Voters in Opelousas Approve Sales Tax Renewal: When it comes to money, politics, and small-town survival, things hit different. And this summer, voters in Opelousas approve sales tax renewal with a twist that could shape the city for generations. On August 16, 2025, residents cast their votes and overwhelmingly said “yes” to keeping the city’s 1 percent sales tax—but here’s the kicker—it’s locked in for 50 years. That’s right, half a century. Kids in Opelousas today will still be paying this tax when they’re grandparents. And while the renewal means no increase in what folks pay at the register, the long-term stability makes this a bold, controversial move that sets Opelousas apart from other Louisiana towns.

Voters in Opelousas Approve Sales Tax Renewal

Opelousas just made history by approving a 1% sales tax renewal for 50 years. Passed with 68% voter approval, it represents one of the longest commitments of its kind in Louisiana. The renewal could generate more than $1.5 billion, funding public safety, infrastructure, and essential city services. This decision offers stability but also raises accountability concerns. Residents will need to stay engaged, ask questions, and ensure leaders use the funds wisely. Done right, Opelousas has just built itself a foundation for growth and safety for generations to come.

| Feature | Details |

|---|---|

| Election Date | August 16, 2025 |

| Approval Rate | 68% voted “Yes” |

| Sales Tax Rate | 1% (equivalent to $0.01 per dollar spent) |

| Renewal Term | 50 years (2025–2075) |

| Start of Collection | October 1, 2025 |

| Purpose of Tax | Public safety, water systems, city operations, employee salaries, infrastructure |

| Projected Revenue | Over $1.5 billion across 50 years (based on Opelousas retail economy estimates) |

| Source / Official Info | City of Opelousas Official Website |

A Little History: Opelousas and Its Money Struggles

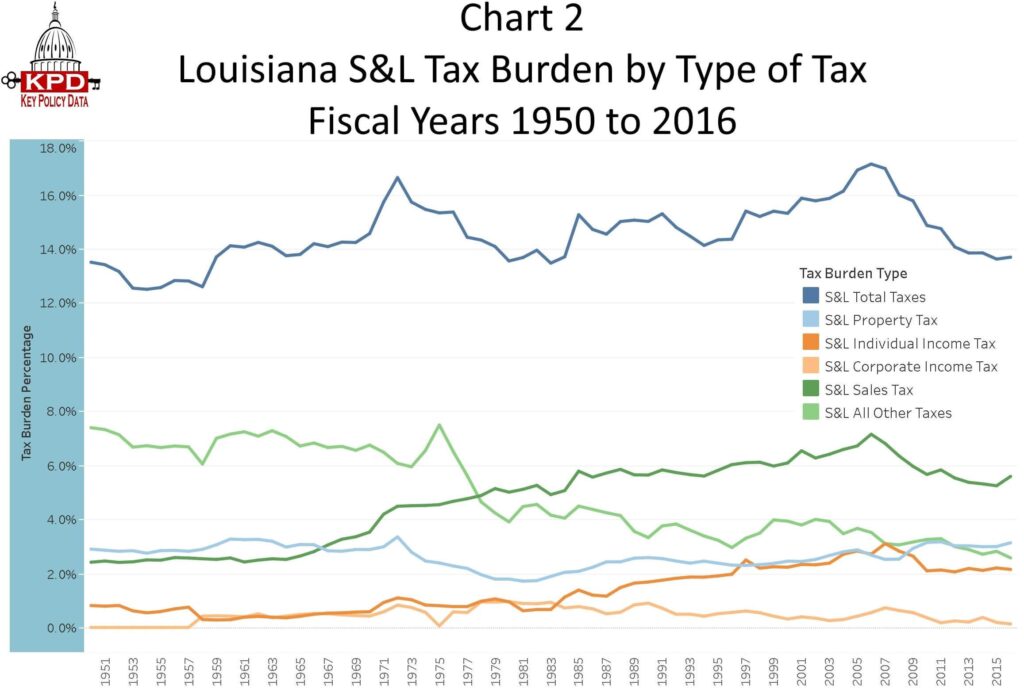

Opelousas, one of Louisiana’s oldest cities, has always worn its history proudly—from Creole cooking and Zydeco music to Civil War landmarks. But when it comes to finances, Opelousas has struggled. Like many towns across the South, it has faced declining industries, aging infrastructure, and a shrinking tax base.

Over the last 30 years, the city leaned heavily on short-term tax renewals to stay afloat. These were often renewed in 10- or 15-year increments, forcing leaders to go back to voters regularly. While this kept local officials accountable, it also made long-term planning nearly impossible. Projects to overhaul water systems or major road networks often stalled because leaders didn’t know if the money would still be there in the future.

That’s the context that made this 50-year renewal so significant. City officials and community leaders argued it was time to think beyond quick fixes and instead lock in stability for future generations.

Breaking Down the Voters in Opelousas Approve Sales Tax Renewal

The 50-Year Extension

Most Louisiana cities avoid tying residents to such a long-term tax. But Opelousas rolled the dice, giving itself one of the longest sales tax renewals in the state. City leaders said it wasn’t just about survival—it was about creating a foundation for growth, safety, and modernization.

Think of it like buying a house with a long-term mortgage. You’re committing for decades, but you also know exactly where the money will come from. For Opelousas, that’s the appeal: no more worrying every 10 years about whether the money will dry up.

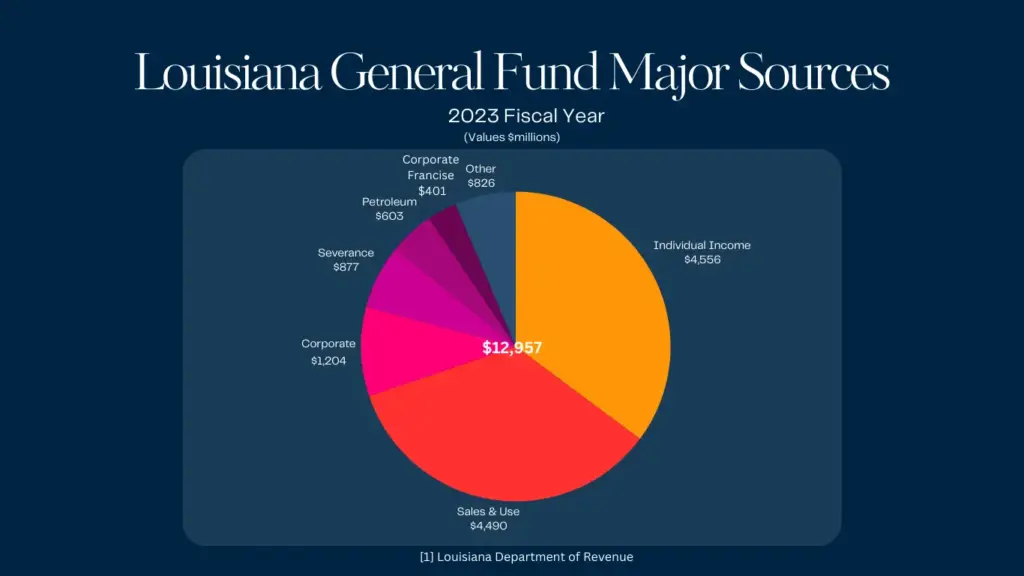

What the Money Will Fund

- Public Safety: Police, fire, and emergency services will have reliable funding for equipment, training, and salaries.

- City Operations: Basic services like trash collection, parks upkeep, and city hall staff.

- Water & Sewer Systems: Some of Opelousas’ underground infrastructure is nearly a century old. Fixing it isn’t optional—it’s essential.

- Employee Salaries: From sanitation workers to city clerks, the people keeping the town running depend on this tax.

- Infrastructure: Roads, bridges, and drainage systems that residents have been demanding for years.

Comparing Opelousas to Other Cities

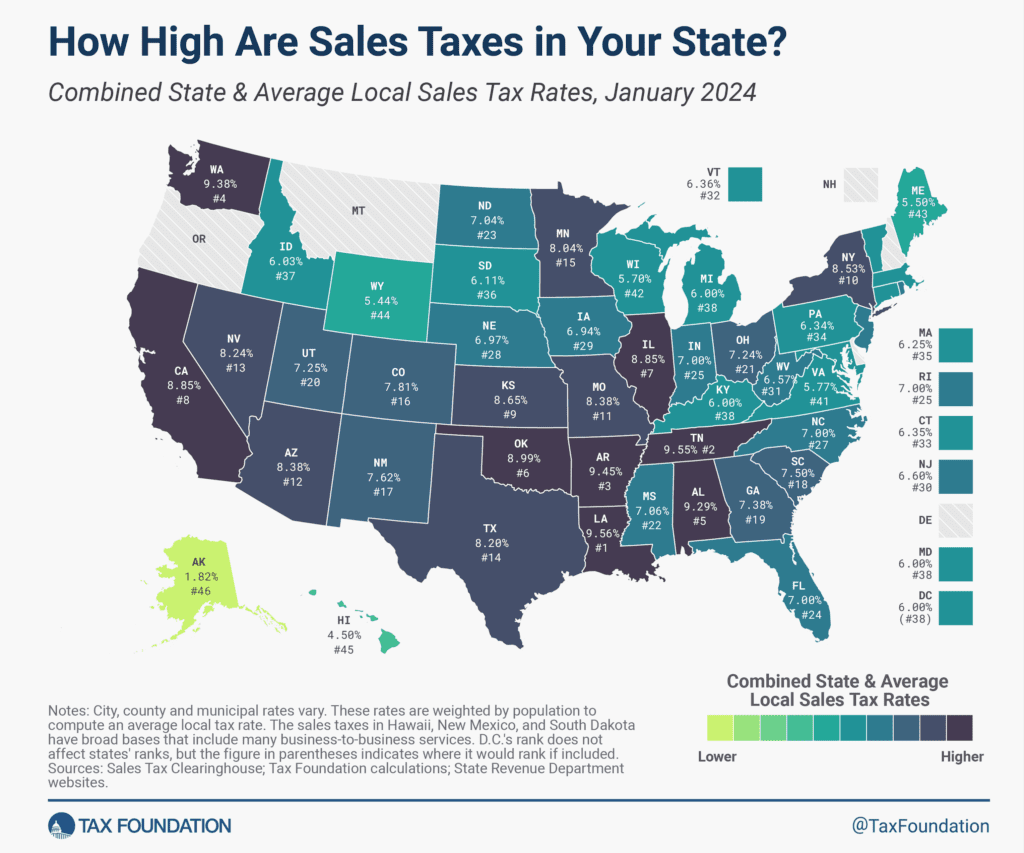

Opelousas’ bold move raises eyebrows across Louisiana and beyond.

- Baton Rouge: Typically renews taxes every 10 years.

- Shreveport: Uses 15-year cycles for infrastructure-focused taxes.

- Lafayette: Has a mix of renewals, often capped at 20 years.

- Texas towns: Generally stick to shorter terms, with most between 5–20 years.

The 50-year span in Opelousas is highly unusual. Experts say if it works, other towns with struggling budgets may follow suit. If it fails, Opelousas could become the cautionary tale of locking in revenue without enough oversight.

The Economic Impact: Billions Over Time

At just 1% on retail sales, Opelousas collects several million annually. Spread across 50 years, projections show the city could rake in over $1.5 billion.

What does that mean in real terms?

- Road Overhauls: Enough funding to repave the city’s major arteries multiple times.

- Water Modernization: Billions could replace outdated pipes, preventing costly breaks.

- Jobs: Construction, city services, and public works projects will employ hundreds of locals.

- Business Investment: Companies want stability. With guaranteed funding, Opelousas can attract new industries.

But the flip side is accountability. If leaders misuse the funds, taxpayers will have little direct recourse for decades.

Community Voices

This wasn’t a quiet vote.

- Residents: Many parents and older voters said safety and infrastructure were their top concerns. One local voter said, “We’re tired of potholes and crime. If this keeps cops on the streets and roads drivable, I’m all for it.”

- Business Owners: For small businesses, stability is everything. A restaurant owner noted, “Customers won’t come downtown if the roads are falling apart or if they don’t feel safe. This tax keeps Opelousas open for business.”

- City Leaders: Mayor Julius Alsandor framed it as a turning point, saying, “This renewal is more than a tax—it’s an investment in Opelousas’ future.”

Accountability: How to Track the Money

With a 50-year renewal, trust becomes the real currency. Here’s how residents can keep their leaders honest:

- Attend Council Meetings – They’re open to the public and streamed online.

- Review City Budgets – Annual budgets are public documents, often posted online.

- Ask for Financial Reports – City residents have the legal right to request transparency.

- Follow Local Media – Outlets like KATC and KLFY regularly report on Opelousas politics.

- Get Involved – Join local boards, volunteer groups, or civic organizations that monitor city finances.

Practical Advice: What Residents Should Do

- Don’t Panic at the Register – The tax rate isn’t changing. It’s still 1%.

- Watch the Roads – Keep track of whether the city delivers on promised improvements.

- Vote Smart – The tax is locked in, but the people spending it aren’t. Future elections still matter.

- Bookmark Resources – The Louisiana Department of Revenue posts tax updates that affect local economies.

Why Businesses Should Care?

For businesses, this renewal is a win. It guarantees decades of consistent services, safer streets, and potentially improved infrastructure. These are conditions that make it easier to attract both customers and investors.

A stable funding source also means the city can market itself as a safer bet to regional developers. That could lead to new commercial centers, jobs, and expanded markets.

Looking Ahead: Opportunities and Challenges

Opportunities:

- Long-term growth fueled by predictable funding.

- Infrastructure upgrades that make Opelousas more livable.

- Potential to attract new businesses and residents.

Challenges:

- Risk of complacency—leaders may feel less pressure to perform without frequent tax renewals.

- Residents locked in for 50 years may feel powerless if money isn’t spent wisely.

- Inflation could erode the real value of the tax revenue over time, meaning today’s dollars won’t go as far in 30 years.

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big

Atlassian Executives Forced To Sell Shares – The Tax Reason Behind It

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom