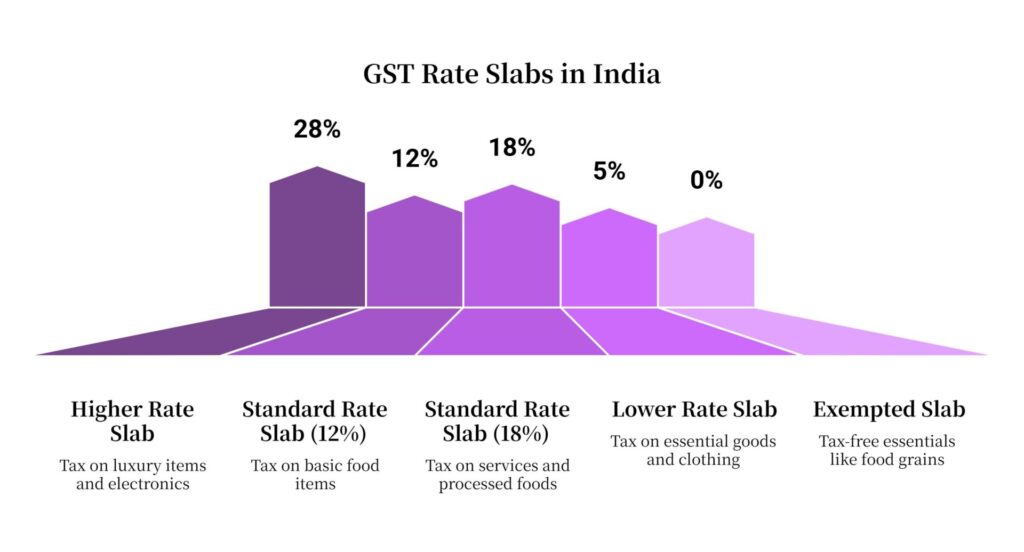

Two-Tier GST Plan Revealed: If you’ve been scratching your head trying to figure out India’s complicated tax system, you’re not alone. The government just rolled out a two-tier GST plan, and it’s making waves across the country. Whether you’re a small business owner, a working parent trying to stretch that paycheck, or a finance nerd tracking policy shifts, this move could seriously impact your wallet. India wants to move away from the four-tax slab GST system (5%, 12%, 18%, and 28%) and shift to just two main rates—5% and 18%—plus a special 40% “sin tax” on luxury and harmful items like tobacco and super-expensive cars. Sounds simple, right? Well, yes and no.

Two-Tier GST Plan Revealed

The two-tier GST plan is the most ambitious tax reform since GST’s launch in 2017. For families, it means cheaper essentials and better affordability. For businesses, it simplifies compliance. For states, it’s a financial challenge that needs central compensation. If implemented carefully, this could boost consumer spending, streamline India’s tax regime, and bring it closer to global best practices. But execution will be key. By Diwali 2025, we’ll know whether this reform is a true game-changer or just another adjustment in India’s long tax journey.

| Aspect | Details |

|---|---|

| What Changed? | 12% and 28% GST slabs scrapped; only 5% and 18% remain |

| Special Levy | 40% tax on luxury/sin goods like tobacco, alcohol, luxury cars |

| Who Benefits? | Consumers (lower prices), businesses (simpler compliance) |

| Possible Issues | Short-term revenue loss for states; inverted duty risks |

| Timeline | GST Council final decision on Sept 3–4, 2025. Expected rollout before Diwali |

| Official Reference | GST Council Website |

A Quick Throwback: GST Since 2017

When GST (Goods and Services Tax) was introduced in July 2017, it replaced a messy web of indirect taxes—service tax, excise duty, VAT, and more. It was hailed as a “One Nation, One Tax” revolution. But soon, the four-slab structure turned confusing. Businesses struggled with classification, consumers complained about high rates, and states worried about losing control over revenue collection.

Over the years, the GST Council tinkered with rates to fix anomalies, but the structure stayed messy. That’s why the Centre is now proposing the biggest simplification yet—a shift to just two slabs, making it easier for everyone to understand and comply.

The Breakdown of the Two-Tier GST Plan Revealed

5% Slab – Essentials for the Masses

This is the “basic needs” bucket—processed foods, medicines, affordable clothing, footwear, and household goods. Almost all items from the 12% slab will now drop to 5%, meaning groceries, healthcare products, and daily-use goods will get cheaper.

Example: A box of breakfast cereal that cost ₹200 plus 12% GST (₹224) will now be taxed at 5% (₹210).

18% Slab – The New Standard

This is the workhorse category. Electronics, consumer durables, personal care, mid-range fashion, furniture, and many services fall under this slab. Nearly all goods previously taxed at 28% will move here, giving a big relief to middle-class and upper-middle-class households.

Example: A washing machine priced at ₹20,000 earlier attracted 28% GST (₹25,600). Now, at 18%, it will cost ₹23,600—a savings of ₹2,000.

40% Special Levy – Luxury and Sin Goods

This rate will apply to items the government wants to discourage—tobacco, alcohol, luxury cars, yachts, and designer imports. The goal is twofold: keep harmful products expensive and ensure the wealthy contribute more to government revenue.

Example: A luxury SUV costing ₹50 lakh will now have a 40% levy, keeping it firmly in the premium category.

Global Perspective: How India Compares

- USA: Uses state-level sales taxes, ranging from 0% to 10%. Each state decides its own rules, so it’s far less uniform than India’s GST.

- European Union: VAT ranges from 15% to 25%. Unlike India’s tiered slabs, most EU countries have one or two standard rates.

- Singapore: Has a flat GST rate of 9%, simple and efficient.

- Australia: Applies 10% GST across most goods and services, with exemptions for essentials.

By moving to just 5% and 18%, India takes a big step toward global simplicity while still protecting lower-income households with a cheaper rate for essentials.

Who Wins, Who Loses?

Consumers

Everyday families stand to gain the most. Essentials and mid-range products will get cheaper, helping household budgets stretch further.

Businesses

For small businesses, this is a relief. Fewer slabs mean less risk of misclassification and fewer disputes with tax officers. Compliance becomes smoother and cheaper.

State Governments

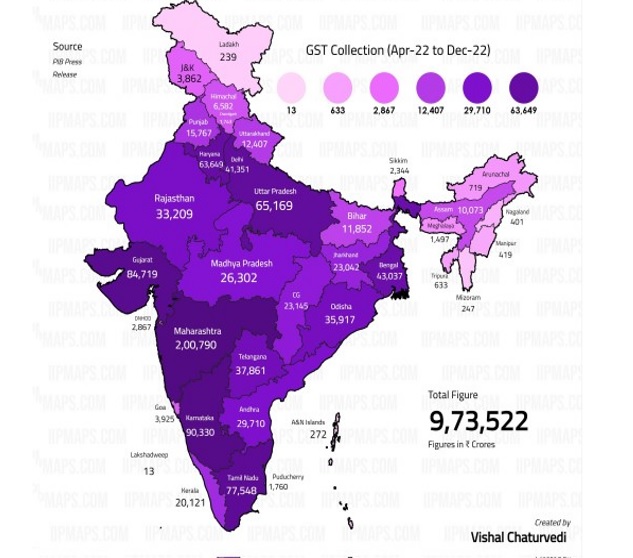

Here’s the catch: revenue loss. States fear losing ₹6,000–₹10,000 crore annually. Many states, especially those relying on luxury goods taxes, are pushing for compensation. West Bengal has even suggested amendments to preserve their revenue streams.

Real-Life Scenarios

- Middle-Class Family: The monthly grocery bill drops, clothing is cheaper, and big-ticket items like TVs or refrigerators become more affordable.

- Small Shop Owner: No more confusion over whether biscuits are 12% or 18%. Billing software updates will simplify accounting.

- Auto Industry: Mid-range cars may see a sales boom as prices drop by thousands. Luxury carmakers, however, will continue to feel the pinch.

- Alcohol Industry: Prices stay high, as the government keeps them under the 40% levy to discourage consumption.

Sector-Wise Impact

- FMCG (Fast-Moving Consumer Goods): Massive boost as most goods move to the 5% slab. Expect companies like Hindustan Unilever and ITC to pass savings to customers.

- Automobiles: Standard cars become cheaper, boosting demand. Luxury brands face challenges.

- Construction & Real Estate: Lower GST on cement and inputs could reduce housing costs, aiding affordable housing.

- Healthcare: Essential drugs taxed lower, making healthcare slightly more affordable.

- Hospitality & Services: Most services stay at 18%, keeping the sector stable.

Expert Opinions

- S&P Global Ratings: Long-term, this will boost revenue through better compliance.

- Economists: Warn of short-term fiscal strain but applaud simplification.

- Industry Leaders: FMCG and housing sectors will benefit most, while luxury sectors face higher levies.

Transition Guide: What You Should Do

For Consumers

- Delay big purchases until the new GST is rolled out.

- Check receipts carefully to ensure lower rates are passed on.

- Plan Diwali shopping strategically—2025 could bring big discounts.

For Businesses

- Update billing and accounting software to reflect the new slabs.

- Train staff on product categorization.

- Revisit pricing strategies—lower GST could allow competitive discounts.

- Watch out for inverted duty structures that may impact working capital.

Historical Significance

This reform echoes the 1991 economic liberalization in spirit. Just as that move simplified trade and investment, the new GST structure could make taxation smoother and encourage consumption. For India, often criticized for “tax terrorism” and red tape, this sends a global signal of reform and ease of doing business.

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali

Singapore Slaps Infosys With ₹66 Lakh GST Fine—Here’s Why

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties