Tusharkanti Satapathy Joins GST Appellate Tribunal: Tusharkanti Satapathy has been appointed as a Judicial Member of the Goods and Services Tax Appellate Tribunal (GSTAT). This appointment is more than a simple shuffle in the legal roster — it’s a key move in India’s ongoing effort to speed up tax dispute resolution and lighten the load on already stretched High Courts.

If you’ve ever been stuck in a long line at the DMV or a traffic jam in downtown traffic, you already know the frustration of waiting for something that should’ve been done hours ago. In India’s legal world, that’s been the case with GST disputes. Before GSTAT became fully functional, these cases crawled through the High Courts, often taking years.

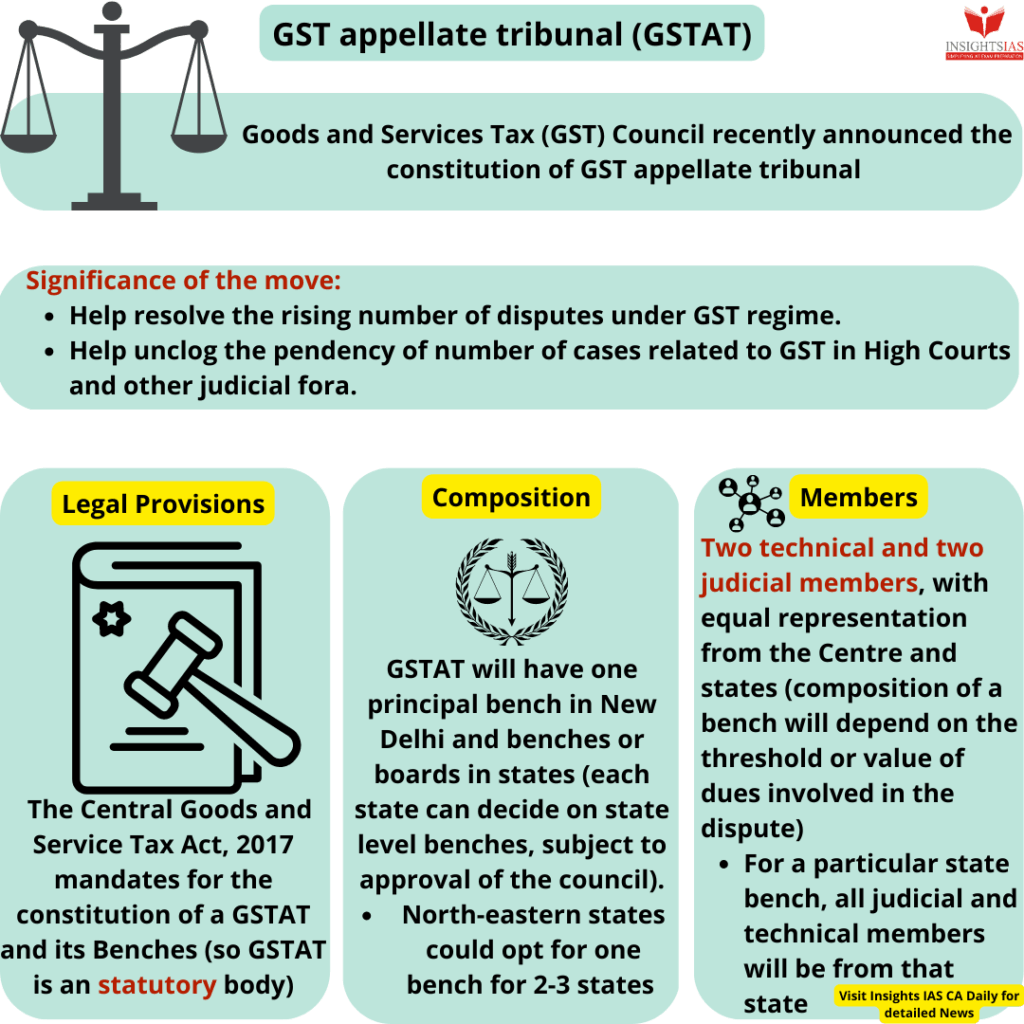

The GSTAT was created to change that — a specialized body set up under Section 109 of the CGST Act, 2017 to hear appeals under GST law. Think of it as the “specialized pit crew” for tax disputes: fast, precise, and built for the job. Now, with the 2025 GST Appellate Tribunal (Procedure) Rules officially notified, and members like Tusharkanti Satapathy stepping into place, the system is ready to run at full speed.

Tusharkanti Satapathy Joins GST Appellate Tribunal

Tusharkanti Satapathy’s appointment is a milestone in India’s GST journey. The GSTAT’s federal structure, digital rules, and hand-picked members position it as a modern, efficient, and fair dispute resolution forum. For taxpayers, businesses, and professionals, this means a faster track to justice. For the legal system, it’s a vital pressure valve. And for Satapathy, it’s the start of a new chapter — one that could shape GST jurisprudence for years to come.

| Highlight | Details | Reference |

|---|---|---|

| Name & Role | Tusharkanti Satapathy appointed as Judicial Member, GSTAT | Official GSTAT Website |

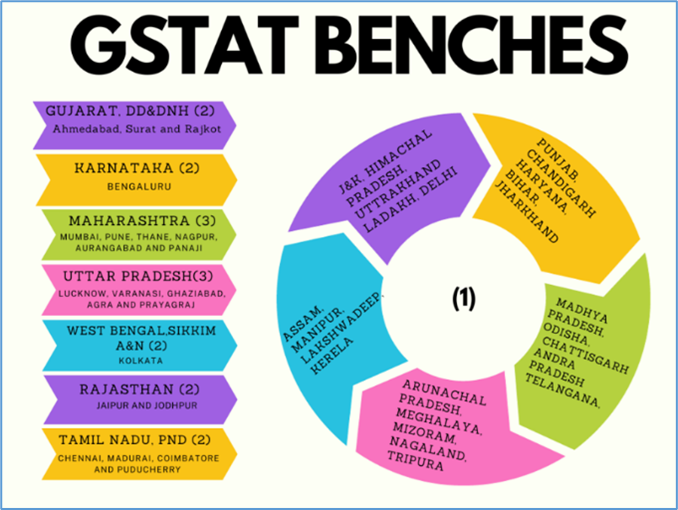

| Tribunal Purpose & Structure | Formed under Section 109 CGST Act; Principal Bench in Delhi + 31 State Benches | wepsol.com |

| Procedure Rules 2025 | Digital filing (Form GST APL-05), strict timelines, daily cause lists, defined appeals process | pwc.in |

| Appointments (Aug 2025) | Justice (Retd.) Mayank Kumar Jain (Judicial), A Venu Prasad & Anil Kumar Gupta (Technical), plus 86 total members | financialexpress.com |

| Term & Pay | Four-year term or until age 67; ₹2.25 lakh/month | financialexpress.com |

| State Selections & Court Cases | Odisha HC paused selection process; later petition dismissed | timesofindia.indiatimes.com |

Why Tusharkanti Satapathy Joins GST Appellate Tribunal Is a Big Deal?

Experience That Speaks Volumes

Tusharkanti Satapathy’s legal career spans more than three decades, with practice at the Odisha High Court since 1991. He has represented the Income Tax Department, Commercial Tax Department, and academic institutions like UGC and Madhusudan Law University. This mix of tax law expertise and broad legal knowledge makes him uniquely suited for GSTAT’s bench.

A Boost for Business Confidence

For small businesses, startups, and large corporations alike, GST disputes can lock up funds and stall operations. A functioning GSTAT means faster decisions and predictable legal timelines, which are essential for maintaining healthy cash flows and operational stability.

Reducing High Court Burden

With over 4.3 million cases pending in Indian High Courts (as per NJDG data), every specialized tribunal that takes away a chunk of the load helps improve the entire judicial system’s efficiency.

A Closer Look: GSTAT Structure

The GSTAT isn’t just one big courtroom. It’s divided into:

- Principal Bench – Located in New Delhi, handles nationwide and inter-state disputes.

- State Benches – 31 benches across India, each with one Judicial Member and one Technical Member (Centre); some have an additional Technical Member (State) if workload demands.

This federal structure means you don’t have to fly to Delhi for a hearing — most cases are handled locally.

GSTAT Procedure Rules, 2025 — What Changed?

The April 24, 2025 notification of GSTAT Procedure Rules brought in:

- E-filing through GST APL-05 — No more stacks of paper; everything is digital.

- Strict Timelines — Respondents get 30 days to reply, and orders are aimed to be delivered within 30 days post-hearing.

- Cause Lists — Published daily, ensuring transparency on when and where cases will be heard.

- Recusal Provisions — Members can step aside in case of potential bias.

- Interim Orders — Power to grant temporary relief until final judgment.

Step-by-Step Guide: How a GST Appeal Works in GSTAT

Step 1: Filing the Appeal

You submit Form GST APL-05 via the GST portal, attaching the certified copy of the order you’re challenging.

Step 2: Acknowledgment

Within a few days, you receive an electronic acknowledgment with an appeal number.

Step 3: Case Listing

Your case is added to the cause list — think of it as the public schedule for all hearings.

Step 4: Hearing

You (or your lawyer) present your case, supported by documents and evidence. GSTAT can also allow video conferencing for certain cases.

Step 5: Decision

The tribunal issues its decision — usually within a month of the hearing’s end.

Step 6: Further Appeal

If you’re still unhappy, you can approach the High Court or, in certain cases, the Supreme Court.

Practical Example: Why GSTAT Matters

Imagine you run a medium-sized export business in Odisha. A GST officer slaps you with a ₹50 lakh demand, claiming incorrect input tax credit. You’re sure it’s wrong.

Before GSTAT, you’d have to go:

Adjudicating Officer → Commissioner (Appeals) → High Court → maybe Supreme Court.

That’s years of waiting and big legal bills.

With GSTAT:

Adjudicating Officer → Commissioner (Appeals) → GSTAT → done (unless you choose to escalate).

You get your verdict in months, not years — and your money isn’t stuck in limbo.

Judicial Challenges & Developments

Not all GSTAT appointments have been smooth. In Odisha, the High Court stayed the selection process for Judicial Members after concerns about fairness. The pause was lifted when the petition was dismissed, clearing the path for Satapathy’s appointment.

Other states have also faced delays in nominating their members, but the Centre has urged them to expedite selections so all benches are operational by late 2025.

Broader Impact on the GST Ecosystem

- For Businesses — Predictable legal timelines mean less uncertainty in planning.

- For Tax Professionals — Clearer procedural rules reduce ambiguity and open up advisory opportunities.

- For the Judiciary — Eases backlog, allowing High Courts to focus on more complex or constitutional matters.

Comparison: GSTAT vs Other Indian Tribunals

While GSTAT focuses exclusively on GST disputes, India has similar specialized tribunals like:

- Income Tax Appellate Tribunal (ITAT) — Handles direct tax cases.

- Customs, Excise & Service Tax Appellate Tribunal (CESTAT) — Handles indirect taxes before GST.

- National Company Law Tribunal (NCLT) — Handles company law matters.

GSTAT’s key differentiator is its fully digital filing process and nationwide uniformity under GST law.

Government Appoints 33 Experts to GST Appellate Tribunal – What This Means for GST Appeals!

Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Personal Take

Having followed tribunal setups for years, I can tell you this — a well-run GSTAT will be a game changer. Satapathy’s deep understanding of tax law, his calm courtroom manner, and his credibility in legal circles make him an asset.

If GSTAT sticks to its digital-first, timeline-driven process, we’re looking at a rare win-win: speed for taxpayers and relief for the judiciary.