Will Modi’s GST Reforms Tame Inflation: When we talk about big economic moves, few things shake up markets like a nationwide tax overhaul. And that’s exactly what Prime Minister Narendra Modi’s GST reforms are about to do in India. With inflation cooling and the Reserve Bank of India (RBI) looking for its next move, folks across the globe are asking: Will Modi’s GST reforms tame inflation and push RBI toward rate cuts? Think of it this way: Imagine you’re at Walmart in Texas or Costco in California, and suddenly, a bunch of items you buy—like cereal, sneakers, or even a new washing machine—get cheaper because the sales tax rates were streamlined. That’s what India’s Goods and Services Tax (GST) reform aims to do for 1.4 billion people, making it one of the largest tax experiments in modern history.

Will Modi’s GST Reforms Tame Inflation

So, will Modi’s GST reforms tame inflation and push RBI toward cuts? The answer looks like yes—with caution. By simplifying the tax system, cutting rates on essentials, and easing consumer costs, inflation is likely to drop further. This gives the RBI room to cut interest rates, boosting growth across Asia’s third-largest economy. However, the real test lies in fiscal discipline. If the government fails to balance revenue losses, deficits could widen, undermining the reform’s long-term benefits. For now, though, optimism is high, and India may be poised for a growth surge.

| Factor | Details | Reference |

|---|---|---|

| GST Reform Rollout | Diwali 2025 (October) | Government of India Official Portal |

| New GST Slabs | 5% & 18% only (12% & 28% removed); 40% for sin/luxury goods | Reuters |

| Inflation Impact | Could reduce inflation by 40–80 basis points | UBS, Morgan Stanley |

| Retail Inflation (July 2025) | Multi-year low at 1.55% | Reserve Bank of India |

| Estimated Fiscal Cost | $20B – ₹1.2 trillion annually | Economic Times |

| RBI Outlook | Possible repo rate cuts to 5.00–5.25% | Morgan Stanley, UBS |

GST in Historical Context

India rolled out GST back in 2017, aiming to simplify a patchwork of state and federal taxes. At the time, businesses celebrated the idea but were quickly bogged down by multiple tax slabs—5%, 12%, 18%, and 28%—plus additional “cess” (surcharges).

This meant that biscuits and cakes could fall into different slabs, creating confusion and compliance headaches. Small businesses often complained they needed tax consultants just to stay compliant.

Now, in 2025, Modi’s government is cutting through the clutter. The plan:

- Two slabs remain: 5% for essentials, 18% for most other goods and services.

- A 40% “sin/luxury” tax will apply to products like tobacco, imported cars, and high-end liquor.

This simplification is designed not just to reduce confusion but also to boost compliance and encourage spending.

Why Does Modi’s GST Reforms Tame Inflation Matter?

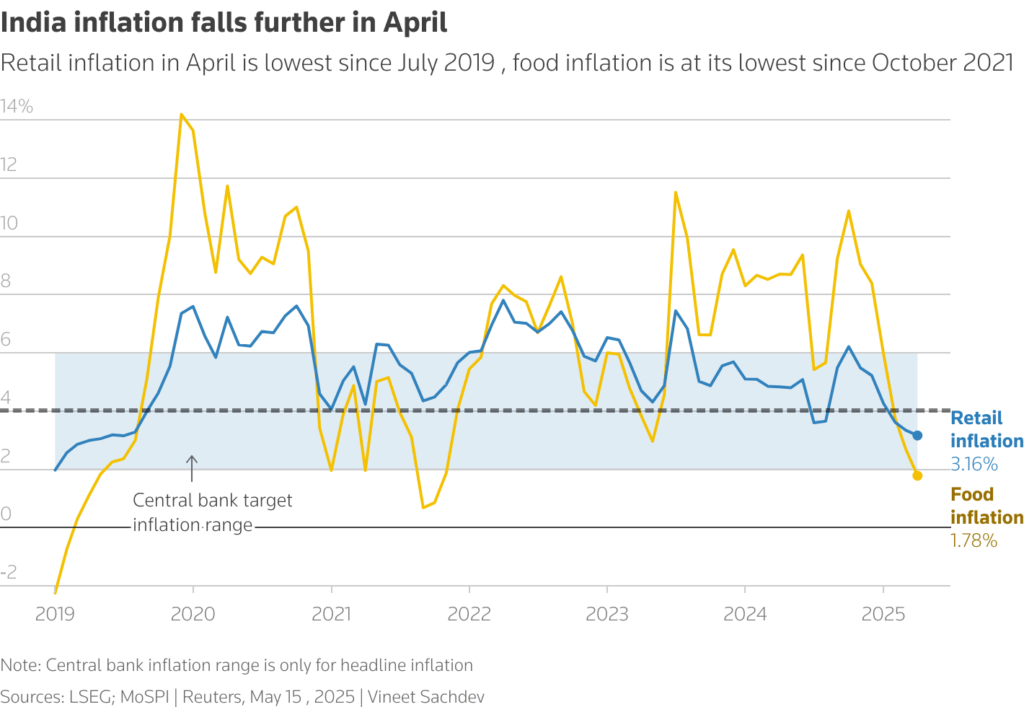

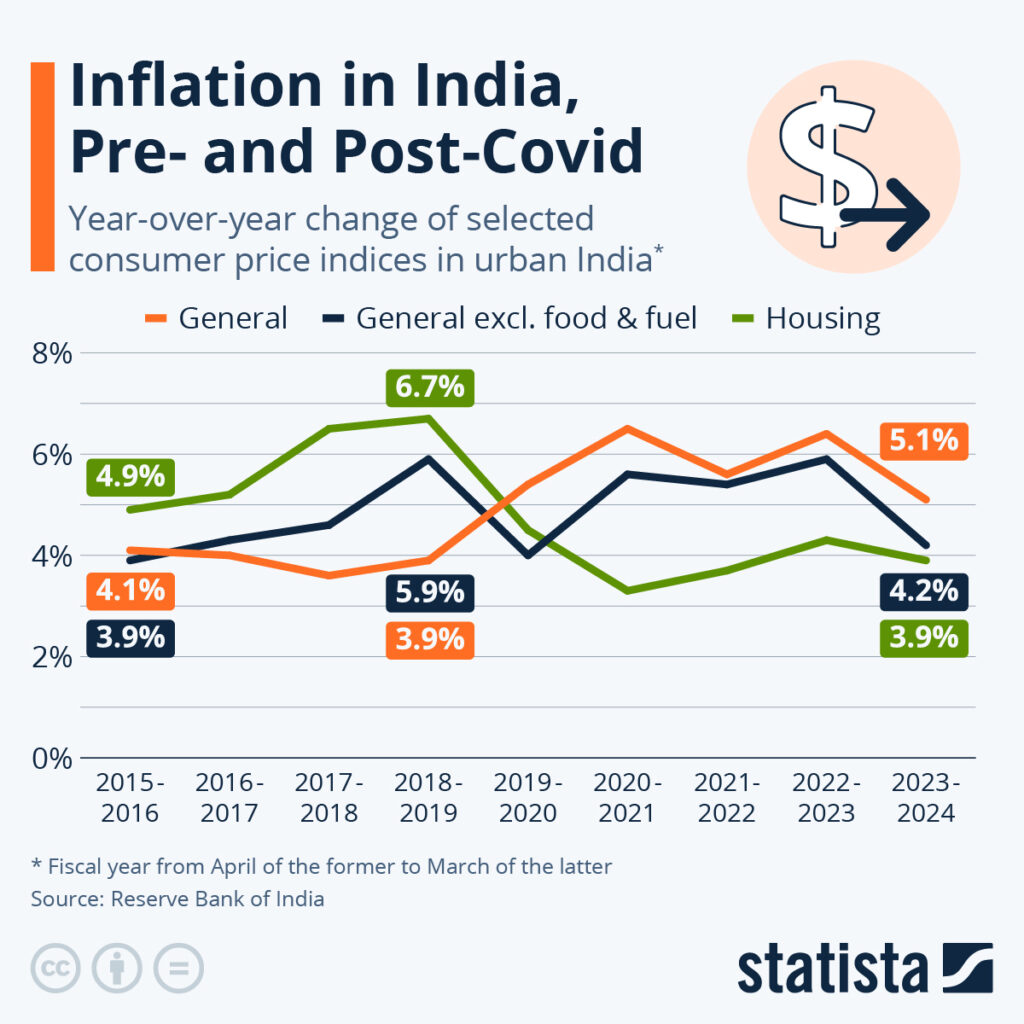

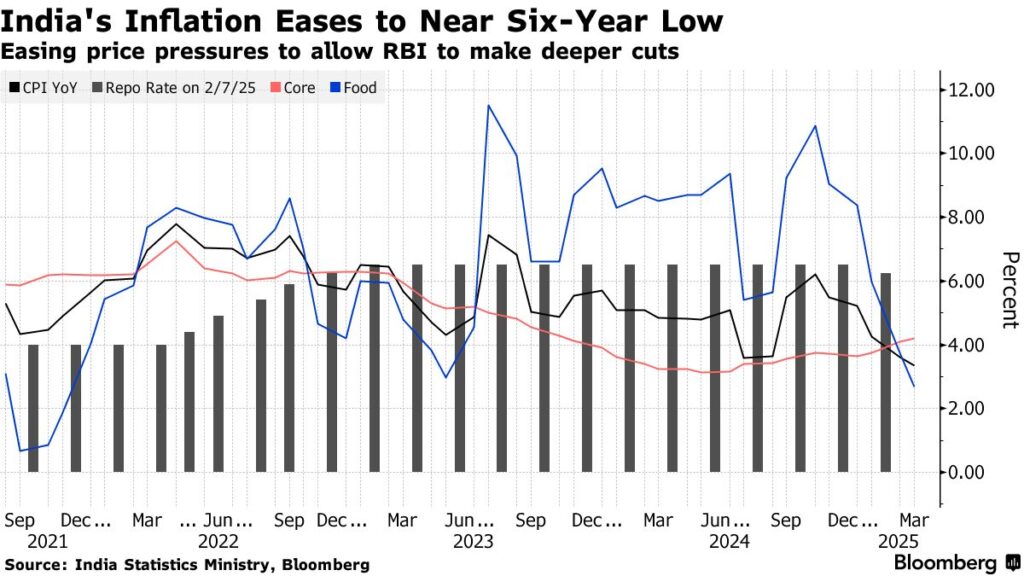

Inflation, at its core, is the shrinking power of your paycheck. India’s retail inflation dropped to 1.55% in July 2025, the lowest in years. With GST reforms, this number could fall even further.

For example:

- A small car previously taxed at 28% might now fall under the 18% slab.

- Appliances and packaged goods moving from 12% to 5% will get cheaper.

Economists estimate this could bring inflation down by 40–80 basis points (bps). To put this in perspective: if U.S. inflation at 3% dropped by 0.5%, it would save American households hundreds of dollars annually on everyday items. For India’s middle class, it’s even more significant.

RBI’s Role: Why Rate Cuts Are on the Table

The Reserve Bank of India (RBI) functions like the Federal Reserve in the U.S., setting interest rates to balance inflation and growth.

Right now:

- Repo rate stands at 6%.

- With inflation so low, analysts believe the RBI has room to cut.

- Global firms like UBS and Morgan Stanley expect a cut by October 2025, possibly reducing rates to 5.00–5.25%.

Lower rates would ease borrowing costs for businesses, consumers, and homebuyers, giving the economy a growth boost. In U.S. terms, it’s like the Fed cutting rates to make mortgages cheaper, fueling housing demand.

Global Lessons: Learning from Other Countries

India isn’t the first to shake up its tax system. Looking around the world:

- European Union (EU): The Value Added Tax (VAT) was simplified decades ago to promote trade across borders. Compliance improved, and inflation remained largely stable.

- United States (2017 Tax Cuts): While not a consumption tax reform, simplifying income tax brackets boosted spending but ballooned federal deficits.

- Japan (2019 VAT hike): Raising consumption tax slowed consumer spending, leading to economic stagnation.

The takeaway? Tax simplification can boost growth, but poorly timed or unbalanced reforms risk long-term fiscal stability.

Consumer Case Studies: Real-Life Impact

Middle-Class Families

An average middle-class Indian household buying a small car, refrigerator, and groceries could save ₹25,000–₹40,000 annually ($300–$500) after the GST cuts. That’s enough for a family vacation or additional savings.

Small Businesses

For shopkeepers and small manufacturers, the biggest win is reduced compliance costs. Less paperwork, fewer disputes, and simpler accounting free up time and resources. In U.S. terms, it’s like TurboTax cutting filing categories in half for small businesses.

Luxury Consumers

On the flip side, the wealthy may pay more. A luxury SUV or imported bottle of whiskey will attract the 40% sin/luxury tax, keeping high-end consumption costly. This ensures reforms benefit the majority rather than the elite.

Risks: The Fiscal Deficit Problem

The most pressing challenge is the fiscal deficit. Lowering GST rates means the government collects less money. Estimates suggest an annual shortfall of $20 billion to ₹1.2 trillion.

This could:

- Widen India’s fiscal deficit, already at 5.6% of GDP.

- Increase borrowing costs, as seen in rising bond yields.

- Pressure RBI to tread carefully—rate cuts could be delayed if deficits worsen.

It’s similar to debates in the U.S. when tax cuts expanded deficits, sparking concern about long-term debt.

Opportunities: Growth, Compliance, and Investment

On the bright side, reforms can deliver significant benefits:

- Higher Compliance: Simpler tax codes leave fewer loopholes, reducing evasion.

- Increased Consumption: Cheaper goods mean more household spending, boosting GDP.

- Foreign Investment: Predictable tax systems attract global companies.

According to the IMF, tax simplification is one of the top reforms that improve ease of doing business, which directly supports growth.

Expert Opinions

Economists are divided, but most see short-term positives:

- UBS: Predicts inflation falling enough to allow rate cuts by October.

- Morgan Stanley: Expects repo rates at 5.25% by year-end.

- Bank of America: Warns fiscal pressure could slow RBI’s cuts.

In essence, the reforms are pro-consumer and pro-business but come with long-term budget risks.

Step-by-Step Guide: How GST Impacts the Economy

- Simplified Tax Structure → Easier compliance for businesses.

- Lower GST on Essentials → Cheaper everyday goods.

- Cheaper Goods → Reduced inflation levels.

- Lower Inflation → RBI has room to cut interest rates.

- Rate Cuts → Cheaper loans for businesses and consumers.

- Cheaper Credit → Higher consumption and investment.

- Higher Growth → Potential fiscal deficit risks if not managed.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Massive GST Cut on Cars, Bikes, SUVs Could Be Around the Corner—Get the Inside Scoop