Uttarakhand HC Turns Down GST & TDS Relief Plea: Understanding GST & TDS Relief in India—that’s where we’re kicking things off. Right out of the gate, we’ll dive into GST relief, TDS relief, why they matter, and how to handle it when relief isn’t granted by the courts. This isn’t just theory. Whether you’re a small shop owner in Mumbai, a mid-size IT company CFO in Bangalore, or an accounting student trying to wrap your head around these tax terms, this guide blends professional know-how with real-life clarity so you can act smart when it counts.

Let’s set the scene. GST (Goods & Services Tax) and TDS (Tax Deducted at Source) are part of India’s tax DNA. GST is a value-added tax collected on goods and services, while TDS is a withholding tax collected at the source of income—like a little pre-payment towards your total tax bill. When business owners get hit with unexpected tax liabilities or penalties, they sometimes seek relief or waivers. That could mean asking the government to forgive late fees, reduce penalties, or adjust a disputed amount. But as the Uttarakhand High Court reminded everyone recently, not every tax dispute belongs in writ jurisdiction under Article 226 of the Constitution. Some fights need to go through the statutory process first.

Uttarakhand HC Turns Down GST & TDS Relief Plea

The Uttarakhand High Court’s decision reinforces a critical point—writ petitions aren’t a shortcut for GST or TDS relief. The smart approach? Know your rights, follow the statutory path, and use professional help where needed. This is how you turn a stressful tax dispute into a manageable process—and maybe even a win.

| Highlight | Details |

|---|---|

| Court Decision | Uttarakhand High Court ruled that GST & TDS relief pleas aren’t fit for writs due to complexity (Article 226 limitations). |

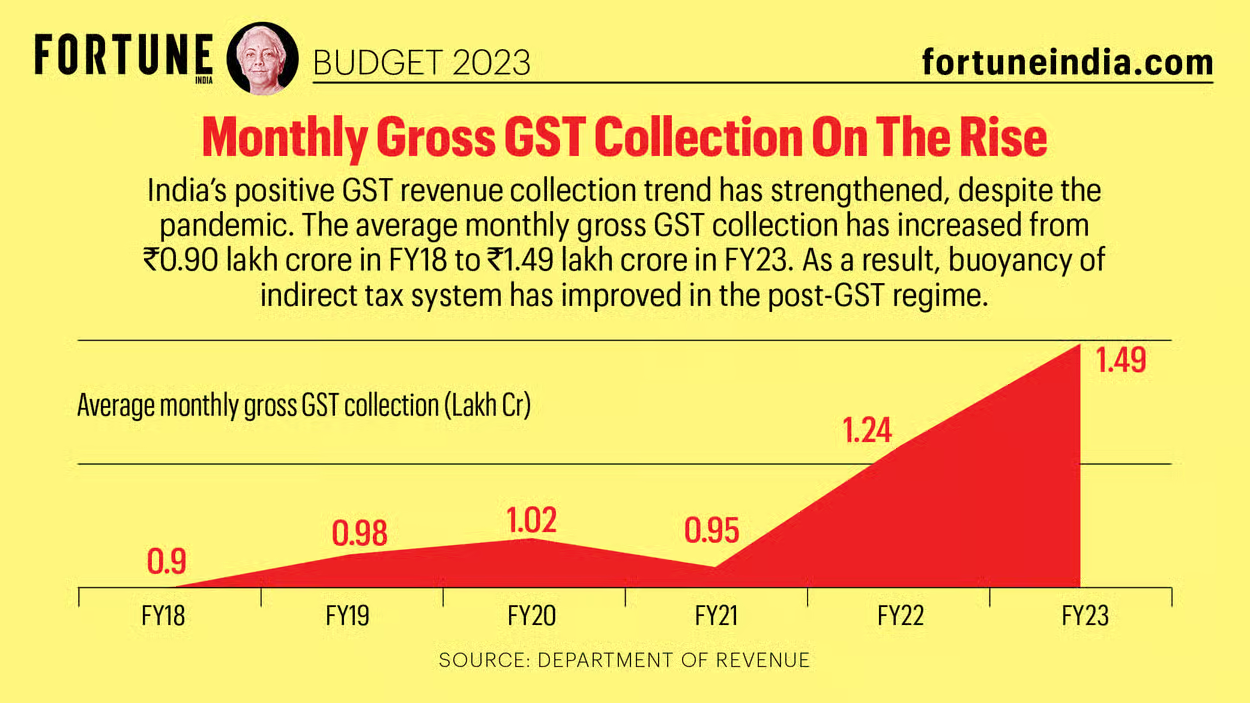

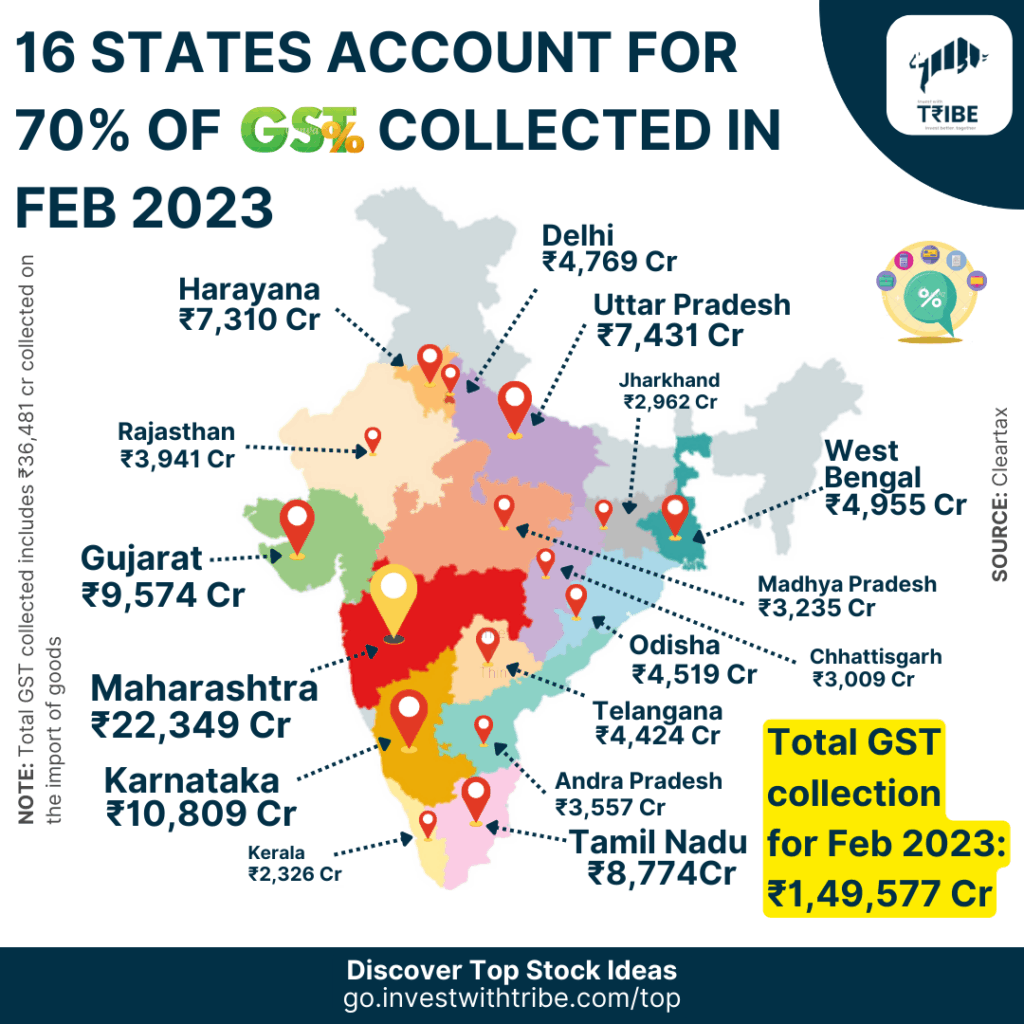

| GST Collection (FY 2023–24) | ₹18.5 lakh crore collected (approx.)—a key revenue source for India’s government. |

| TDS Revenue (FY 2023–24) | ₹7.5 lakh crore collected via TDS (approx.)—a major chunk of direct tax inflow. |

| Relief Routes | Appeal before GST Appellate Authority, Tribunal, or negotiation with assessing officer. |

| Real-Life Example | Small Delhi café appealed TDS demand via proper route and won 80% reduction in penalty. |

| Pro-Tip | Document your case neatly; use experts, and don’t insist on writs when scope is restricted. |

| Further Reading | Visit the official websites: Ministry of Finance, India, GST Portal |

Understanding GST & TDS in Simple Terms

GST — The Goods & Services Tax

Think of GST as the all-in-one indirect tax that replaced multiple old taxes like VAT, service tax, and excise duty. It’s collected at every stage of the supply chain but ultimately paid by the end consumer. Businesses collect it on behalf of the government and pass it along.

Key facts:

- Introduced in July 2017.

- Standard rates: 0%, 5%, 12%, 18%, 28% depending on goods/services.

- Monthly filing required for most registered businesses.

TDS — Tax Deducted at Source

TDS is a direct tax mechanism where the payer deducts a certain percentage before making payment to the payee, then deposits it with the government.

Example: A company pays a freelancer ₹1,00,000 for services. Before paying, it deducts 10% (₹10,000) as TDS and pays ₹90,000 to the freelancer. The freelancer can later claim credit for the ₹10,000 already paid to the government.

Why Uttarakhand HC Turns Down GST & TDS Relief Plea?

Article 226 of the Indian Constitution gives High Courts the power to issue writs for enforcing fundamental rights or for any other legal purpose. But there’s a catch—writs are meant for clear legal or jurisdictional errors, not for disputes involving complex fact-finding or detailed calculations.

In tax matters, if a dispute requires:

- Detailed examination of invoices

- Checking compliance over multiple periods

- Evaluating multiple laws in combination

…then the High Court usually directs parties to go through statutory appellate channels first.

Step-by-Step Guide: What to Do When GST or TDS Relief Isn’t Granted via Court

Step 1: Gather Your Paper Trail

Get all the evidence—returns filed, payment challans, notices, emails, and bank statements. A messy file could cost you relief.

Step 2: Identify the Correct Authority

For GST, start with the First Appellate Authority.

For TDS, the journey usually begins with the Assessing Officer and can go up to the Income-Tax Appellate Tribunal.

Step 3: File a Timely Appeal

Remember:

- GST appeal deadline: 60 days

- Income-tax appeal deadline: 30 days

Late filings may be accepted if you have a good reason—but it’s not guaranteed.

Step 4: Negotiate with Evidence

Sometimes authorities are willing to settle or reduce penalties if you can show:

- Genuine error

- Financial hardship

- Voluntary compliance efforts

Step 5: Escalate When Needed

If the appellate authority rejects your case, escalate to the Tribunal, then possibly to the High Court/Supreme Court—but only after exhausting prior remedies.

Real-Life Examples Across Industries

- Retail: A Mumbai clothing store was slapped with a ₹15 lakh GST demand for missed filings. They appealed, citing technical glitches on the GST portal, and the penalty was cut by 60%.

- IT Services: A Bangalore startup faced a TDS mismatch because of incorrect PAN entries by a client. The Assessing Officer corrected the error without imposing penalties once documents were provided.

- Hospitality: A Delhi café, as shared earlier, reduced its penalty by 80% through appeals and evidence of corrected billing.

Practical Tips for Businesses Facing GST or TDS Disputes

- Stay Updated: Tax laws change frequently—subscribe to updates from the GST Council and Income Tax Department.

- File on Time: Late filings almost always invite penalties.

- Invest in Software: Automated GST/TDS filing software reduces manual errors.

- Train Your Team: Accounting staff should understand compliance basics, not just data entry.

- Get Professional Help: Chartered accountants and tax lawyers can save more money than their fees cost.

International Comparison — How Other Countries Handle Similar Issues

- USA: The IRS offers abatement for penalties if you have a clean compliance history and a reasonable cause—much like Indian relief provisions.

- UK: HMRC allows appeals to the First-tier Tribunal, similar to India’s appellate route.

- Australia: Businesses can request remission of GST penalties via the Australian Taxation Office if they prove the delay wasn’t intentional.

Delhi High Court Rules GST Show-Cause Notice Invalid After Registration Cancellation

2025’s Most Important ITAT Rulings: Half-Yearly Income Tax Case Digest Reveals Critical Insights

What Does the Lok Sabha’s New GST Amendment Bill Mean for Manipur’s Economy? Find Out Now!

Action Checklist (Quick Takeaways)

- Collect and organize all relevant documents.

- Understand your correct appellate route.

- File appeals within deadlines.

- Use evidence to negotiate.

- Escalate only after exhausting lower remedies.

- Keep updated on law changes.

- Seek expert advice for high-value disputes.