US Minimum Tax Exemption Decision: The CPA Group (AICPA/CIMA) has officially urged the Organisation for Economic Co-operation and Development (OECD) to move faster on finalizing a decision regarding the U.S. minimum tax exemption under Pillar Two, the landmark global tax reform framework. At its core, this debate is about fairness, competitiveness, and whether American multinational companies should be recognized as already complying with minimum tax rules. Without clarity, businesses face double taxation, higher compliance costs, and uncertainty—all of which could ripple across the economy.

US Minimum Tax Exemption Decision

The CPA Group’s call for urgency in the OECD’s U.S. minimum tax exemption decision under Pillar Two is about more than tax policy—it’s about protecting competitiveness, avoiding double taxation, and keeping the global system fair. With billions of dollars, hundreds of jobs, and decades of global cooperation at stake, the OECD’s next move will shape the future of international tax rules, corporate strategy, and cross-border investment. For professionals and businesses alike, the advice is simple: prepare for all outcomes, stay informed, and push for clarity.

| Topic | Details |

|---|---|

| Who’s involved? | CPA Group (AICPA/CIMA), OECD, U.S. Treasury, G7 nations |

| Issue at hand | Exemption for U.S. multinationals from OECD’s Pillar Two global minimum tax |

| Why it matters | Avoids double taxation, reduces compliance burdens, protects U.S. competitiveness |

| Revenue impact | OECD estimates Pillar Two could raise $220 billion annually worldwide |

| Recent timeline | G7 “side-by-side” deal (June 2025); OECD draft (August 2025); decision pending late 2025 |

| Countries opposing | 28 nations including Germany, France, China, UK |

| Official resource | OECD Pillar Two overview |

The Backstory: Why Are We Here?

This fight didn’t appear out of nowhere. For over a decade, the OECD has been working on global tax reform to tackle the problem of “profit shifting.” Large companies often route profits through tax havens like Bermuda, Luxembourg, or Ireland, paying extremely low tax rates.

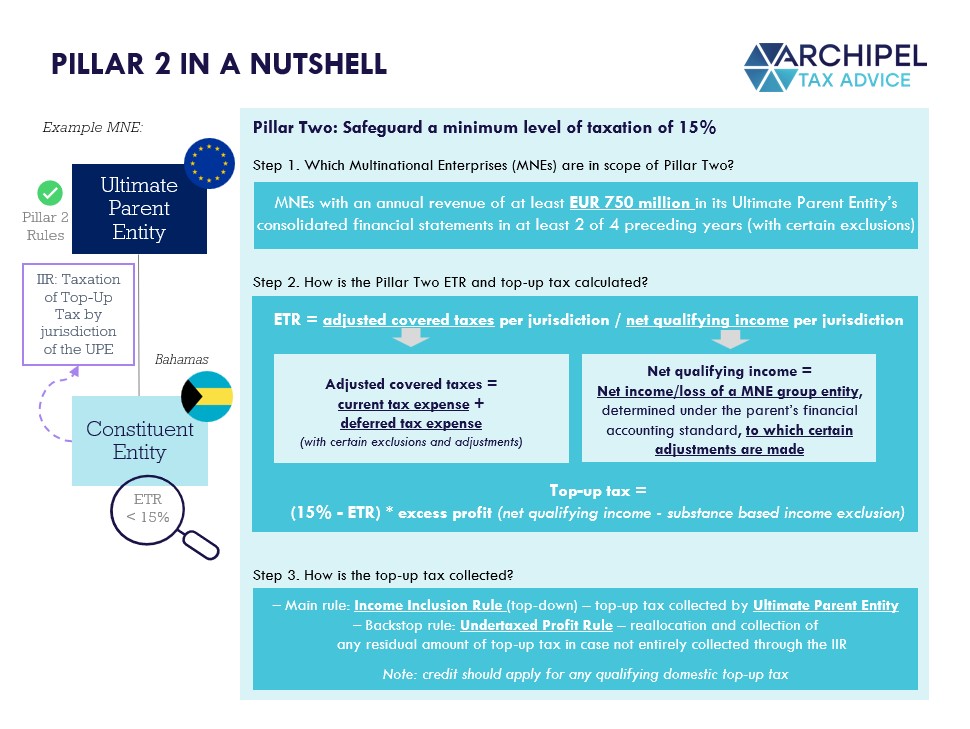

In 2013, the OECD launched the Base Erosion and Profit Shifting (BEPS) initiative. That work eventually gave rise to two pillars:

- Pillar One: Ensures more profits are taxed where customers and markets are located.

- Pillar Two: Introduces a 15% global minimum corporate tax for multinationals with revenue above €750 million.

The goal? Level the playing field so every multinational pays at least 15%—no matter where they’re headquartered.

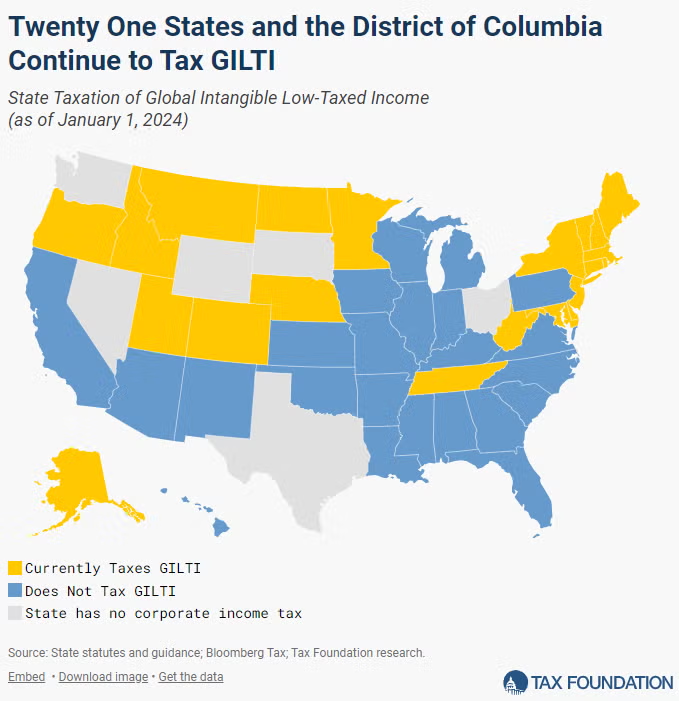

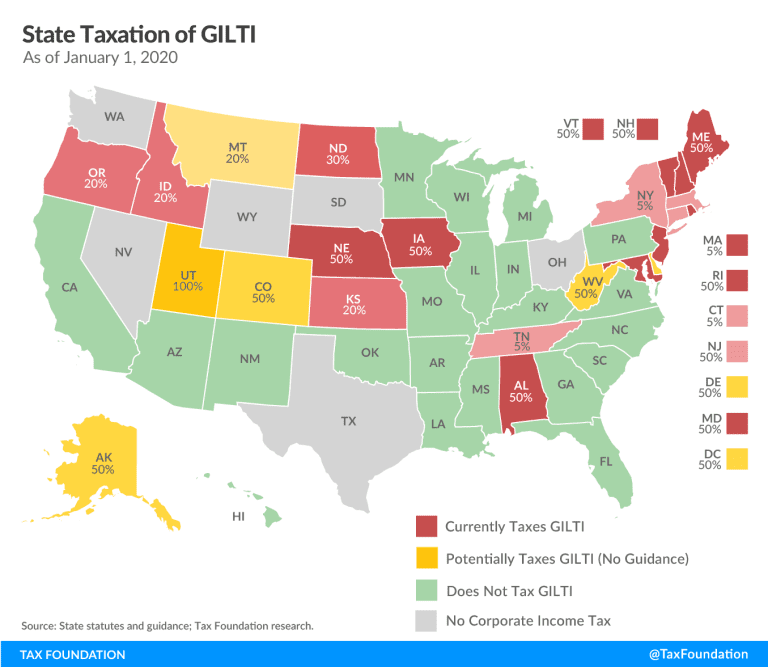

But here’s the twist: the U.S. already has its own minimum tax system, called Global Intangible Low-Taxed Income (GILTI). It’s not identical to Pillar Two, but it serves a similar purpose. That’s where the tension begins.

The “Side-by-Side” Agreement

In June 2025, the G7 countries struck what they called a “side-by-side” agreement. Here’s how it breaks down:

- For U.S. multinationals: If they’re subject to GILTI, they won’t also be hit by the OECD’s Income Inclusion Rule (IIR) or Undertaxed Profits Rule (UTPR).

- For the U.S. government: America agreed to drop its controversial Section 899 retaliatory tax, which would have punished foreign companies operating under OECD rules.

This was hailed as a political breakthrough, but it raised eyebrows internationally. Countries like Germany, France, and China quickly pushed back, claiming it would give U.S. companies a competitive edge.

Why US Minimum Tax Exemption Decision Matters for U.S. Businesses?

Imagine running a global company like Apple, Microsoft, or Pfizer. You already report and pay taxes under GILTI. Now the OECD wants you to do the same thing under a different system, possibly paying even more.

The risks for American companies are threefold:

- Double Taxation: Without recognition of GILTI, U.S. firms could pay once under U.S. rules and again under OECD’s.

- Compliance Burdens: Two sets of rules mean more accountants, more reports, and millions in extra costs.

- Competitiveness: If rivals in Europe or Asia don’t face the same overlap, U.S. companies fall behind.

The U.S. Chamber of Commerce estimates that unresolved Pillar Two issues could reduce U.S. competitiveness by billions of dollars each year.

Pushback from Other Nations

Not everyone’s on board with giving the U.S. a pass. In July and August 2025, 28 countries submitted objections to the OECD draft rules. Their main arguments:

- Fairness: If America gets an exemption, why shouldn’t others?

- Integrity: A carve-out for the U.S. could unravel global buy-in for Pillar Two.

- Competition: U.S. firms might gain an edge in foreign markets.

Countries like Germany and France argue that allowing the U.S. exemption could create a “two-tier” global system, weakening trust in OECD leadership.

Real-World Examples

Apple

Apple reports huge profits in Ireland, where tax rates have historically been low. Under OECD Pillar Two, those profits would face a top-up tax. But with a U.S. exemption, Apple could stick with GILTI rules and skip the OECD’s added reporting.

Microsoft

Microsoft spends billions on R&D tax credits in the U.S. If OECD doesn’t recognize these credits, Microsoft loses a significant incentive to innovate domestically.

Pfizer

Pharmaceutical companies like Pfizer often rely on global operations for production and sales. Without coordination between OECD and U.S. rules, they could be taxed multiple times on the same profits, making drug development even more expensive.

The CPA Group’s Position

In September 2025, the CPA Group sent a detailed letter to the OECD. They urged action on three fronts:

- Reduce Administrative Burdens: Companies can’t handle two overlapping systems without massive costs.

- Recognize U.S. Credits: Incentives like the R&D Section 41 credit and renewable energy credits must be factored in.

- Act Fast: Every month of delay creates uncertainty, complicating investment and compliance planning.

Their message was clear: without swift action, the system could collapse under its own weight.

Practical Guide: What Companies Should Do Now

If you’re a CFO, tax director, or advisor, here’s how to prepare:

1. Track OECD Updates

Visit the OECD tax page weekly. Rules and drafts are being updated quickly.

2. Analyze Your Credits

Map out which U.S. credits your company relies on. Know whether they’ll be recognized internationally.

3. Run Tax Scenarios

Model your effective tax rate (ETR) under three possibilities:

- U.S. exemption granted

- U.S. exemption delayed

- No exemption granted

4. Upgrade Systems

Prepare for dual reporting. Even if the exemption comes through, there may be transition periods requiring both OECD and U.S. filings.

5. Engage with Advocacy Groups

Join forces with industry bodies like the AICPA, Business Roundtable, and Chamber of Commerce to ensure your concerns are represented.

What’s at Stake: Numbers That Matter

- $220 billion: OECD’s estimate of annual global revenue gains from Pillar Two.

- $30 billion: Rough estimate of what U.S. multinationals might overpay annually if both systems apply without exemption.

- 130+ countries: Signed onto the OECD framework, showing broad support worldwide.

- 28 countries: Formally objected to the U.S. carve-out, highlighting serious tensions.

Future Outlook

What happens next depends on how quickly the OECD moves:

- If exemption is granted promptly: U.S. companies avoid chaos, and global rules move forward—though not without grumbling from Europe and Asia.

- If delayed: Uncertainty grows, companies hesitate to invest, and compliance costs skyrocket.

- If rejected: Expect trade tensions between the U.S. and EU, legal battles, and a potential collapse of Pillar Two cooperation.

The OECD’s decision is expected by late 2025, making the next few months crucial.

BBC Drops a Tax Secret That Could Save You Thousands in 2025

What Is the Digital Services Tax That Could Spark New Trump Tariffs?

Trump’s 50% Tariffs on India: Why US Left Indian Pharma Out of Tax Bracket