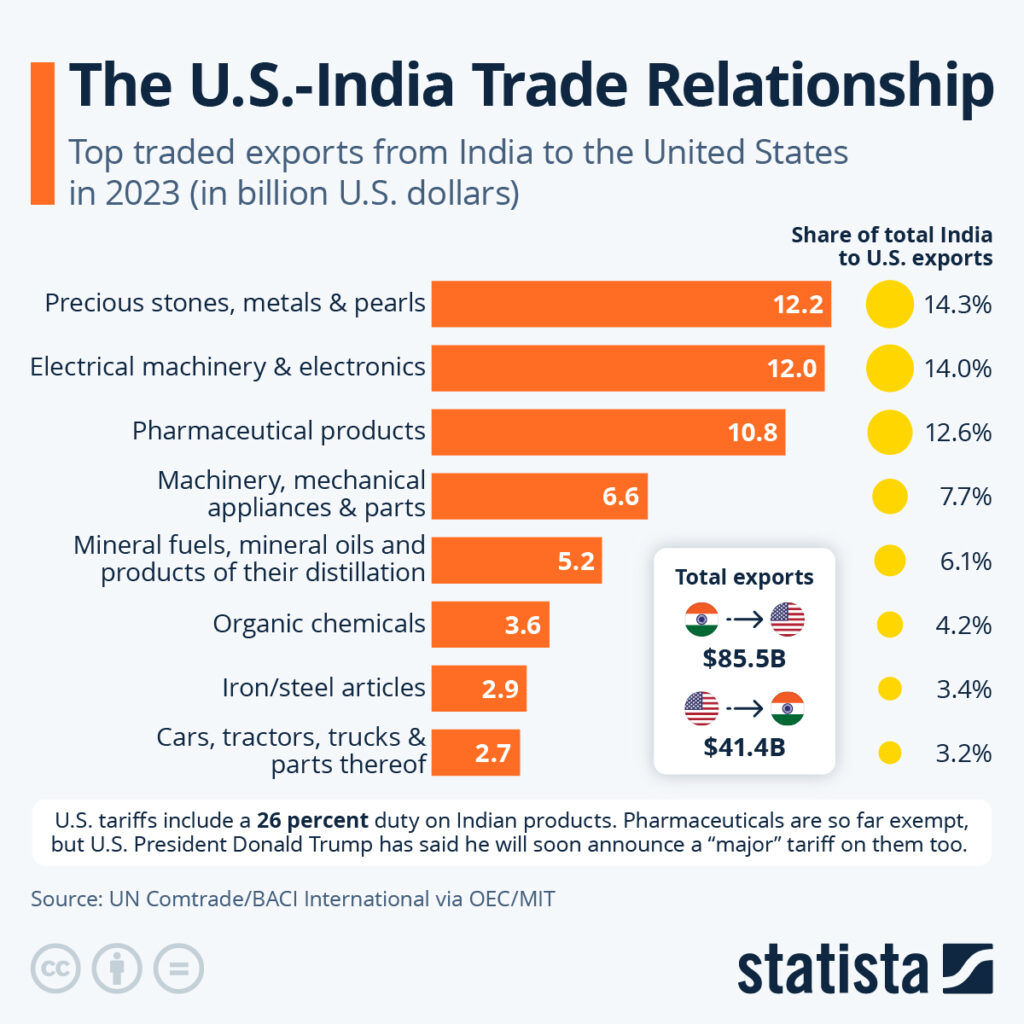

Trump’s 50% Tariffs on India: When you hear “Trump’s 50% Tariffs on India,” it almost sounds unreal. Fifty percent? That’s no small hike—it’s one of the biggest tariff waves the United States has ever rolled out against a trade partner. Announced on August 27, 2025, this tariff surge is meant to punish India for its ongoing purchases of discounted Russian oil and to enforce what President Trump calls “reciprocal fairness” in trade. But here’s the twist that has Wall Street, Main Street, and global health experts talking: while tariffs hammered Indian textiles, jewelry, shrimp, and leather, pharmaceuticals were completely left out of the tax bracket. That wasn’t by accident. It was a deliberate move, and it reveals just how much America relies on India for something far more important than shrimp cocktails or diamond rings—affordable medicines.

Trump’s 50% Tariffs on India

| Topic | Details |

|---|---|

| Tariff Rate | U.S. imposed 50% tariffs on most Indian goods (effective Aug. 27, 2025). |

| Reason for Tariffs | India’s discounted Russian oil purchases + push for “reciprocal” trade fairness. |

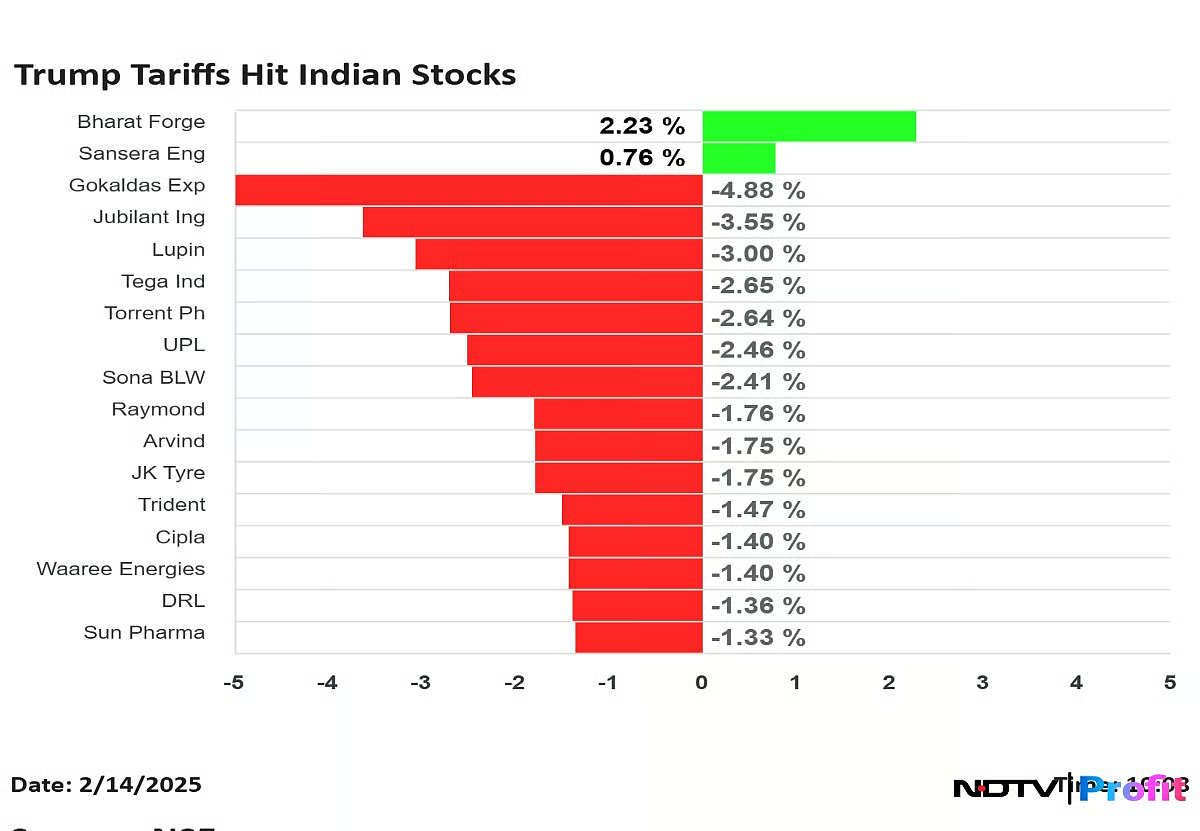

| Sectors Affected | Textiles, gems & jewelry, seafood (shrimp), furniture, leather, auto parts, chemicals. |

| Exempted Sectors | Pharmaceuticals, consumer electronics (iPhones), petroleum, renewable energy. |

| Pharma Dependence | U.S. imports ~50% of its generic drugs from India. U.S. FDA |

| Market Impact | Tariffs could spike U.S. healthcare costs if applied to medicines. |

| India’s Pharma Share | India accounts for 6% of total U.S. pharma imports, but dominates generics. |

| Indian Exports to U.S. | Worth over $100 billion annually, making U.S. India’s top export market. |

Why Trump’s 50% Tariffs on India, Why Now?

The Trump administration’s tariff announcement was no spur-of-the-moment decision. The 50% rate comes from stacking two measures:

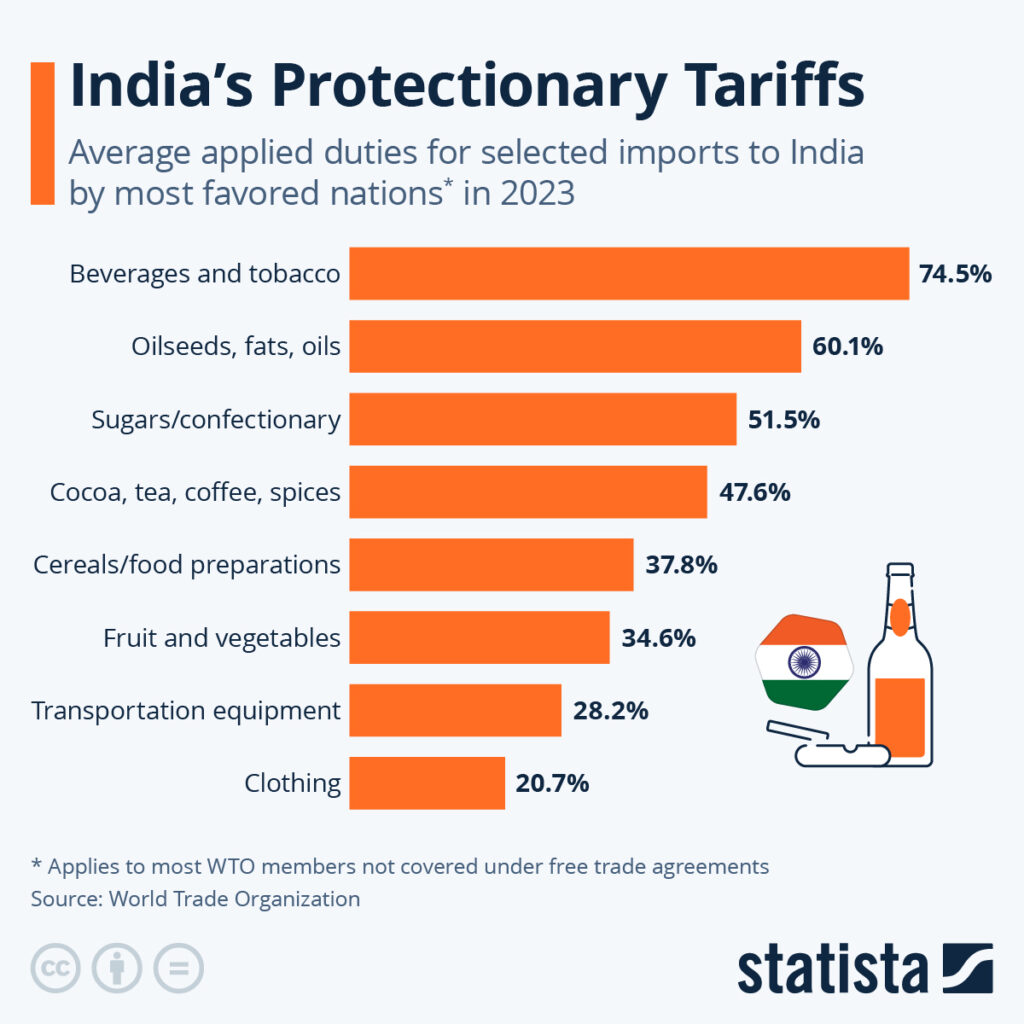

- A 25% “reciprocal tariff” to balance out what Trump argues are unfair Indian duties on U.S. goods.

- An extra 25% penalty tariff tied to India’s refusal to stop buying Russian oil, which Washington sees as undermining Western sanctions.

In simple terms, the U.S. is saying: “Play fair, or pay more.” Tariffs make Indian goods more expensive, giving American products a fighting chance in U.S. markets.

But unlike with China in 2018, the U.S. is playing a more delicate game with India. India is not just a trade partner—it’s also a geopolitical ally in countering China. That’s why the tariffs are sharp but selective.

Why Indian Pharma Got a Free Pass?

America’s Dependence on Generics

Nearly 90% of prescriptions in the U.S. are filled with generics. And who supplies the lion’s share? India. It’s no exaggeration to say that Indian companies are the backbone of America’s medicine cabinet.

According to the U.S. Food and Drug Administration, India accounts for about 40–50% of U.S. generic drug imports. From blood pressure pills to cholesterol medicine, Indian-made drugs keep costs down for millions of Americans. Without them, healthcare spending would skyrocket.

Public Health vs. Politics

Tariffing pharma would create instant chaos:

- Patients would face unaffordable drug prices.

- Insurers would raise premiums to cover costs.

- Medicare and Medicaid budgets could balloon.

Trump’s team likely realized that hitting pharma would have backfired politically. Headlines like “Tariffs Drive Up Drug Prices for Seniors” would be disastrous in an election year.

Section 232: The Sword Hanging Over Pharma

Pharma’s exemption isn’t permanent. The sector is under a Section 232 national security review, the same legal tool Trump used in 2018 to tariff steel and aluminum. This means the White House could revisit pharma tariffs once it gauges risks and costs. For now, the exemption reflects caution.

Historical Context: Lessons from Trade Wars

This isn’t the first time tariffs have been used as a blunt instrument. In 2018, Trump’s tariffs on Chinese goods disrupted global supply chains and sparked retaliatory duties on U.S. farm exports. India itself was hit with U.S. tariffs on steel and aluminum back then.

The lesson? Tariffs may achieve short-term political wins but often cause longer-term pain. Businesses adjust by moving supply chains, not by bringing jobs back to the U.S.

India’s Likely Response

India has been here before and has a few strategies ready:

- World Trade Organization (WTO) – India may challenge the U.S. move as unfair trade practice.

- Counter-Tariffs – India could raise duties on U.S. farm goods like almonds, apples, and pulses, which directly hit American farmers.

- Diversification – Expanding exports to Europe, ASEAN, Africa, and the Middle East to reduce dependence on the U.S. market.

India’s policymakers are also weighing measures to protect vulnerable industries, such as textile subsidies and seafood export incentives.

Geopolitical Angle: More Than Just Trade

Tariffs aren’t just about economics—they’re about power. The U.S. needs India as a counterweight to China but doesn’t want India cozying up too much with Russia. By targeting trade-sensitive industries while sparing pharmaceuticals, Washington is sending a mixed but strategic message: “We’ll squeeze, but not too hard.”

Impact on India’s Key Sectors

Textiles and Apparel

India is one of the world’s biggest textile suppliers, with the U.S. as its top market. The tariff makes Indian T-shirts, jeans, and cotton garments uncompetitive compared to imports from Vietnam or Bangladesh. That could hit millions of jobs in cities like Tiruppur and Surat.

Gems and Jewelry

India processes 90% of the world’s diamonds. But with tariffs, American jewelers may pivot to cheaper suppliers in Africa or the Middle East, cutting into one of India’s most valuable exports.

Seafood (Shrimp)

The U.S. imported over $2.6 billion worth of Indian shrimp in 2024. Tariffs could slash demand, hurting India’s coastal economies and raising prices at U.S. seafood restaurants.

Furniture and Leather

Margins are thin in these industries, and tariffs could lead to order cancellations, layoffs, and factory slowdowns across India.

What This Means for Everyday Americans?

So, what does this all mean for U.S. households?

- Clothing and Jewelry – Expect higher retail prices. That holiday sweater or diamond ring will cost more.

- Seafood – Your shrimp platter at Red Lobster may go up in price.

- Furniture and Decor – Expect higher costs at retailers importing from India.

- Medicines – No price changes for now. Indian generics remain tariff-free.

For families already battling inflation, these tariffs add another layer of price pressure. The one relief: your medicine cabinet stays safe.

Case Study: Shrimp Tariffs

India dominates U.S. shrimp imports. If tariffs double costs, buyers may pivot to Ecuador, Indonesia, or Vietnam. That hurts Indian exporters, but American consumers won’t escape unscathed—shrimp lovers will face higher bills at grocery stores and restaurants.

Professional Insights for Businesses and Investors

- Importers – Diversify sourcing beyond India to avoid tariff shocks.

- Retailers – Build tariff costs into pricing strategies now to avoid margin losses.

- Healthcare Providers – Stay engaged in policy discussions around Section 232 reviews.

- Investors – Watch Indian textile and jewelry stocks for downside; pharma may hold steady or even gain from being spared.

GST Rejig – Household Items Likely To Get Cheaper Soon

Tamil Nadu Pushes Back on GST Reforms – Could States Lose Crucial Revenue?

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?