UP Shopkeeper Shocked by ₹1.41 Billion Income Tax Notice: Tax Identity Theft Protection is no longer a luxury—it’s a must. Whether you’re a full-time worker, a side hustler, or just learning how taxes work, protecting your tax identity is just as important as locking your front door at night. Tax identity theft happens when someone uses your Social Security Number (SSN) and personal information to file a fraudulent tax return, usually trying to snatch your refund. The catch? You don’t even know it until the IRS hits the brakes on your real return.

In this article, we’ll break down exactly what tax identity theft is, why it’s getting worse, what you can do to prevent it, and how to recover if you’re hit. And we’re not going to overcomplicate it—you’ll get real examples, step-by-step guidance, and official resources you can trust.

UP Shopkeeper Shocked by ₹1.41 Billion Income Tax Notice

Tax identity theft is a real and growing threat—but you’ve got the power to fight back. Whether it’s locking down your SSN, getting an IP PIN, filing quickly, or using the TAS to resolve a delayed case, every step you take gets you closer to safety. Don’t let scammers grab what’s yours. Be smart, stay protected, and share this with anyone who files taxes in your life—from your kid brother to your grandma.

| Highlight | Details / Source |

|---|---|

| Avg. case resolution time | ~506 days in FY 2025 (down from 676 days in FY 2024) |

| Newer cases | ~100 days to resolve if filed after July 13, 2024 |

| Tax returns flagged | 2.1 million flagged in FY 2025 for potential identity fraud (irs.gov) |

| IP PIN users | 10+ million taxpayers now use IRS Identity Protection PINs |

| Common victims | Senior citizens, low-income earners, gig workers, and children are frequent targets |

| AI & deepfake risks | Rising number of cases using AI-generated IDs and documents |

| Support options | Taxpayer Advocate Service (TAS), IRS IDTVA program, and IRS Identity Theft Central |

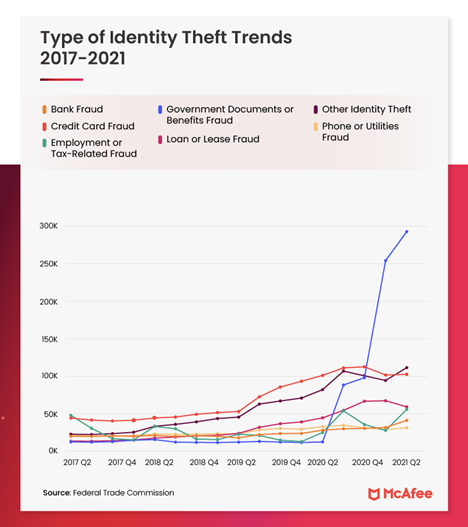

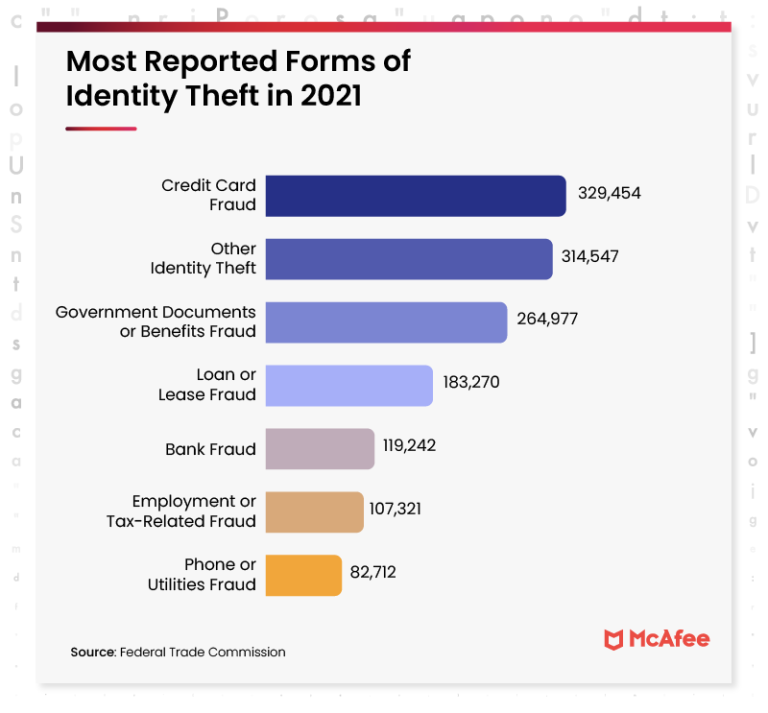

Why Tax Identity Theft Is Spiking?

The IRS flagged over 2 million tax returns as potential identity theft in fiscal year 2025. And while it’s gotten better—especially for newer cases filed after July 13, 2024—many taxpayers are still waiting more than 1.5 years to get things sorted.

The rise of AI tools, data breaches, and phishing attacks has made identity theft easier for cybercriminals. They can generate fake driver’s licenses, forge W-2s, or pretend to be you using deepfakes.

Even more concerning: thieves often target people who aren’t even filing taxes—like kids, retirees, and low-income folks. Why? Because these identities aren’t being monitored, making them easier targets.

What Happens When You’re a Victim?

Let’s say you go to file your return, and it gets rejected because someone already filed using your SSN.

Now what?

Here’s the usual chain of events:

- You’re confused—maybe you think it’s a tech glitch.

- You contact the IRS and find out your SSN was already used.

- You’re told to fill out Form 14039, an Identity Theft Affidavit.

- You submit a paper return—no e-filing anymore.

- The IRS opens an IDTVA case and assigns it to a specialist.

From here, resolution can take 100 days to 676 days, depending on how recent the fraud occurred and IRS workload.

Real-World Examples

This isn’t just theory—there are real victims all over the U.S. facing this nightmare:

- A shopkeeper in Uttar Pradesh, India, was wrongly sent a ₹1.41 billion tax notice due to stolen identity details tied to fake firms. Fraudsters misused his PAN and Aadhaar numbers to register companies. Cases like this are becoming common in the U.S., too.

- A Tennessee school teacher in 2024 waited 18 months to get her $3,500 refund after a scammer filed using her SSN.

- Several gig workers on platforms like Uber, DoorDash, and Fiverr have reported identity thefts during the past two tax seasons—especially when using unsecured public Wi-Fi to file returns.

Step-by-Step Guide to Protecting Yourself

Step 1: Get an Identity Protection PIN (IP PIN)

- What is it? A 6-digit code that only you and the IRS know. Required to file your return.

- Why it matters: No one can file a return in your name without it.

- How to get it: Visit https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

If you can’t create an online IRS account, you can request one by filing Form 15227 by mail.

Even children and dependents can get IP PINs—great for protecting your entire family.

Step 2: Strengthen Your Digital Hygiene

Protecting your tax identity is about more than just tax season.

Here’s what to do year-round:

- Use strong passwords (12+ characters, mixed case, symbols).

- Set up two-factor authentication (2FA) wherever possible.

- Never click on suspicious emails, texts, or pop-ups.

- Don’t file taxes on public Wi-Fi—especially at cafes or airports.

- Use antivirus and firewall software—especially if you’re a small business owner or tax pro.

Step 3: Know the Signs of Tax Identity Theft

- Your return is rejected when e-filing.

- You receive an IRS notice for a return you didn’t file.

- The IRS contacts you about a suspicious W-2 or 1099.

- You see unknown bank accounts or employment on your IRS transcript.

If any of these happen, act immediately.

Step 4: File Form 14039 and a Paper Return

Form 14039 is your official “I didn’t do this” statement.

Download it from https://www.irs.gov/pub/irs-pdf/f14039.pdf

Fill it out, attach it to your paper return, and send it via certified mail. This will trigger the Identity Theft Victim Assistance (IDTVA) process.

Step 5: Contact the Taxpayer Advocate Service (TAS)

If you’re stuck and haven’t heard back from the IRS in 30+ days, reach out to the Taxpayer Advocate Service.

They offer free, independent help and have over 1,000 employees across all 50 states.

TAS hotline: 877-777-4778

Step 6: Monitor Your Credit and Tax Records

Identity thieves don’t stop at tax fraud. They may try to open credit cards, loans, or utilities in your name.

Here’s how to watch for red flags:

- Sign up for free credit monitoring (offered by most banks).

- Check your IRS transcript annually.

- Request your free credit report at https://www.annualcreditreport.com

If you suspect broader ID theft, file an identity theft report at https://www.identitytheft.gov

Special Tips for Tax Professionals

If you’re a tax preparer, accountant, or work with sensitive data, you have legal and ethical responsibilities to protect client data.

Here’s what you must do:

- Follow the “Security Six”: antivirus, firewalls, backup software, encryption, strong passwords, and multi-factor authentication.

- Create a Written Information Security Plan (WISP) based on IRS guidelines.

- Report any breaches immediately to the IRS and affected clients.

- Subscribe to IRS e-News for weekly updates and scam alerts.

₹4 Crore Bank Fraud in Bhopal Exposed After Income Tax Notice Triggers Probe

Madras HC Slams GST Notice on Nizam Pakku—Says 5% Tax Demand Was Clear Abuse of Law

Europe Blocks U.S.-Bound Parcels – Tax Rule Change Behind The Move