Trump Tariffs Debate Heats Up: The issue of Trump tariffs—and whether they count as a tax on everyday Americans—has ignited controversy all over the U.S. It’s a hot topic in economics, politics, and business right now. In this article, I’ll break down what tariffs are, what the evidence shows about their impacts (short and long term), extra angles people often overlook, steps for evaluating their effects, plus advice for consumers and businesses. I write this as someone who’s followed trade policy for years—you’ll get both the kid-friendly version and the deeper, professional angle. Whether you’re a 10-year-old learning about economics for the first time, or a professional managing supply chains, this article will give you the clarity and actionable insights you need.

Trump Tariffs Debate Heats Up

In short: yes, Trump’s tariffs do behave a lot like a tax on many Americans—especially through higher consumer prices, lower household purchasing power, and slower growth. They may not look like a tax on paper, but in practice, they raise costs and complicate life for families and businesses. Beyond today’s price hikes, tariffs risk long-term impacts on competitiveness, innovation, and global trade relations. The key for households and businesses is to stay informed, adapt quickly, and plan strategically to manage the costs and risks.

| Topic | Stat / Fact | Why It Matters Professionally / for Careers |

|---|---|---|

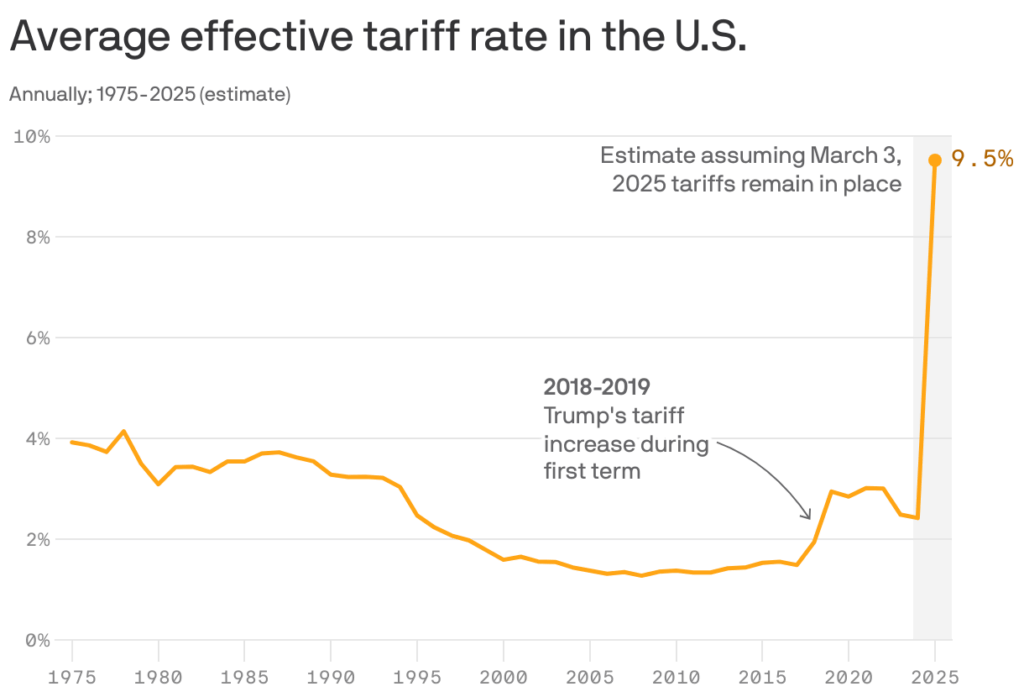

| Increase in U.S. Tariff Rate (2025) | Average effective tariff rate ~17.4% under baseline scenario; ~6.8% if certain IEEPA tariffs are invalidated. | Affects importers, manufacturers, supply chain costs—jobs and capital investment decisions depend on this. |

| Price level / Household Loss | Short-run price level rise ~1.7%, meaning ~$2,300 income loss per household in 2025 under baseline. If IEEPA tariffs invalidated, ~0.5% rise and ≈ $700 loss. | For financial planning, budgeting, wage negotiation: households & businesses need to factor in higher input & consumer costs. |

| Core goods price inflation | Core goods (excluding food & energy) are about 1.9% above trend as of mid-2025. Electronics and appliances especially elevated. | Procurement, retail, and manufacturing sectors have cost pressures; procurement strategies must adjust. |

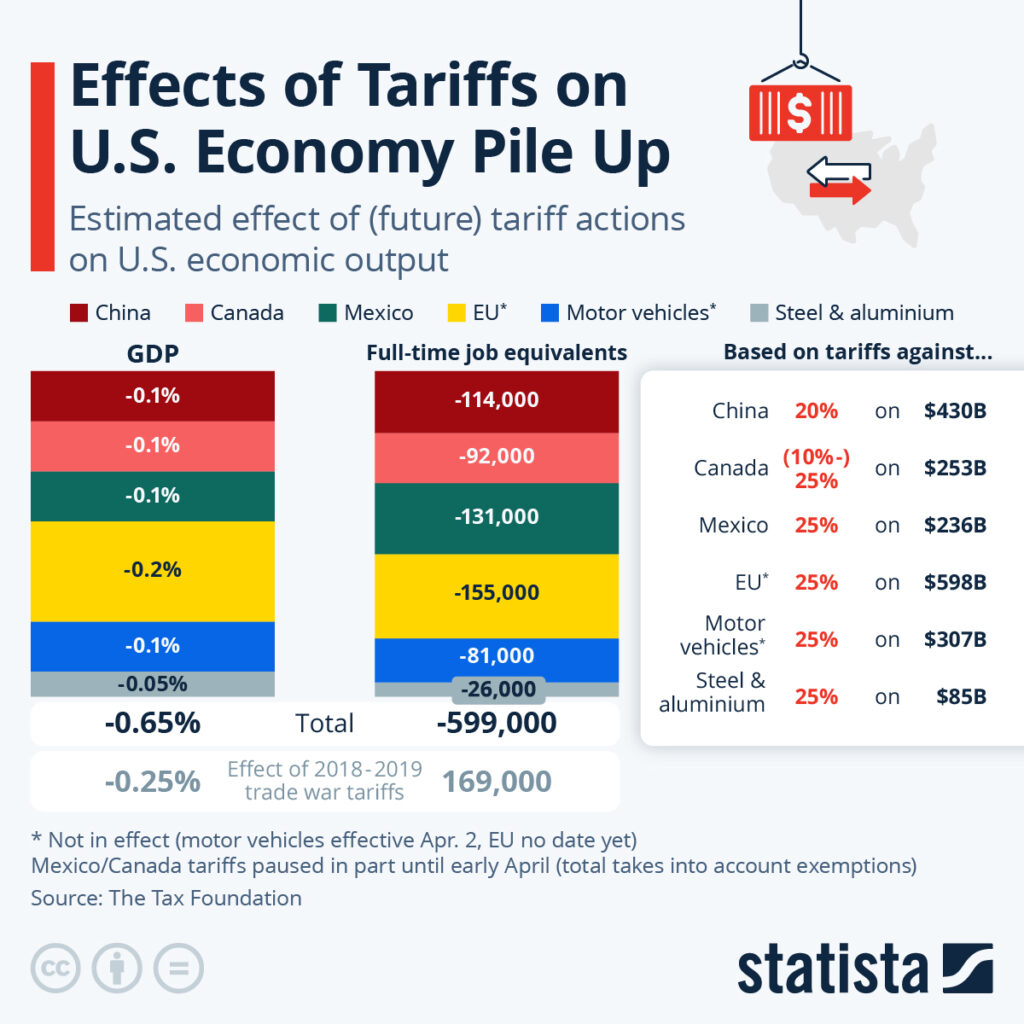

| Impact on GDP & Jobs | U.S. real GDP growth in 2025-26 is estimated to be −0.5 percentage points lower per year under baseline; ~480,000 fewer payroll jobs by end-2025. | Firms hiring, investments, planning capital often depend on GDP & employment growth. Weaker growth = more risk. |

| Consumer Sentiment & Inflation Expectations | Consumer sentiment has plunged; inflation expectations have jumped, some forecasts nearing or exceeding 6% year-ahead. | Expectations shape behavior: less spending, more saving, harder for businesses and Fed to plan. |

What Are Tariffs? Quick Refresher

A tariff is a tax or duty imposed by a government on goods coming into the country. Think of it like a toll you pay for bringing something across the border. When the U.S. sets tariffs on imported goods, those extra costs tend to affect several players: the foreign exporter, the U.S. importer, sometimes domestic businesses, and ultimately often the consumer.

The Trump administration has imposed sweeping tariffs since early 2025, including “reciprocal” tariffs and changes under the International Emergency Economic Powers Act (IEEPA). These moves are part of an attempt to protect U.S. industries and strengthen negotiating power in global trade.

Treasury leaders now argue that these tariffs are not a tax on Americans. Critics strongly disagree. Let’s dig in.

Two Sides: Are Tariffs a Tax?

The Administration’s View: “It’s Not a Tax”

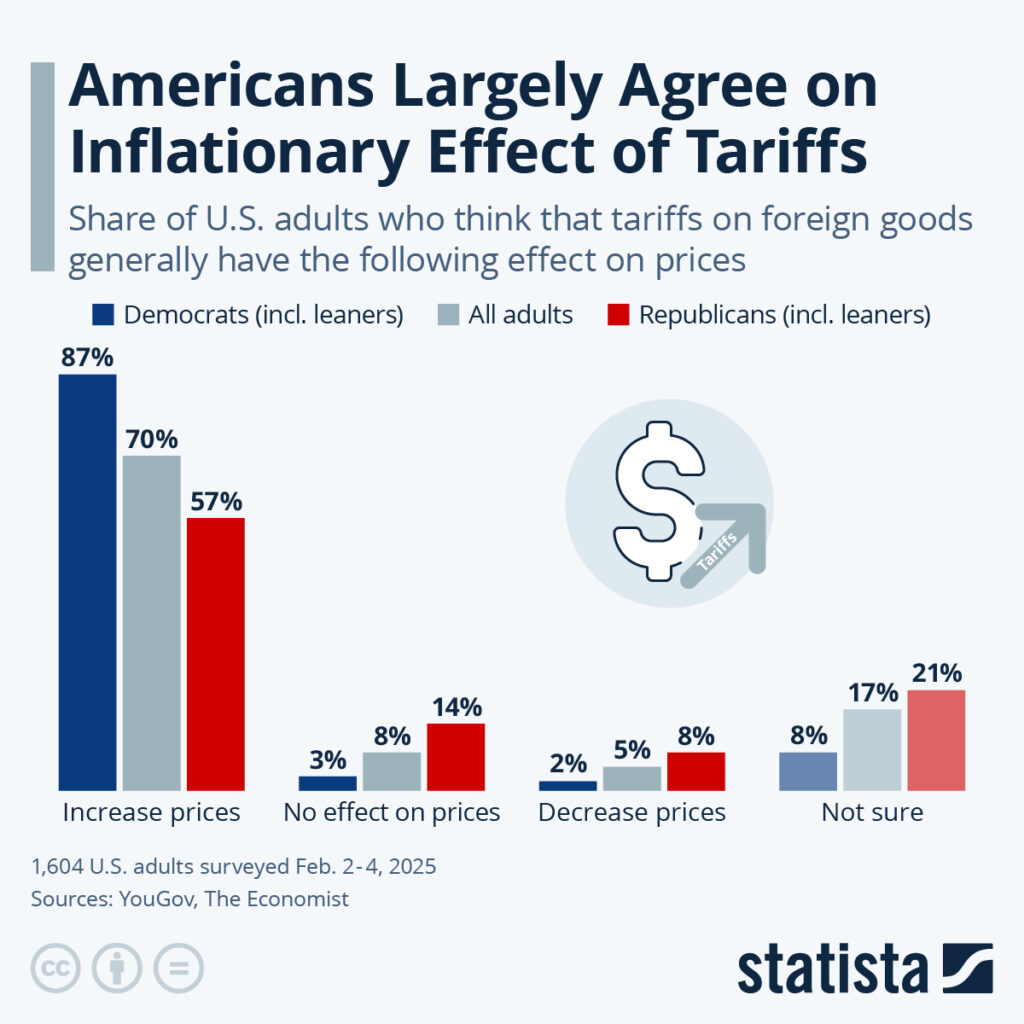

Officials like Treasury Secretary Scott Bessent argue that tariffs are not like regular taxes such as income or sales tax. They say the burden is shared: some by foreign exporters, some by importers or domestic firms, not fully by consumers.

They argue that tariffs serve broader goals: protecting U.S. manufacturing, reducing unfair trade practices, negotiating future trade deals, or addressing large trade deficits. They also point to macro indicators like GDP growth (~3.3%) and a strong stock market as signs the economy is holding up under these policies.

The Critics’ View: “Yes, It’s Basically a Tax”

Many economists, business associations, and consumer advocates say that in practice, tariffs function a lot like taxes on consumers. They drive up prices, especially for goods with no easy domestic substitute, and hurt lower-income families hardest.

Evidence suggests that much of the cost is passed through to consumers. Goldman Sachs estimates that initially U.S. firms absorbed a good fraction of costs, but the burden on consumers is rising, possibly up to ~67% of new tariffs by some forecasts.

Also, there’s the political, legal, and international fallout: companies complaining, consumer sentiment dropping, and legal cases that may force refunds for import businesses (not consumers).

What’s Often Overlooked?

To give a more rounded picture, here are extra things people often forget when debating tariffs:

- Effect on Retirement and Long-Term Savings

Inflation eats into fixed incomes. If your retirement fund or pension assumes low inflation, rising costs of everyday goods can erode purchasing power. Also, retirement investments in manufacturing or import-heavy industries may suffer. - Innovation & Competitiveness Trade-Off

Protection via tariffs might help some industries in the short run, but could reduce incentives to innovate if tariffs are expected to stick around. Industries that compete globally need pressure to evolve; tariffs can reduce that pressure. - Retaliation by Other Countries

Other nations often respond with their own tariffs or barriers, which can harm U.S. exporters like farmers, tech firms, and seafood producers. This tit-for-tat can escalate into trade wars that hurt both sides. - Policy & Legal Uncertainty

When laws are challenged (for example, whether IEEPA gives the president power to impose sweeping tariffs), businesses face risk. If policies change suddenly, firms that invested under the older assumptions may face losses. - Small vs Large Business Differences

Big firms may be better able to absorb shocks, shift supply chains, or negotiate with suppliers. Small businesses often have less margin, less flexibility, and are more vulnerable to cost hikes. - Supply Chain Delays & Logistic Costs

Tariffs don’t just affect the duty cost—they also lead to delays, increased shipping expenses, and inventory management issues. Some businesses report significant increases in delivery delays, raising overall costs.

Trump Tariffs Debate Heats Up: How To Understand the Real Effects of a Tariff Policy

Step 1: Look at the Tariff Rate & Which Products It Affects

Identify what goods are being tariffed, from what countries, and at what rate. Check exemptions or carve-outs, and see whether your products or raw materials are on the list.

Step 2: Trace the “Pass-Through” to Prices

Ask how much of the cost is absorbed by businesses versus passed on to consumers. Studies show that between 61%–80% of new tariffs are passed through to consumer prices, especially for durable goods.

Step 3: Estimate Household / Business Impact

Households can use average models to see how much they might lose (about $2,300 per year under baseline scenarios). Businesses should calculate input cost changes, and see if they can substitute suppliers.

Step 4: Model Long-Term Effects

Think beyond the immediate costs. Consider how tariffs might slow GDP growth, affect job creation, and reduce innovation over the long term. Watch how retaliatory tariffs might affect your exports.

Step 5: Stay Alert to Legal / Policy Changes

Monitor court rulings, Congress oversight, and international trade talks. Legal challenges could alter tariff policies, which might change the entire cost structure for businesses.

Step 6: Plan Strategically

For businesses: diversify supply chains, negotiate flexible contracts, and redesign products where possible. For households: adjust budgets, shop local when possible, and stay informed about policy developments.

Practical Advice: What Consumers & Businesses Can Do

For Consumers

- Compare prices and shop smart. Domestic products may sometimes avoid tariffs.

- Buy sooner if you expect price hikes—especially for durable goods.

- Budget for increases, especially in sectors like electronics and home appliances.

- Follow policy changes: you can adjust your shopping habits based on exemptions or trade agreements.

For Businesses

- Audit supply chains to identify exposure to tariffs.

- Negotiate contracts with tariff-protection clauses.

- Explore domestic sourcing or alternative suppliers.

- Invest in efficiency, redesign products, or automate to cut reliance on expensive inputs.

- Monitor legal risks and court cases closely to anticipate changes.

Clear Examples To Illustrate

Example 1: Appliance Store Owner

A refrigerator store owner sees compressor prices rise by 25% due to tariffs. After absorbing some costs, they must increase fridge prices. Customers react by delaying purchases, hurting sales.

Example 2: Small Coffee Shop

A café sourcing beans from Latin America pays more due to tariffs. They must either raise coffee prices, use cheaper beans, or cut quality. Over time, this may weaken customer loyalty.

Example 3: Tech Company

A U.S. chipmaker relies on imported components. Tariffs raise costs, while retaliatory tariffs abroad reduce export sales. R&D budgets shrink, slowing innovation, and employees worry about job security.

Recent Data: What’s Changed So Far in 2025

- Core goods prices are ~1.9% above trend, especially in electronics and appliances.

- Consumer sentiment is falling; inflation expectations are climbing, with some forecasts near 6%.

- Goldman Sachs finds U.S. firms initially absorbed ~64% of tariff costs, but consumers may bear ~67% later in 2025.

- Legal challenges to tariff authority under IEEPA may force refunds for companies, but consumers won’t get direct compensation.

What Is the Digital Services Tax That Could Spark New Trump Tariffs?

Trump’s 50% Tariffs on India: Why US Left Indian Pharma Out of Tax Bracket

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big