GST Council Eyes Rationalising 12% & 18% Rates: If you’ve been watching your wallet (and honestly, who isn’t these days?), here’s some hot news: Your expenses could change soon—GST Council eyes rationalising 12% & 18% rates. That’s right. India’s Goods and Services Tax (GST) Council is gearing up for a big shake-up in its tax system. And this isn’t just bureaucratic jargon. We’re talking real-life effects on your grocery bills, your next car purchase, and even the cost of your health insurance. Think of it as a tax remix—simpler, leaner, and potentially easier on your pockets.

GST Council Eyes Rationalising 12% & 18% Rates

The GST Council’s plan to rationalise 12% & 18% rates could be the most significant reform since GST’s inception in 2017. It promises cheaper essentials, affordable insurance, and a friendlier business environment. While consumers stand to gain, states worry about revenue losses, making the upcoming Council meeting in September crucial. For now, it’s wise to hold off on major purchases, review insurance options, and stay tuned. Because when the dust settles, your expenses really could change soon.

| Aspect | Current Status | Proposed Change |

|---|---|---|

| GST Slabs | 5%, 12%, 18%, 28% | Streamlined to 5% & 18% |

| Items in 12% bracket | ~12% of goods/services | ~99% → move to 5% |

| Items in 28% bracket | ~28% of goods/services | ~90% → move to 18% |

| Luxury & Sin Goods | 28% + cess | New 40% GST slab |

| Insurance Premiums | 18% GST | Proposed full exemption |

| Final Approval | Pending | GST Council Meet Sept 3–4, 2025 |

| Revenue Impact | TBD | States cautious, seeking safeguards |

| Official GST Council Portal | gstcouncil.gov.in |

GST 101: A Quick Refresher

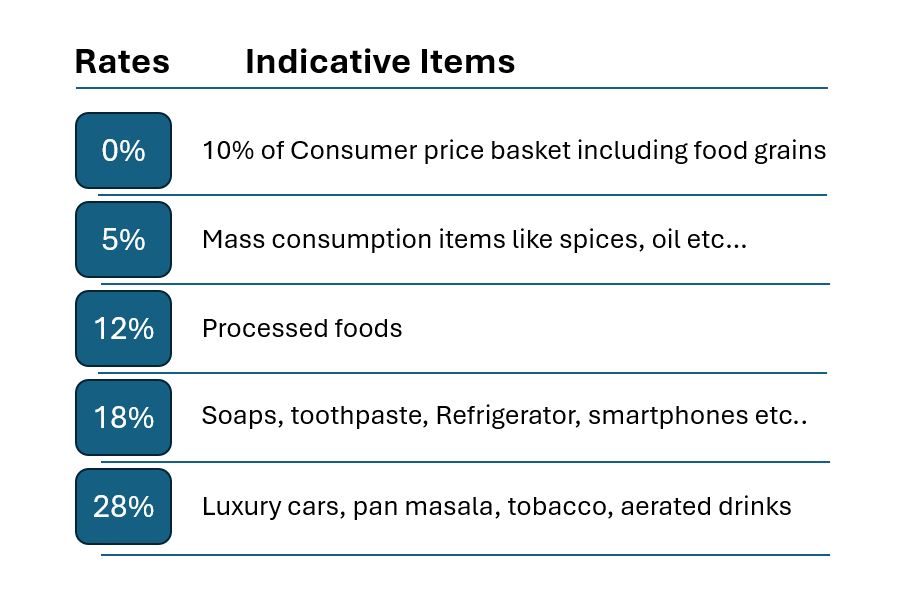

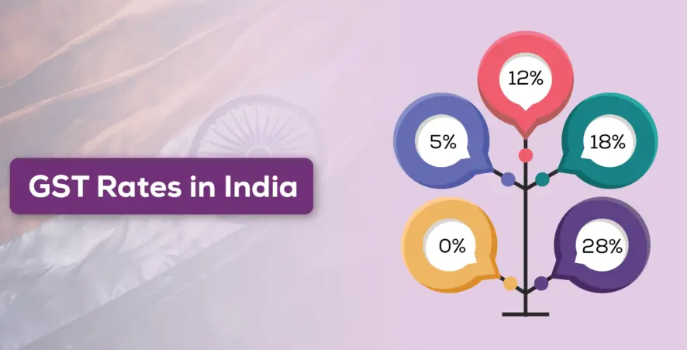

Back in July 2017, India introduced the GST system to replace a confusing mix of taxes like VAT, excise duty, and service tax. The idea was simple: one nation, one tax. But politics and practicalities led to multiple slabs—5%, 12%, 18%, 28%, plus cesses on luxury and sin goods.

Over time, businesses and consumers found the structure complicated. Disputes over classification, higher compliance costs, and uneven tax incidence made life harder. Countries like Singapore (9% flat GST) or the UK (20% VAT with reduced rates) showed simpler models, which sparked calls for rationalisation in India.

Now, eight years later, policymakers want to fix the complexity and make GST friendlier for both businesses and consumers.

What’s Changing and Why It Matters?

Goodbye 12% Slab

Almost everything currently taxed at 12%—from packaged foods to toiletries—may drop into the 5% slab. This could mean cheaper bills for millions of households.

Big Shift in 28% Slab

Nearly 90% of goods in the 28% category may move to 18%. This includes many consumer durables, electronics, and standard automobiles. Lower costs could trigger higher sales, especially during festive seasons.

New 40% Luxury Tax

Luxury and sin goods will face a new 40% GST slab. Items like tobacco, pan masala, and luxury SUVs will get pricier, balancing out the government’s revenue concerns.

Insurance Premium Relief

Health and life insurance—currently taxed at 18%—may soon be exempt. For a family paying ₹30,000 annually on insurance, this means direct savings of ₹5,400.

Sector-Wise Impact of GST Council Eyes Rationalising 12% & 18% Rates

FMCG (Fast-Moving Consumer Goods)

Shifting from 12% to 5% could cut prices on essentials like soaps, toothpaste, shampoos, and packaged food. Companies may pass on the benefits to consumers, boosting demand in rural and urban markets alike.

Automobiles

This is a mixed bag. Small and mid-range cars moving from 28% to 18% will likely become more affordable, spurring demand in a sluggish sector. But luxury vehicles will become costlier with the new 40% slab.

Insurance

Currently under-penetrated, India’s insurance market could see a boom if premiums become tax-free. More families could afford coverage, reducing the burden on public healthcare systems.

E-Commerce

Electronics and consumer goods sold online may see price cuts, fueling higher online sales. Platforms like Amazon and Flipkart may experience a surge in festive shopping.

Hospitality

Restaurants and hotels that currently face 18% may benefit from simplified slabs. Slight reductions in bills could attract more domestic tourists and encourage dining out.

The State vs. Centre Tug-of-War

The elephant in the room is revenue. GST collections are a key source of income for both states and the central government. Shifting items to lower slabs could shrink collections.

According to Reuters, the government has not quantified the revenue impact yet. States like Maharashtra and Tamil Nadu have voiced concerns about potential losses. To compensate, policymakers propose keeping the 40% slab and perhaps additional cesses on luxury and sin goods.

How Will This Affect Inflation and the Indian Economy?

One of the biggest questions around GST rationalisation is its impact on inflation. When tax rates on essentials and mid-range products fall, prices should drop, directly easing the pressure on households. Lower taxes on consumer goods could increase purchasing power, putting more money back into people’s pockets.

Economists believe this could provide a short-term relief from inflation, especially in sectors like FMCG and household items where demand is price-sensitive. More affordable goods could boost consumption, which in turn might fuel economic growth.

However, there’s another side to it. States worry about revenue shortfalls. If the government struggles to balance lower tax collections, it might lean on higher borrowing or indirect levies elsewhere. In such a scenario, the inflationary benefit could get diluted over time.

The Reserve Bank of India (RBI) will also be closely watching these changes. If GST rationalisation helps cool inflation, the RBI may gain more flexibility in setting interest rates—potentially good news for borrowers and businesses seeking loans.

In the long run, experts predict that a simpler GST system will encourage formalisation of the economy, reduce tax evasion, and expand the tax base. With more compliance and fewer loopholes, India could see steady revenue without overburdening consumers.

Global Comparisons

- USA: Has no GST. Instead, each state levies its own sales tax (0–10%). It’s fragmented and complex.

- UK: Standard 20% VAT, with 5% on essentials and 0% on basics like food and books.

- Singapore: Runs a simple 9% flat GST system, proving efficiency in collection and compliance.

- India: Currently runs four slabs + cess. Proposed shift to two slabs + luxury tax is a step toward global norms, though not as flat as Singapore.

Historical Lessons

When GST was first rolled out, many businesses struggled with compliance due to multiple slabs and confusing rules. Over the years, several items were shifted to lower slabs (like washing machines, refrigerators, and TVs). But the structural problem of too many slabs remained.

This rationalisation attempt could be India’s boldest tax reform since 2017. By reducing slabs, the government hopes to reduce litigation, simplify compliance, and spur growth.

Expert Opinions

Economists have long pressed for fewer slabs. Arvind Subramanian, former Chief Economic Advisor, once argued that GST should ideally have just two slabs—a low rate for essentials and a standard rate for everything else.

Industry associations like CII and FICCI believe rationalisation will improve compliance, reduce disputes, and revive demand. Some experts, however, caution that the 40% slab could encourage smuggling or evasion in luxury segments.

Practical Guide: What Should You Do?

For Consumers

- Delay Big Purchases: If you’re planning to buy electronics or a car, waiting until after the GST Council decision could save money.

- Review Insurance Plans: Post-rationalisation, premiums could be lower. Families may want to expand coverage.

- Budget Smarter: Essentials may cost less, freeing up household income for savings or discretionary spending.

For Businesses

- Reprice Products: Once slabs change, businesses should adjust MRPs quickly to stay competitive.

- Educate Customers: Highlight reduced prices to boost brand loyalty.

- Review Supply Chains: Contracts and invoices must reflect new tax rates.

- Upgrade Compliance Systems: ERP software and accounting teams must be prepared for changes in GST filing.

Future Outlook

If this reform passes, India could see a short-term dip in GST revenues but long-term benefits from higher consumption, lower disputes, and stronger compliance. Experts expect a 2–3% boost in GDP growth over the medium term if rationalisation succeeds.

This move may also pave the way for India to eventually adopt a single standard GST rate, like many developed economies. That could make India one of the most business-friendly markets in Asia.

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali