Traverse City Man Faces Tax Fraud Charges: When news broke that a Traverse City man faces tax fraud charges over illegal marijuana sales, folks across Michigan and the wider U.S. took notice. At first glance, this might seem like just another case of someone cutting corners. But when you peel back the layers, this story dives into the heart of the cannabis industry, tax laws, and how communities benefit—or lose—depending on whether people play by the rules. At the center of this case is 55-year-old John Cunningham, a Traverse City resident accused of running an unlicensed marijuana operation while skipping out on state taxes. He’s now facing two felony counts of filing false or fraudulent income tax returns. And while the headlines focus on the weed, the bigger story is about money, fairness, and accountability.

Traverse City Man Faces Tax Fraud Charges

The case of the Traverse City man facing tax fraud charges over illegal marijuana sales isn’t just a legal drama—it’s a lesson. Cannabis may be legal in Michigan, but success depends on following the rules. Taxes, compliance, and transparency matter as much as the product itself. For everyday readers, it’s a reminder that community funding depends on fair contributions. For professionals, it’s a blueprint of what not to do. And for policymakers, it’s proof that strong enforcement remains critical in the post-legalization era.

| Aspect | Details |

|---|---|

| Defendant | John Cunningham, 55, Traverse City |

| Charges | Two counts of filing false/fraudulent tax returns (5-year felonies each) |

| Operation | Unlicensed marijuana grow and distribution in Grand Traverse County |

| Seized Evidence | 134 plants, 230+ lbs marijuana, $100K+ cash, 2 vehicles, 6 Rolex watches |

| Tax Issues | Alleged failure to file taxes for 2021 and 2022 |

| Court Proceedings | Arraigned Sept. 4, 2025; Probable cause hearing set for Sept. 11, 2025 |

| AG’s Statement | Fair taxation critical; legal marijuana funds communities |

| Official Reference | Michigan Attorney General’s Office |

The Bigger Picture: Cannabis, Taxes, and the Law

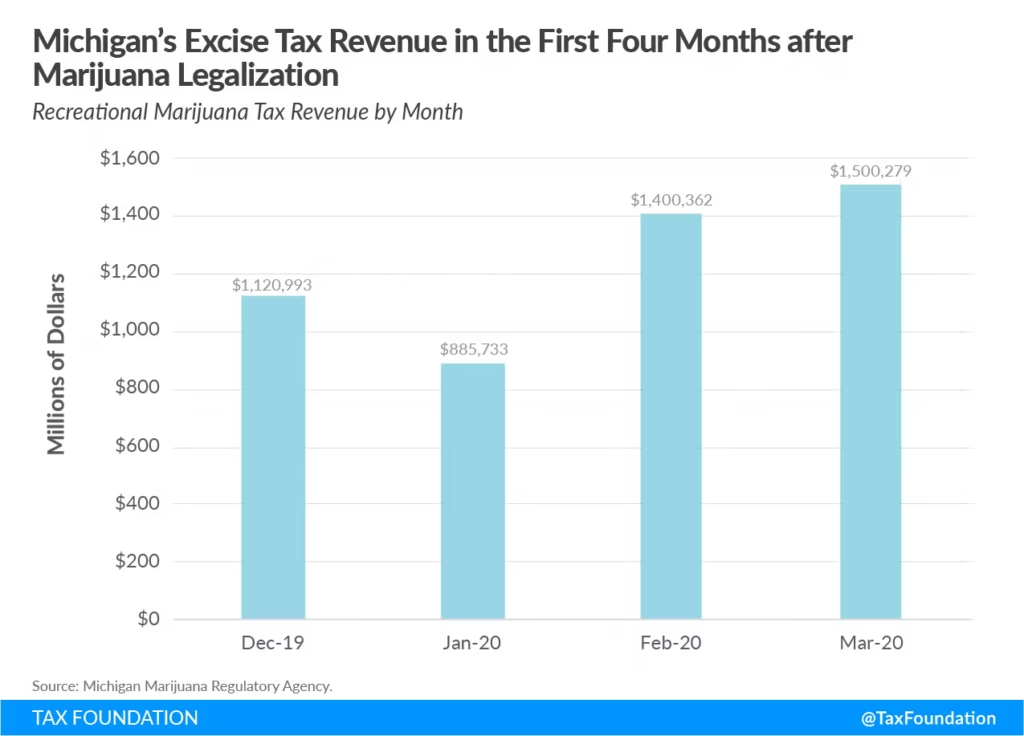

Marijuana is legal in Michigan—recreationally since 2018—but only if you’re licensed and paying your share of taxes. The law was designed to bring black-market cannabis sales out into the open, regulate them, and funnel revenue back into schools, roads, and public services.

According to the Michigan Department of Treasury, cannabis taxes generated over $87 million for schools and $115 million for municipalities in 2023. That’s not pocket change—it’s money that impacts classrooms, road repairs, and emergency services across the state.

When someone like Cunningham sidesteps taxes, it doesn’t just hurt the state—it directly shortchanges local communities.

Historical Context: Michigan’s Cannabis Journey

Michigan has long been at the forefront of the cannabis debate in the Midwest. Medical marijuana was legalized in 2008, making Michigan one of the earlier adopters. By 2018, voters approved recreational marijuana, cementing the state’s position as a cannabis hub.

The Cannabis Regulatory Agency (CRA) oversees the industry today. Licenses exist for growers, processors, retailers, and transporters. But with regulation came a price tag: applicants must meet strict standards, pay licensing fees, and, of course, contribute through taxes.

Cunningham’s case is a reminder that not everyone transitioned to the regulated system. Some operators chose to stay underground, seeking fast profits without oversight.

What Investigators Found?

In January 2023, Michigan State Police conducted raids on multiple properties linked to Cunningham. Their findings painted a clear picture of a profitable operation:

- 134 marijuana plants

- Over 230 pounds of processed marijuana

- More than $100,000 in cash

- Two vehicles

- Six Rolex watches worth over $100,000 combined

This wasn’t a hobby grower. Authorities uncovered evidence of a sophisticated, money-making business operating outside the law.

Why Traverse City Man Faces Tax Fraud Charges?

It may sound odd—why charge Cunningham with tax fraud when the marijuana operation itself was illegal? The reason is straightforward: tax cases are often easier to prove.

The IRS and state tax agencies require you to report all income—even from illegal activities. The IRS makes this clear on its website: “Income from illegal activities, such as money from dealing illegal drugs, must be included in your income.” Failing to do so is fraud.

This approach isn’t new. Al Capone, one of history’s most notorious gangsters, wasn’t jailed for bootlegging or violence—he went down for tax evasion. Cunningham faces a similar fate, with each count carrying up to five years in prison.

Economic Impact of Cannabis in Michigan

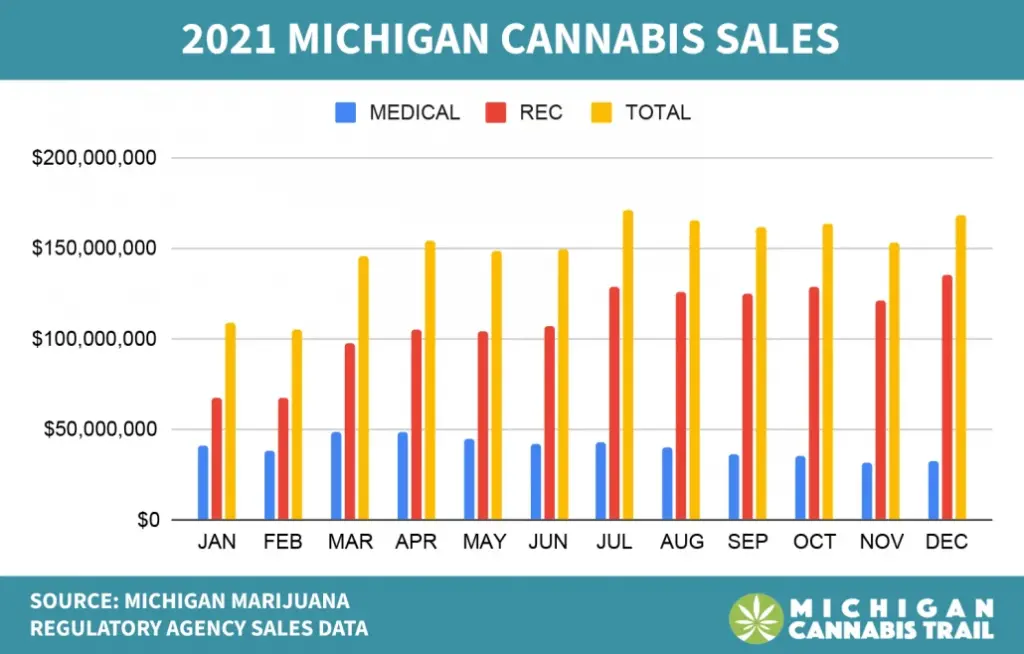

The stakes are high. Michigan’s cannabis industry hit nearly $3 billion in legal sales in 2023, according to MJBizDaily. This made Michigan one of the largest legal cannabis markets in the United States.

This success translates into:

- Thousands of jobs statewide

- Millions in tax revenue supporting public services

- New investment opportunities in real estate, agriculture, and retail

When unlicensed operators siphon profits, they create unfair competition and weaken the regulated industry. Legal businesses face high compliance costs and taxes, while black-market sellers can undercut prices.

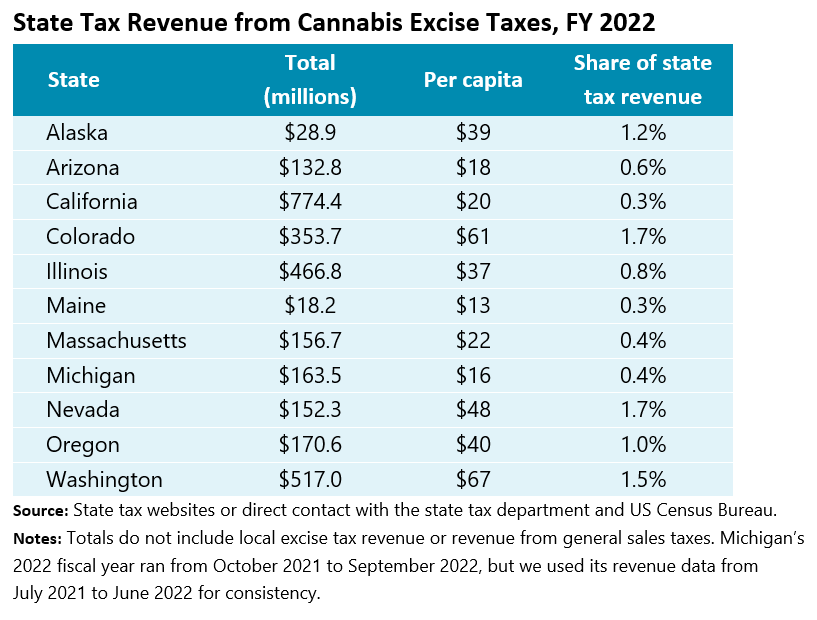

Comparison with Other States

Michigan’s struggle isn’t unique. California, despite its size and market maturity, continues to battle a thriving black market that outpaces legal sales in some areas. Colorado, often hailed as a model, also cracks down on unlicensed growers and distributors through tax enforcement.

By focusing on tax fraud, Michigan aligns itself with a strategy that’s proven effective elsewhere: follow the money.

Legal Process Breakdown

For readers wondering what happens next in Cunningham’s case, here’s a step-by-step look:

- Arraignment (Sept. 4, 2025): Cunningham was formally charged and entered a plea.

- Probable Cause Hearing (Sept. 11, 2025): The court decides if there’s enough evidence to proceed.

- Pre-Trial Conferences: Lawyers negotiate, possibly considering plea deals.

- Trial: If no plea deal is reached, prosecutors present their case, and the defense responds.

- Sentencing: If convicted, Cunningham faces up to 10 years, plus fines and possible forfeiture of seized assets.

This timeline helps illustrate how serious financial crimes are treated in Michigan’s legal system.

Professional Insights: Lessons for Cannabis Entrepreneurs

If you’re an entrepreneur—or even thinking about entering the cannabis space—there are practical takeaways here:

- Licensing is everything. Without it, you’re not just bending rules, you’re breaking the law.

- Taxes aren’t optional. Build compliance into your business plan. Budget for accountants who specialize in cannabis.

- Transparency protects you. Keep meticulous records of sales, payroll, and expenses. Regulators respect businesses that can show clean books.

- Compliance is an investment. It may not be flashy, but it ensures your business survives long-term.

Ethical and Community Impact

This case isn’t only about one man. It’s about the broader implications for Michigan’s communities. Legal cannabis tax revenue funds education, infrastructure, and healthcare. When operators dodge their obligations, the ripple effects are felt by families, schools, and neighborhoods.

For Native and rural communities in particular, where resources are already stretched thin, these funds can make a significant difference.

Future Outlook: Cannabis and Compliance

Looking forward, Michigan is expected to continue expanding its cannabis market. Analysts predict sales could surpass $4 billion within the next few years. But with growth comes more scrutiny.

We’re likely to see:

- Increased audits of cannabis businesses

- More sophisticated tracking of sales and taxes

- Collaboration between state police, the CRA, and tax authorities

For entrepreneurs, this means the days of operating in legal gray areas are numbered. For communities, it promises more reliable funding if enforcement is consistent.

Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable

Why High Taxes And Poor Facilities Are Driving Wealthy Indians Abroad

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case