Union Blames Job Cuts for CRA’s Call Centre Collapse: When we talk about taxes in North America, most folks think about April deadlines, confusing forms, and long hours trying to get answers on the phone. But lately, things have gotten even tougher in Canada. Union leaders are blaming massive job cuts for the collapse of the Canada Revenue Agency (CRA)’s call centres, leaving taxpayers stranded, frustrated, and—let’s be real—on hold for what feels like forever. This story isn’t just about wait times; it’s about government cutbacks, workers being pushed out of jobs, and regular taxpayers paying the price in missed answers and delays. Let’s break this down so it makes sense whether you’re a 10-year-old learning about how taxes work, or a professional trying to understand what this means for service delivery.

Union Blames Job Cuts for CRA’s Call Centre Collapse

The collapse of CRA call centres isn’t just a staffing story—it’s a service crisis affecting millions of Canadians. Job cuts meant to save money are leaving taxpayers in limbo, workers burned out, and the government at risk of losing compliance revenue. The “Canada On Hold” campaign is rallying Canadians to push back, but the bigger question remains: Will Ottawa prioritize balanced budgets, or will it invest in taxpayer service? The answer could shape public trust in government for years to come.

| Issue | Details |

|---|---|

| Job Cuts | About 3,300 call centre employees cut since May 2024, including 1,300 in May 2025 |

| Workforce Trends | CRA workforce dropped from 59,000 in 2024 to 52,500 in 2025 |

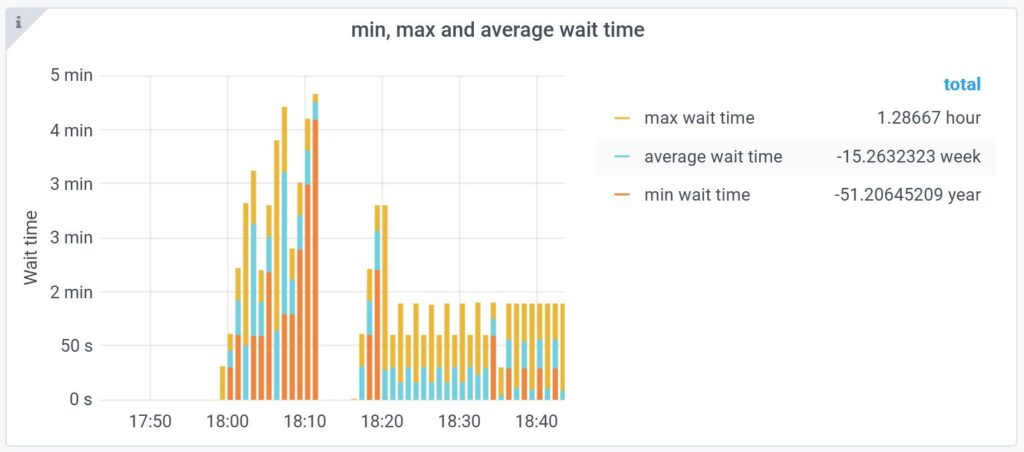

| Service Impact | Longer wait times, unanswered calls, burnout among staff |

| Complaints | 24% of complaints to the Taxpayers’ Ombudsperson are about call centres |

| Government Mandate | Federal goal: 15% spending cuts by 2028–29 |

| Union Response | “Canada On Hold” campaign urges public to contact MPs, Ombudsperson |

| Reference | Canada Revenue Agency Official Website |

What’s Going On With CRA Call Centres?

Picture this: you’ve got a burning question about your taxes. You dial the CRA call centre, wait on hold, hear that same looped music for what feels like an eternity… and then the call drops. That’s not just bad luck—it’s the new reality for many Canadians.

The Union of Taxation Employees (UTE), along with the Public Service Alliance of Canada (PSAC), says the collapse of CRA call centres is directly tied to the loss of thousands of jobs. Since spring 2024, more than 3,300 workers have been shown the door. The most recent round, in May 2025, cut another 1,300 people.

Marc Brière, National President of UTE, didn’t sugarcoat it: “You can’t cut this many workers and expect the system to keep up.”

Why Does This Matter for Taxpayers?

For everyday folks, this isn’t about abstract numbers. It’s about not being able to get answers to tax questions, delayed refunds, or even penalties if you can’t resolve an issue in time.

Think about single parents calling for child benefit information, seniors asking about pension deductions, or small business owners clarifying GST/HST rules. All of them depend on CRA call centres. And when these centres collapse? They’re the ones left in limbo.

Union Blames Job Cuts for CRA’s Call Centre Collapse: Breaking Down the Numbers

- CRA staff peaked at nearly 59,000 employees in 2024.

- By mid-2025, staffing dropped to 52,500.

- The federal government has a plan to reduce 15% of program spending by 2028–29.

- CRA’s workforce is projected to shrink further to about 47,700 employees by 2027–28.

That’s like cutting the players off a football team and still expecting them to win the Super Bowl. Fewer players, same size field, and the fans (taxpayers) are the ones who lose.

Historical Context: CRA’s Rollercoaster Service Record

The CRA’s call centres have long been criticized for poor service. Back in 2017, the Auditor General found that nearly 30% of calls never reached an agent, and taxpayers often got wrong answers when they did. The agency promised to fix things—hiring more agents, upgrading phone systems, and adding callback options.

For a while, service improved. During the pandemic, when Canadians needed help with CERB, CRB, and wage subsidies, CRA hired thousands of temporary workers. But those hires were never permanent. Once funding dried up, the layoffs began.

Now, instead of moving forward, Canadians are watching the system slide backward—worse than it was nearly a decade ago.

Worker Perspective: Burnout Behind the Phones

It’s easy to focus on taxpayer frustration, but there’s another side to this story: the workers themselves. Agents describe feeling burned out, pressured to handle dozens of calls per shift, often without adequate training or resources.

One CRA call centre worker, quoted in union reports, explained: “We want to help, but we’re dealing with angry callers who have been waiting for hours. It’s stressful, and a lot of my colleagues are leaving.”

Fewer staff doesn’t just mean slower service—it means the workers who remain are stretched thin, leading to even higher turnover. It’s a vicious cycle.

International Comparison: How Canada Stacks Up

- IRS (United States): In 2023, the IRS hired more than 5,000 customer service reps with Inflation Reduction Act funding. Wait times dropped to just four minutes, compared to 27 minutes in 2021.

- HMRC (United Kingdom): The UK closed call lines in 2024 to push taxpayers online. Public outrage forced them to reopen lines within weeks.

- CRA (Canada): Instead of adding staff, Canada is shrinking its call centres.

Compared to peers, Canada risks becoming an outlier in taxpayer service.

The Union’s Campaign: “Canada On Hold”

The “Canada On Hold” campaign is urging Canadians to fight back. Its goals are simple:

- Contact MPs to demand funding.

- File complaints with the Taxpayers’ Ombudsperson.

- Share stories publicly to raise awareness.

Phase two of the campaign, launching later this year, may expand beyond call centres to include cuts in enforcement, audits, and taxpayer services.

Policy and Budget Analysis

Why is this happening? It comes down to money.

The 2023 federal budget mandated across-the-board 15% program cuts by 2028–29. CRA, despite handling billions in tax revenue, wasn’t spared. In Ottawa’s view, temporary pandemic staff were no longer “necessary.”

Critics argue this is shortsighted. Every dollar spent on taxpayer service can actually increase government revenue by boosting compliance. When taxpayers can’t get answers, mistakes and late filings rise. That means less tax collected, not more.

Economic Impact: Why Service Matters

Poor taxpayer service doesn’t just cause stress—it hits the economy. Small businesses face penalties, families lose out on benefits, and professionals spend more billable hours fixing preventable errors.

A recent study from the U.S. showed that every $1 invested in IRS customer service generated about $4 in additional tax compliance revenue. Canada risks losing out on similar gains by cutting instead of investing.

Tech & Digital Alternatives

The CRA encourages taxpayers to use digital portals like My Account and My Business Account. These tools are helpful, but not perfect. Many Canadians—especially seniors, rural residents, and newcomers—still rely on the phone.

The push toward digital-first solutions risks creating a digital divide, where tech-savvy taxpayers manage fine but vulnerable groups are left behind.

Practical Advice for Taxpayers

Here’s what Canadians can do if they’re stuck:

1. Use CRA Online Tools

Start with the CRA website for guides, calculators, and forms.

2. Call at Off-Peak Hours

Best times are early mornings or evenings.

3. Document Every Attempt

Keep a record of calls in case you need to escalate.

4. Escalate to the Ombudsperson

The Taxpayers’ Ombudsperson can intervene in unresolved cases.

5. Use a Tax Professional

Accountants and tax preparers often have direct access and experience navigating CRA systems.

6. Contact Your MP

Political pressure is one of the few tools taxpayers have to influence government funding decisions.

Future Outlook: What’s Next?

The CRA projects further cuts through 2027–28. Unless the government reverses course, taxpayers may face even longer wait times and reduced service.

The question is whether public pressure—through the union’s campaign, media coverage, and political advocacy—will be enough to change the trend.

For now, Canadians may need to brace for a few more years of frustrating “on hold” music.

GST Amnesty Scheme Alert — Must-Read Advisory for All Registered Taxpayers

ITR Filing 2025 Warning: 7 Common Issues Taxpayers Must Watch Out For

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid