Trump’s Tax Credit Shock Isn’t As Bad As Feared: When the news first broke about Trump’s tax credit shock, a lot of folks—from Wall Street traders to homeowners just thinking about putting panels on their roofs—tightened up real quick. After all, tax credits are the backbone of clean energy adoption in the United States. If they vanish or shrink, the whole industry could slow down. But instead of being the disaster many feared, this latest move turned out to be more bark than bite. The new guidance shook things up for big utility-scale projects, but smaller systems like rooftop solar came out mostly untouched. That’s why, instead of a selloff, solar stocks took off like a rocket.

Trump’s Tax Credit Shock Isn’t As Bad As Feared

The Trump tax credit shock ended up being more of a ripple than a tidal wave. Yes, big projects face tougher rules, but homeowners and small businesses came out unscathed. That’s why the stock market rewarded solar companies with huge gains instead of punishing them. For everyday Americans, this means the 30% tax credit is still alive and kicking, and solar remains one of the smartest investments you can make—for your wallet and for the planet.

| Topic | Details & Stats |

|---|---|

| What Happened | Treasury issued new guidance (Aug. 15, 2025) on renewable energy tax credits under Trump’s One Big Beautiful Bill Act. |

| Rule Change | Large projects must start physical construction to qualify, not just spend 5% upfront. |

| Exemption | Small solar projects (<1.5 MW) still qualify under the 5% investment threshold. |

| Market Reaction | Solar stocks soared: Sunrun (+39%), First Solar (+13%), Enphase (+12%), Array Technologies (+27%). |

| Why It Matters | Residential solar and smaller projects remain largely protected, easing investor fears. |

| Jobs Impact | U.S. solar industry employs 263,000+ people (SEIA, 2024). Rooftop-focused jobs remain secure. |

| Reference | Official Treasury Guidance |

The Big Picture: What’s Really Going On?

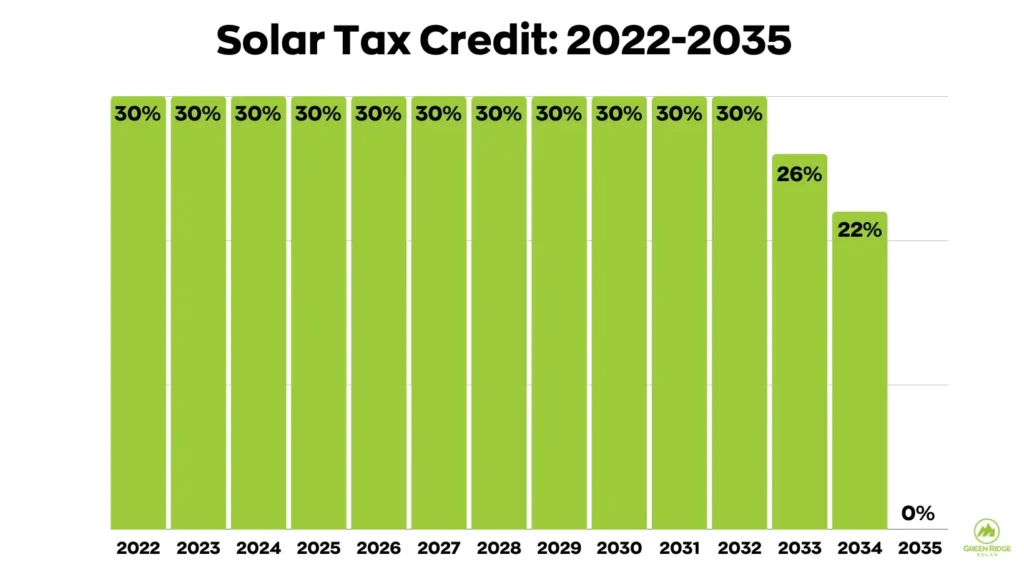

Tax credits are the bread and butter of clean energy growth. They lower costs, attract investors, and make solar panels affordable for families. Without them, the economics would shift dramatically.

The new Treasury guidance issued August 15, 2025, basically redefines how projects qualify. Previously, developers just had to show that they spent 5% of the total project cost—a quick and easy way to lock in federal credits. But now, large solar and wind projects must prove they’ve started real construction. That means building foundations, installing equipment, or showing physical progress.

The catch? Smaller projects—anything under 1.5 megawatts—are still safe. They can use the old 5% rule. For rooftop solar and community-based projects, that’s a lifeline.

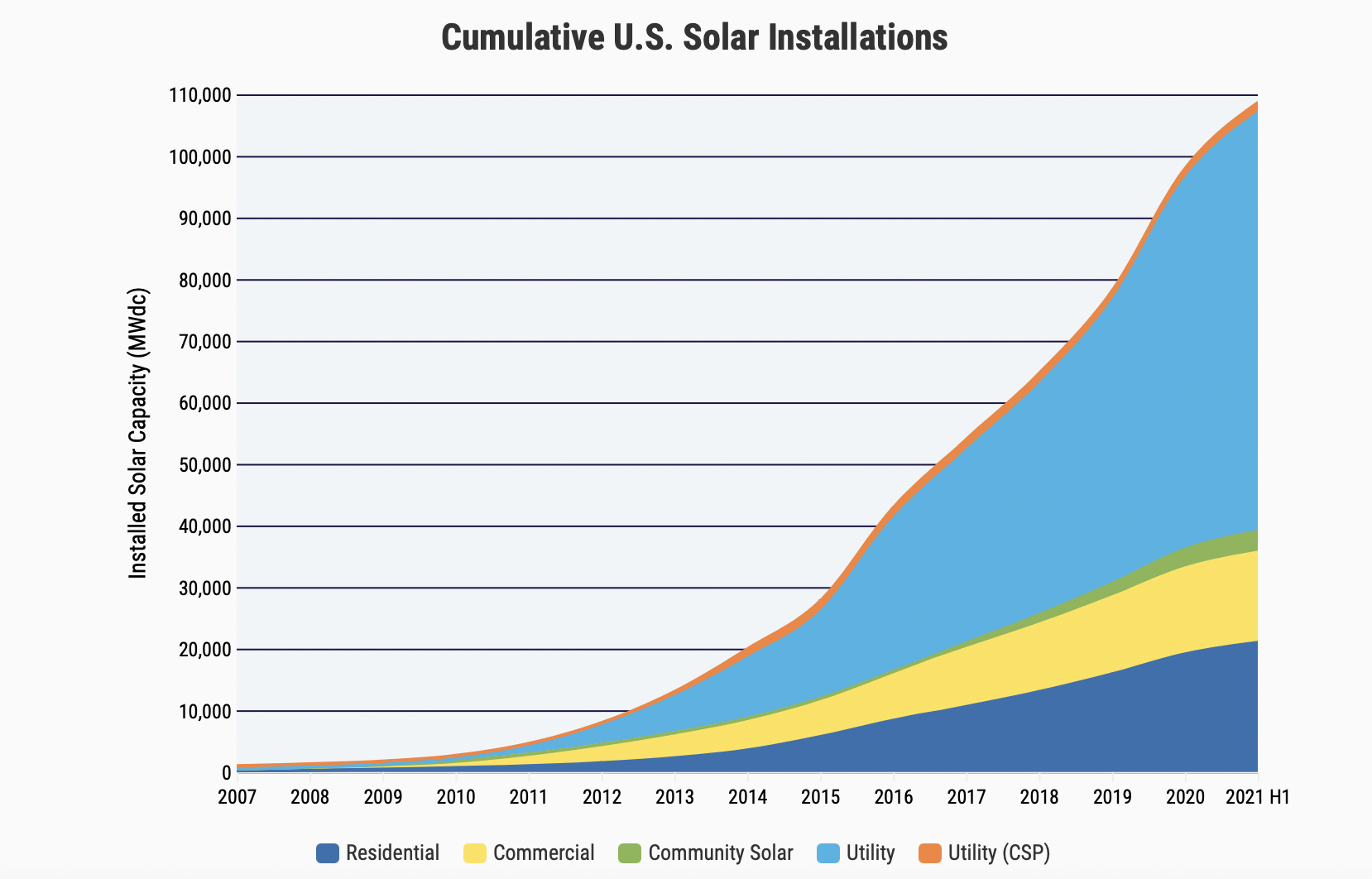

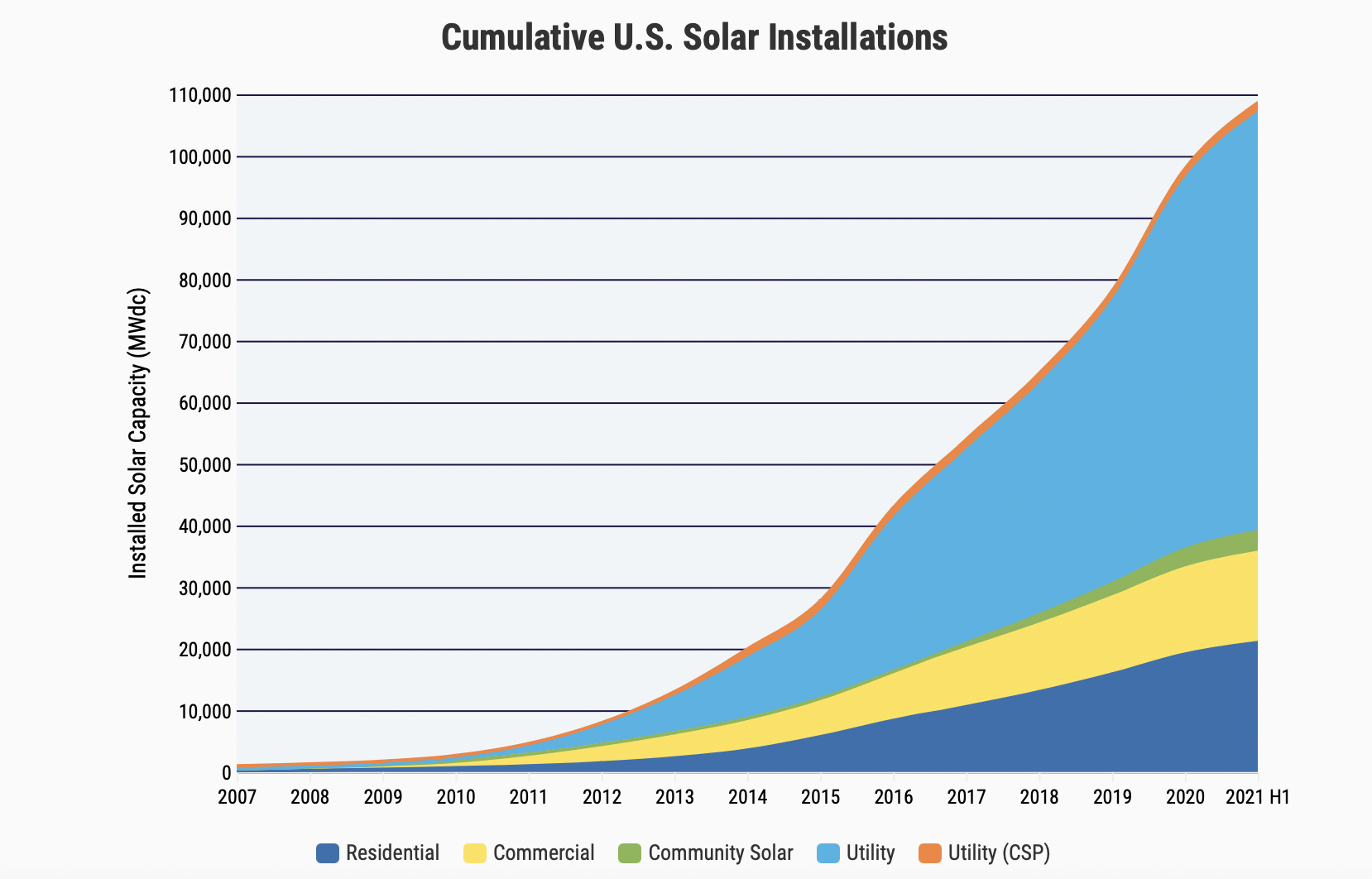

Historical Context: Why This Matters

This isn’t the first time Washington has tinkered with renewable energy incentives.

- 2009–2016 (Obama years): Big expansion of clean energy tax credits. Billions went into solar and wind, laying the foundation for the industry we see today.

- 2017–2020 (Trump’s first term): Renewables were targeted, but Congress kept many credits alive. The market still grew, though slower.

- 2021–2024 (Biden years): The Inflation Reduction Act supercharged credits, locking in 30% residential tax credits until at least 2032. Solar adoption hit record highs.

- 2025 (Trump’s second term): The new rules represent his administration’s first big move against clean energy, though it’s less damaging than expected.

By putting today’s changes in context, we see a pattern: policies shift, but solar keeps adapting and growing.

Why Did Solar Stocks Surge Instead of Crash?

Investors hate uncertainty more than bad news. The fear was that Trump’s team would strip out tax credits entirely or apply new rules retroactively. But since they didn’t, and small projects are still protected, Wall Street took it as good news.

Here are the big winners after the announcement:

- Sunrun (RUN): +39%

- First Solar (FSLR): +13%

- Enphase Energy (ENPH): +12%

- Array Technologies (ARRY): +27%

- NextEra Energy (NEE): +5%

This rally shows confidence that solar’s future—especially in residential and community markets—remains strong.

Real-Life Example: Homeowner Savings

Let’s say you’re a family in Arizona looking at solar:

- System Size: 6 kW rooftop system

- Upfront Cost: $18,000

- Federal Tax Credit (30%): –$5,400

- Final Cost After Credit: $12,600

- Average Yearly Savings: ~$1,200

- Payback Period: About 10 years

After the system pays for itself, you’re saving thousands per year. Under the new rules, nothing changes for you—credits remain safe.

That’s why companies like Sunrun, who focus on residential solar, saw their stocks skyrocket after the announcement.

Jobs and Economic Impact

The solar industry is one of America’s fastest-growing job creators. According to the Solar Energy Industries Association (SEIA), over 263,000 people worked in solar in 2024.

Most of these jobs are tied to installation and residential projects, not massive utility-scale plants. By leaving small projects untouched, the Treasury preserved the bulk of U.S. solar jobs. That’s not just a win for workers—it’s also good politics, since solar jobs exist in red states and blue states alike.

Practical Guide: Navigating the Trump’s Tax Credit Shock Isn’t As Bad As Feared

Step 1: Figure Out Your Project Size

- Residential & Small Commercial (<1.5 MW): Still safe with 5% spending.

- Utility-Scale (>1.5 MW): Need physical construction started.

Step 2: Lock in Credits Early

The earlier you sign contracts, pay deposits, or order equipment, the better your chance of securing credits.

Step 3: Follow Trusted Sources

Keep up with updates from:

- U.S. Department of Energy

- IRS Renewable Energy Guidance

Step 4: Think Long-Term

Even without tax credits, solar keeps getting cheaper. The price of solar panels has dropped by almost 90% since 2010.

Professional Insights

Industry analysts point out that this was a “middle ground” move.

- Phil Shen (Roth Capital): Called the new rules “much better than expected,” stressing that rooftop and residential markets remain largely safe.

- Clean Energy Investors: Many see this as a short-term shake-up, but long-term solar adoption is still on track.

This means financial institutions will continue financing projects, and homeowners should feel confident about installing panels.

Future Outlook: Where Solar Is Heading

Looking ahead, the solar industry is still on a growth path despite the rule changes.

- Technology: Panels are becoming more efficient, producing more power with fewer materials.

- Batteries: Energy storage costs are falling, making solar power more reliable at night.

- Policy: Future administrations may loosen or expand credits again—policy always swings back and forth.

- Forecast: The SEIA projects that solar could supply 25% of U.S. electricity by 2030, up from just 6% in 2024.

Even with bumps in the road, solar’s direction is clear: up.

Apollo Tyres Hit With ₹61.52 Lakh GST Demand Over Ineligible Input Tax Credit

ED Cracks Down on Fake ‘Input Tax Credit’ Fraud in West Bengal, Maharashtra, and Jharkhand!

Rs 16.30 Crore Missing? GST Officers Take Down Tax Evader in Major Crackdown!