Tripura Leads the Way in GST Collection: Tripura has emerged as a frontrunner in India’s Goods and Services Tax (GST) collection, recording an impressive 7.5% year-on-year increase in its tax revenue for July 2025. This surge positions the northeastern state as one of the top performers in the country, showcasing a remarkable growth trajectory. But what makes this achievement stand out in a country as vast and diverse as India? The answer lies in a combination of smart policies, improved economic activities, regional collaboration, and efficient tax administration. In this article, we will explore how Tripura managed to achieve this impressive feat and what other states can learn from its experience.

Tripura Leads the Way in GST Collection

Tripura’s growth in GST collection is a powerful example of how strategic policy changes, economic focus, and regional collaboration can transform the fiscal landscape. The state’s success highlights that even smaller regions can contribute significantly to national revenue through effective tax administration, business development, and community engagement. For other states, adopting these approaches can lead to more sustainable economic growth, enhancing the financial health of the country as a whole.

| Key Data | Details |

|---|---|

| GST Revenue Growth in Tripura | 7.5% increase year-on-year |

| National GST Growth | 7.5% growth, reaching ₹1.96 lakh crore in July 2025 |

| Growth in Domestic Transactions | 6.7% increase |

| Growth in Import-Related GST | 9.7% increase |

| Northeastern States’ Performance | Tripura, Sikkim, Nagaland, and Meghalaya show robust growth |

| Official Source | Taxscan, DD News |

What Makes Tripura’s GST Collection Stand Out?

Tripura’s impressive performance is not merely a result of favorable market conditions; it’s a reflection of careful, strategic planning and execution. The state has worked relentlessly to modernize its tax collection systems and foster an environment conducive to economic growth. Let’s explore the elements that contributed to Tripura’s leadership in GST collection.

1. Effective Policy Measures

Tripura has introduced a series of policy reforms and technological upgrades that streamline the tax collection process. The introduction of GSTN (Goods and Services Tax Network), a nationwide platform for tax filing, has played a vital role in automating the system and reducing errors. Additionally, invoice-matching systems have been refined to ensure better accuracy and transparency.

In Tripura, the state government has further refined this system, ensuring that businesses—large and small—are able to comply with tax laws efficiently. They have also facilitated e-filing options that reduce paperwork and the chance for human error. These initiatives have not only improved the accuracy of the tax returns but have also reduced the chances of tax evasion.

Another policy that has worked wonders is the simplification of GST filing for smaller businesses. The state introduced user-friendly interfaces and accessible platforms for local entrepreneurs to file taxes, which lowered the barrier to entry for many small businesses. The result has been greater participation in the GST system, contributing significantly to increased revenue.

Example: GSTN’s automated systems allow businesses to file taxes and automatically receive reminders for due dates, helping avoid penalties and streamlining the entire process. For Tripura, this has meant smoother operations and more efficient tax compliance.

2. Encouraging Economic Activities

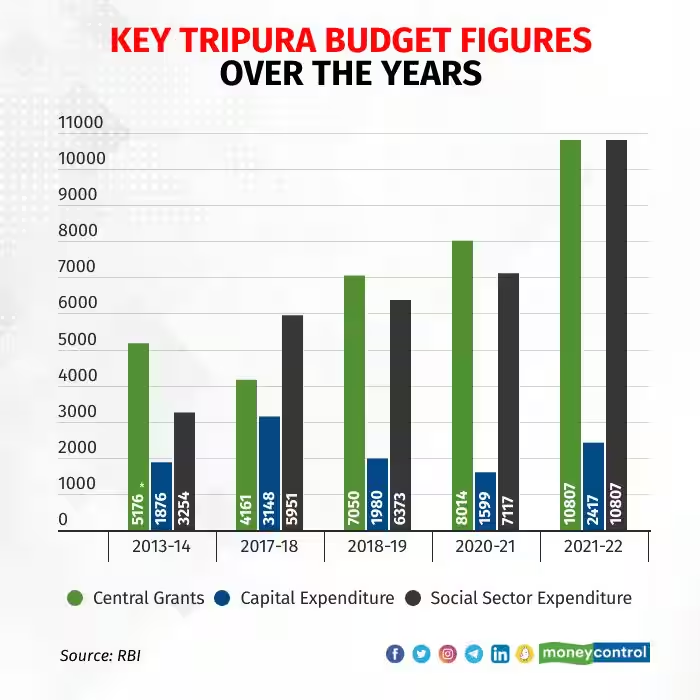

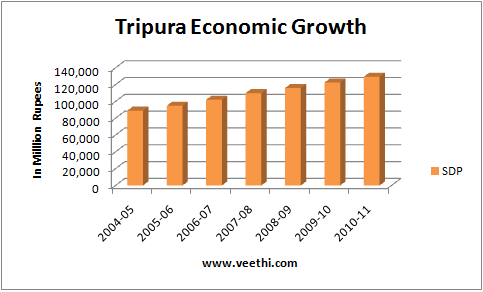

A key element in driving higher GST collection is economic activity. Tripura has invested heavily in sectors like manufacturing, agriculture, and handicrafts, which form the backbone of its economy. This not only drives local business growth but also increases taxable transactions.

The state has also benefited from the resurgence of its agricultural economy, which has led to more transactions related to agri-business and trade. The handloom and handicraft sectors, for example, have long been vital to Tripura’s economy and contribute significantly to GST collections, especially as these products reach broader national and international markets.

Local government initiatives have also focused on improving the infrastructure needed to support these industries, like road connectivity, logistics support, and financial services. By making it easier for businesses to operate and trade within Tripura and across borders, the state has created an environment ripe for economic growth.

Example: Tripura’s growth in the handloom industry has been significant. The government’s focus on promotion and exports of handloom products has opened up new markets for local businesses, directly increasing their GST contributions.

3. Regional Collaboration and Economic Ties

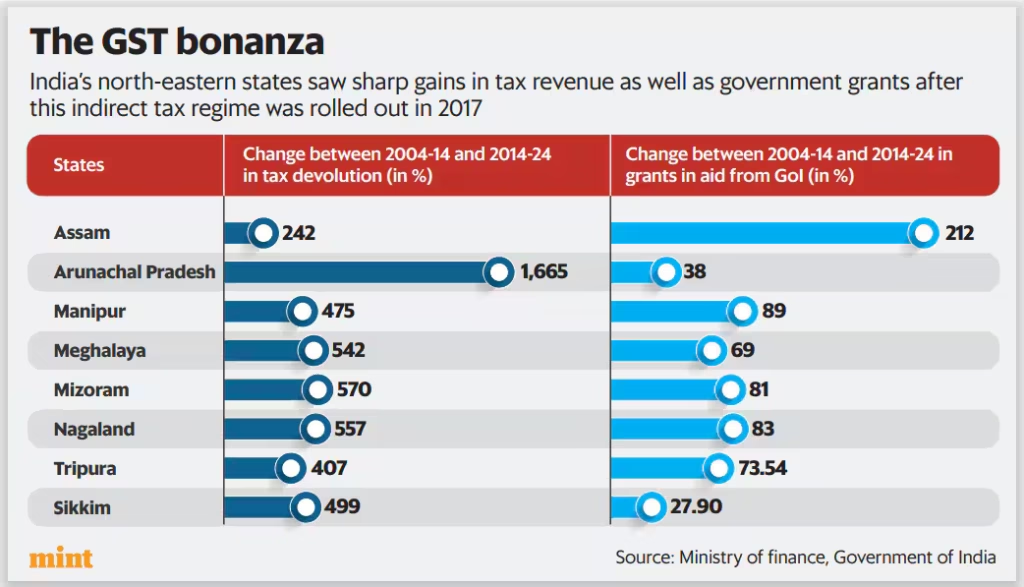

Tripura is a part of India’s northeastern region, where states like Sikkim, Nagaland, and Meghalaya have also experienced strong growth in GST revenue. This regional economic cooperation has benefited Tripura, as it has opened new avenues for trade and business collaborations.

Through better regional infrastructure development, such as improving road and rail connectivity, these states are now able to engage in more fluid trade activities. For instance, smoother trade routes have allowed for greater cross-border commerce, contributing significantly to overall GST revenue.

The state’s strong ties with neighboring states have allowed for enhanced trade, and this has been reflected in the growth of GST revenue. For example, better connectivity with Bangladesh has also increased the state’s engagement in cross-border commerce, driving more taxable transactions.

Example: The government has prioritized border trade facilitation, easing the passage of goods and services between India and Bangladesh, benefiting businesses in Tripura by boosting sales and exports, leading to more tax compliance and higher GST collections.

4. Boosting Taxpayer Education and Compliance

One of the most effective strategies in Tripura’s GST collection success has been its emphasis on taxpayer education. The state government regularly conducts workshops, seminars, and training programs for business owners and tax professionals. These programs aim to clarify the benefits of GST and help small businesses understand their tax obligations better.

Example: The state has launched online platforms where businesses can easily get help with filing taxes, staying informed about deadlines, and receiving guidance on how to ensure they remain compliant with tax laws.

Tripura has also made efforts to simplify the tax filing process for small businesses and freelancers, ensuring that they can easily navigate the system without much complexity.

Step-by-Step Guide: How Tripura Leads the Way in GST Collection

If other states wish to replicate Tripura’s success story, they need to adopt a multi-pronged approach, including policy reforms, economic development, and improved compliance. Here’s a detailed breakdown of the steps that can be followed:

Step 1: Implement Stronger Compliance Measures

The first step for any state is to build a solid foundation for tax compliance. This can be achieved by automating the process and investing in invoice-matching systems. Using technology to streamline tax filing not only reduces errors but also encourages businesses to comply.

Tip: Invest in cloud-based software and platforms that help businesses reconcile taxes more efficiently.

Step 2: Focus on Economic Growth and Development

For higher GST revenue, it is essential to encourage economic activity in key sectors like manufacturing, services, and agriculture. Supporting local industries with financial aid, infrastructure development, and market access can significantly increase taxable transactions, thus driving GST collections.

Tip: Create special economic zones (SEZs) and industrial parks to encourage business activities that generate tax revenue.

Step 3: Foster Regional Cooperation

Strong regional collaboration is essential. Work towards building cross-border trade initiatives with neighboring states and countries. By facilitating free trade and improving logistics and infrastructure, businesses can thrive and increase taxable transactions.

Tip: Develop trade corridors that allow goods and services to flow seamlessly between neighboring regions.

Step 4: Promote Taxpayer Education and Simplicity

Educating businesses about the benefits of GST compliance and simplifying the filing process can significantly improve overall compliance rates. Offering online resources, dedicated help desks, and user-friendly portals can make the process less daunting.

Tip: Develop training programs and online workshops aimed at small business owners to ensure they understand the advantages of adhering to GST regulations.

Why Is This Important for the Country?

Tripura’s remarkable achievement is more than just a win for the state; it has broader implications for India’s economic future. As the country seeks to enhance its fiscal health and boost national revenue, it is crucial that GST collections continue to rise.

- Strengthening National Economy: As the GST collection rises, the government will have more funds to allocate to infrastructure, healthcare, and other essential services that benefit the nation.

- Fiscal Sustainability: By boosting GST revenue, India’s fiscal deficit can be controlled, ensuring long-term economic stability.

- Promoting Economic Equality: More revenue from GST means more funding for social welfare programs, which can help bridge the economic gap between different regions.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices—Is This a Step Forward or Backward?

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!