UK Tax Fraud Crackdown: When we talk about a UK tax fraud crackdown, the name Arif Patel now tops the charts. Patel, a 57-year-old businessman of Indian origin, has been ordered by a UK court to repay £90.5 million ($115 million) for orchestrating one of Britain’s largest tax scams. This case isn’t just another courtroom headline—it’s a massive story about how financial crimes affect everyday taxpayers like you and me, and why governments worldwide are getting tougher on fraud. Patel’s downfall shows both the scale of global tax scams and the determination of law enforcement to recover stolen money.

UK Tax Fraud Crackdown

The UK tax fraud crackdown on Arif Patel is more than a court ruling—it’s a lesson in accountability. Patel’s empire, built on fake invoices and counterfeit goods, has crumbled under the weight of justice. For professionals, the takeaway is clear: compliance and transparency are non-negotiable. For everyday citizens, it’s a reminder that fraud doesn’t just hurt governments—it hits all of us. And for fraudsters? The message is simple: you can run, but you can’t hide forever.

| Aspect | Details |

|---|---|

| Mastermind | Arif Patel (57), fugitive since 2011 |

| Conviction | 2023 in absentia for VAT fraud, money laundering, false accounting |

| Fraud Scheme | VAT carousel fraud + counterfeit designer clothing |

| Original Fraud Amount | ~£33.4M in VAT fraud, ~£50M in counterfeit goods |

| Order Value | £90.5M confiscation of global assets |

| Assets Targeted | Properties in UK, Morocco, UAE, Turkey, luxury Ferrari |

| Co-conspirators | 24+ associates, including Dubai-based Mohamed Jaffar Ali |

| Official Reference | UK Government — HMRC |

What Went Down?

Back in 2011, Patel fled the UK to Dubai, leaving behind one of the biggest carousel VAT frauds the country had ever seen. For years, he and his crew faked trades in textiles and electronics, then filed false VAT refund claims on goods that never existed.

It didn’t stop there. Patel’s network also pushed counterfeit designer clothing—nearly £50 million worth—onto the market. We’re not talking about knockoffs sold from a car trunk. This was an international operation, feeding counterfeit goods into legitimate-looking supply chains.

In 2023, Patel was convicted in absentia after refusing to return from Dubai. Two years later, the UK courts slapped him with a £90.5 million confiscation order, seizing everything from his flashy Ferrari 575 Superamerica to real estate spread across Preston, London, Morocco, Turkey, and the UAE.

Why This Case Matters?

This isn’t just about one fraudster. It’s about billions lost to schemes like this every year. According to HM Revenue & Customs (HMRC), VAT fraud alone costs the UK economy around £1.1 billion annually. Globally, the OECD estimates that tax evasion drains $427 billion from public budgets each year.

That money was supposed to fund schools, hospitals, and roads. Instead, it bought sports cars, overseas villas, and counterfeit sneakers. For everyday taxpayers, cases like Patel’s mean fewer resources for communities and higher pressure on honest citizens and businesses.

Breaking Down UK Tax Fraud Crackdown (Easy Mode)

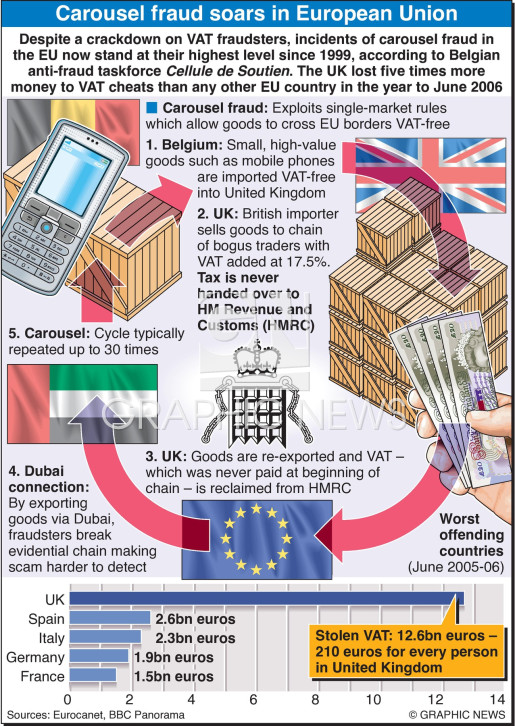

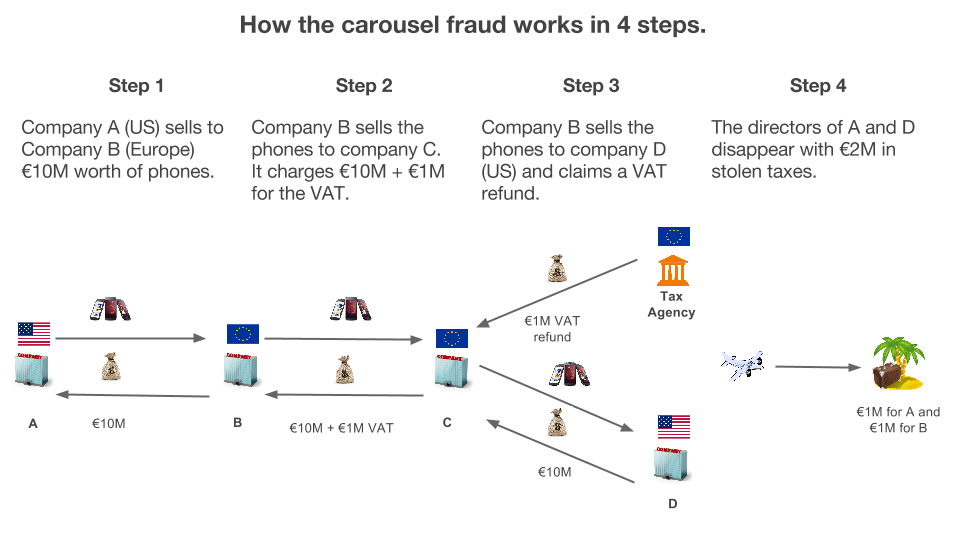

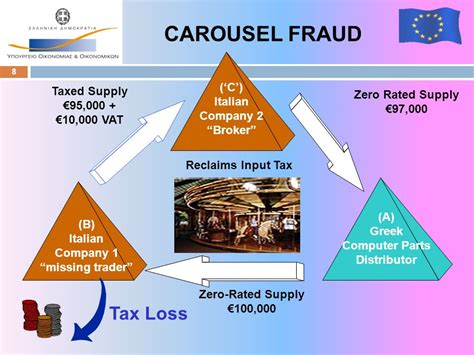

Carousel VAT fraud sounds complicated, but here’s the simple version:

- A company pretends to buy goods like phones or clothes.

- They claim to export them overseas (but they don’t).

- Because exports are VAT-free, they file for a tax refund.

- The goods either never existed or are endlessly “traded” in a paper loop.

- Fraudsters pocket millions in refunds while taxpayers foot the bill.

Think of it like someone returning sneakers to a store and getting a refund—even though they never bought the sneakers in the first place. Repeat that trick thousands of times, and you’ve got Patel’s carousel scheme.

Co-Conspirators and Sentences

Patel wasn’t working alone. His associate, Mohamed Jaffar Ali, and 24 other accomplices were convicted in trials between 2011 and 2014. Together, they’ve received over 116 years of prison time.

Patel himself may face even more jail time if he fails to pay the £90 million. Under UK law, defaulting on a confiscation order means additional prison years. In other words, if he doesn’t cough up the money, the judge has a backup plan.

Historical Context: Famous Fraudsters

This case isn’t the first of its kind.

- In the UK, the 2006 “Operation Euripus” exposed a £200 million VAT fraud.

- In the US, Bernie Madoff’s $65 billion Ponzi scheme showed how unchecked financial crime devastates trust in markets.

- Globally, the Panama Papers leak in 2016 revealed how elites worldwide stash cash offshore to dodge taxes.

Patel’s case fits into a long tradition of financial crimes—but also into a growing trend of governments fighting back with asset seizures, cross-border cooperation, and data analytics.

Impact on Businesses

Fraud doesn’t just rip off governments—it undercuts legit businesses too.

Imagine you’re a small clothing retailer in Manchester, paying your taxes, following the rules. Then along comes Patel’s operation, selling counterfeit designer wear at rock-bottom prices because they don’t pay taxes or licensing fees. Your business loses customers, not because you’re bad at what you do, but because someone else is cheating the system.

This is why fraud investigations matter for both big corporations and local family shops. They help level the playing field.

Global Angle: Chasing Assets Abroad

Patel stashed wealth worldwide—London, Preston, Morocco, UAE, Saudi Arabia, Turkey. Recovering those assets isn’t easy. It requires treaties, cooperation between courts, and sometimes even political pressure.

Groups like Interpol, the Financial Action Task Force (FATF), and the OECD push for stronger cross-border collaboration. Without these efforts, fraudsters could enjoy luxury lifestyles overseas, untouchable by justice back home. Patel’s confiscation order proves that walls are closing in on financial criminals who try to hide abroad.

Practical Tips: How to Protect Yourself

You don’t need to be running a million-dollar business to care about this. Fraud touches everyone. Here are some practical takeaways:

- Double-check your paperwork: If you run a business, be sure your invoices and records are airtight.

- Beware of “too good to be true” deals: Knockoff brands and super-cheap imports are often linked to fraud.

- Know your supply chain: Vet your partners, suppliers, and distributors carefully.

- Report fraud: In the UK, you can use the HMRC hotline. In the US, the IRS has a whistleblower program that even offers cash rewards for reporting fraud.

Comparing the UK and US Crackdowns

The UK and US take slightly different approaches, but the goal is the same: shut down fraud and recover stolen money.

- UK: Focuses heavily on confiscation orders under the Proceeds of Crime Act (2002), seizing cars, houses, and global assets.

- US (IRS): Prioritizes penalties, public exposure, and jail time. The IRS frequently publicizes convictions to deter would-be offenders.

- Both: Use AI and big data to spot suspicious patterns in tax filings. That means schemes are harder to hide than they were 20 years ago.

The message is clear: whether you’re in London or Los Angeles, tax cheats eventually get caught.

Broader Social Impact

Financial crime isn’t victimless. While Patel drove luxury cars, communities lost out on funding. Fraud creates distrust in the system, making everyday taxpayers feel like suckers for playing fair.

A 2022 survey by the Institute for Fiscal Studies found that nearly half of UK citizens believe tax fraud reduces their trust in government institutions. Cases like Patel’s reinforce why transparency and accountability are essential for democracy.

Government Notifies Income Tax Act 2025 Effective April 1

New £40,000 Pension Rule Could Hit Every UK Household; Here’s What You Need to Know

GST Overhaul Could Make Big Bikes Pricier While Smaller Ones Get Cheaper – Here’s the New Tax Twist