Your Daily Bills Might Be About to Drop: When you hear the phrase “Your daily bills might be about to drop”, it usually feels like a marketing trick. But this time, it’s a serious policy shift making global headlines. We’re talking about GST 2.0 — India’s bold move to simplify its Goods and Services Tax, slash prices on essentials, and open the door to billions in consumer spending. Even if you live in the U.S., this matters. India isn’t just another country — it’s the world’s most populous nation and one of the fastest-growing markets. A change in how India taxes goods and services could make your imported groceries cheaper, boost profits for U.S. companies, and attract new investments. For professionals, consumers, and investors alike, GST 2.0 is worth understanding.

Your Daily Bills Might Be About to Drop

GST 2.0 is shaping up to be one of the most significant economic reforms in India since liberalization in the 1990s. It promises lower costs for households, stronger demand for businesses, and cleaner rules for compliance. For India’s middle class, it could mean real relief at the checkout counter. For U.S. exporters and investors, it could open up one of the world’s largest markets even further. While challenges remain — from state-level pushback to revenue concerns — the direction is clear: a simpler, fairer, and more consumer-friendly system.

| Point | Details |

|---|---|

| New GST 2.0 Slabs | Two main rates: 5% for essentials, 18% for most goods, plus 40% for luxury/sin goods. |

| Items Getting Cheaper | Food items, packaged goods, electronics, insurance, telecom bills. |

| Consumer Boost | Estimated $24 billion (₹1.98 lakh crore) extra spending power. |

| Govt Revenue Impact | Short-term loss of $10 billion+ annually. |

| Council Approval Timeline | GST Council meet set for Sept 2025. |

| Official Reference | GST Council of India |

From GST 1.0 to GST 2.0: Why the Change Matters

When India rolled out GST in 2017, it was celebrated as a “one nation, one tax” moment. Before GST, businesses had to navigate dozens of taxes across states, creating inefficiency and confusion. Imagine if every U.S. state not only had its own sales tax but also taxed goods differently depending on whether they were manufactured, transported, or sold. That was India before GST.

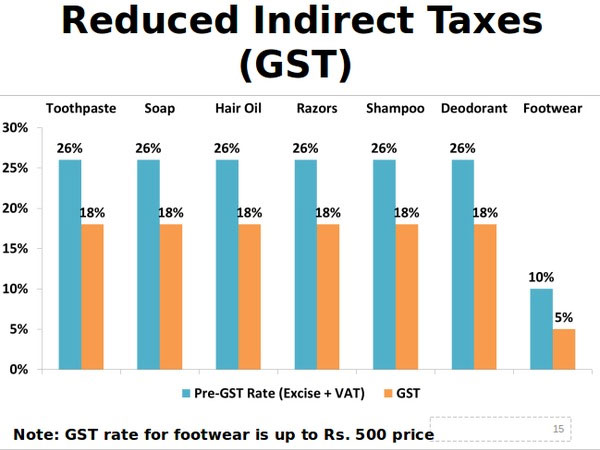

The problem? GST 1.0 introduced four major tax slabs (5%, 12%, 18%, 28%), and the classification of products became a battlefield. Is chocolate a luxury at 28% or a snack at 18%? Should butter be taxed like milk at 5% or like processed food at 12%? These disputes clogged courts and confused businesses.

GST 2.0 is designed to fix that:

- Simplify slabs to just 5% and 18%, with a 40% rate for luxury and harmful products.

- Make compliance easier for small businesses.

- Boost demand by lowering everyday costs.

How Your Daily Bills Might Be About to Drop?

Essentials at 5%

Everyday goods like butter, jam, nuts, dates, mushrooms, and packaged snacks are expected to move from 12% down to 5%.

Example: If a family spends ₹10,000 ($120) a month on groceries, they could save around ₹700 ($8). Multiply that across 300 million households, and the savings become enormous.

Electronics and Cars at 18%

Big-ticket items like washing machines, air conditioners, smartphones, and even cars may drop from the current 28% tax slab to 18%.

Example: A mid-range smartphone priced at ₹20,000 ($240) could cost about ₹2,000 ($24) less. For cars, the savings could run into hundreds of dollars.

Services Like Telecom and Insurance

Bills for your phone plan, insurance premiums, and even salon visits are expected to move into lower tax brackets. For middle-class families, this could mean noticeable monthly savings.

Comparisons to the U.S. Tax System

To put this in perspective for Americans, think about sales tax in the U.S. It varies by state, from 0% in states like Delaware to over 7% in places like Tennessee. Now imagine if Washington, D.C., decided to unify it all into just two simple national rates. That’s what India is trying to do, but at a far bigger scale — for over a billion people, across 29 states and 7 union territories.

Why Americans Should Care?

Cheaper Imports

Indian textiles, packaged foods, and spices might cost less at Costco, Walmart, or Amazon once GST 2.0 takes hold.

A Growing Market for U.S. Companies

Companies like Apple, Tesla, and GE that sell in India could benefit from lower prices making their products more affordable.

Investment Opportunities

Wall Street investors are watching closely. A cleaner tax system and $24 billion in extra consumer spending is attractive for funds tied to Indian markets.

The Other Side: Challenges Ahead

Revenue Loss for Governments

India could lose more than $10 billion annually in tax revenue in the short term, raising concerns about how state governments will cover expenses.

State Resistance

State governments rely heavily on GST collections. Some may resist reforms, fearing a squeeze on their budgets.

Equity Concerns

Middle-class and urban consumers stand to benefit the most. Rural and low-income households, which spend less on taxed goods, may not see the same level of relief.

What Experts Are Saying?

Economists see GST 2.0 as a powerful demand booster. SBI Research predicts nearly $24 billion in extra spending power. Businesses are cautiously optimistic but worry about the short time frame to update billing systems. Consumers, on the other hand, simply want bills to come down without new layers of confusion.

Real-Life Examples

- A middle-class family in Mumbai may save on groceries, utility bills, and a new refrigerator purchase all in the same month.

- A small business owner in Delhi can cut compliance costs by not juggling multiple tax categories.

- A U.S. spice exporter to India may find products more affordable and competitive on Indian shelves.

Step-by-Step Guide to Preparing for GST 2.0

For Consumers

- Keep an eye on essential product prices.

- Delay big purchases until reforms are implemented, likely by Diwali 2025.

- Ensure businesses are passing on the savings — anti-profiteering laws require them to.

For Small Businesses

- Update accounting and billing software.

- Train staff on the simplified slab structure.

- Use price reductions in marketing campaigns.

For U.S. Exporters and Investors

- Track which of your products fit into the 5% or 18% slab.

- Partner with Indian distributors to market savings.

- Watch consumer-facing stocks in India — auto, telecom, and FMCG sectors may benefit the most.

Global Economic Impact

This reform isn’t just about India. It signals that emerging markets are serious about cleaning up messy tax systems. By putting more money in consumers’ hands, India could drive global demand at a time when Europe is slowing and China faces economic headwinds.

GST Structure Simplified – Key Changes Explained

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly

GST Rate Rejig to Benefit Farmers and Middle Class – FM Sitharaman Outlines Reform Gains