Zuckerberg Secretly Lobbied Trump on Digital Service Taxes: When we talk about Zuckerberg secretly lobbying Trump on digital service taxes, we’re diving into a story that’s part Washington politics, part Silicon Valley hustle, and part global trade war. According to reports, Mark Zuckerberg met privately with former President Donald Trump in late August 2025. His mission? To fight back against digital service taxes (DSTs) being pushed by European countries that hit U.S. tech giants right in the wallet.

Just days later, Trump rolled out tariff threats against nations imposing such taxes, sparking fresh tensions between Washington and Brussels. If you’re thinking, “Wait, why should I care?” — hang tight. This story has ripple effects for anyone using Facebook, Instagram, Google, Amazon, or even just shopping online.

Zuckerberg Secretly Lobbied Trump on Digital Service Taxes

The story of Zuckerberg secretly lobbying Trump on digital service taxes is more than a private meeting — it’s a snapshot of the global struggle over tech, trade, and taxation. Between tariff threats, Big Tech profits, and government regulation, this fight will ripple far beyond boardrooms and Brussels. Whether you’re a small business owner buying Facebook ads, a parent shopping on Amazon, or an investor watching stock prices, the fallout could land right in your lap.

| Topic | Details |

|---|---|

| Event | Mark Zuckerberg met Trump privately in August 2025 over digital service taxes |

| Aftermath | Trump threatened tariffs on countries with DSTs |

| Impact | Escalating U.S.-EU tensions over tech, trade, and regulation |

| What’s at Stake | Billions in revenues for U.S. tech firms (Meta, Google, Amazon, Apple) |

| Official EU Info | European Commission – Digital Services Tax |

What Are Digital Service Taxes (DSTs)?

Think of DSTs as a cover charge for Big Tech. Countries like France, Italy, and the U.K. set up these taxes to make sure tech giants pay their fair share when making money off local users. Instead of taxing profits (which companies can shift around with clever accounting), DSTs go after gross revenues — meaning even if Facebook isn’t profitable in a country, it still owes taxes on ad dollars made there.

For example:

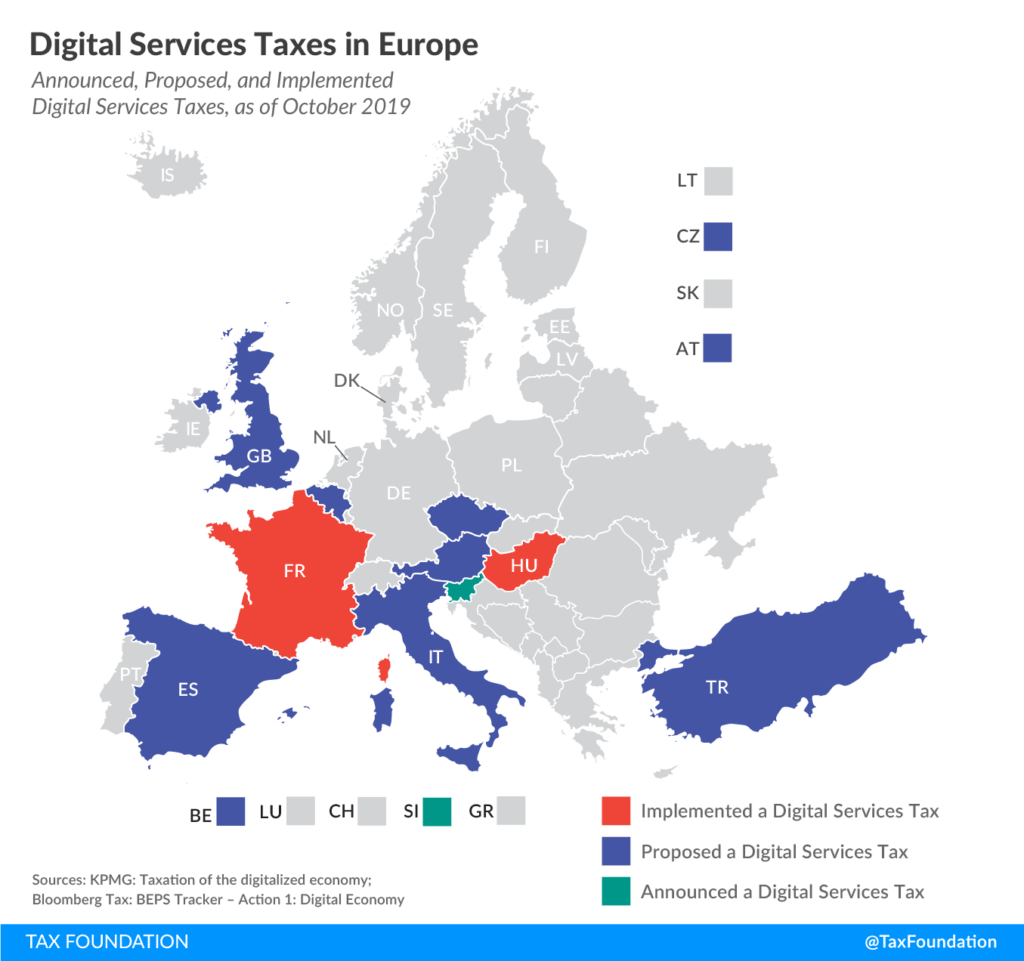

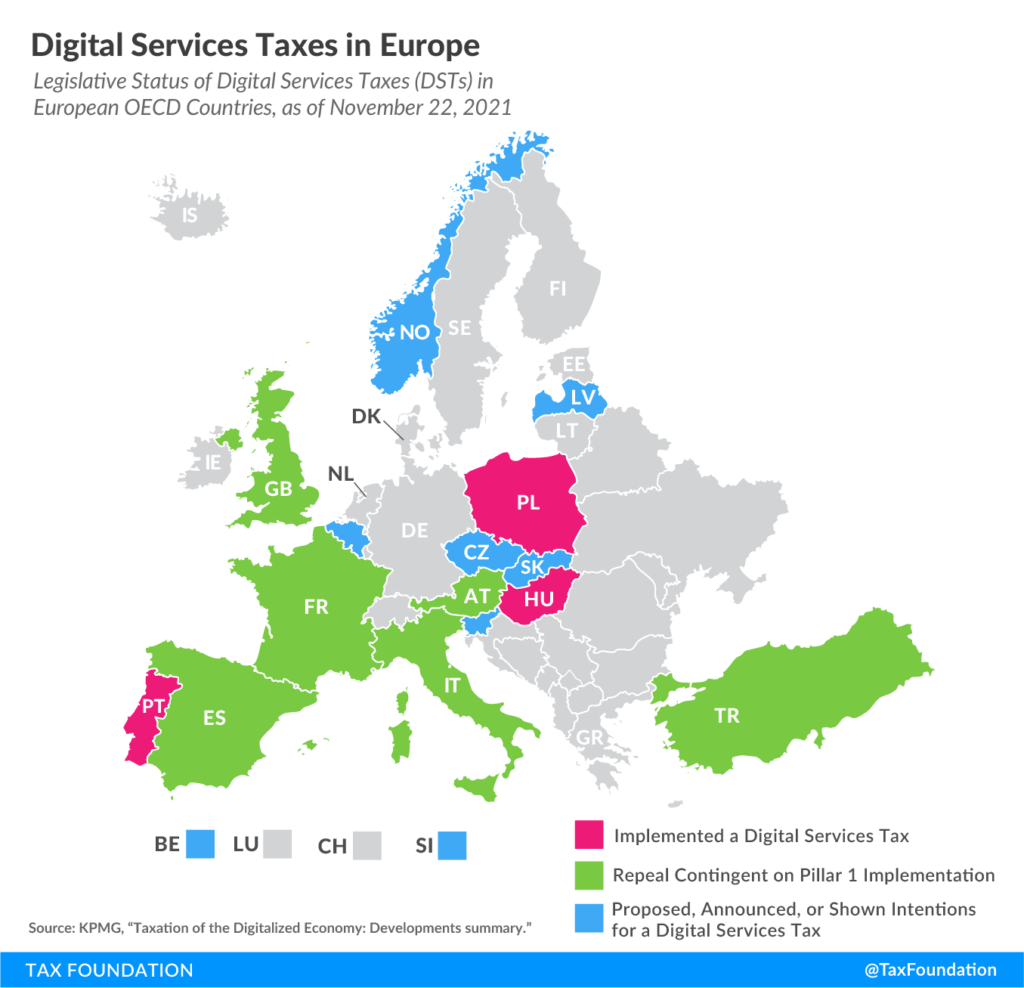

- France slapped a 3% tax on revenue from digital ads and online marketplaces.

- Italy and Spain introduced similar measures.

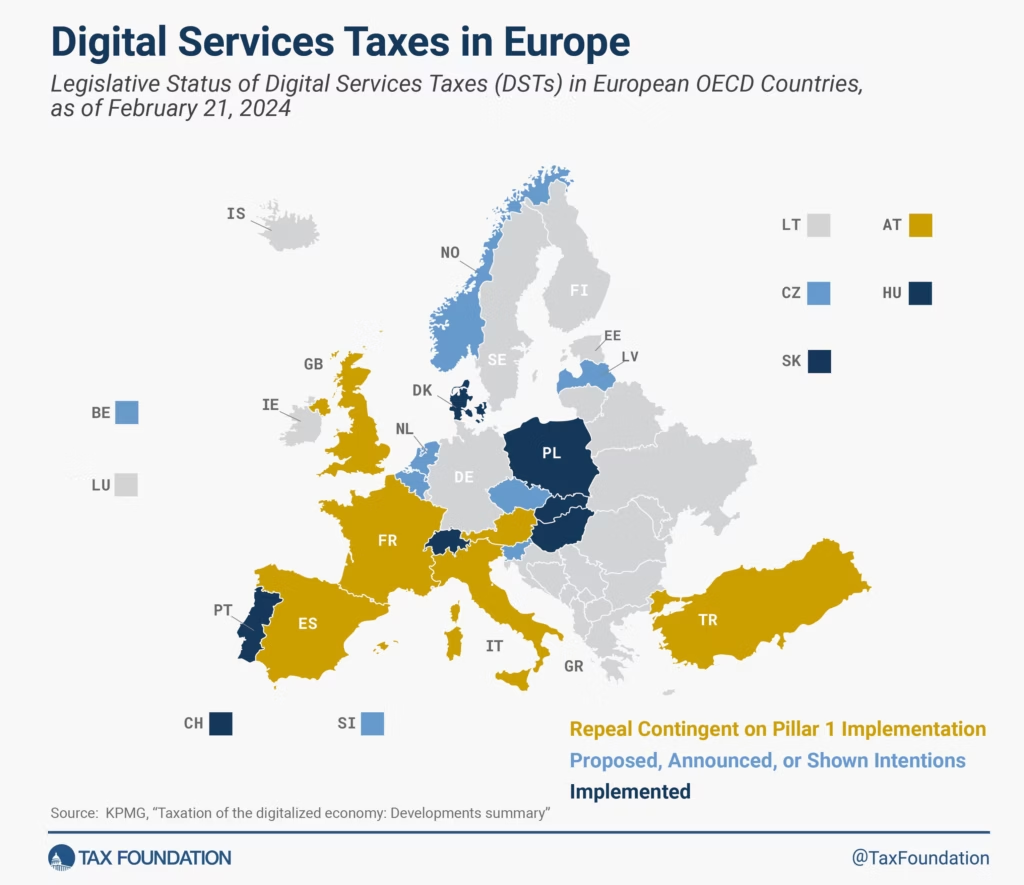

- The EU has debated a bloc-wide DST but hasn’t pulled the trigger yet.

The big issue? Nearly every company targeted is American. Facebook, Google, Apple, and Amazon make billions from European users, but many pay relatively little in local taxes due to profit-shifting through Ireland, Luxembourg, or the Netherlands.

A Little History Lesson

This isn’t Zuckerberg’s first dance with DSTs. Back in 2019, France pushed through its digital tax. Trump responded with a threat of 100% tariffs on French wine, cheese, and handbags, forcing a temporary truce. The Organisation for Economic Co-operation and Development (OECD) stepped in, attempting to broker a global framework.

In 2021, more than 130 countries agreed in principle to a 15% global minimum corporate tax, but implementation dragged. By 2023, frustration boiled over again, and Europe restarted its push for DSTs.

Fast forward to 2025, and the same fight is back — only with higher stakes. This time, it’s not just France but multiple EU nations pushing forward, while the U.S. insists these measures unfairly punish American innovation.

Why Zuckerberg Secretly Lobbied Trump on Digital Service Taxes?

Meta (aka Facebook’s parent company) lives off ad dollars. Every click, every like, every boosted post is part of a machine that churns billions annually. In 2024, Meta generated over $134 billion in ad revenue worldwide. Roughly a quarter of that came from Europe.

So if the EU slaps a 3% to 5% tax across its major markets, we’re talking billions in added costs. For a company already under pressure from TikTok, privacy laws, and AI competitors, that’s a heavy hit.

That’s why Zuckerberg went straight to Trump. Instead of fighting one country at a time, he sought top-down protection by getting the White House to flex its trade muscles. And Trump delivered with his signature move: tariff threats.

The Trump Factor

Trump framed DSTs as “discrimination against U.S. companies”, promising tariffs on cars, wine, and other EU exports unless digital taxes were dropped. It’s a tactic straight out of his first term, when he used tariffs against China, Mexico, and the EU to force negotiations.

Why does this matter? Because U.S.-EU trade ties are massive:

- The EU is America’s largest trading partner, with over $1.3 trillion in goods and services exchanged in 2023.

- Tariff wars could push prices higher for everything from BMWs to French champagne — not just digital ads.

Trump also sees this as a campaign issue. Standing up for American tech champions plays well with Silicon Valley donors and with voters who like the “America First” message.

Global Angle: It’s Not Just Europe

The EU may be the headline act, but DSTs are spreading worldwide:

- India introduced a 2% “equalization levy” on foreign digital companies.

- Canada passed DST legislation in 2024 but delayed enforcement amid U.S. pressure.

- Turkey, Austria, and Mexico have also implemented their own versions.

For U.S. tech companies, this isn’t just a European headache — it’s a global challenge that threatens their international growth strategies.

How This Impacts Everyday Americans?

Here’s the breakdown:

- Higher Costs for Tech Companies = Higher Costs for You

If Meta or Google pay extra taxes abroad, ad prices go up. That means local businesses pay more for ads — and then pass those costs down to you. - Trade Tensions = Pricier Imports

A tariff war with Europe means pricier electronics, cars, and luxury goods. That Audi or iPhone you’ve been eyeing? Yeah, it might cost more. - More Regulation Battles

The EU isn’t just taxing — it’s also cracking down with the Digital Services Act (DSA) and Digital Markets Act (DMA), which regulate online platforms. These rules affect how you see ads, how data is handled, and even what speech is allowed.

The Small Business Angle

For small businesses in the U.S. using Facebook Ads or Google Ads, DSTs may seem like a foreign problem — but they’re not. Here’s why:

- A local bakery in Ohio running ads on Instagram might suddenly pay 15% more for ad campaigns if Meta hikes prices to offset DSTs.

- Startups relying on global e-commerce sales could see higher fees when selling to European customers.

In other words, this fight between governments and tech giants trickles down to the smallest players.

Breaking It Down: Professional Takeaways

Step 1: Follow the Money

- Meta, Google, Apple, and Amazon earn tens of billions in Europe yearly.

- DSTs skim billions, shrinking profits and potentially affecting stock valuations.

Step 2: Watch Trade Negotiations

- The U.S. Trade Representative (USTR) may use tariffs as leverage.

- If the EU digs in, expect retaliation and higher consumer costs.

Step 3: Track Consumer Impact

- Tech firms don’t eat costs — they pass them on.

- Small businesses relying on Facebook or Google Ads could see cost hikes.

Expert Opinions

- The OECD has long argued for a global digital tax framework to prevent trade wars.

- The Brookings Institution warns unilateral DSTs could undermine tax fairness and international cooperation.

- The Council on Foreign Relations highlights that escalating tariffs risk damaging transatlantic unity at a time when both sides need cooperation on security and technology.

US Abruptly Cancels India Trade Talks Amid Tariff Tensions

Europe Blocks U.S.-Bound Parcels – Tax Rule Change Behind The Move

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Future Outlook: What’s Next?

Here are three possible scenarios:

- EU Backs Down

- Under U.S. pressure, EU countries pause or freeze DSTs.

- Global talks at the OECD restart with urgency.

- Trump Escalates

- Tariffs on EU exports spark a mini trade war.

- U.S. tech firms get temporary relief, but consumers pay higher prices.

- Compromise Deal

- The EU keeps limited DSTs.

- The U.S. tolerates them in exchange for avoiding a full tariff war.

Each path carries consequences for businesses, consumers, and global trade.