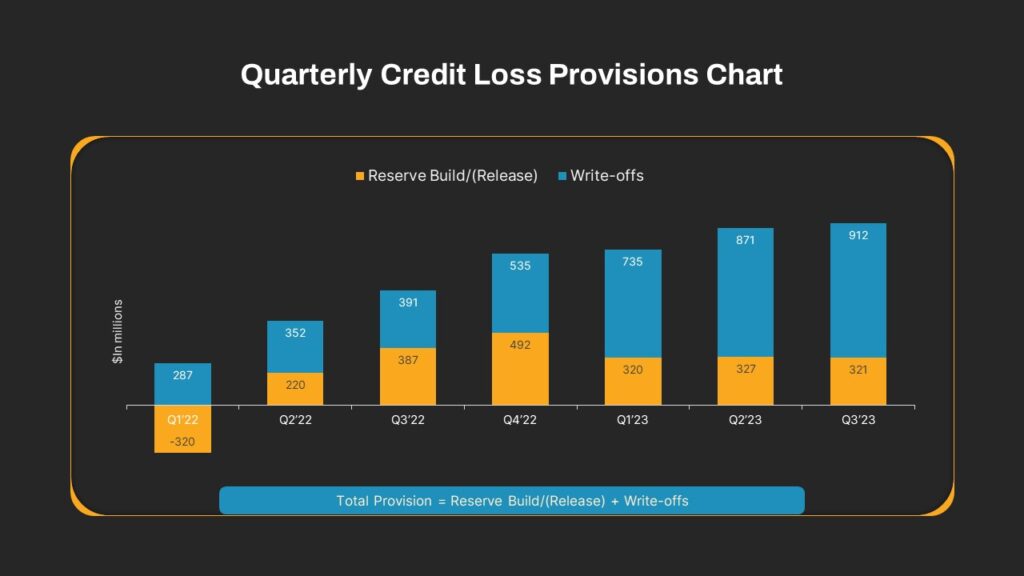

- Building Loan Loss Provisions – RBC is setting aside more capital to cover potential defaults. This is like having a safety net ready in case businesses or households can’t repay their debts.

- Tightening Credit Standards – Loans will be harder to get, especially for riskier borrowers. That protects the bank but can make financing tougher for small businesses.

- Watching Interest Rates Closely – With central banks in both countries signaling that rates could stay higher for longer, RBC is preparing for slower loan demand. High interest rates already make borrowing expensive, and trade disruptions could add more stress.

Breaking Down the Risks Step by Step

Step 1: The Key Players

- Canada and the United States: deeply connected through supply chains.

- Government negotiators: shaping trade rules, tariffs, and market access.

- Global markets: reacting instantly to news, moving billions in stock prices within hours.

Step 2: Warning Signs to Watch

- Tariffs or new quotas announced on goods like steel, lumber, or dairy.

- Consumer and business confidence surveys dropping.

- Negative signals in earnings calls from banks, automakers, and exporters.

Step 3: How to Prepare

- Families: Avoid new high-interest debt and budget for possible price increases.

- Investors: Diversify portfolios to avoid being overexposed to trade-sensitive industries.

- Small Businesses: Build savings cushions and explore multiple supply sources.

The Ripple Effect on Everyday Life

Trade tensions hit closer to home than most people realize. A U.S. tariff on Canadian steel, for example, can mean higher prices for cars and appliances. Farmers on both sides of the border rely on open markets, and when tariffs hit, food prices climb. Even industries like tech and energy feel the impact since they depend on global supply chains.

For households already struggling with inflation and high interest rates, this could mean even tighter budgets. RBC’s caution is essentially a signal: if one of the world’s most stable banks is worried, everyday people should also brace themselves.

Expert Opinions and Data

The Bank of Canada has called trade wars the “greatest threat to Canada’s economy”. Analysts at Moody’s estimate that prolonged tensions could trim 0.5 to 1% off GDP growth within a year.

Economists often compare trade uncertainty to a hidden tax. As Avery Shenfeld of CIBC Capital Markets explains: “Trade uncertainty has the same effect as a tax hike. Businesses hit pause, households spend less, and banks start hedging their bets.”

Meanwhile, data from Statistics Canada shows that exports account for nearly a third of Canada’s GDP, making the economy especially sensitive to shifts in trade policy.

Global Implications

The impact doesn’t stop at the U.S.-Canada border.

- Automotive Supply Chains: A single vehicle may cross the border several times during production. Tariffs could slow assembly lines and raise prices for consumers.

- Energy: Canada provides over half of U.S. crude oil imports. Disruptions would affect fuel costs and energy security.

- Agriculture: Dairy, beef, and grain producers are often bargaining chips in trade talks, meaning farmers live with uncertainty.

These ripple effects mean global markets—from Asia to Europe—also watch North American trade negotiations closely.

What the Future Might Hold?

The next quarter could play out in three possible scenarios:

- Best Case: Trade negotiators strike agreements quickly, tariffs stay minimal, and confidence rebounds.

- Middle Case: Talks drag on without major breakthroughs, leaving businesses and banks in limbo.

- Worst Case: Talks collapse, tariffs rise sharply, and both economies face slower growth.

RBC’s warning shows they expect something between the best and middle cases—manageable but still risky.

Practical Tips for Different Audiences

For Families:

- Stick to necessities when shopping and avoid unnecessary debt.

- Keep an emergency savings buffer for unexpected price hikes.

For Investors:

- Monitor companies with exposure to exports, manufacturing, and commodities.

- Add defensive assets like utilities or healthcare stocks to balance risk.

For Small Business Owners:

- Consider diversifying suppliers, especially if dependent on cross-border shipments.

- Explore financing options early before credit conditions tighten further.

For Employees:

- If working in trade-sensitive sectors, consider upgrading skills to stay adaptable.

Coimbatore Trade Bodies Petition CM Against State GST Harassment

US Abruptly Cancels India Trade Talks Amid Tariff Tensions

Zuckerberg Secretly Lobbied Trump on Digital Service Taxes Before EU Showdown, Report Claims

The Bigger Picture

At its core, trade is about confidence. Clear, predictable rules create growth. Uncertainty creates hesitation. RBC’s warning shows that even strong financial institutions are uneasy about the current environment.

This isn’t about fear—it’s about preparation. RBC is sending a message: don’t ignore the risks. If businesses, families, and investors take steps to protect themselves, the impact of trade turbulence can be managed.