Zerodha Second Demat Account: If you’ve been investing in India for a while, you already know Zerodha is the country’s largest retail stockbroker, with more than 1.3 crore active clients as of 2025 according to NSE data. Known for democratizing investing with low brokerage fees and user-friendly platforms like Kite and Console, Zerodha has now introduced a feature that has caught the attention of both seasoned investors and casual traders: the Second Demat Account. At first glance, it might sound like just another account, but it is far from ordinary. This second demat account is designed to help you save on taxes, manage your portfolio more strategically, and even protect you from impulsive selling. To understand its full impact, let’s walk through how it works, why Zerodha launched it, and how you can use it to your advantage.

Zerodha Second Demat Account

The Zerodha Second Demat Account is not just another account; it’s a strategic tool for Indian investors to reduce taxes, simplify portfolio management, and build discipline. By separating long-term and short-term holdings, investors can minimize taxable gains, better utilize the ₹1.25 lakh LTCG exemption, and avoid emotional mistakes. Yes, there are costs and some restrictions, but for anyone with serious investments, the benefits far outweigh them. If you’re committed to long-term wealth building while keeping your tax bill in check, Zerodha’s second demat is worth considering.

| Aspect | Details |

|---|---|

| Product | Zerodha Second Demat Account |

| Main Benefit | Reduces taxable gains by separating long-term and short-term holdings |

| Tax Rule in Play | FIFO (First-In-First-Out) applies separately for each demat account |

| Charges | AMC: ₹300 + GST per year; Transfer: ₹13 + GST per transaction |

| Visibility | Secondary holdings visible on Console (not Kite app) |

| Sell Restriction | Must transfer back to primary account (24-hour delay) before selling |

| Who Can Open | Resident individuals only (not NRIs, HUFs, or corporates) |

| Official Resource | Zerodha Support Page |

Why Did Zerodha Launch a Second Demat Account?

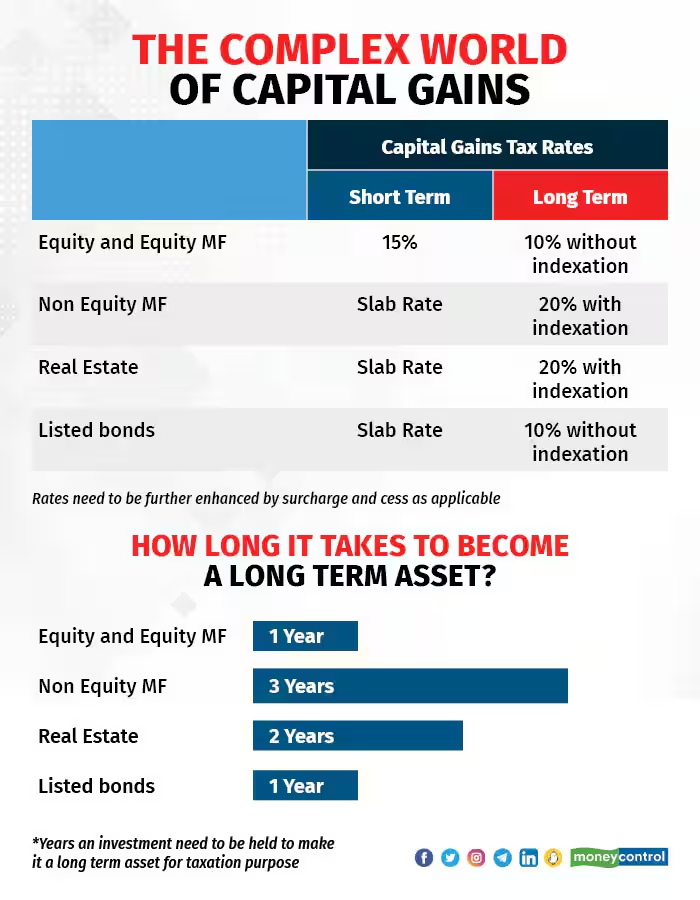

The answer lies in the way taxation works for Indian equity investors. India’s Income Tax rules make a sharp distinction between:

- Short-Term Capital Gains (STCG): Profits from selling shares within 12 months, taxed at 15%.

- Long-Term Capital Gains (LTCG): Profits from selling after 12 months, taxed at 10% beyond the ₹1.25 lakh annual exemption.

When investors sell shares, the FIFO rule comes into play. FIFO means the system assumes you are selling your oldest shares first, regardless of your actual intention. This can lead to higher taxable gains if older, low-priced shares are sold first on paper, even if you wanted to offload newer, high-cost shares.

Zerodha’s second demat account is an elegant solution. By separating long-term holdings into a secondary account, FIFO applies only within that account, leaving your short-term trades in the primary account. This separation gives you control over how your sales are taxed.

Understanding FIFO with Examples

Consider this scenario:

- January 2022: Buy 100 Infosys shares at ₹100 each.

- January 2024: Buy another 100 Infosys shares at ₹150 each.

- March 2025: Infosys trades at ₹180. You sell 100 shares.

Without Second Demat

FIFO applies across your entire demat. The sale picks the January 2022 batch (₹100).

- Profit = (₹180 – ₹100) × 100 = ₹8,000 taxable.

With Second Demat

You transfer the January 2022 batch to the secondary account. The primary now only holds the January 2024 batch (₹150).

- Profit = (₹180 – ₹150) × 100 = ₹3,000 taxable.

That’s a 62.5% reduction in taxable profits just by reorganizing holdings.

Why Zerodha Second Demat Account Matters for Tax Planning?

For investors, especially those with large portfolios, the difference is not trivial. India allows an annual LTCG exemption of ₹1.25 lakh. But if FIFO pulls in a large, low-cost batch, you may quickly exceed this limit, forcing you to pay 10% LTCG tax.

With two accounts, you can choose to sell from batches that keep you within the exemption cap. Similarly, short-term traders benefit by avoiding premature sale of long-term holdings.

In short, this tool allows investors to time their tax liability smarter without breaking any law.

Additional Benefits Beyond Tax Saving

1. Discipline and Impulse Control

Transfers between accounts require 24 hours. This enforced waiting period prevents impulsive decisions, especially panic selling during volatile markets. Many behavioral finance experts argue that such friction improves long-term outcomes.

2. Portfolio Clarity

Long-term holdings disappear from the Kite app interface, reducing clutter and mental noise. You only see them in the Console dashboard, which is better for strategic tracking rather than daily price watching.

3. Corporate Actions Still Apply

Dividends, stock splits, and bonus issues will apply seamlessly to whichever account holds the shares. You don’t lose out by moving stocks to the secondary account.

Costs and Limitations

| Feature | Details |

|---|---|

| AMC | ₹300 + GST per year, per account |

| Transfer Charges | ₹13 + GST per off-market transfer (~₹15.34) |

| Selling | Cannot sell directly from the secondary account; must move back to primary (24-hour delay) |

| Eligibility | Only resident individuals; no NRIs, HUFs, or corporates |

| Tax P&L | Transfers are not recorded in Tax P&L; only sales from primary are reported |

While costs are minimal, investors should calculate whether expected tax savings outweigh AMC and transfer charges. For most investors handling portfolios above ₹5–10 lakh, the savings easily surpass the costs.

Case Studies and Real-Life Examples

Case 1: The Retail Investor

Rohit invests ₹10 lakh in equities. By transferring long-term holdings into the secondary account, he avoids FIFO pulling them into taxable sales. His annual tax savings: about ₹40,000, even after paying AMC and transfer costs.

Case 2: The Conservative Long-Term Investor

Meera has a ₹25 lakh portfolio in blue-chip stocks meant for retirement. She keeps these locked in the secondary account. This protects her from accidentally selling them during short-term trades, while also avoiding FIFO complications.

Case 3: The Active Trader

Arjun trades in derivatives but also has ETF investments. By separating them, he ensures tax reporting is clean, and he doesn’t trigger unnecessary LTCG or STCG.

Global Perspective

Interestingly, investors in countries like the United States and United Kingdom don’t have this option. In the U.S., the IRS allows specific identification of lots when selling securities, giving flexibility to pick which batch to sell. In the U.K., tax rules follow a “same-day and 30-day rule” before averaging out.

India’s demat system doesn’t yet allow lot identification. Zerodha’s second demat account is an innovative workaround, uniquely suited to Indian investors.

Pros and Cons

| Pros | Cons |

|---|---|

| Reduces taxable gains significantly | Additional AMC and transfer fees |

| Encourages disciplined investing | 24-hour transfer delay before selling |

| Clean separation of long-term and short-term holdings | Secondary holdings not visible in Kite app |

| Helps maximize LTCG exemption | Only resident individuals can use it |

| One login for both accounts | Adds an extra layer of management for casual investors |

Step-by-Step Guide to Using Zerodha’s Second Demat

- Apply online via Zerodha’s support portal.

- Pay AMC of ₹300 + GST.

- Move long-term holdings into the secondary account.

- Keep short-term trades in the primary account.

- Sell from whichever account optimizes taxes.

- Remember transfers take 24 hours, so plan ahead.

- Consult your Chartered Accountant for reporting clarity.

China’s Super Rich Hit With Surprise Global Tax Crackdown

Bengaluru Professional Saves ₹70,000 by Switching to New Tax Regime

Experts Push for 40% Sin Tax on Alcohol, Cigarettes and Junk Food