US Treasury Signals Strategic India-US Partnership on Horizon: When folks hear the phrase “Not Just About Russia,” it sounds like another headline about sanctions and oil. But this time, the U.S. Treasury isn’t just talking punishment—it’s signaling something bigger: a strategic India-U.S. partnership on the horizon. This isn’t just another blip on the foreign policy radar. It’s a potential game-changer that affects your job, your gas prices, your tech devices, and even the way America competes with China. Let’s break it down in plain English.

US Treasury Signals Strategic India-US Partnership on Horizon

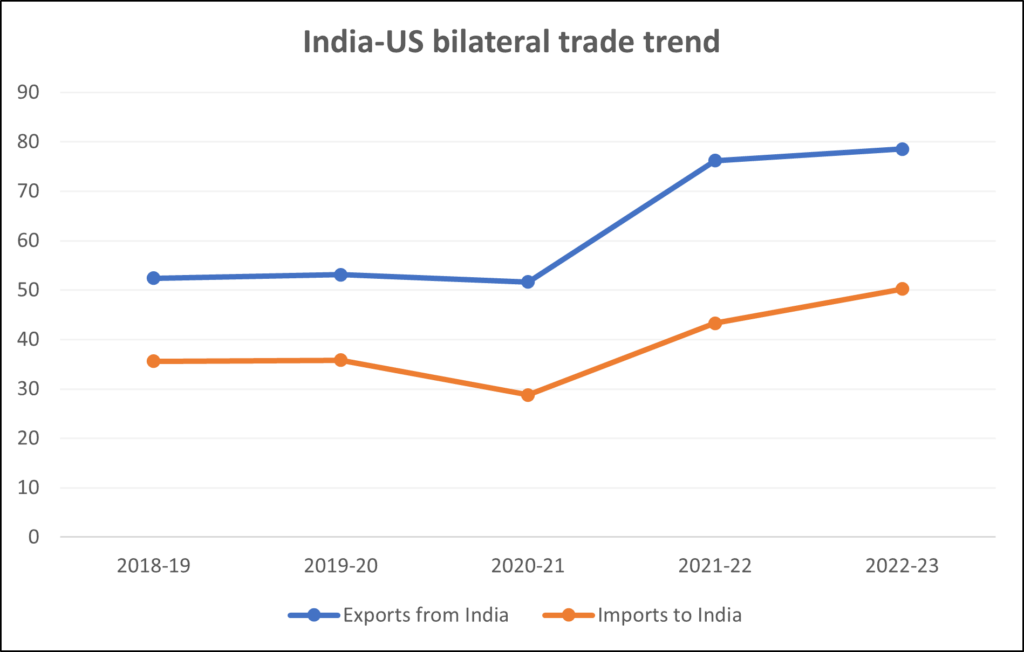

The India-U.S. relationship is messy right now—but not broken. Tariffs, Russian oil, and trade spats dominate the headlines. But behind the noise, both countries are building something bigger: a strategic partnership that covers defense, technology, and energy. Like any marriage, there are fights—but both partners know they’re stronger together. In the 21st century, the U.S. needs India just as much as India needs the U.S. And that’s the real story—not just about Russia.

| Topic | Details |

|---|---|

| Tariffs & Tensions | U.S. slapped 50% tariffs on Indian goods, hitting ~$87 billion in exports. |

| Impact on India | Exports may drop by 40% (~$37 billion). |

| Treasury’s Stance | Treasury Sec. Scott Bessent says talks are “complicated” but expects progress by October. |

| Beyond Russia | U.S. sees India as a partner in tech, defense, and energy. |

| Strategic Value | India is central to the Quad Alliance and the Indo-Pacific strategy. |

| Long-term Outlook | Partnership expected to strengthen in critical technologies, semiconductors, AI, and energy. |

| Official Resource | U.S. Treasury Department |

The Current Flashpoint: Tariffs and Trade

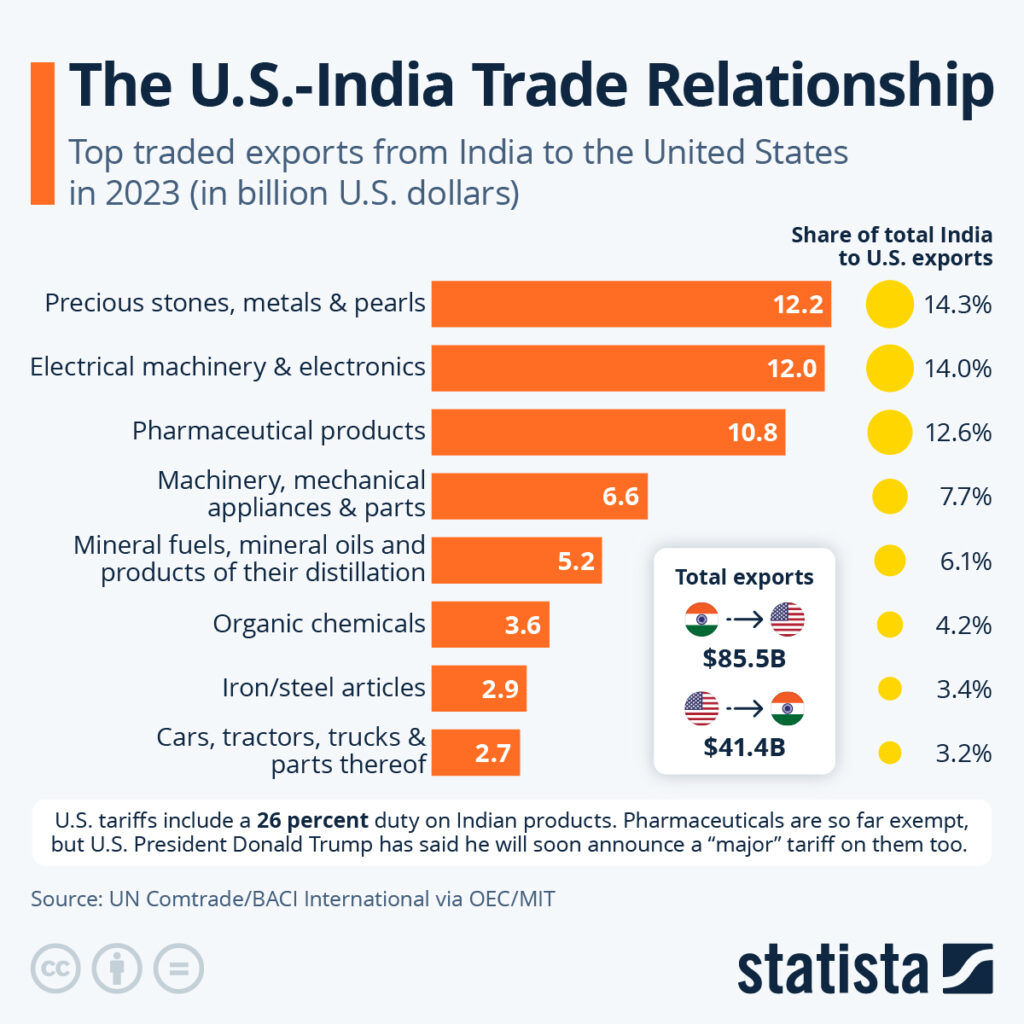

On August 27, 2025, the U.S. imposed 50% tariffs on Indian exports. That’s not pocket change—it impacts 55% of India’s goods to America, worth around $87 billion. Economists predict this could slash exports by 40% (roughly $37 billion) in the near term.

Why? Washington argues India’s continued purchase of Russian oil indirectly funds the war in Ukraine. For India, though, Russian crude is cheaper, helping keep domestic energy affordable for its 1.4 billion people. It’s a tough balancing act.

But here’s where it gets interesting: U.S. Treasury Secretary Scott Bessent didn’t just slam India—he called the situation “complicated” and said, “We’ll come together at the end of the day.” In plain talk: tariffs are leverage, not a breakup.

Historical Context: From Cold War to 2025

To really get this, you need some backstory.

- Cold War era (1947–1991): India leaned toward the Soviet Union, while the U.S. backed Pakistan.

- Post-2000: Relations warmed as India liberalized its economy. President George W. Bush’s 2005 civil nuclear deal was a turning point.

- Obama years: Washington pushed the “Pivot to Asia,” positioning India as a key democratic partner in the Indo-Pacific.

- Trump years: Trade spats grew, but defense cooperation expanded.

- Biden years: Renewed focus on iCET, climate, and tech.

- 2025 and beyond: With tariffs now in play, the partnership looks tested—but both nations need each other too much to walk away.

That’s why today’s drama is part of a longer love-hate story between the world’s largest democracy and its oldest.

Why US Treasury Signals Strategic India-US Partnership on Horizon?

Here’s the real scoop: Russia is just the excuse. The U.S. isn’t going after India only for oil—it’s about shaping a long-term partnership.

Technology Collaboration

- The iCET initiative focuses on AI, semiconductors, 5G/6G wireless, and quantum computing

- India is emerging as a semiconductor hub, and U.S. companies want alternatives to China.

- Think of it as co-building the backbone of tomorrow’s digital economy.

Defense Ties

- India is the largest arms importer in the world, and the U.S. is eyeing that market.

- Big-ticket deals: Apache helicopters, Predator drones, and C-130 transport aircraft.

- Joint exercises like “Yudh Abhyas” showcase U.S.–India defense trust.

Energy Security

- Washington is pitching itself as India’s go-to oil and LNG supplier.

- Beyond oil, renewables are key—India is betting big on solar and wind, and U.S. firms want to invest.

- With ExxonMobil and Chevron ready, billions in long-term contracts are on the table.

Geopolitics

- Enter the Quad—the U.S., India, Japan, and Australia.

- Purpose: keep the Indo-Pacific free and open, countering Beijing’s growing influence.

- India’s geography (right in the middle of global shipping lanes) makes it indispensable.

Which Sectors Are Hit by Tariffs?

The 50% tariffs don’t hit every product equally. Here’s where it hurts most:

- Textiles and Apparel: India is the second-largest supplier of clothes to the U.S. Price hikes are likely.

- Pharmaceuticals: India supplies 40% of U.S. generic drugs. While not all are tariffed, supply chains are under pressure.

- IT Services: Outsourcing contracts may face new taxes, impacting U.S. healthcare and financial firms.

- Agriculture: Indian spices, rice, and seafood exports may shrink under tariff pressure.

But remember—tariffs often get negotiated down. This is more about political signaling than permanent restrictions.

The Economic Angle

So what does this mean for your pocketbook and career?

- For U.S. Businesses: Tariffs may sting, but they also push supply chains to diversify. Want to sell tech, clean energy, or defense goods in Asia? India’s your next big customer.

- For Indian Exporters: Short-term pain, but long-term gain if supply chains shift away from China. Think “Made in India” boom.

- For Investors: Keep an eye on semiconductor, defense, and LNG stocks—they’ll benefit most from deeper U.S.-India ties.

India’s GDP is forecasted to reach $7 trillion by 2030. Missing out on that market? That’s like ignoring the next iPhone launch.

Practical Takeaways

- If you’re a U.S. entrepreneur: Watch for tariff carve-outs or exemptions. Tech and energy exports to India may grow.

- If you’re an Indian exporter: Diversify markets now—Europe and ASEAN are prime alternatives.

- If you’re a student: STEM exchanges are expected to expand, making study and work visas more valuable.

- If you’re in energy: The U.S. is betting big on LNG exports to India. Expect long-term deals.

Real-World Examples

- Apple: Moving iPhone assembly from China to India helps both U.S. tech and Indian jobs.

- Tesla: Elon Musk has hinted at opening a Gigafactory in India, betting on clean energy ties.

- Defense: Predator drone deals worth billions are under discussion, giving India cutting-edge tech and the U.S. steady defense revenue.

The Road Ahead

So what’s next?

- October 2025 Trade Talks: Both sides are aiming for a compromise. Expect some tariff rollbacks.

- Energy Deals: Expect major U.S.–India LNG contracts signed within the year.

- Tech Cooperation: New semiconductor fabs and AI research centers may launch in India with U.S. backing.

- Quad Expansion: Expect more military exercises and joint security dialogues.

The bottom line: the future looks rocky short-term, but strong long-term.

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

Never Broke, Always Ahead: These 11 Daily Habits Separate the Financially Free from the Rest

Mother vs. Children: Family Torn Apart Over R56,000 Death Benefit After R2 Million Payout