Lok Sabha’s New GST Amendment Bill Mean for Manipur’s Economy: The recent passage of the Goods and Services Tax (GST) Amendment Bill by the Lok Sabha has sparked debates across India, especially in regions like Manipur, which has been directly impacted by the changes. But what does this mean for the state’s economy? How does this bill affect local businesses, consumers, and the overall fiscal health of the region? In this article, we’ll break it all down, giving you a thorough yet easy-to-understand explanation of the GST Amendment Bill, its implications, and the way forward for Manipur’s economy.

Lok Sabha’s New GST Amendment Bill Mean for Manipur’s Economy

The GST Amendment Bill passed by the Lok Sabha is a crucial step towards stabilizing Manipur’s economy. While it may cause short-term changes in the tax structure, particularly for businesses dealing with alcohol, it brings long-term benefits for infrastructure, healthcare, and security. The additional ₹2,898 crore allocated to the state will help fund much-needed projects that will improve the quality of life for its citizens. However, for this amendment to truly benefit Manipur, it is essential for the local leaders and communities to be involved in future discussions to ensure that the state’s unique challenges are addressed.

| Key Topic | Details |

|---|---|

| GST Amendment Bill 2025 | Passed by the Lok Sabha to align Manipur with national GST provisions, allowing the state to collect GST on specific goods like undenatured alcohol. |

| Financial Impact | An additional ₹2,898 crore has been allocated to Manipur for capital expenditures, rehabilitation, and security. |

| Economic Implications | Local businesses will face new tax regulations, but they stand to benefit from increased state revenue. |

| Concerns Raised | Local leaders express concerns over lack of consultation, transparency in decision-making. |

| Official Resources | GST Council Website and Indian Express Article |

Introduction: What Is the GST Amendment Bill?

Before we dive into how the GST Amendment Bill affects Manipur, let’s take a moment to understand what this bill actually does. The Goods and Services Tax (GST) is a single tax that replaced multiple indirect taxes in India. It’s a unified system that allows the government to collect tax on goods and services at various stages of production and distribution. The amendment passed by the Lok Sabha seeks to bring Manipur in line with national tax provisions, allowing the state to collect and regulate certain goods that were previously excluded from the state’s tax net.

The Context: Why the Amendment Was Necessary

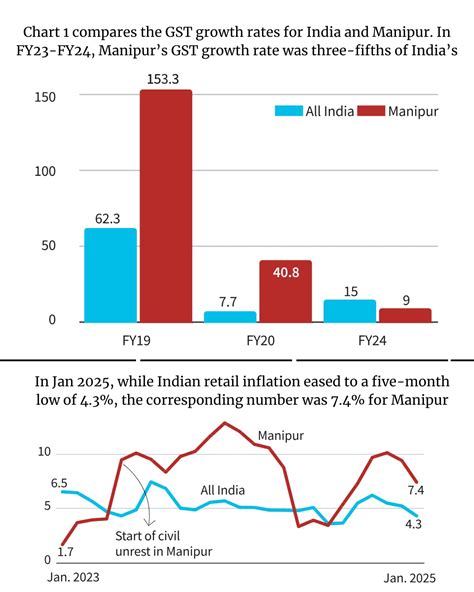

Manipur, like many states, has faced challenges in managing its revenue and taxes. With an economy reliant on trade, local businesses, and agriculture, the state needed a more streamlined and efficient tax structure. The GST Amendment Bill comes at a time when the state is working towards rebuilding its infrastructure, improving security, and promoting growth.

The bill includes provisions for the collection of GST on undenatured extra neutral alcohol (ENA), which is an essential component in the production of alcoholic beverages. This was a point of concern because without the amendment, the state would be unable to impose taxes on these goods, affecting revenue collection. The amendment allows the state to continue taxing these products without disrupting the business landscape.

Manipur’s Economy: Current Challenges and Opportunities

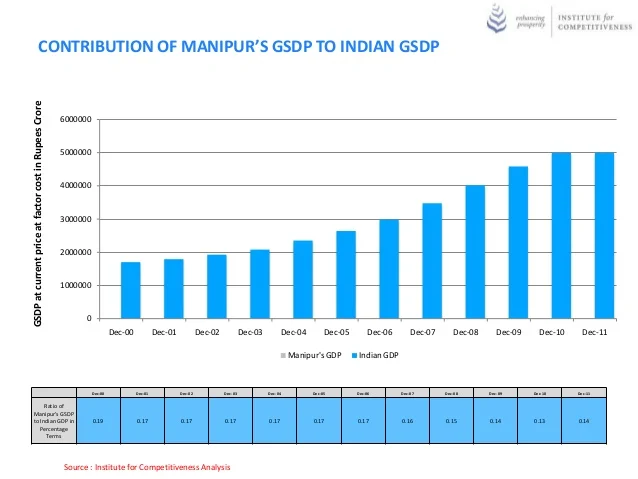

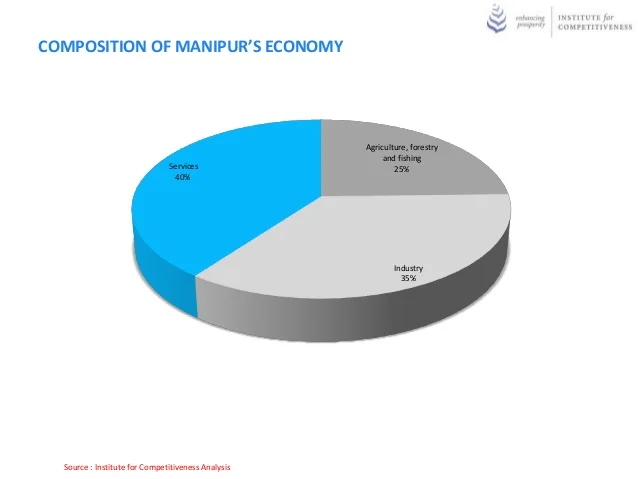

Manipur, located in the northeastern part of India, is a state with immense natural beauty, but its economic growth has faced several hurdles. Political instability, a lack of infrastructure, and the geographic remoteness of the region from the rest of India have made it difficult for businesses to thrive. However, Manipur is rich in resources, and industries such as agriculture, handicrafts, and tourism hold immense potential.

In recent years, the state has focused on rebuilding its infrastructure, and the passage of the GST Amendment Bill will provide a crucial boost to its economic recovery. It will ensure that the state can continue collecting taxes on key goods and services, providing the necessary financial resources for growth and development.

The Economic Impact of the Lok Sabha’s New GST Amendment Bill Mean for Manipur’s Economy

The passage of the GST Amendment Bill provides more than just a legal framework for tax collection. It is a step towards reviving the state’s economy and offering businesses the opportunity to grow. But what does this mean for businesses and consumers in Manipur?

For Local Businesses

Businesses that deal with products like alcohol or other goods subject to the amended GST will now have to follow updated tax guidelines. This could mean higher tax rates or new compliance requirements. However, this also ensures that businesses remain part of the formal economy, and it brings in much-needed revenue that can be reinvested into the state’s infrastructure and services.

For example, manufacturers and retailers in the alcohol industry will need to adjust their pricing and tax plans. Small businesses in sectors like agriculture, handicrafts, and tourism might not directly face tax hikes but will benefit indirectly from increased state revenue that can be spent on public services and infrastructure.

For Consumers

Consumers in Manipur may see changes in the pricing of goods, especially alcoholic beverages, as the new tax structure takes effect. Prices may rise for some products as businesses pass on the higher taxes to customers. However, this should not lead to an overall negative economic impact as the additional revenue generated will help the state invest in sectors like education, healthcare, and infrastructure—all of which will benefit the public in the long run.

The National GST Framework: How the Amendment Aligns with India’s Tax Goals

The GST Amendment Bill for Manipur doesn’t just apply to the state in isolation. It’s part of a larger effort to harmonize tax laws across India. The GST Council, which sets the rates and framework for GST across the country, has been working toward a uniform tax system that encourages economic growth while ensuring that states can generate the necessary revenue for public services.

Manipur’s alignment with the national GST framework means that it is now better positioned to manage its fiscal resources. By bringing local goods and services under the GST umbrella, the state joins the broader effort to simplify and standardize the tax collection process across the country. This is especially important in regions like Manipur, where economic integration with the rest of India can stimulate growth and opportunities for local businesses.

What Happens Next: How the GST Amendment Bill Will Affect Manipur’s Fiscal Health

The most immediate impact of the GST Amendment Bill will be on the state’s fiscal health. The state has received an additional ₹2,898 crore allocation for capital expenditures, which will go towards building infrastructure, rehabilitating communities, and enhancing security efforts. This will be a welcome boost to a state that has struggled with infrastructure deficits for years.

The allocation includes funding for critical sectors such as:

- Healthcare – Hospitals and healthcare facilities in Manipur will benefit from better funding, which can improve access to medical services for the population.

- Infrastructure – Roads, bridges, and other essential infrastructure projects will receive investment, which can help local businesses and improve the overall quality of life.

- Security – Given the region’s history of instability, enhancing security infrastructure will provide a safer environment for residents and businesses.

Common Concerns: What Local Leaders Are Saying

While the passage of the GST Amendment Bill has been hailed as a step in the right direction for Manipur, there are concerns. Local leaders, including Congress MP Bimol Akoijam, have raised issues regarding the lack of consultation with state representatives and the absence of a meaningful debate on the bill.

They argue that decisions affecting the state should involve local leaders and experts who understand the unique challenges Manipur faces. While the government’s priority is to boost revenue and ensure fiscal stability, it is important to ensure that the voices of local people are heard in the decision-making process.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Hostel Inmates Cry Foul as GST Hike Sends Rents Soaring in Chennai

Moving Forward: What Local Stakeholders Can Do

As Manipur transitions into this new phase of economic growth under the GST framework, local businesses and leaders must take an active role in ensuring the system works effectively. Here’s what stakeholders can do:

- Stay Informed: Local business owners should stay updated on the latest tax regulations and ensure they are in compliance with the new laws. The GST Council’s website provides detailed guidelines.

- Engage in Dialogue: Local leaders can work with the state government to ensure that future amendments and policies reflect the needs of Manipur’s unique economy.

- Invest in Infrastructure: Business owners and citizens can participate in initiatives to improve local infrastructure, which will help create a more conducive environment for businesses and residents.